Scheduling Note: This week is one of the three weeks each year (spring break, late August, and Christmas) that I take a few days off with the family. As a result, there will be no posts from me until next Sunday, August 24. Enjoy your week!

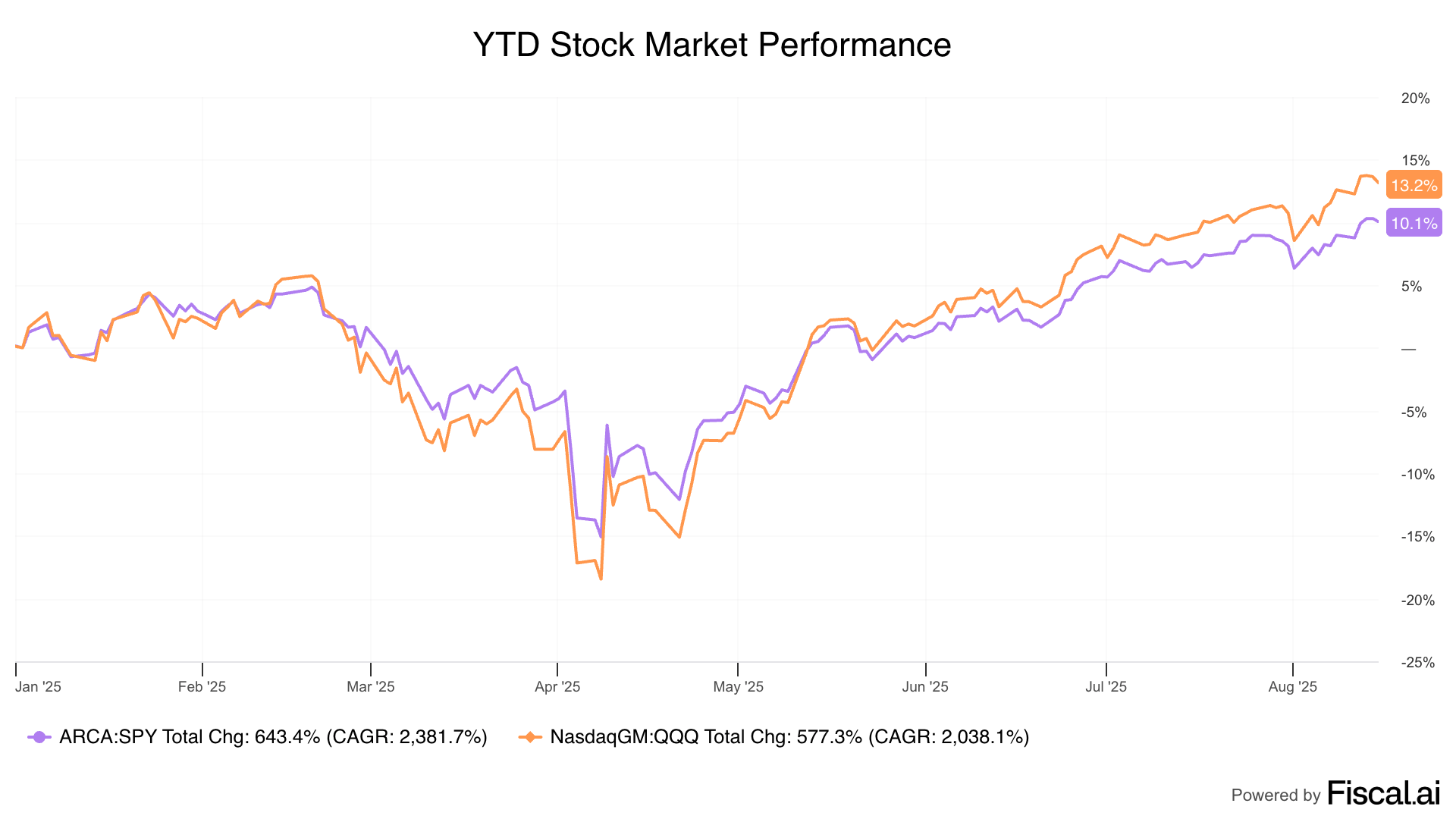

In April, President Trump announced widespread tariffs on imports into the United States. The market panicked and fell nearly 20% because tariffs mean higher prices for consumers who are already facing a weak labor market, a looming student loan cliff, and high housing costs. Higher costs for goods could lead to an outright recession.

Since then, the market has ripped higher as delay after delay of tariffs have been announced. But on August 7, 2025, tariffs did take effect, and in some cases, the rates were even higher than what was announced on April 2.

The market doesn’t seem to care, and I listened to this week’s B2G Podcast with amazement as Altimeter Capital’s Brad Gerstner confidently exclaimed that countries were eating the tariffs, they weren’t being passed on to U.S. consumers.

This is simply not true!

And yet, based on the chart below, the market seems to agree. I’ll get to why this week; that story may change in a moment.

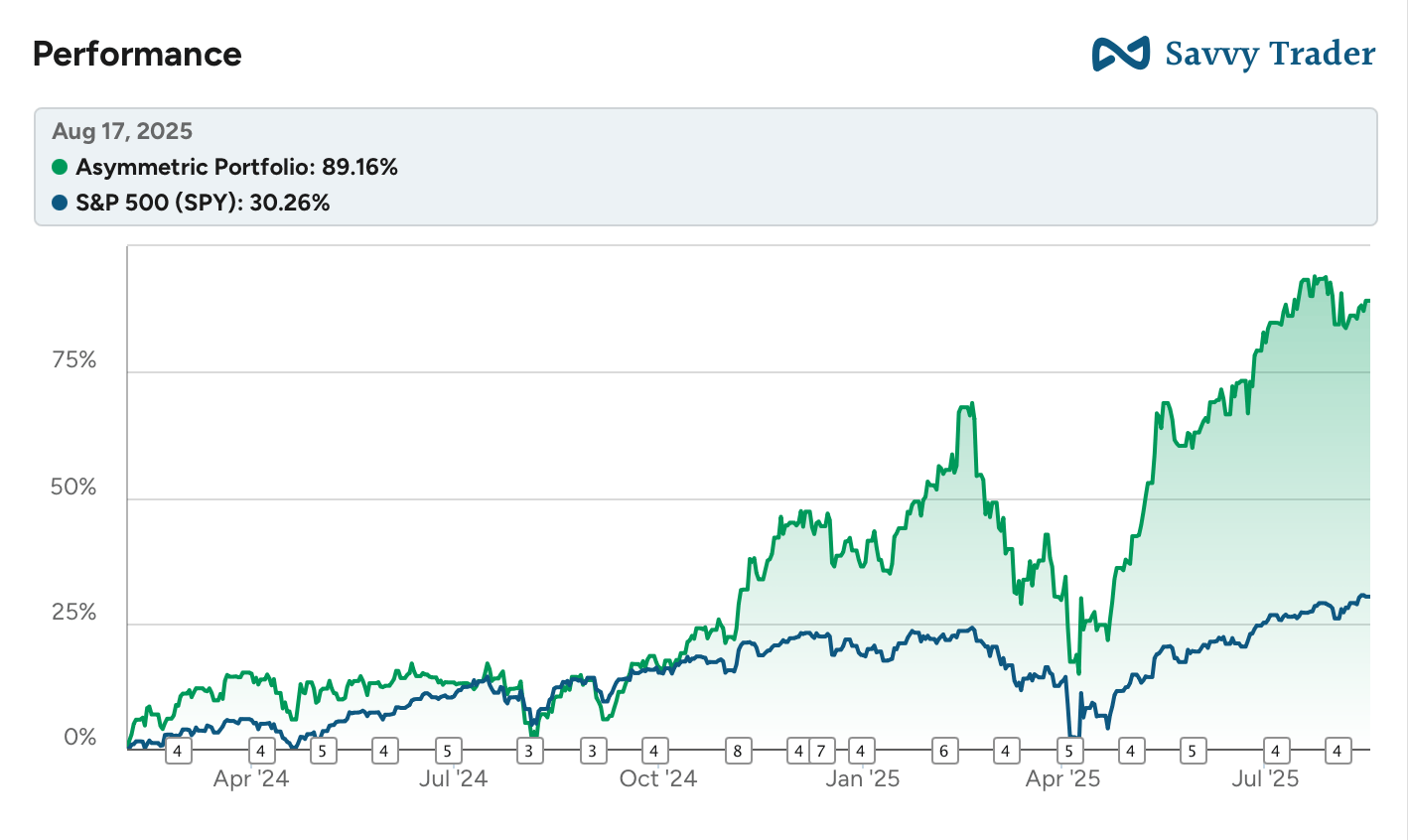

The Asymmetric Portfolio had another wild week with some of the top holdings struggling (no surprise given their valuations) while some smaller positions like Lyft $LYFT ( ▲ 0.36% ) suddenly came to life. It was a shockingly quiet earnings season for the portfolio, and I’m not sure if that’s good because the market is holding steady or bad because even great results didn’t lead to much movement.

In Case You Missed It

Here’s some of the content I put out this week.

When Great Isn’t Good Enough: On Running is reporting phenomenal results, so why is the stock dropping?

Earnings Season Catch-Up: Part 2: A look at some of the overlooked earnings reports this quarter.

The Inflation Boogeyman

We’ve been hearing for months that inflation is around the corner.

And it never arrives.

Last week’s consumer price index (CPI) reading showed a 2.7% increase in prices from a year ago, above the Federal Reserve’s target but not problematic. Investors still think that level of inflation will allow the Fed to cut interest rates, which doesn’t make sense to me given relatively low unemployment and high-ish inflation, but that’s the expectation.

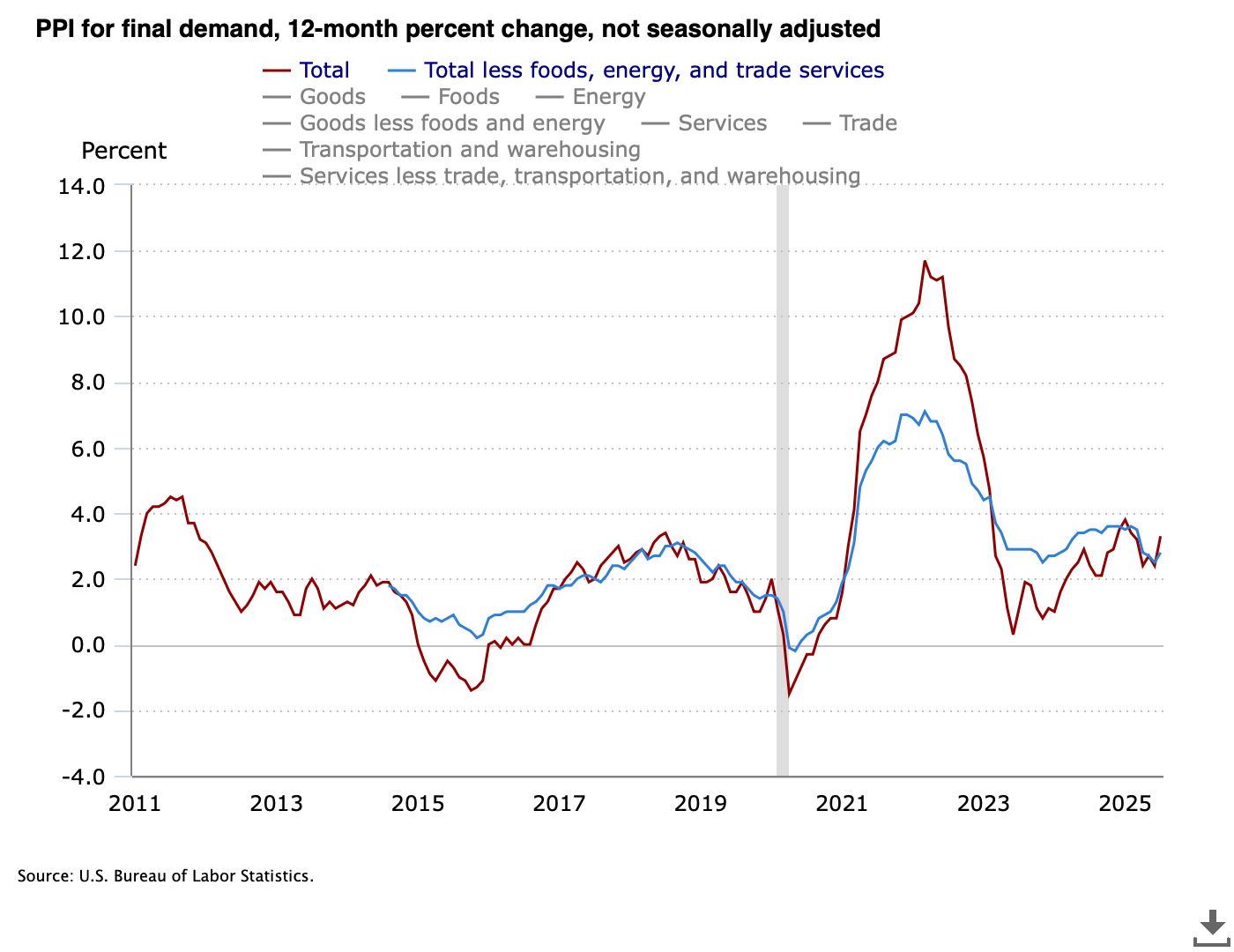

You can see below that inflation is a little high, but we’re not in a 2022 situation.

But then Thursday’s producer price index (PPI) came out, and it showed a 3.3% increase in prices for companies, led by things like equipment coming from overseas. Is this a canary in the coal mine?

PPI is a precursor to CPI.

If prices are going up on imports, it’ll hit companies first and consumers next.

And this time lag is what the market seems to be missing.

Tariffs, Time, and Inflation

When a tariff is announced on April 2, 2025, retailers don’t go out and raise prices on April 3. It takes many months for those higher costs to be seen in stores.

Some of the delay is logistical. Store merchandise is planned over a year in advance, and signage is designed months in advance.

But there’s also the reality that goods don’t go from where they’re produced to someone’s home in the blink of an eye. The shirt you’re wearing may have been made 6 months before you bought it in Cambodia.

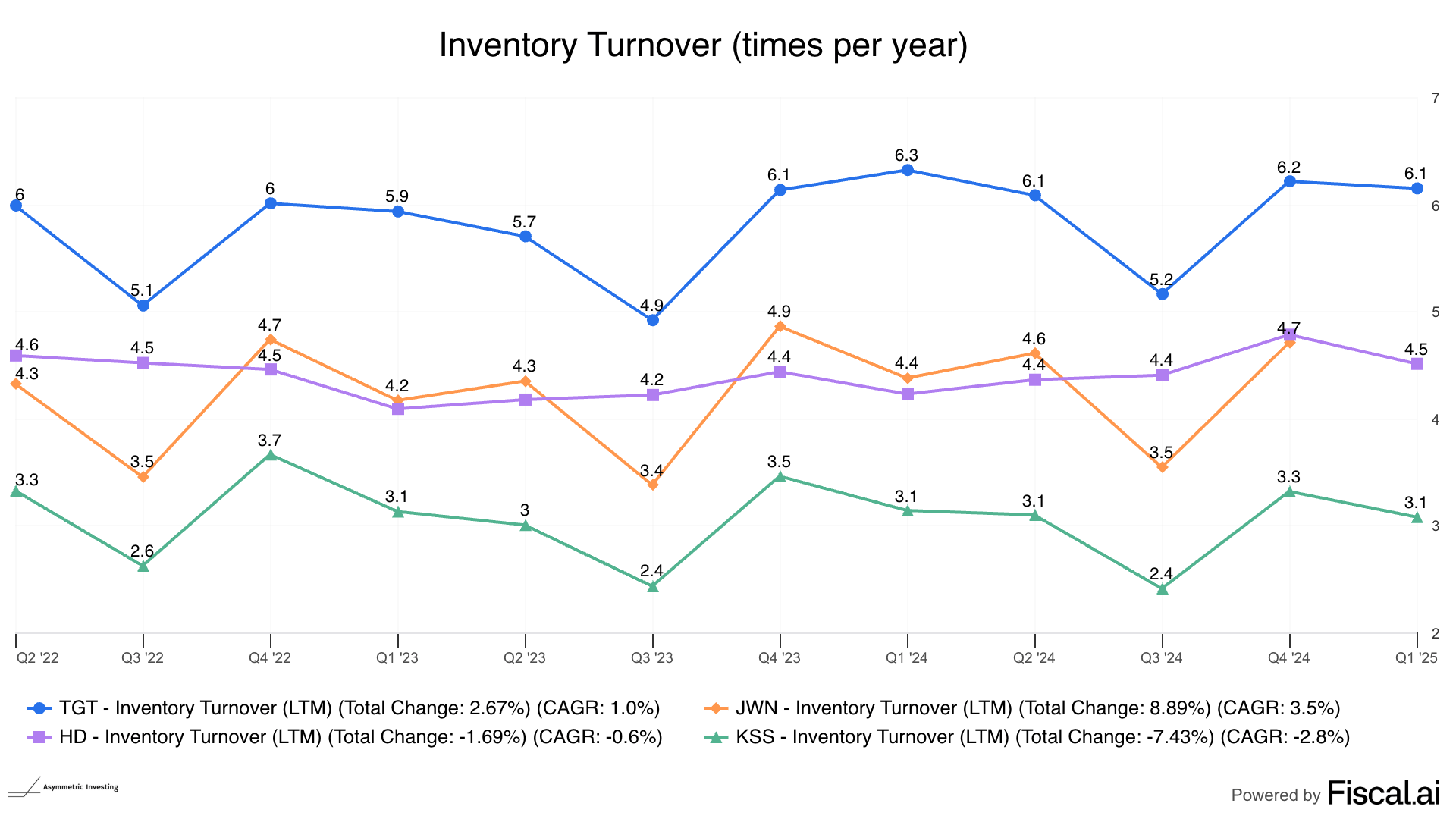

To put some numbers to it, below is the inventory turnover rate of Target, Nordstrom (which is now private), Home Depot, and Kohl’s. This is just their inventory turnover and doesn’t include any time in a manufacturer’s warehouse, distribution center, etc.

Target is the most efficient of the four, turning over inventory in a little less than two months on average. Home Depot turns inventory about every 2.5 months. Kohl’s is least efficient at about every 4 months.

So, the average product on a Target shelf today (including groceries) was purchased by Target in mid-June. For products like clothing, electronics, and domestic items, that figure probably extends further to April, May, or even earlier.

The prices on Target’s shelves haven’t really been impacted by tariffs because orders, signage, and contracts were set well before June, when the average item hit Target’s warehouse. But move into September and October, and we’re getting to the point where contracts could be changed, orders may shift up or down, and in-store signage could be adapted to the tariff reality.

There’s a multi-month delay between when tariffs were announced and when higher prices would be seen by consumers. And with most retailers reporting this week, it’s likely we’ll see price increases be a topic of discussion.

I’m not saying prices are going to go up 20% or 30%, but I am saying a 2.7% CPI reading may be unlikely in the back half of the year. And if inflation goes up to 3%, 4%, or 5%, it may change the direction of the Fed Funds rate and economic projections.

What does that mean for stocks?

We’ll learn a lot this week, and I think we’ll start to see the discussion around tariffs and inflation start to shift because higher costs are now starting to flow through the system.

And by Christmas, higher costs will hit everyone.

This was predictable.

In fact, on April 27, I wrote about the Christmas shopping season being when tariffs will hit our pocketbooks.

Prepare for the “countries are eating tariffs” narrative to go by the wayside soon because companies are only now being forced to choose between giving up profits or raising prices to pay for tariffs.

And business isn’t a charity, so higher prices it is.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your research before acquiring stocks.