Business models matter.

I don’t write that enough, but it’s a slogan I want to put on my wall, so it’s seen in every YouTube video I do.

Today, there are numerous companies with flawed/unsustainable business models that investors have become enamored with because they’ve demonstrated revenue growth without profitability.

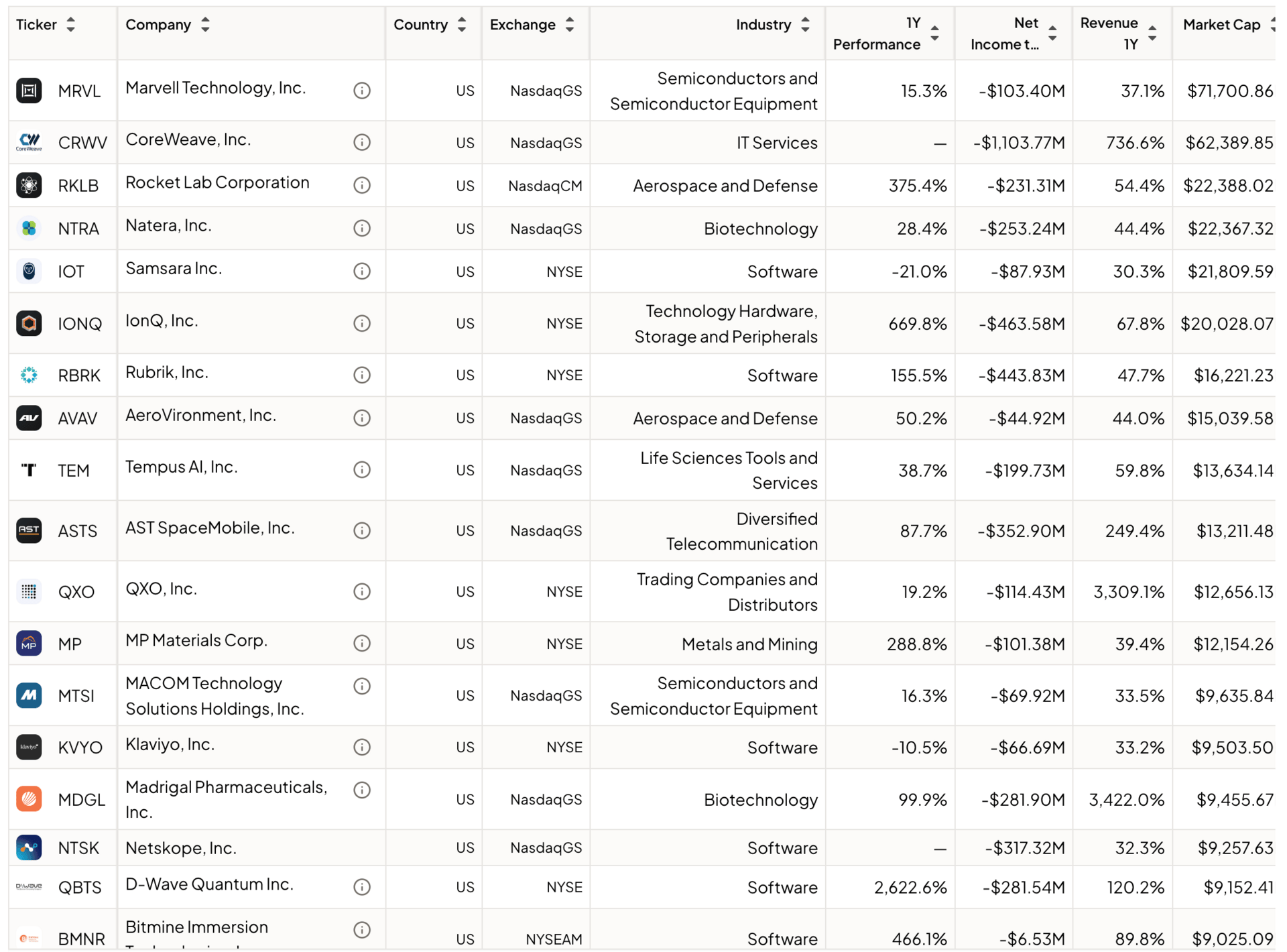

Don’t believe me? Here’s a screener featuring stocks with a value of over $1 billion, 1-year revenue growth exceeding 30%, and that are losing money.

These stocks AVERAGED a 306.4% return over the past year!!!!

How did I miss all of these stocks?

The answer is simple. I am looking for 10x stocks over 10 years, not 1 year.

Over a long period of time, market-beating stocks need revenue growth AND positive earnings. Losing money year after year isn’t sustainable. And it won’t win long-term, a lesson investors will learn again…eventually.

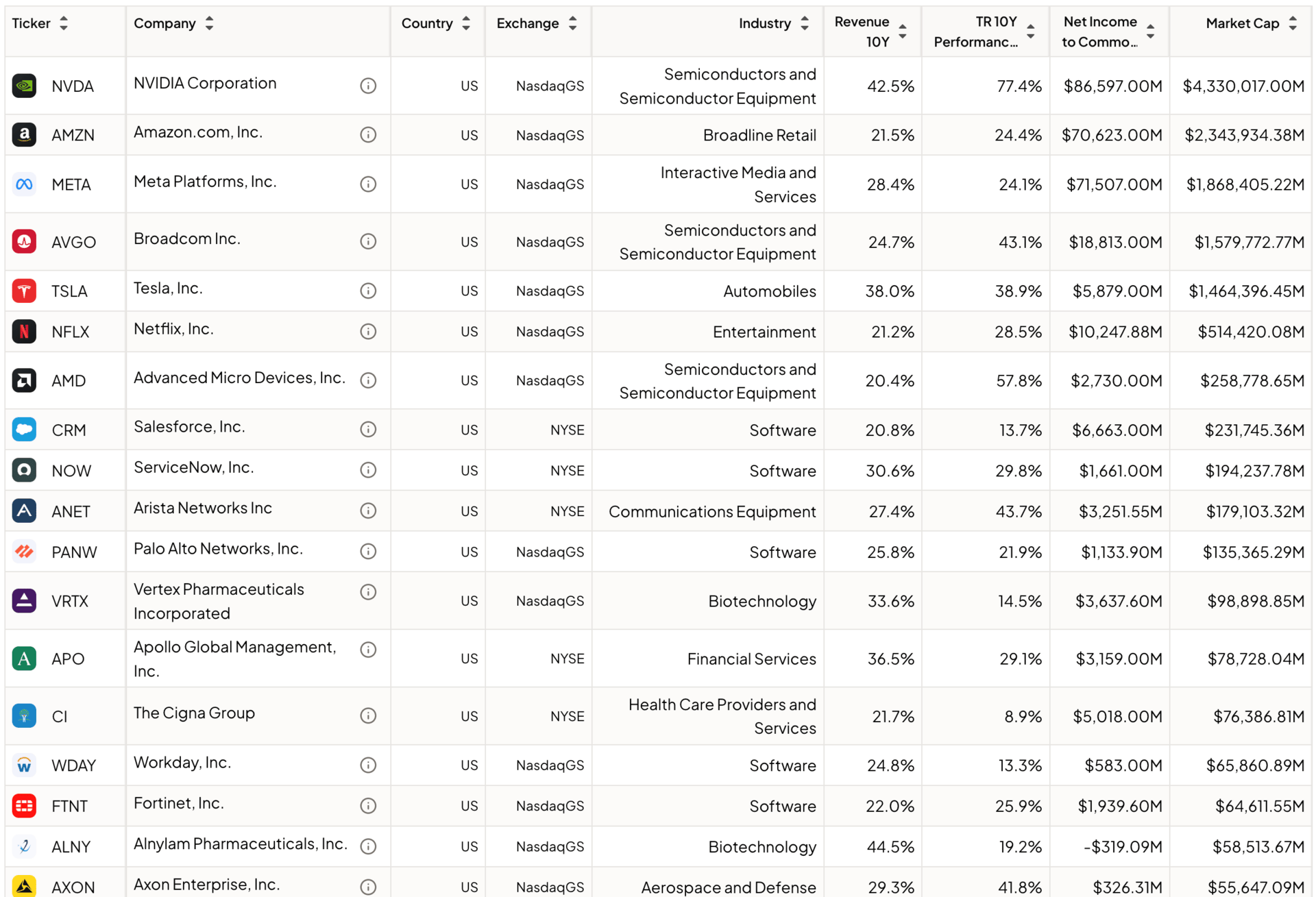

Below is a similar screen with a 10-year revenue growth rate of over 20%. You can see that every company that sustained revenue growth that high was profitable.

For perspective, a stock with a 10-year performance CAGR of 25.9% is a 10x stock over 10 years!

More on why growth isn’t enough in a moment.

This week, the market pulled back a bit. The Fed lowered rates, but long-term rates pushed higher, which will be a drag on stocks.

s

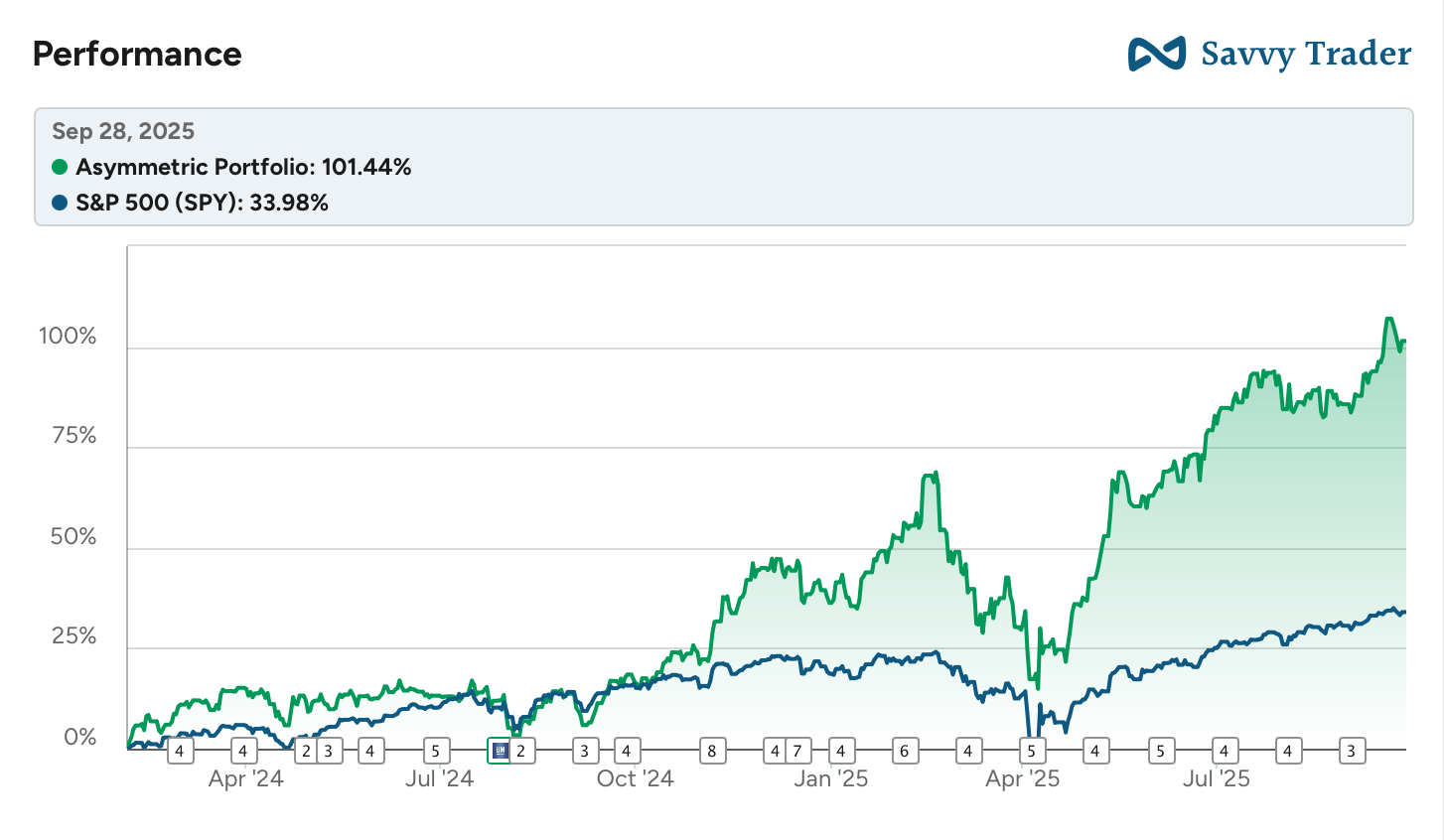

The Asymmetric Portfolio also pulled back from a week ago, but remains over a 100% gain since February 2024. Earnings season in a few weeks will determine if the momentum continues through the end of the year.

In Case You Missed It

Here’s some of the content I put out this week.

Invention vs Innovation: Inventing new things is great, but turning those ideas into money is better.

OpenAI Is Holding Up the Market: Trillions of dollars in market value depend on OpenAI.

Is Airbnb Lost or Just Getting Started?: Airbnb stock has struggled, but the opportunity ahead is still large.

Growth Isn’t Enough

Revenue growth is a huge part of finding market-beating stocks. But if a company can’t turn revenue growth into profits, there’s no sustainable business.

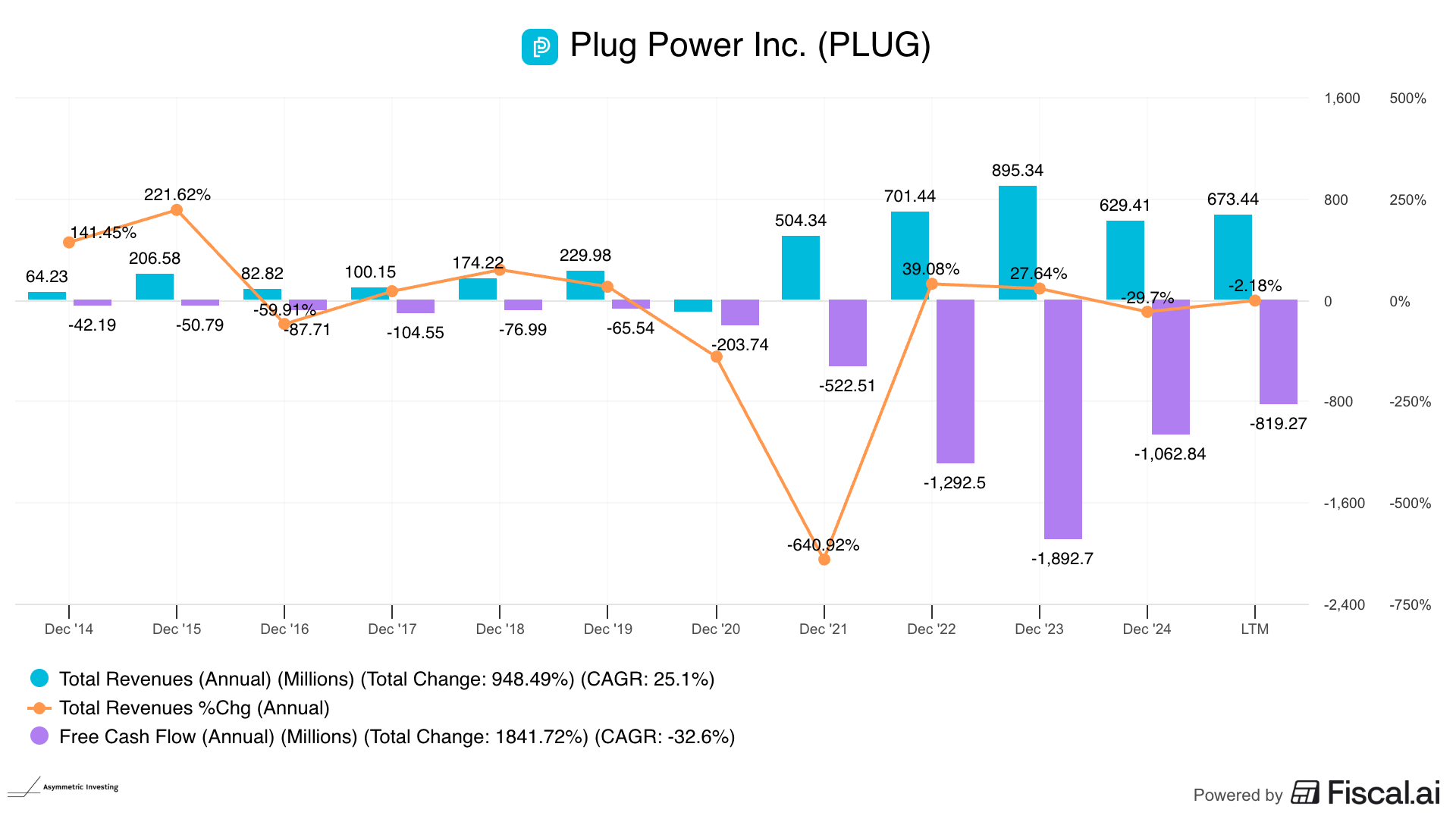

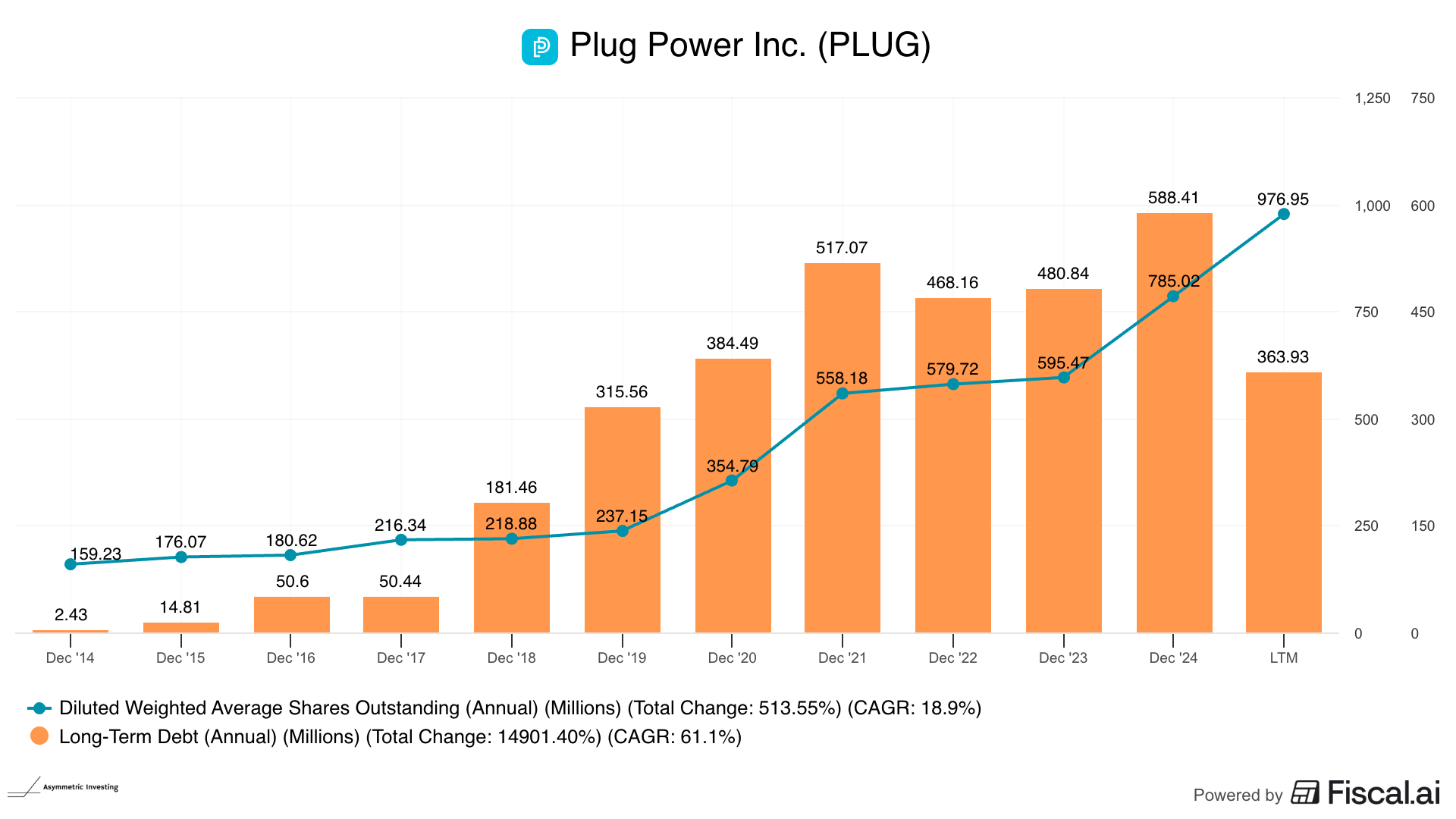

A perfect example is Plug Power, which has been among the hottest stocks in the market in 2014 and 2020. But the company never made money.

And without profits and cash flow, the company needed to fund operations with growing levels of debt offerings and stock sales. Over the past decade, shares outstanding have risen 19% annually, and the stock has plunged, despite growing revenue.

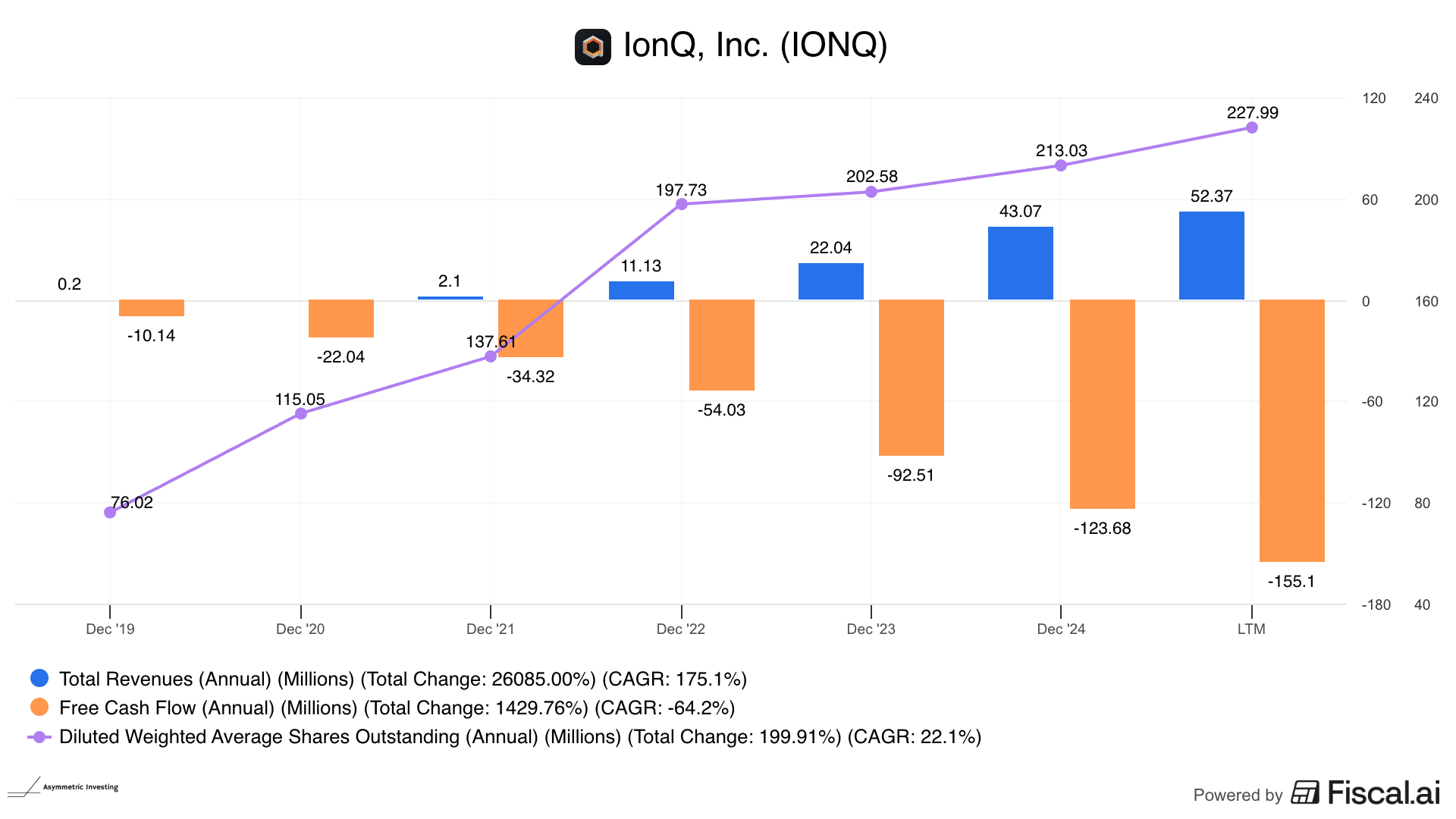

Is it different this time? IonQ thinks it can be bigger than NVIDIA, but the numbers don’t back up those claims. And at this rate, the company will need to continue issuing shares to stay afloat.

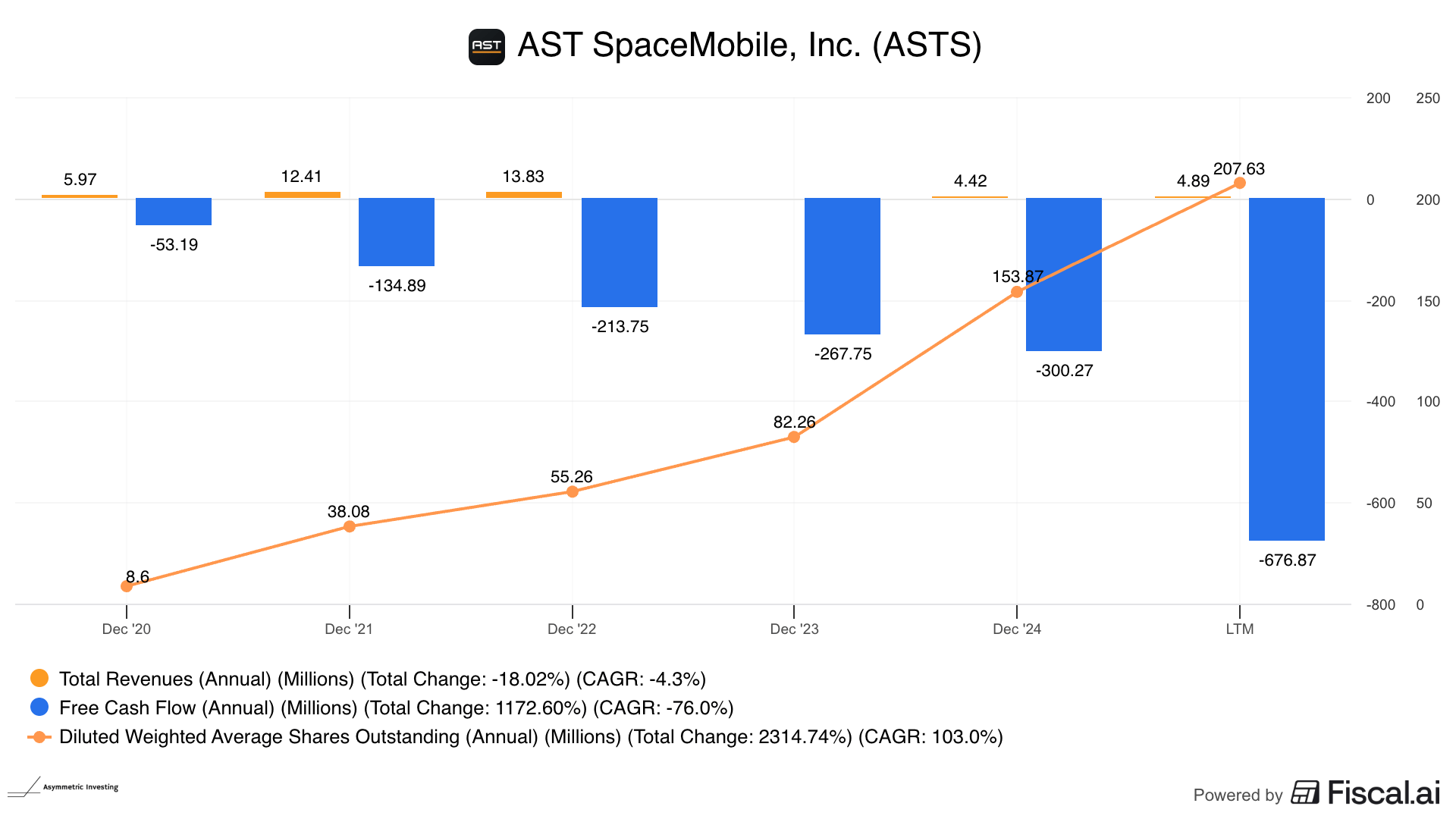

AST SpaceMobile has been incredibly hot this year, but it hasn’t proven a business model or even revenue generation. Yet, this is a $13 billion business.

When you’re looking for asymmetric stocks, revenue growth is great. But if that revenue growth isn’t eventually followed by profits, the business won’t be sustainable.

I have a feeling that a lot of investors will find that out the hard way in the next few years.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your research before acquiring stocks.