Most companies would love to report the kind of numbers On Running $ONON ( ▼ 4.01% ) just reported for the second quarter of 2025. The company’s revenue increased by 38.2% on a constant currency basis, gross margin reached an impressive 61.5%, and operating profit nearly doubled.

For comparison, Nike’s revenue dropped 12% and Deckers Outdoor (which makes Hoka) saw a 17% increase in sales, with a 20% increase in Hoka sales.

On Running is lapping the field!

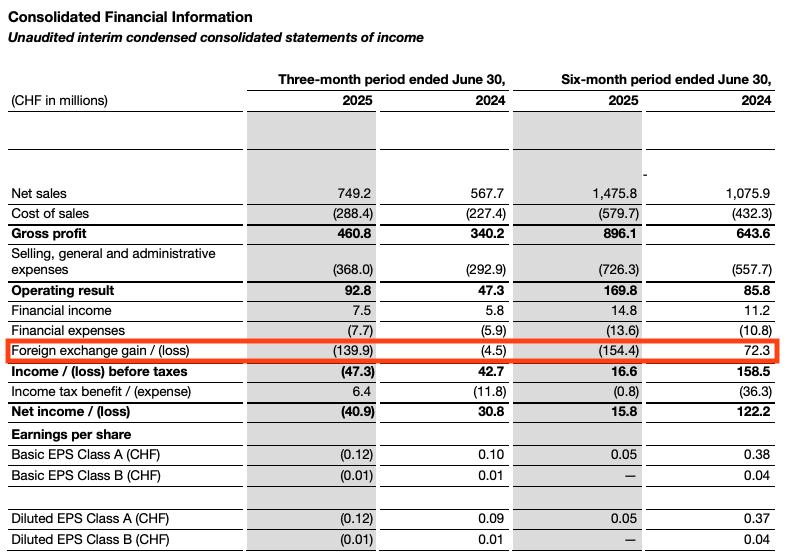

But On reported a surprise net loss for one simple reason. There was a loss of 139.9 million Swiss francs related to foreign currency changes. In other words, a weak dollar resulted in a huge loss.

I’ll explain what happened below, but this is a look at the important metrics in U.S. dollars, which is the lens through which I’ll discuss most results below. Like I said, they’re impressive.

The On Running Currency Confusion

Every once in a while, you’ll see a strange reaction to a quarter from On because the company reports earnings in Swiss francs and most of their revenue is in U.S. Dollars.

Think of it this way: The Swiss franc is the “lens” with which On reports results. And relatively little of the company’s sales and cash is generated or held in Swiss francs, so currency fluctuations can make that “lens” confusing for investors.

When the dollar is weak, as it is now, it makes sales in the U.S. “look” lower than they would be if the company reported in U.S. dollars.

On also holds U.S. dollars on the balance sheet, and if the dollar falls, it needs to take a loss on the dollars it holds because the balance sheet’s “lens” is in Swiss francs.

For example, if On sold a shoe for $100 on May 25, 2024, it would have been reported as 92 Swiss francs in revenue. The same shoe sold for $100 on May 25, 2024, would be 82 Swiss francs in revenue. It’s a drop in revenue on a reported basis, but constant sales on a constant currency basis.

The same thing would happen to dollars on the balance sheet. $100 in cash on May 2024 would be reported as 92 Swiss francs at that time. If it were held for a year, the value had dropped to 82 Swiss francs, so the balance sheet would be worse from the Swiss franc lens. Here’s the important part: That change in value would be recorded as a 10 Swiss Franc loss on the income statement!

This is technically a “real” loss. But only through the Swiss franc lens. Through a U.S. dollar lens, sales and the balance sheet would look better.

This isn’t right or wrong, it’s a matter of perspective. And sometimes investors don’t understand when a loss isn’t really a loss for On Running.

The Real On Running Story

What’s really going on at On Running?

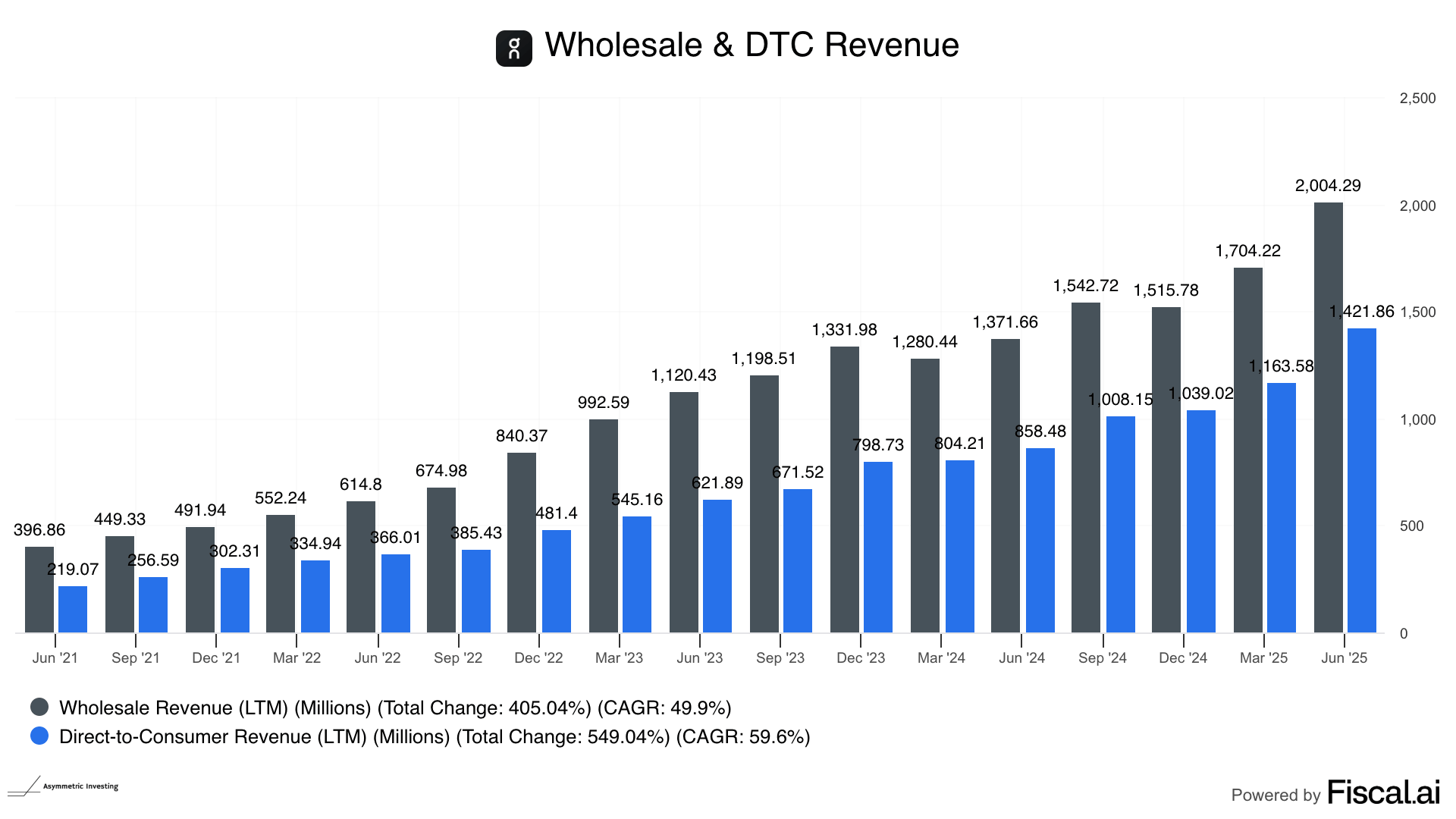

Let’s not make this complicated. The company is growing in both wholesale and direct-to-consumer, indicating strong growth even in what some companies thought was a weak quarter for consumers.

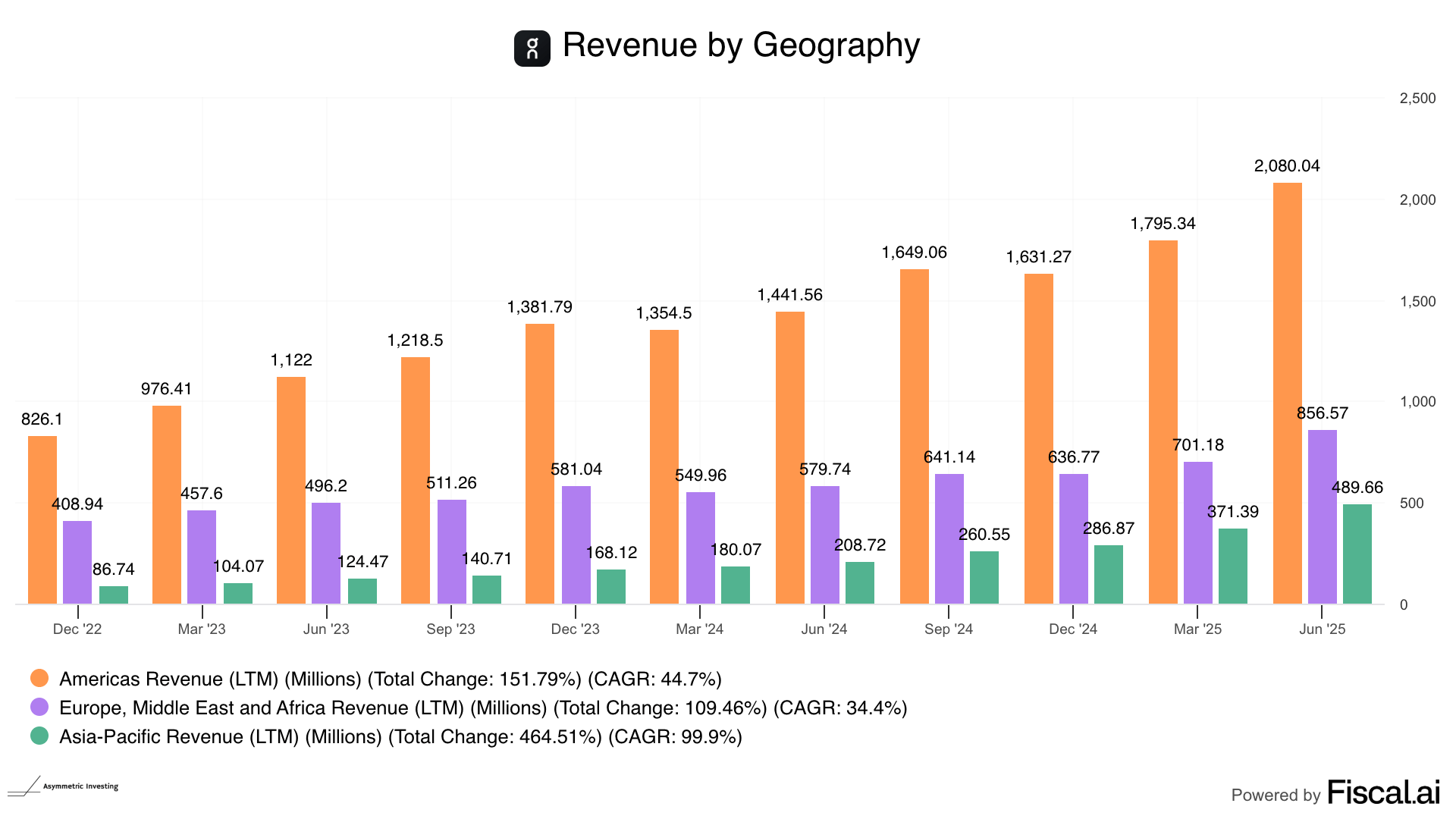

Growth is broad-based around the world, but U.S. demand seems particularly strong.

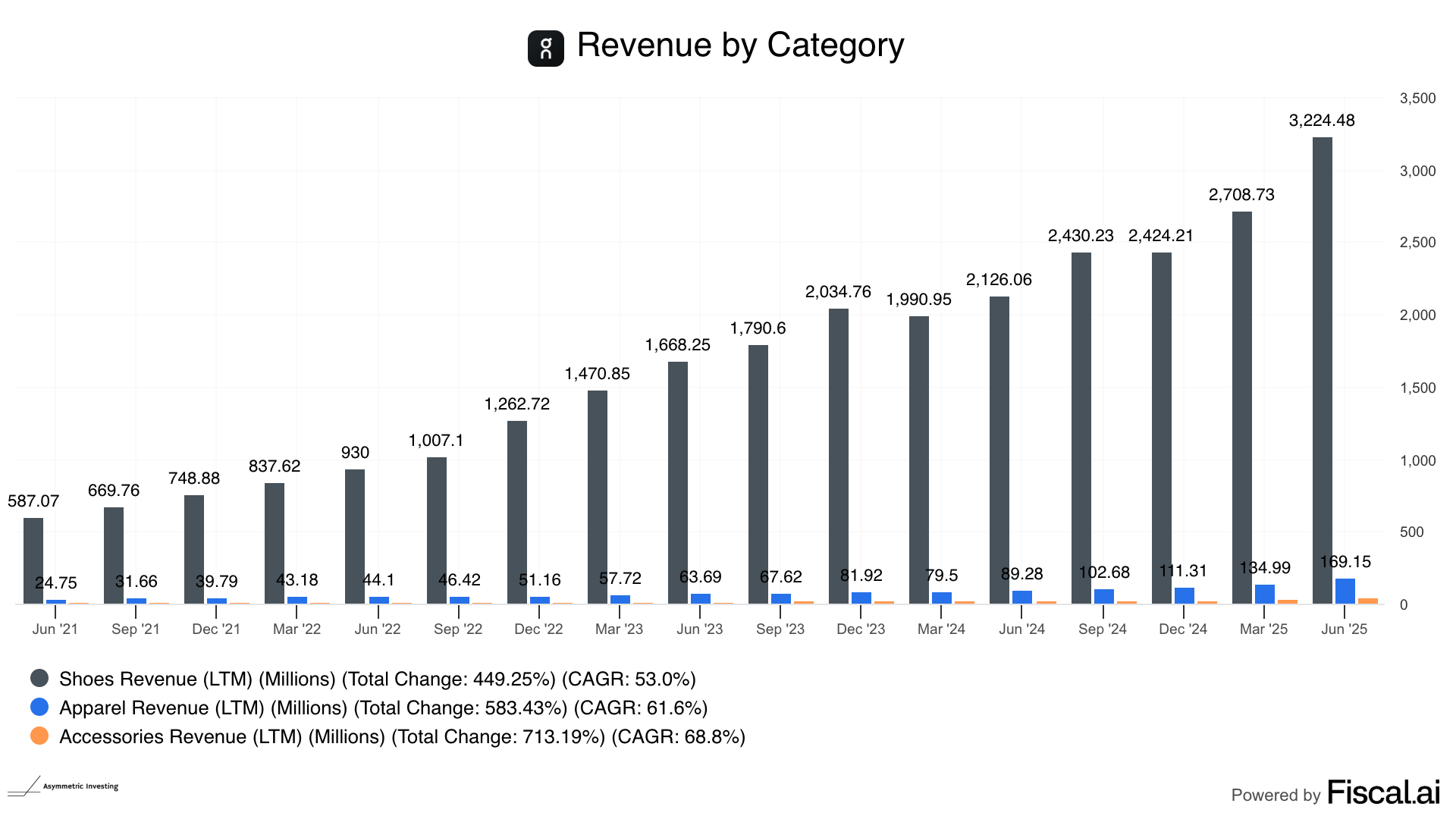

Shoe demand is high, but do you see the opportunity for apparel and accessories? They’re minuscule on this chart.

If we take away shoes, you can see that apparel is growing quickly and there’s room to 10x revenue over the next decade.

There are tailwinds behind the business, and management continued to increase guidance for the full year after Q2.

This management team typically sandbags results, so expect full-year growth to be higher than the 31% outlook on a constant currency basis.

What’s not to like?

I have pored over the numbers and I can’t find anything. There’s no indication of a loss in pricing power or weak margins, or slowing growth. Nothing. It’s about as good as a quarter can be.

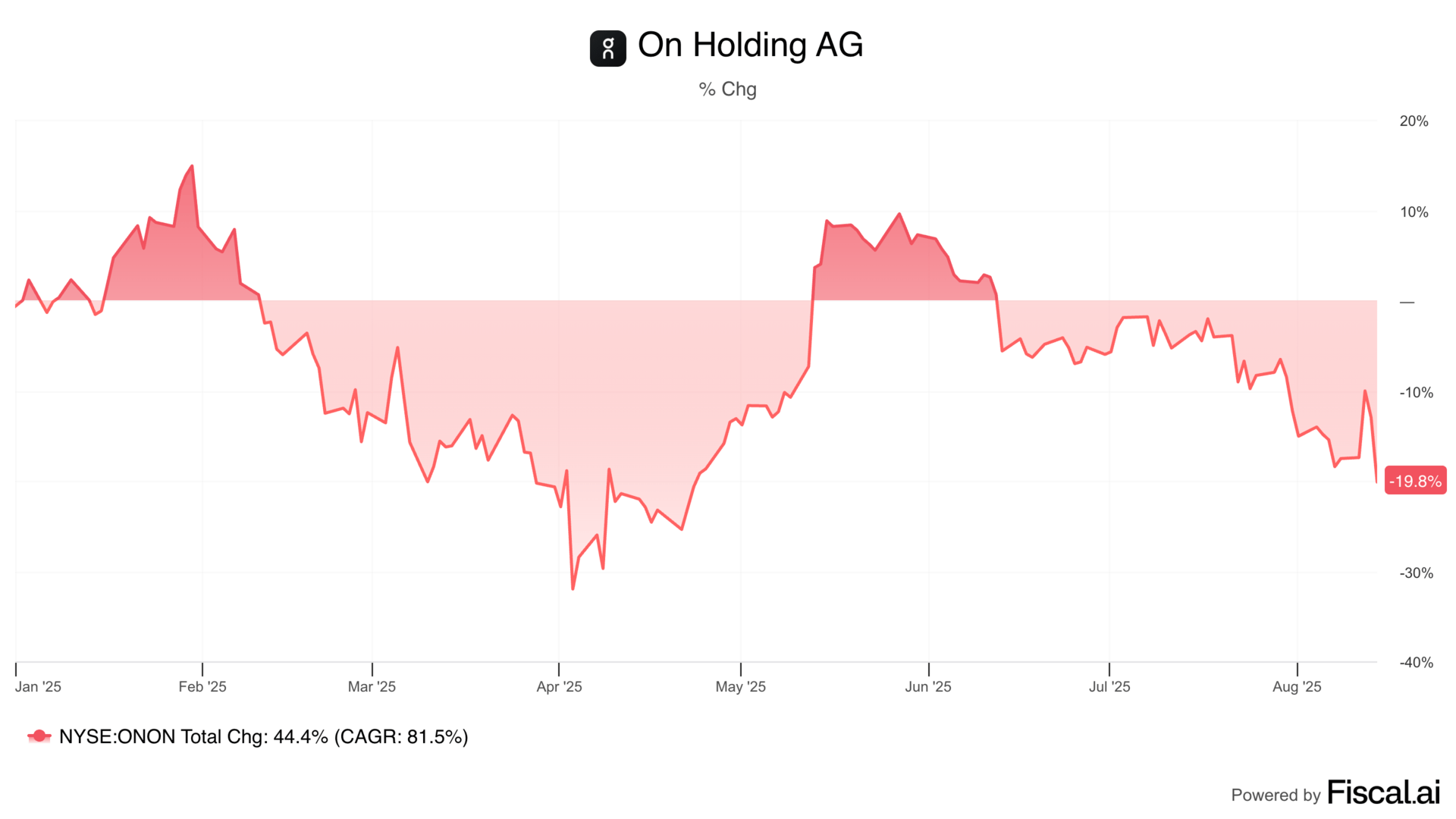

And yet, the stock is down.

Why Investors Are Freaking Out

I don’t know what everyone in the market is thinking, but I have three explanations for On’s drop while the results look phenomenal.

Currency Confusion

Did On Running beat estimates or miss estimates by a wide margin?

The answer likely depends on whether you include the impact of currency fluctuations or not.

Is a weak dollar bad for On because it’s a Swiss company? No, but that’s the market’s view right now.

Confusion around currencies can hurt a stock like On, and that makes some sense. But I see that as an opportunity.

Tariff Unknowns

Depending on the day, investors are worried about tariffs.

On Thursday, the market dropped because inflation (PPI) was high for producers in the U.S., and that could be a leading indicator of goods costs over the next year.

Will On Running be impacted?

Probably with higher costs.

But with high margins and pricing power, I’m not worried about it compared to more cost-sensitive companies.

Markets don’t like uncertainty, but in this case, that’s our opportunity.

Jefferies Spooks Investors

One of the advantages we have over the market is being able to think long-term, while most analysts and investors try to guess what next quarter or next year is going to look like.

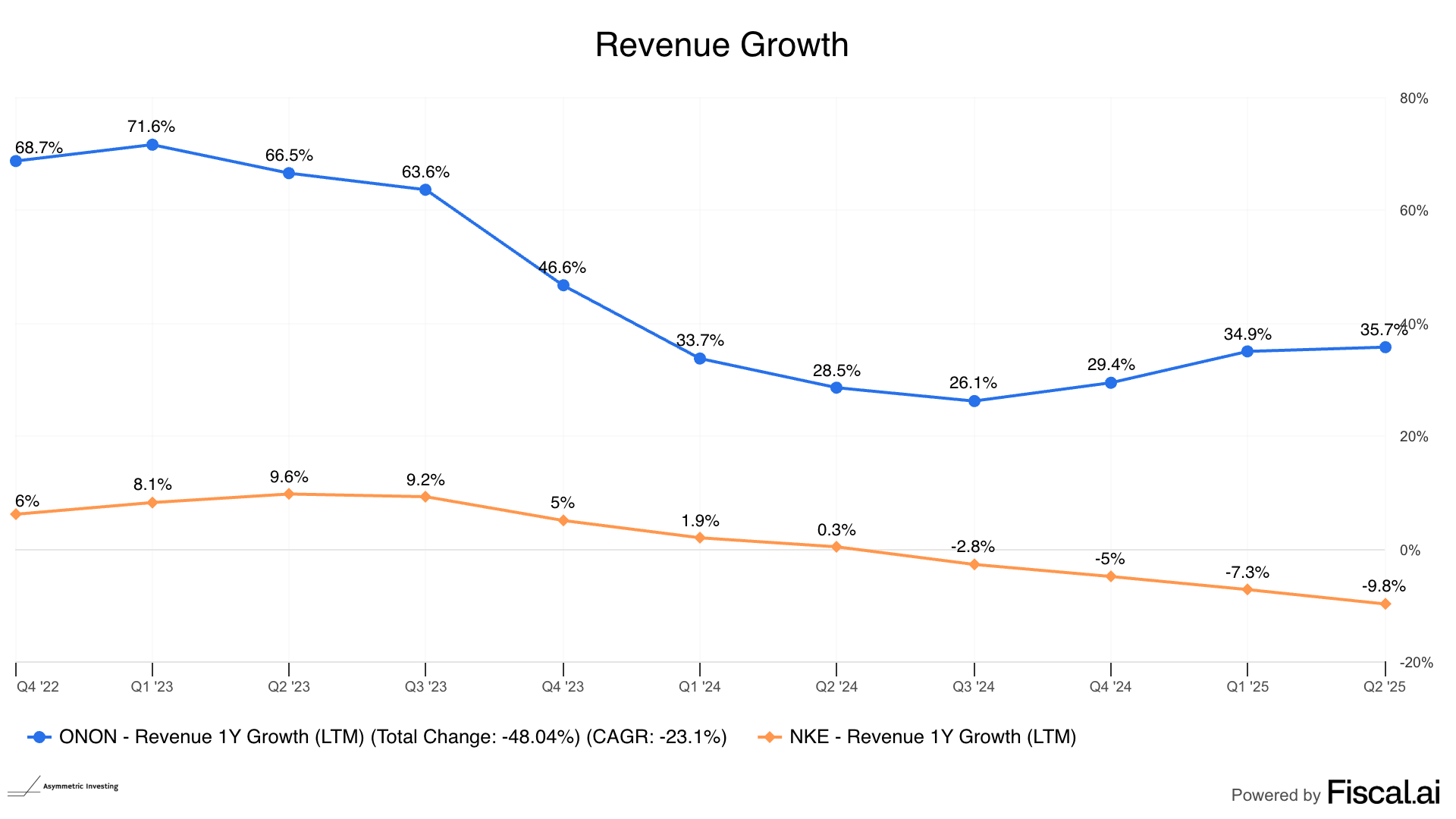

We’re seeing this in action this week after Jefferies said On’s growth would slow to mid-teens in 2026 because Nike is going to take back market share. Yes, the Nike with a 12% drop in sales is going to beat On in 2026!?!

Jefferies downgraded On Holding AG to Underperform from Hold, saying the Swiss athletic footwear maker’s rapid growth is likely to slow from 2025 as U.S. store openings plateau and retailer orders shift back toward Nike.

The brokerage said On’s sales growth rate would likely peak this year before moderating in 2026, when it expects sales to rise in the high-teens percentage range, below Wall Street forecasts of about 25%.

It also sees EBITDA growth halving as the company adds fixed costs from expanding its own stores and brand ambassador programs, while introducing new footwear styles that could carry higher markdown risk.

Jefferies warned that Nike’s renewed product pipeline and wholesale push would challenge On’s sell-in and sell-through momentum, reversing some of the more than 200 basis points of market share gains On captured while Nike retrenched from wholesale distribution.

The note also flagged the company’s premium pricing, with most footwear retailing for $150 to $200 or more, and a reliance on its Cloud franchise as constraints on its addressable market and a potential fashion risk.

Apparel, which makes up less than 5% of sales, is too small and expensive to meaningfully expand the brand’s reach, it added.

Jefferies lowered its price target to $40, based on a mid-teens EV/EBITDA multiple, and set a bear-case valuation of $30, citing the likelihood of multiple compression as growth slows.

The stock’s current EV/EBITDA multiple, just under 20 times, is nearing Nike’s despite Nike’s larger scale, global share lead and broader lifestyle offering, the analysts noted.

I’m not going to say the bear thesis is impossible. But let’s put the Jefferies take into some perspective because this is the same thing the market seems to think.

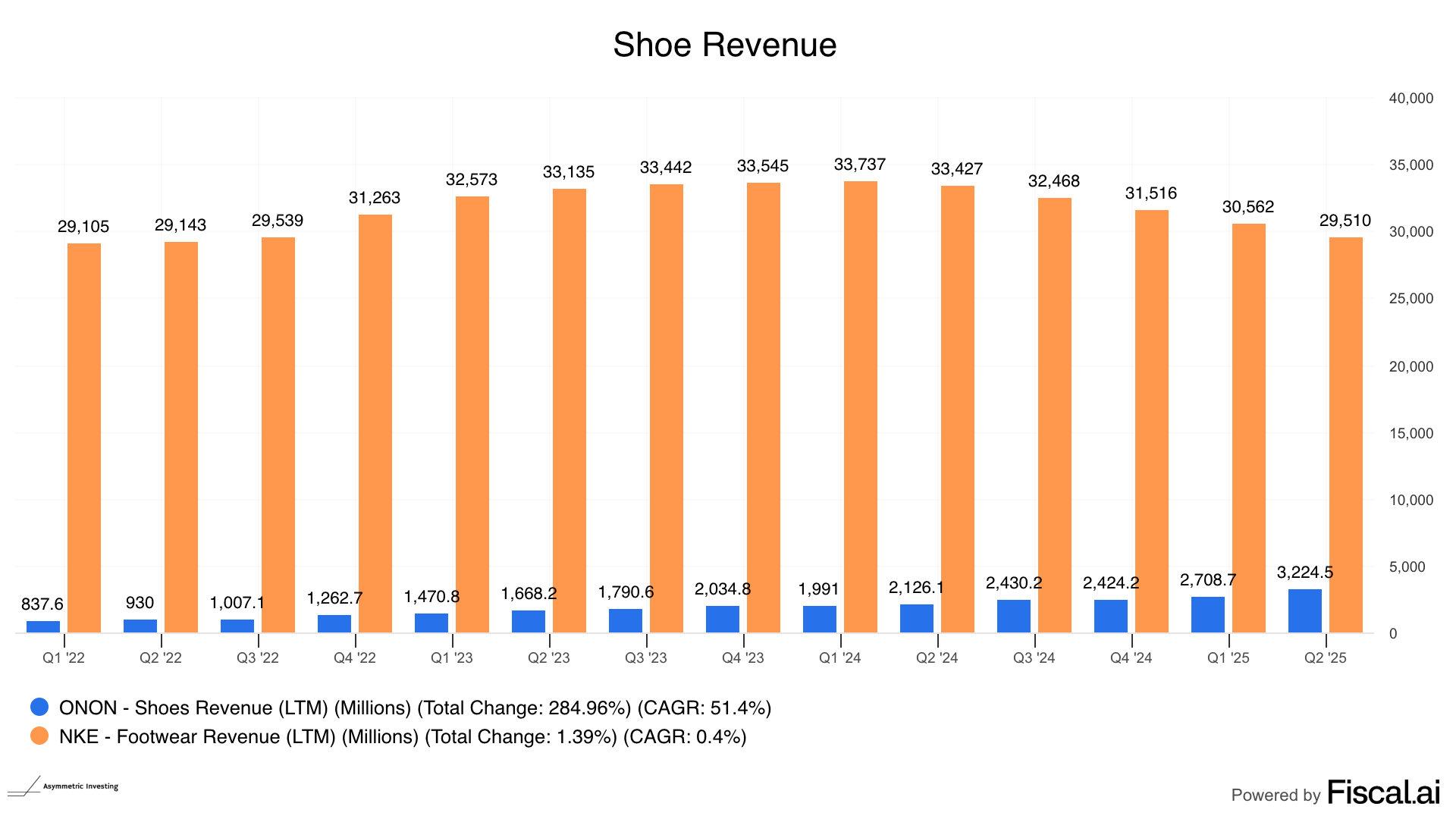

On’s shoe business is tiny compared to Nike, and you can see that a large portion of its revenue is direct to consumer. On top of that, On is a premium price point, which Nike doesn’t really touch. Consumers may be trading down for many products, but those spending $200 on a pair of shoes are the least likely to give up a pair of Ons for a pair of Nikes.

Why do I think On has pricing power? Because management says so, and the numbers back it up!

Nike, on the other hand, has lost its pricing power.

I don’t see how this turns around in a matter of months?

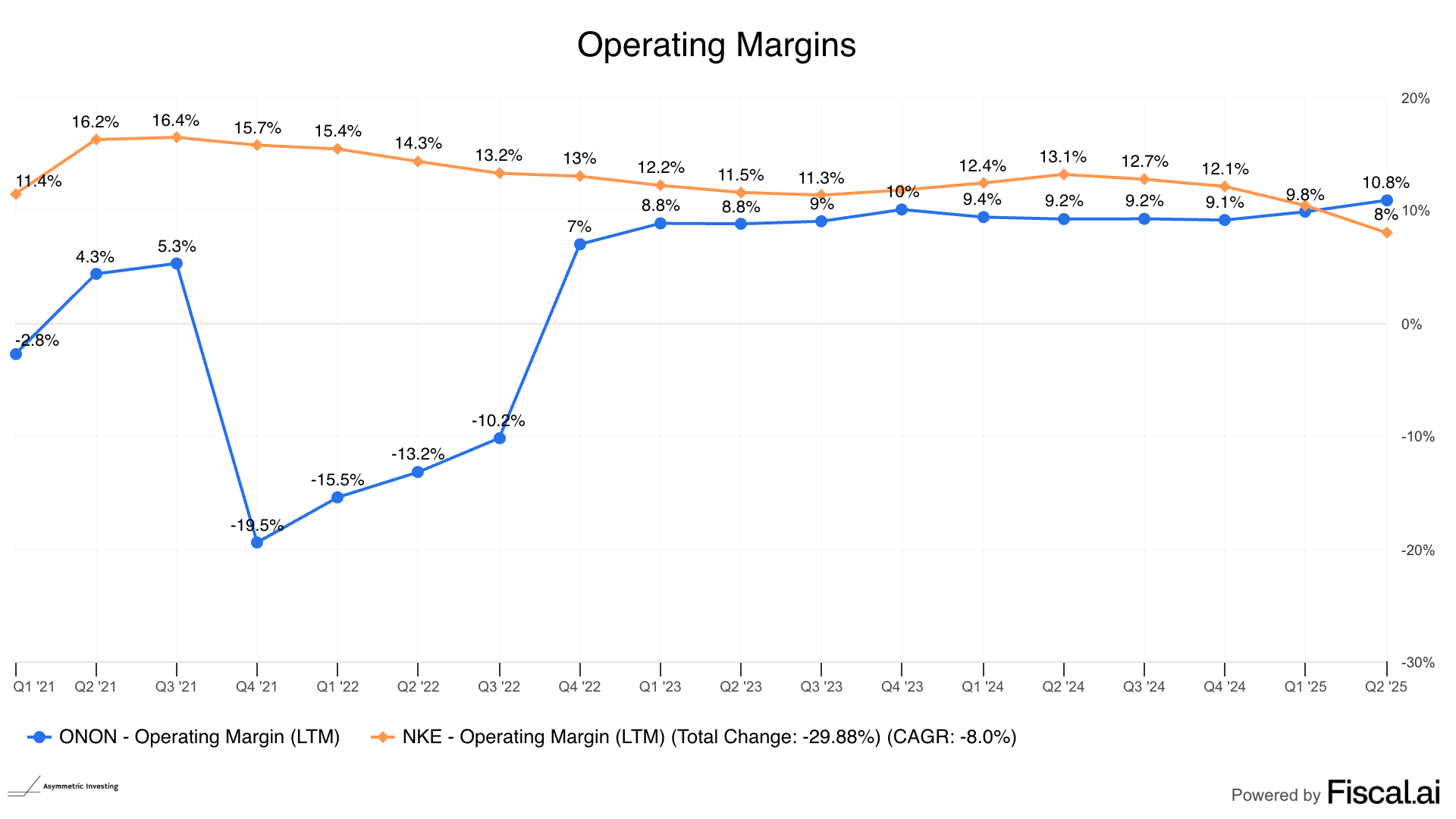

Despite the spending required to expand quickly, On has even better operating margins than Nike.

On’s rate of growth may indeed slow, but we aren’t seeing signs of that yet, and even a mid-teens growth rate would be significantly higher than Nike's.

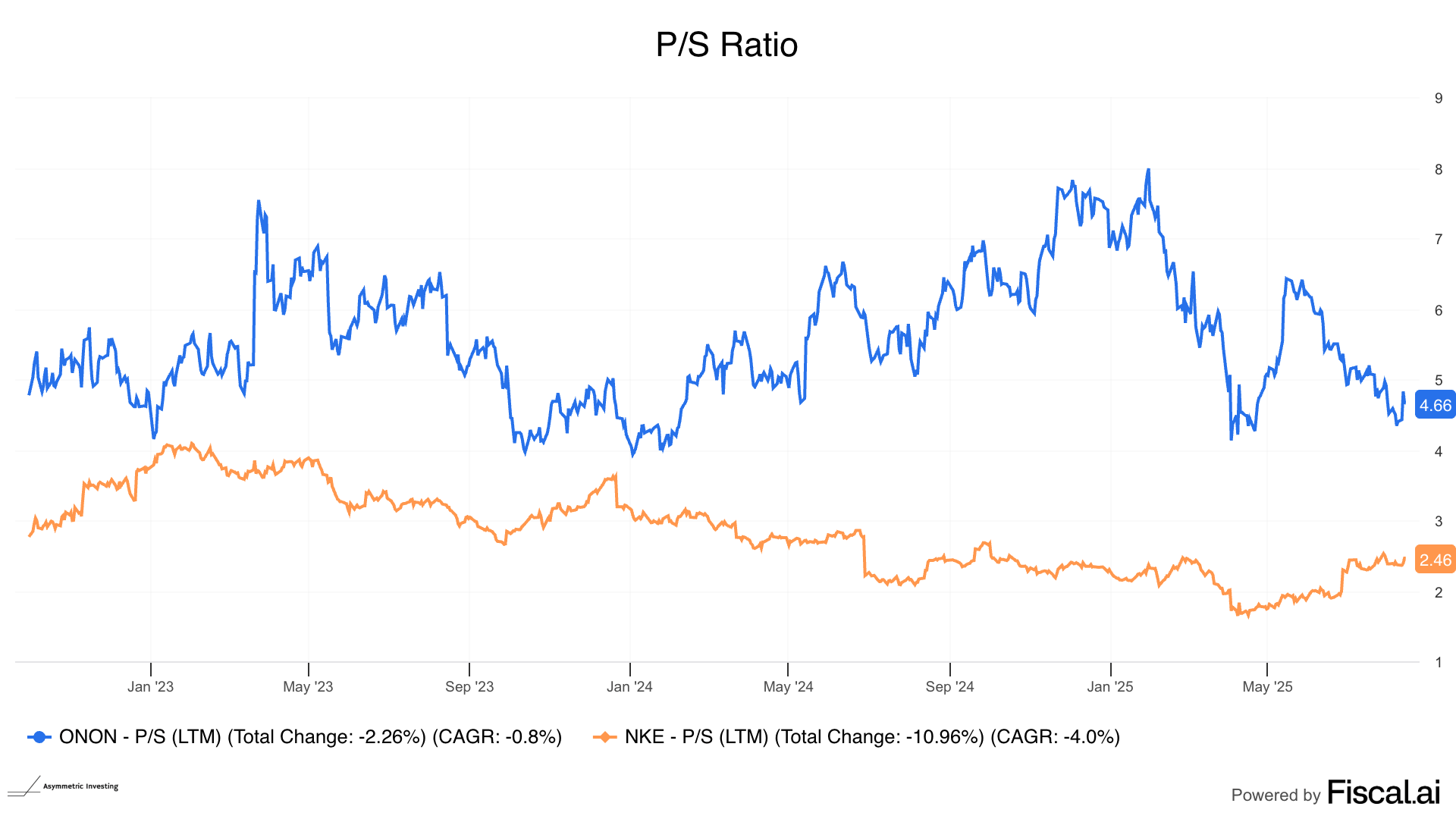

Add all of On’s advantages up (better growth, better margins, more upside potential), and you may think On is far more expensive than a shrinking company like Nike. But On’s shares are still less than 2x Nike’s price on a price-to-sales ratio. And that doesn’t account for On’s better margins, which haven’t truly been shown in On’s earnings because the company is still investing for growth.

I don’t see any sign of On Running’s shoes going out of fashion, and I’m happy the market is giving us a discount. This is one I’ll make a much bigger portion of the Asymmetric Portfolio at the current $44 per share price.

Forest for the trees!

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.