Meta Platforms $META ( ▲ 1.69% ) announced a new pair of Ray-Ban AI glasses last week, and it was a compelling demo, if not a compelling product. The announcement was a decade and tens of billions of dollars in the making, and still, I was left wondering who would really “figure out AI glasses?”

Don’t get me wrong, I like the effort. But inventing everything that goes along with a new device is very different than innovating in a new technology paradigm. And the difference could be between being a good investment and burning through billions.

More on that in a moment.

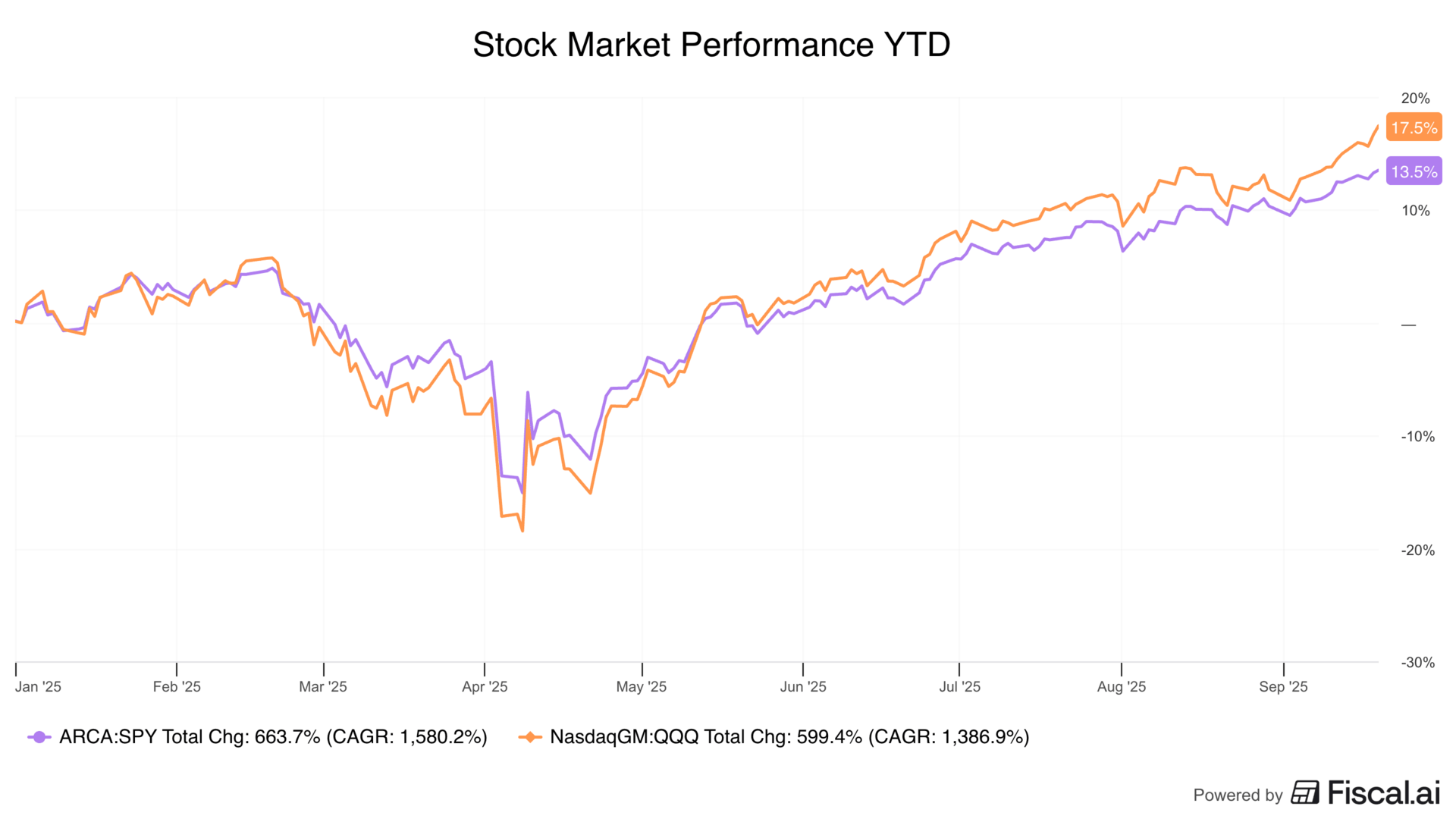

As far as the market goes, stocks kept moving higher last week. The Fed cut rates a quarter percentage point, as expected, and I guess that was enough to please the market.

s

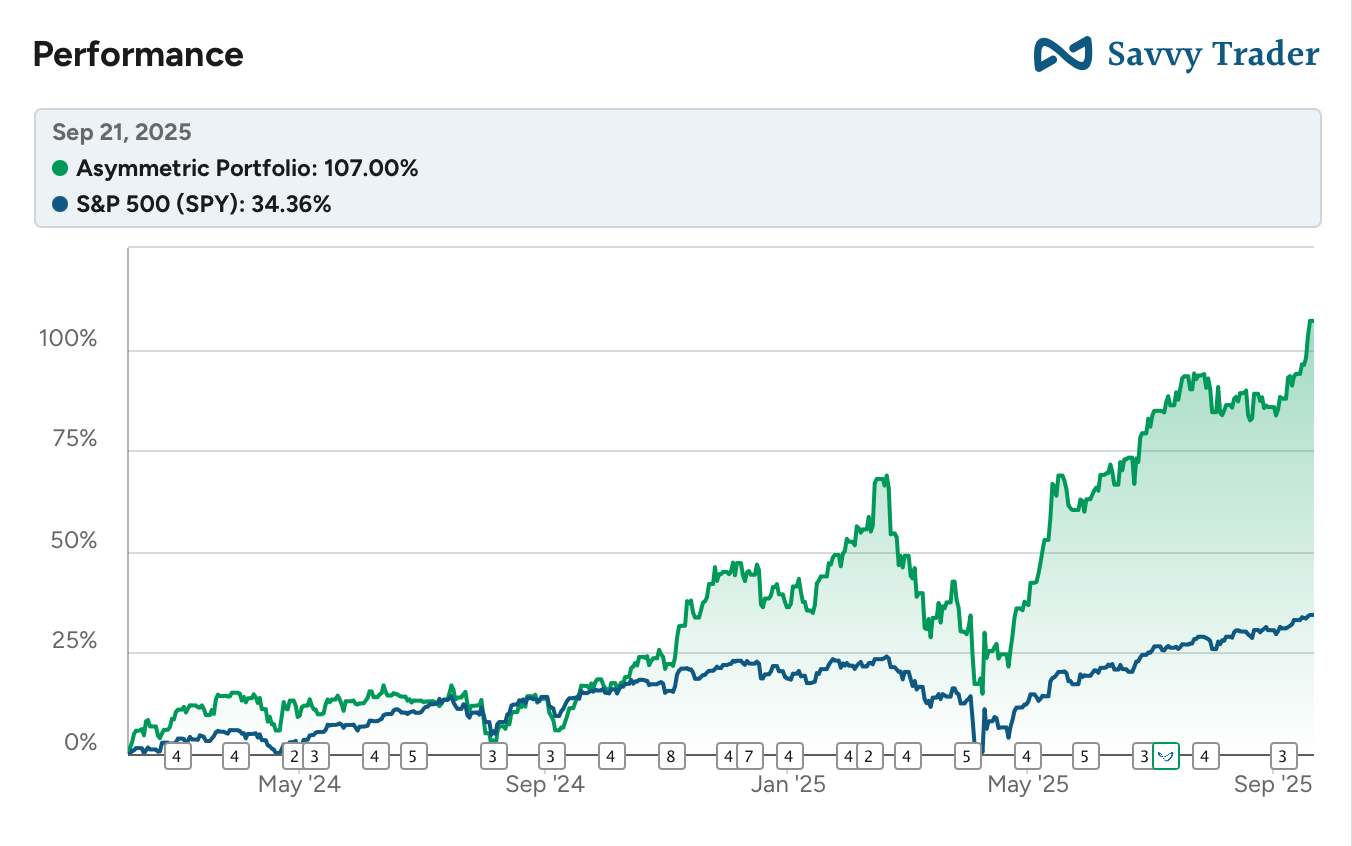

The Asymmetric Portfolio has achieved a 100% return since I started tracking on Savvy Trader. Despite a lack of news, it was a good week, and I’ll take the wins when they come.

In Case You Missed It

Here’s some of the content I put out this week.

Lyft Stock Soars: Lyft has partnered with Waymo, potentially showing the market how much potential the company has in autonomy.

Can We Talk About Spotify?: Spotify is up 450% in the Asymmetric Portfolio, so what went right?

Duolingo Spotlight: The next stock in the portfolio is Duolingo!

Invention vs Innovation

One of the lasting lessons from my time in 3M’s lab was two simple lines I was taught about innovation and invention.

Invention is turning money into ideas.

Innovation is turning ideas into money.

My job, at the time, was to invent cool stuff in what I called the “deep lab”, but those ideas were just that until someone turned them into something someone would buy. The difference is subtle, but profound. You need ideas to make money, but without ideas, you have nothing.

In many cases, inventing things isn’t enough. In fact, it’s just the start. And inventing something doesn’t mean you can turn the idea into money.

Apple didn’t invent the mouse, graphical user interface, or Ethernet; Xerox did.

Apple didn’t invent the smartphone; General Magic did.

Apple innovated by turning those inventions into lots and lots of money.

The tale is as old as time.

Nikola Tesla invented the alternating current power system and the radio, but it was innovators like Thomas Edison and Guglielmo Marconi who turned those ideas into some of the biggest companies in the world.

Are we seeing the same thing today with wearables?

Is Meta inventing everything that goes into making AI/AR glasses only to see someone else make all the money?

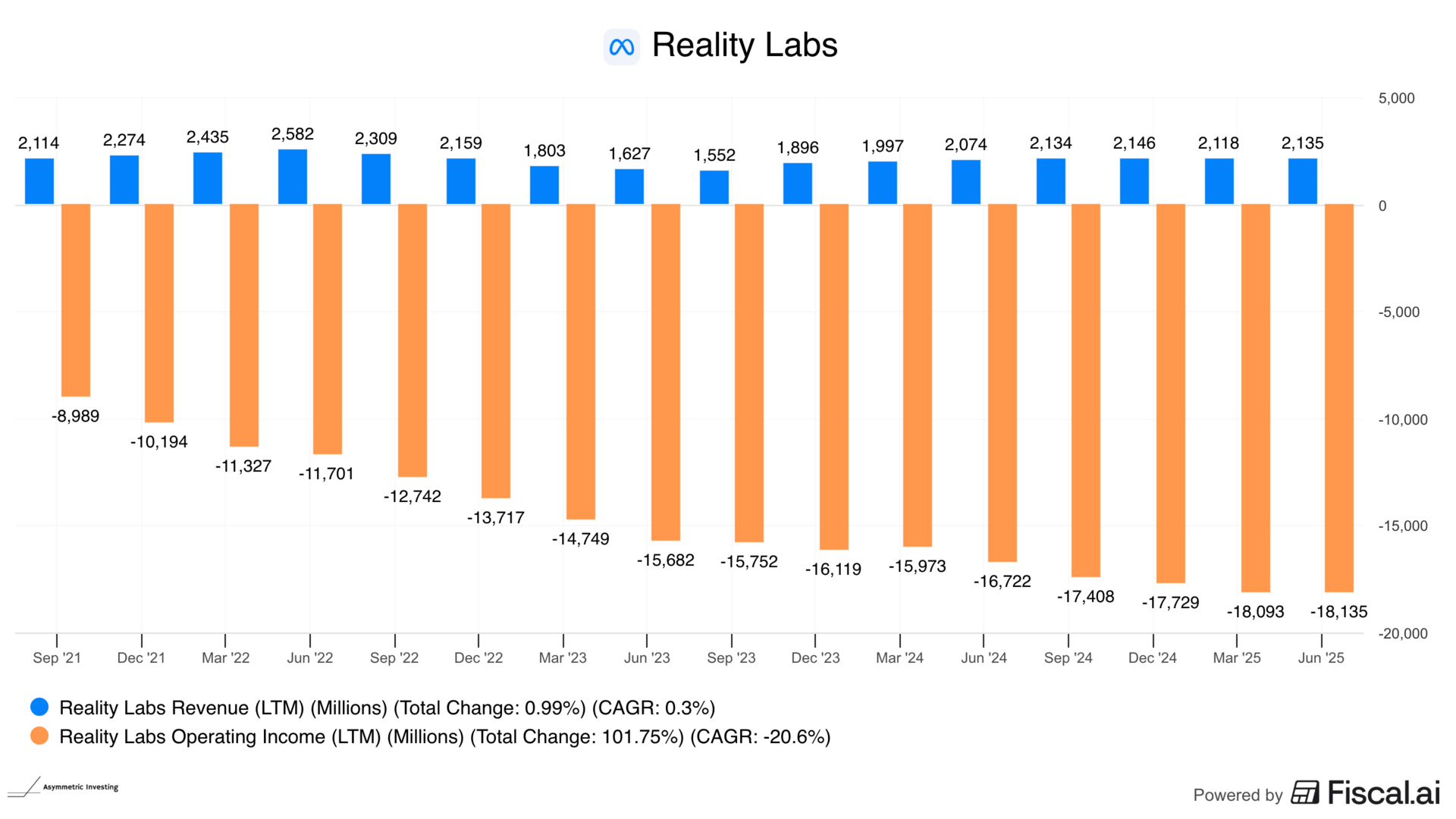

The cost to develop this technology within Reality Labs is astounding. And I have to wonder if the company will ever sell enough devices to make up for what it’s spending.

If these glasses were sold at $800 apiece with a $200 gross profit (doubtful today), Meta would need to sell 91 million pairs of glasses to break even on Reality Labs.

Meta looks like a company that’ll invent what it needs to in order to build AI/AR glasses. But will people want to buy these early glasses, or will a “good enough” pair based on Google Android or another AI be enough to capture the market?

Innovation is where the money is made, and in this case, I have a hard time seeing Meta turning AI/AR glasses into a big moneymaker.

There’s an opportunity here, but it may be with the innovator that’s yet to emerge, not the inventory of cool AI/AR technology, that provides the best investment opportunity.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your research before acquiring stocks.