News broke this week that Disney is in negotiations with the NFL to acquire the NFL Network, RedZone, and up to 7 NFL games currently shown on the NFL Network.

Details of the deal aren’t known, and I’ve seen it reported that the NFL will receive 10% of ESPN as part of the agreement. However, what’s important here is that Disney and ESPN could be securing more rights and making ESPN a “must-have” for most households.

Every media and streaming company has been positioning itself to have the content that will draw in consumers, and no asset is more valuable than NFL games. That’s why Netflix agreed to pay $75 million for a Christmas Day game, and Amazon is paying $1 billion per year for 15 games.

If ESPN gets 7 additional games and RedZone, it will be the must-have subscription for even casual sports fans. And at $30 per month, ESPN’s streaming service could be a huge growth engine for Disney, which is bundling it with Disney+ and Hulu. This bundle was central to my long-term thesis in Disney, and getting a deal with the NFL would make me even more bullish on Disney stock.

Sports Streaming Assets & The Smiling Curve

Unlike most streaming, which is more or less interchangeable, sports is a zero-sum game.

You either have NFL games, or you don’t.

You either have college football games, or you don’t.

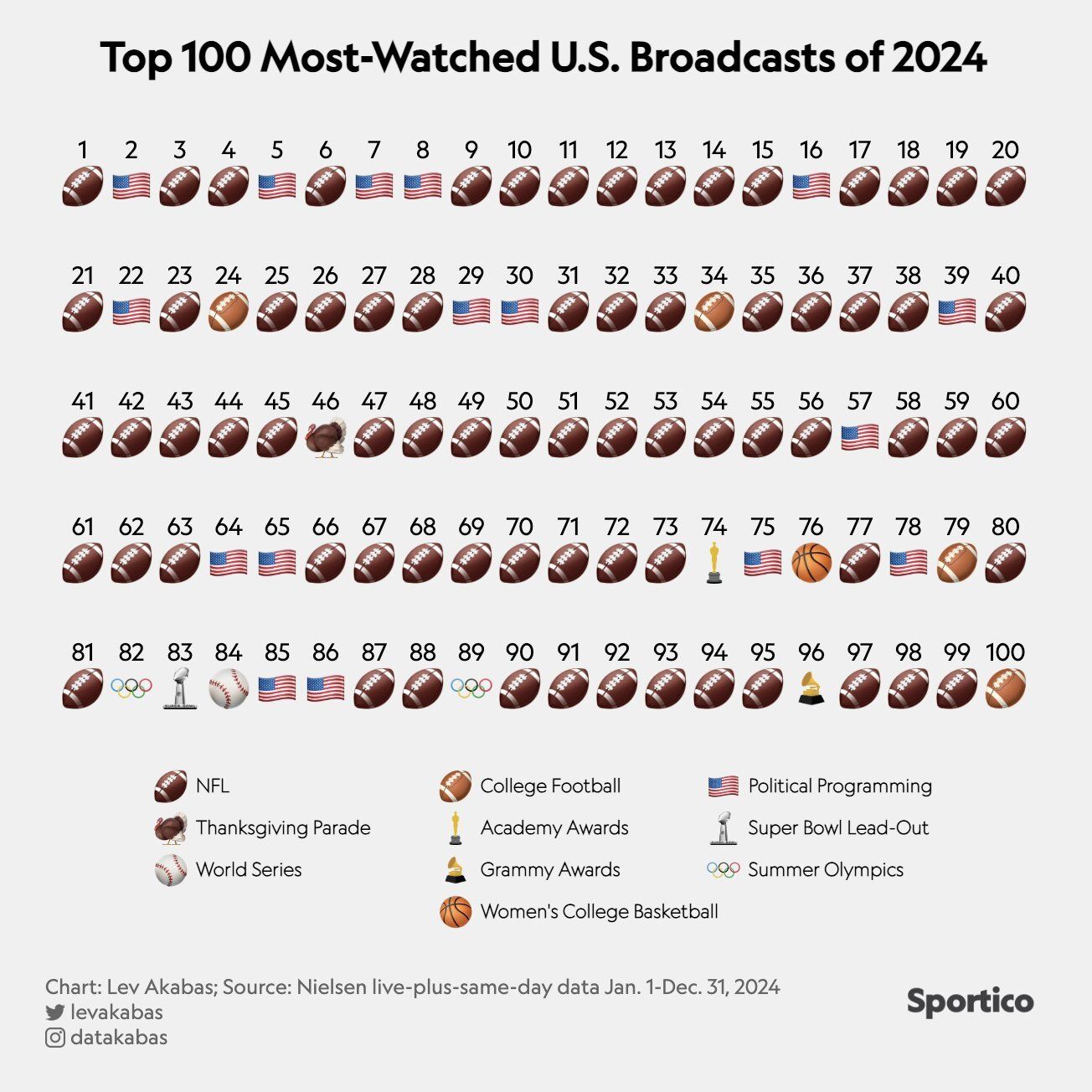

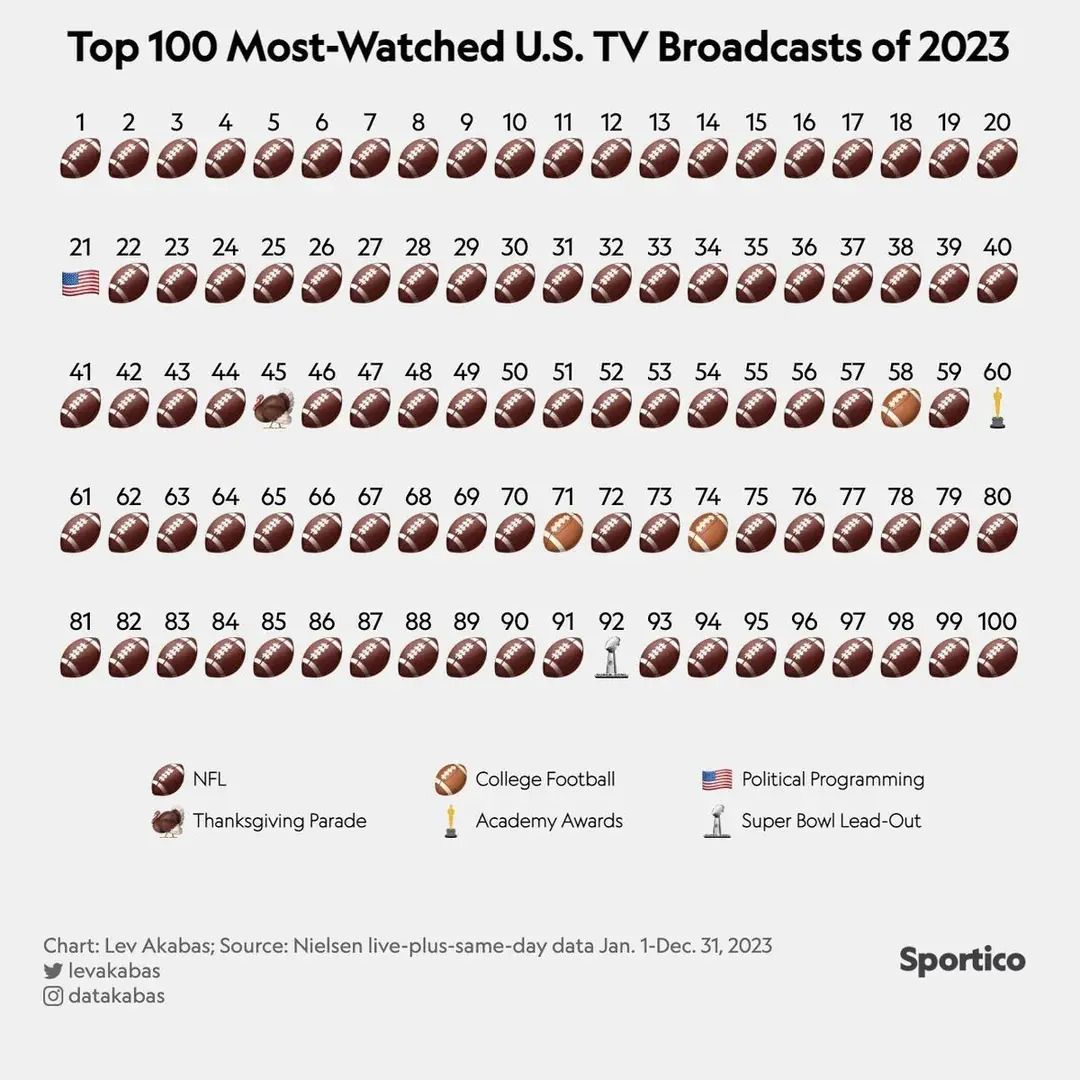

As Sportico shows below, outside of Presidential Debates and conventions, football is the most important thing for U.S. TV viewers.

Maybe 2023’s most watched shows make the trend clearer.

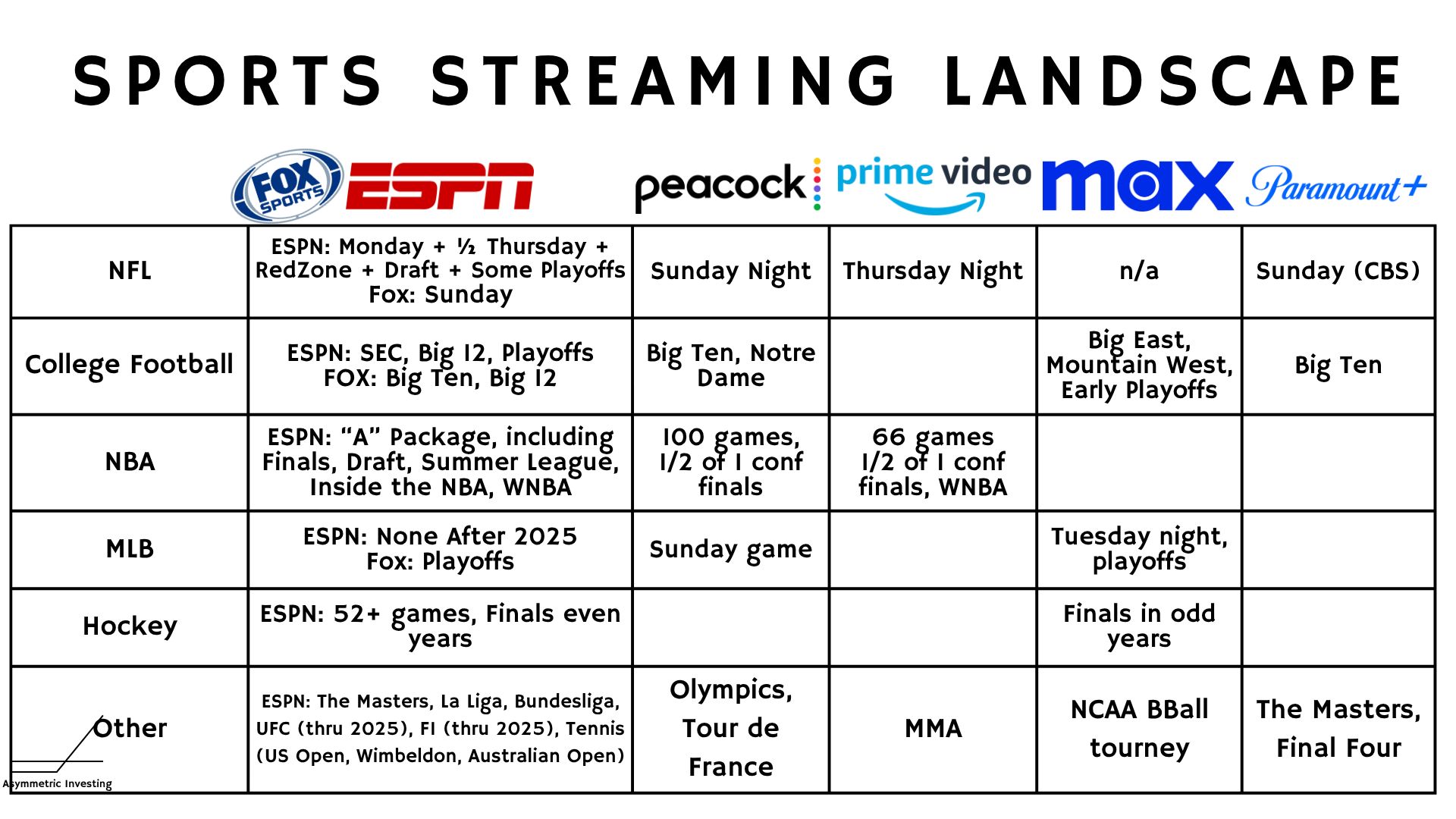

So, who has the most NFL games?

ESPN and NBC have the prime spots on Monday and Sunday, respectively, with Fox and CBS carrying traditional Sunday afternoon games. The NFL has spread the wealth, but in the era of streaming, that may not be the best strategy.

I made this table for The Netflix of Sports Is… and I’ve updated it with some of the recent deals. In that article, I theorized that Fox would license its sports content to ESPN because it didn’t have a streaming service. Since then, Fox announced Fox One, which sounds like an awkward combination of NFL games, Hannity, NCAA games, and cartoons. I kept the Fox assets under ESPN below, but you can still see that ESPN has by far the best sports assets today.

This is relevant for a few reasons.

First, the best content will attract the most subscribers, and I think the bundle of ESPN, Disney+, and Hulu will make for something of a “must-have” for most households.

Second, the company with the most subscribers and the highest prices will have the most money to buy more sports content.

Third, more subscribers means a bigger audience for sports, which also makes money on events, and needs to think about cultivating the next generation of fans.

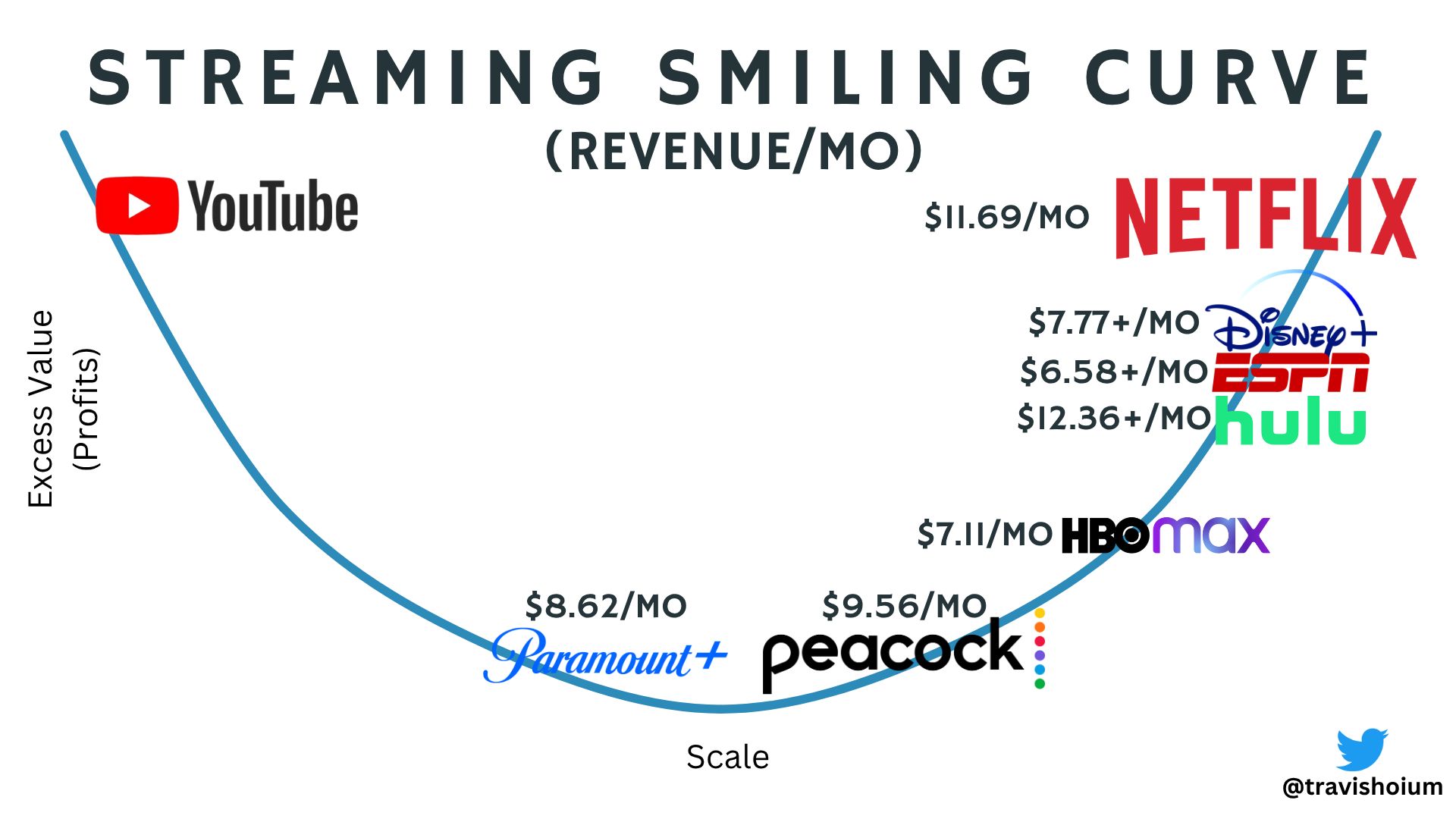

In other words, the smiling curve is in full effect in sports streaming. Probably more so than regular streaming.

Remember, the NFL wants 2 things:

The most possible viewers

The most money

When it comes to viewers, Netflix probably reaches the most households of any single service, streaming or linear. But ESPN’s reach with ESPN on cable, ESPN streaming coming in the fall, and Disney+ as the connective bundle will be compelling. ESPN is the bridge between linear and streaming TV.

And who can pay the NFL the most and offer reach?

There are only two companies with the reach the NFL wants regularly, Netflix and Disney/ESPN. And surprisingly enough, they have about the same amount of revenue from streaming and sports. This is before ESPN streaming launches, which will cost $30 per month and could push Disney’s streaming revenue ahead of Netflix.

Netflix Revenue Runrate: $44.3 billion

Disney Streaming + ESPN Revenue Runrate: $42.6 billion ($6.118B in Q1 streaming + $4.53B in Q1 sports)

Netflix isn’t likely to do something like buy the NFL Network and RedZone because, as much as it could be a player in sports streaming, that’s not its core business. Sports is a churn mitigation strategy for Netflix.

The clear losers in sports streaming are already CBS/Paramount+ and NBC/Peacock, who don’t have viable (profitable) streaming services at scale and are losing subscribers from their linear offerings.

If the NFL wants the biggest check and the biggest reach for the NFL Network games and RedZone, ESPN is the logical choice.

And if ESPN gets more games and RedZone, I think it solidifies Disney as the king of sports content and the only must-have for sports fans. As that attracts more subscribers and higher revenue per subscriber, it will be a reinforcing feedback loop for Disney/ESPN as rights partners.

What you’re seeing here is power shifting in sports. I recently wrote in The Most Important Investing Trend of the Decade that the power suppliers had in the market have given way to companies that control demand. You see this in the fall of big brands like Budweiser and Kraft (supply) and the rise of the apps we choose to interact with, like Instagram and Netflix (demand).

The NFL is a supplier and has long had power over partners, who essentially all had the same position in the cable bundle. But now, there’s a difference between being on Peacock and being on ESPN. The biggest aggregator of sports fans will win!

Do you want to take a big check from Apple — like the MLS did — and have no one watch your games? Or do you want to sign such a lucrative deal that your partner goes bankrupt, like NBA, NHL, and MLB teams did with Sinclair (formerly Fox Sports regional networks)?

The big check upfront may be a short-term win for long-term irrelevance. Just ask MLB how not being on TV is working out for the next generation of fans. Hint: Kids don’t watch baseball games on TV either because they don’t have access to them or because they’re “boring”.

Or do you want a more modest check that comes with more viewers and more growth opportunities long-term?

The NFL is a unique asset given its popularity, so I wouldn’t be surprised to see ESPN “overpay”. And the reason is that it wants to establish itself in the top right corner of the smiling curve.

If ESPN gets more NFL games, it’ll be hard for other sports to go elsewhere.

The UFC and F1 are looking for new deals for next year. Why wouldn’t they ride the NFL’s coattails on ESPN, where they can meet sports fans where they are?

Sure, ESPN is reportedly offering ~$50 million less than Apple’s $150 million per year offer for F1 rights starting in 2026. But is it worth it for F1 to take the money if it means losing 60% of viewers?

That’s about what MLS lost in moving from ESPN to Apple.

The UFC has a similar conundrum. It’s looking for a $1 billion annual deal for rights and has a rabid fanbase that any streamer would love. But Netflix doesn’t have a tie to linear TV, and big tech has proven they aren’t exactly putting a priority on streaming as they have bigger fish to fry.

ESPN is likely the best partner for both, especially if viewers are already there because they watch NFL games.

But both F1 and UFC may go elsewhere for more money. I think that would be a mistake for everyone.

As we’ve seen in so many businesses over the past two decades, the power is moving from supply (sports leagues) to demand (streaming services). And we will see if sports leagues are ready for the change, starting with what the NFL does with the NFL Network and RedZone.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.