The most valuable companies in the world are banking their future on a non-profit that doesn’t have a clear business model and expects to burn another $115 billion between now and 2029.

That company is OpenAI.

The numbers are staggering. OpenAI plans to spend, directly or indirectly, somewhere around $1 trillion on building out infrastructure for its AI models and ChatGPT over the next five years. That’s hundreds of billions in chips, energy, data centers, and air conditioning that have driven up the value of the most valuable companies in the world.

Is this spending the start of a new future or a bubble that’ll ultimately pop?

This may be the most important question facing investors today.

OpenAI’s Commitments

It’s challenging to keep track of the amount OpenAI has committed to spending. Here’s a start of the list:

$300 billion in spending commitments with Oracle

10 gigawatts (~$500 billion) in expenditures for AI data centers with NVIDIA’s backing

$500 billion on Stargate

$850 billion in power spending

The numbers are opaque, and some of that may be double-counting. But you get the picture. OpenAI has committed to spending hundreds of billions of dollars on the AI buildout.

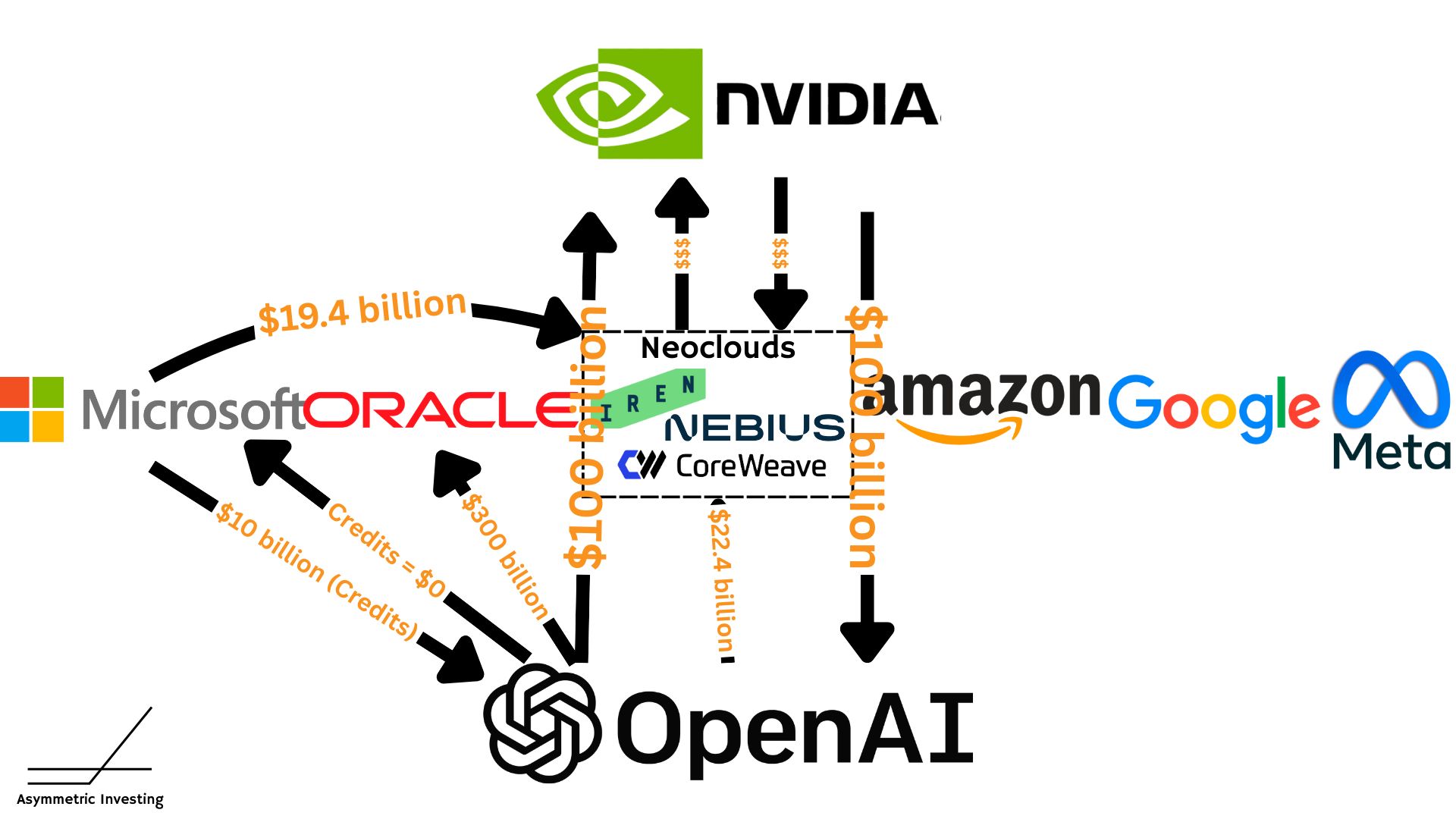

That spend it holding up the valuation of Oracle $ORCL ( ▲ 1.64% ) and NVIDIA, along with neoclouds like Nebius $NBIS ( ▼ 1.17% ), CoreWeave $CRWV ( ▼ 0.39% ), and Iren $IREN ( ▲ 0.48% )?

When Microsoft signs $19.4 billion in deals with CoreWeave, it’s likely to serve ChatGPT demand.

When Oracle announces $300 billion in remaining purchase obligations…that’s OpenAI.

There’s quite literally trillions of dollars of market value hanging in the balance of OpenAI’s planned spending.

Even NVIDIA is caught up in the mix, with over half of its demand (AI chips are split about evenly between Microsoft, Oracle, Neoclouds, Amazon, Google, and Meta) going to companies serving OpenAI.

This image only scratches the surface of the financial shenanigans going on.

Is It a House of Cards?

What’s crazy about the numbers being thrown out is how circular the spending is.

NVIDIA invests in neoclouds like Coreweave, Nebius, and Iren so they can serve AI demand (driven by OpenAI).

Neoclouds then turn around and buy NVIDIA chips.

NVIDIA uses the profits to invest $100 billion in OpenAI.

Who then makes deals with Oracle and Neoclouds, who buy NVIDIA chips?

It’s an AI spending circle.

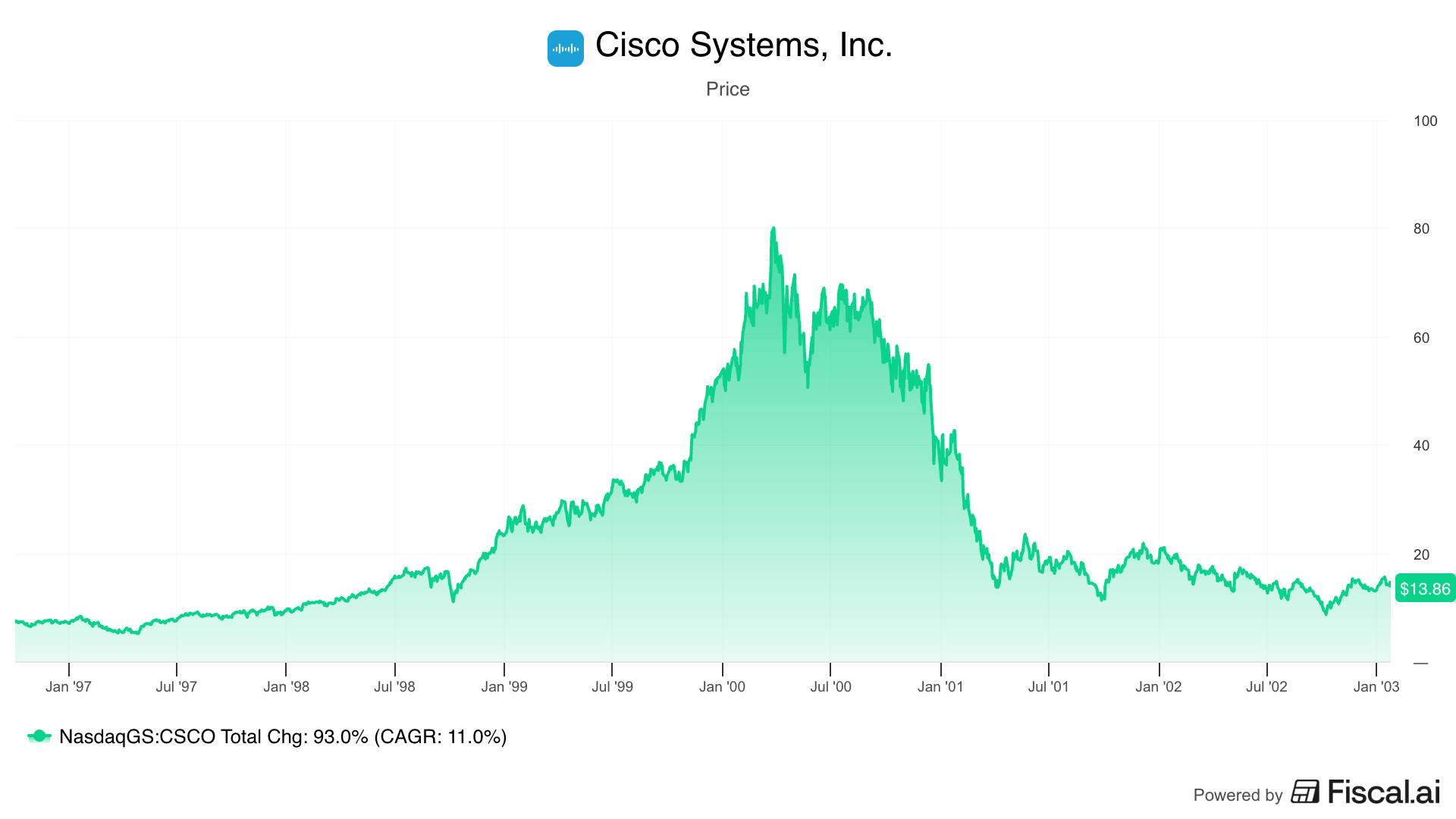

This strategy isn’t new.

It’s called vendor financing. Historically, this financing has been done with debt, but in this case, NVIDIA is financing customers by buying their equity.

But if a supplier is financing demand, what does it say about sustainable demand?

Cisco used vendor financing in the late 1990s to fuel growth. Failing telecoms would turn to Cisco for funding, and they would use vendor financing, or debt provided by Cisco, to buy Cisco products.

It was a great deal until it fell apart. When vendors couldn’t pay their bills, Cisco’s business collapsed, and the telecom bubble burst.

AI is being built on similarly opaque, circular deals. When Microsoft invested $10 billion in OpenAI in 2023, it didn’t write a check; it provided cloud credits. OpenAI used those credits to run ChatGPT at a massive financial loss, but who cares when real money isn’t involved?

Demand was proven out, and to build better models, the vision needs to get bigger.

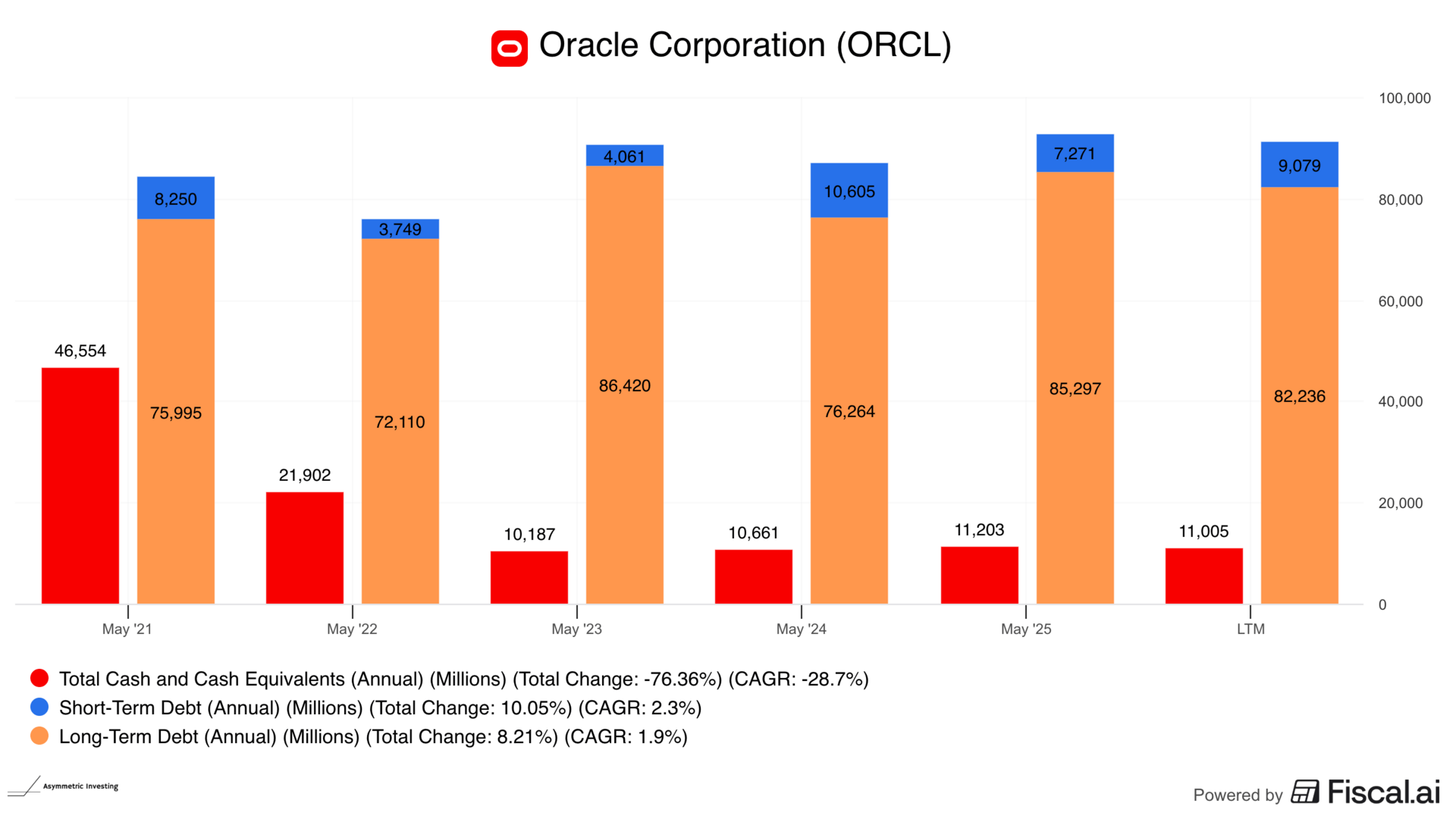

Larry Ellison is convinced of OpenAI’s vision, and so is Jensen Huang, who is willing to fund OpenAI’s grandiose plans. Oracle will even add tens of billions in debt to fund the build-out. (Oracle recently closed an $18 billion debt raise on top of the debt you see below)

All of this spending will pay off IF OpenAI’s business grows as expected. The company expects $174 billion in revenue in 2030, up from ~$13 billion this year. Is that a big leap?

Absolutely!

It took Meta from 2014 to today to grow that much.

And Meta was profitable!

OpenAI is expecting to burn $130 billion between now and 2029!

The money to fund this expansion is easy to get now, but what if the money dries up?

The Market’s $10 Trillion Gamble on OpenAI

The companies agreeing to build hundreds of billions of dollars of chips and infrastructure to serve OpenAI are assuming OpenAI can fund these investments.

But OpenAI is only expecting to generate ~$13 billion of revenue this year, and it will burn around $8 billion in cash.

That cash burn is now expected to be $130 billion through 2029.

There’s a lot of “yada, yada” between here and justifying hundreds of billions of dollars in AI compute investment. And yet the market thinks it’s all real.

I have my doubts, despite being an investor focused on the 10x upside in stocks.

Keep in mind that prices — not just stories — matter, and right now, I don’t see a lot of 10x opportunities in the AI market. I see a risk that’s looking a lot like 1998/1999.

NVIDIA turning to vendor financing is a red flag.

As was NVIDIA guaranteeing $6.3 billion of cloud revenue if CoreWeave doesn’t have demand.

in instances where [CoreWeave’s] datacenter capacity is not fully utilized by its own customers, NVIDIA is obligated to purchase the residual unsold capacity through April 13, 2032

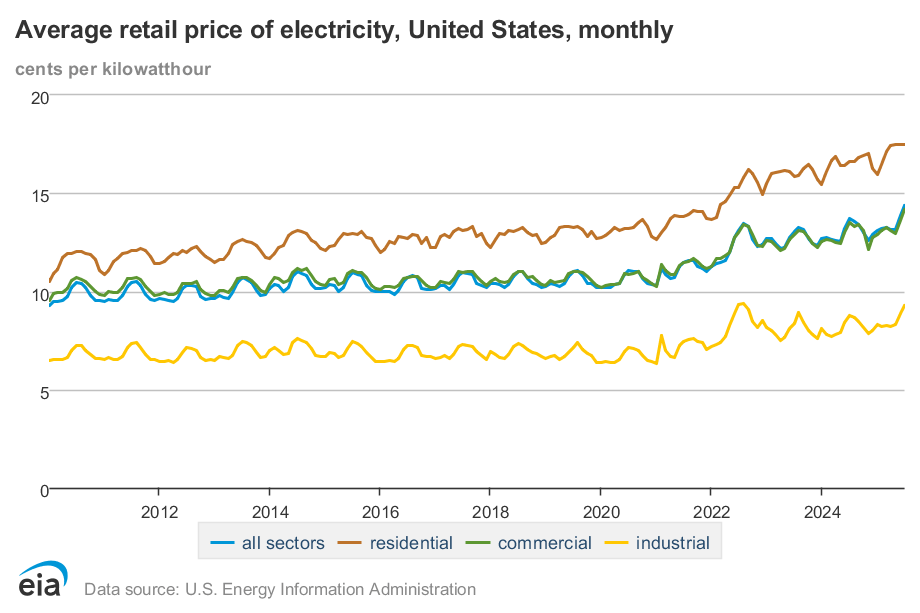

None of this is to mention the cost of electricity, which is rising at a rate we haven’t seen in decades. Will the average consumer be happy about higher electricity costs when the payoff is…a better ChatGPT?

It’s all a big gamble.

We haven’t seen a gamble of this scale since the late 1990s. And that one didn’t end well for investors buying at the peak.

The fact that so much of the market’s value is riding on demand from OpenAI, which is burning money, doesn’t have a business model, and is now losing market share to Google, is concerning.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.