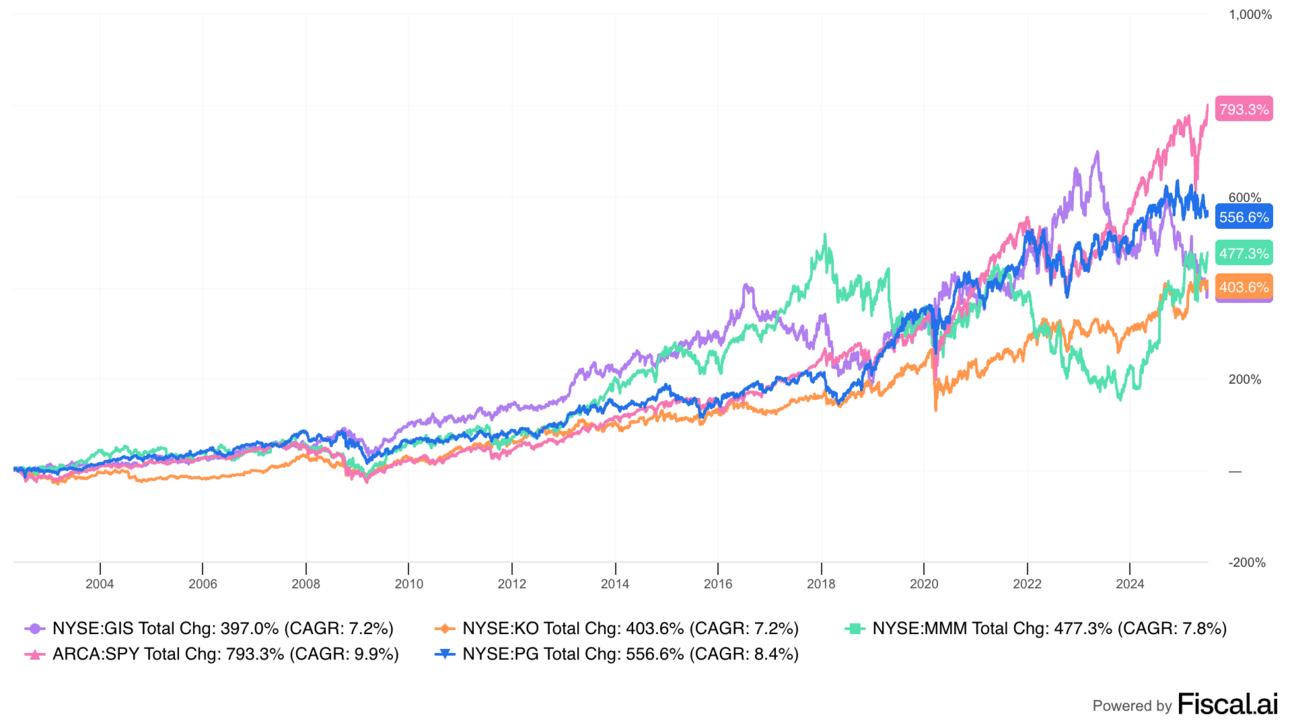

For decades, suppliers wrote the rules. They controlled advertising, the media, retailers, and culture.

You know the brands I’m talking about: Budweiser, Kraft, Pepsi, Coca-Cola, Chevy, Nike, M&Ms, General Mills, 3M, and more. The winning business strategy was to build a great brand and then acquire more brands to gain power over retailers and customers.

Want your shipment of Pepsi? Make some more shelf space for Doritos!

Want the new Jordans? Sell a few more Nike shirts!

Bud Light is the best-selling beer at your bar? If you want tomorrow’s shipment, you better get that new local microbrew off the tap list!

Suppliers had the power to create culture and awareness through mass advertising, and they leveraged this with distributors such as retailers, restaurants, and bars.

But something has changed over the past 18 years, and the market still doesn’t fully realize it.

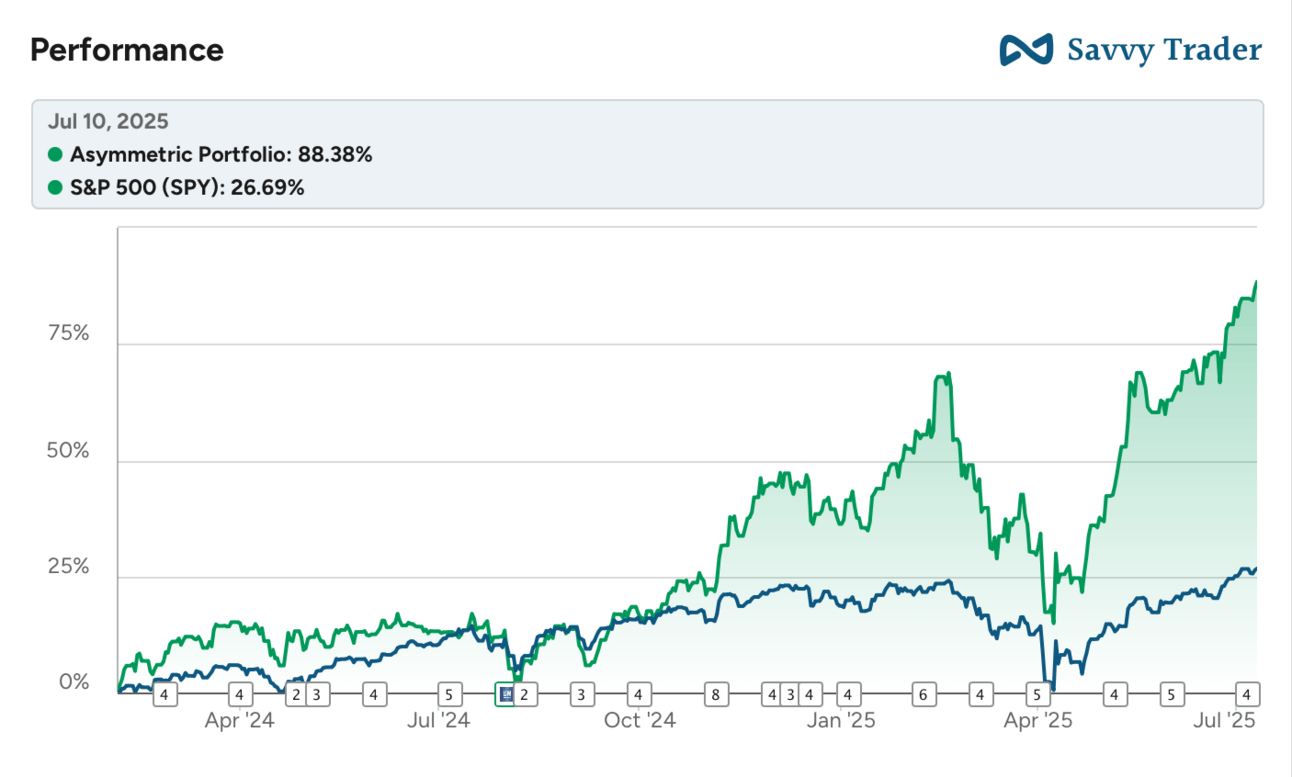

The S&P 500 has beaten former power brokers in consumer packaged goods for two decades.

As you can see above, suppliers are relegated to fighting for scraps. The power now resides with the apps and websites that customers choose to interact with. Amazon. Netflix. Facebook. Google. Spotify.

The opportunities for investors today aren’t with old-world suppliers. They’re with new world aggregators of demand. These are the applications we choose to interact with, and these are the trends and companies I’m watching right now.

Finding the companies that win directly with consumers is harder than it was in a supplier-driven world, but the upside is much higher.

Asymmetric Investing Foundations

For starters, I want to reiterate some concepts that I will come back to multiple times today.

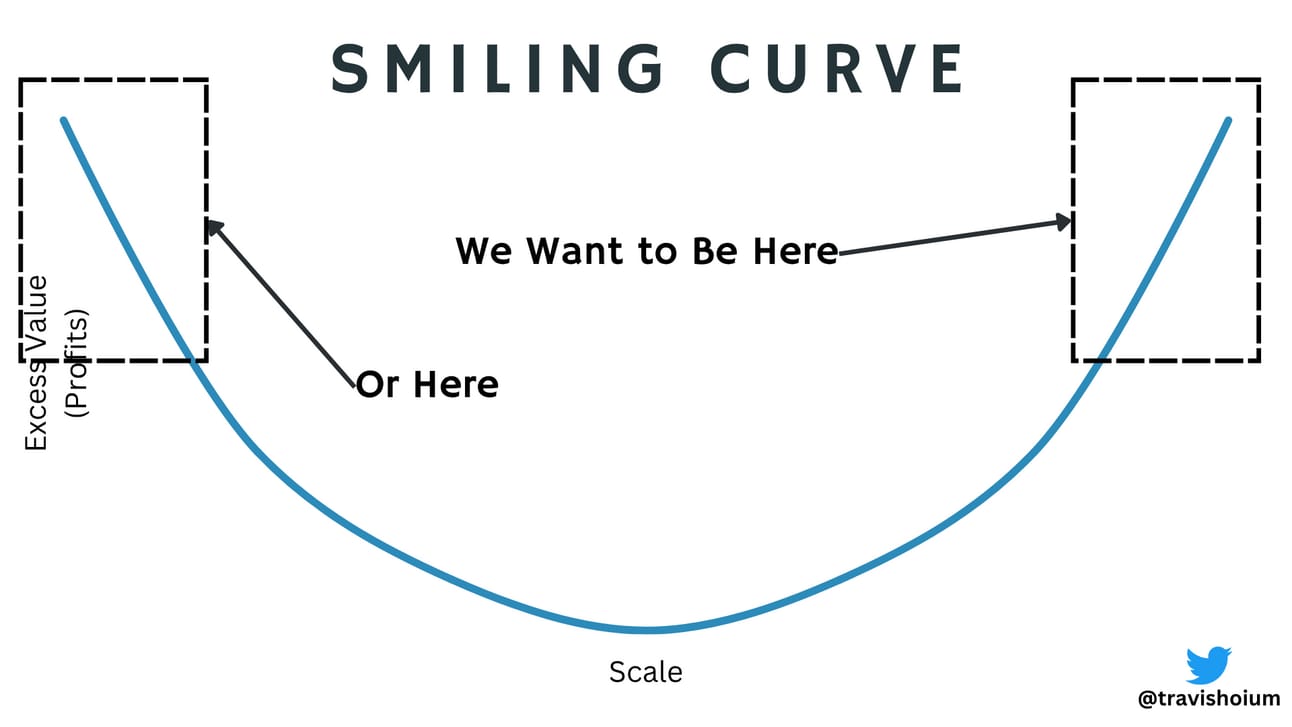

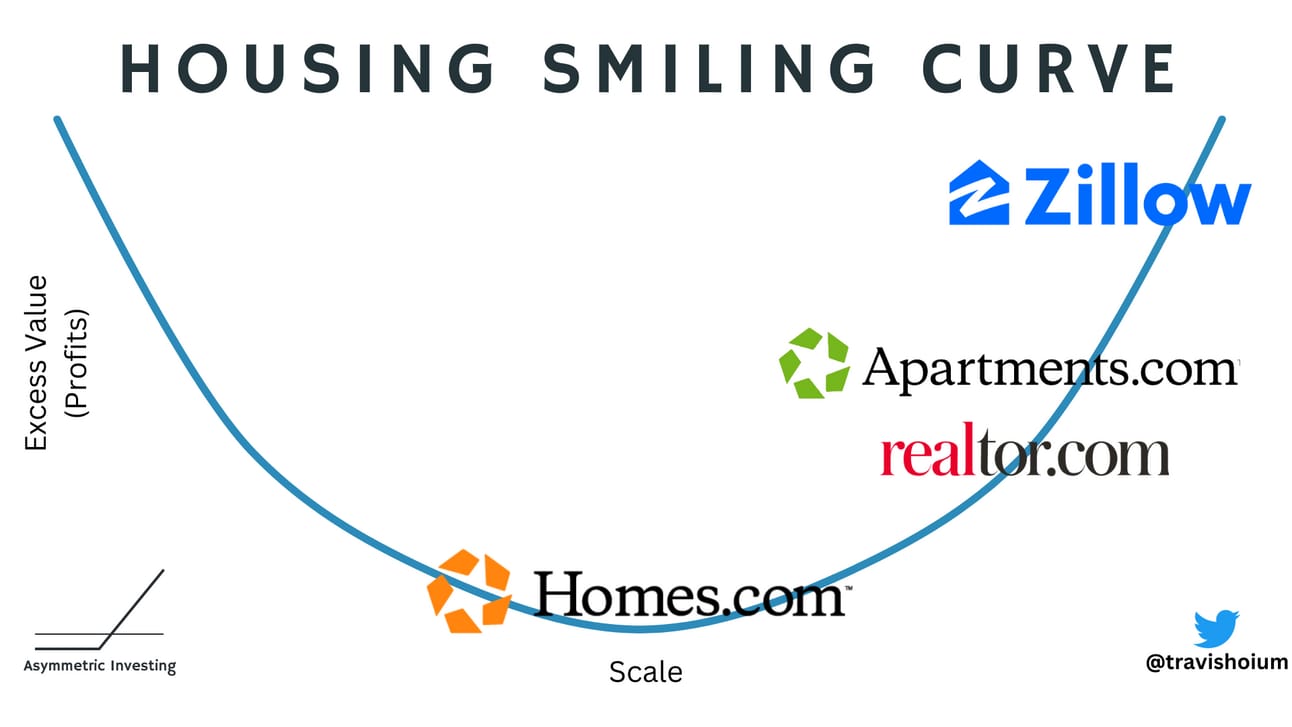

The Smiling Curve

Read more about the Smiling Curve here.

The smiling curve is a core concept in Asymmetric Investing because it easily shows who the winners and losers of markets are.

Technology Native Businesses

There’s a differentiation in business from being native to a technology paradigm.

Amazon won in e-commerce because it was internet native, not because it could make a website and Sears couldn’t.

Etrade became disruptive to Fidelity because it was internet native.

We will likely see the same thing in artificial intelligence. An AI-native company will beat a legacy company even if they go all-in on being “AI-first.”

The differentiation we see from native companies is often modest on the surface. It could be a better user interface (Robinhood vs Interactive Brokers) or a more streamlined product offering (Hims & Hers vs CVS), but those advantages compound as consumers choose the easier-to-use platform.

Who Do You Choose?

The shorthand for everything I’m going to write today is this: What app/company/product do consumers choose to interact with first?

Answer that for an industry and you likely have a winner.

Media (Sports next)

The media business has clearly followed the smiling curve, and the company people choose to interact with has won — Netflix!

But we have another shoe to drop in the media, and that’s sports.

This update really came from thinking about the NBA’s current conundrum, which really extends to MLB, NHL, MLS, F1, and eventually the NFL.

Right now, the NBA has a massive $76 billion TV deal with ESPN, NBC, and Amazon Prime that will run through the 2035-2036 season. That’s an average of $7 billion in revenue per year from national TV and streaming, up from $2.7 billion per year under the old deal.

You would think the NBA is set for the next decade, right?

Here’s where it gets interesting. We just finished the first wave of free agency, and under the CBA, the first/second apron, which effectively acts as a salary cap, and other restrictive caps can increase 10% per year. With the new NBA deal increasing TV revenue as much as it is, you would think the caps are set to go up 10% per year indefinitely.

But early estimates are that the apron for the 2026-2027 season, the first where the new TV deal will be in place prior to free agency, will only see a 7% increase.

These are early reports, but I was taken aback when I heard that.

National and streaming TV money is going up, but something else is dragging revenue down. And the answer is TV!

Regional sports networks are effectively dead, leaving teams outside of the Top-5 markets without significant content distribution and ultimately less TV revenue. I live in the Minneapolis area, and our only option to stream Timberwolves games is Fanduel Sports Network, which I paid for in previous years and was the worst streaming experience I’ve ever had. I wouldn’t be surprised if the subscriber numbers are counted in the hundreds, down from about 3 million at Fox Sports North’s peak.

This leads to lower revenue for the regional network and ultimately the teams involved.

Eventually, that will lead to fewer fans watching and ultimately caring enough to pay to go to games.

This is a paradigm shift in sports.

For decades, sports leagues have been the suppliers with power in the TV business. Fox, ESPN, NBC, and RSNs would fight to win sports rights deals that would put nearly every game on their channels, sitting next to every other channel in the cable lineup. Cable did fine, and the channels were OK, but the real winners were the sports leagues.

The dynamic is about to change.

ESPN is going over the top this fall and will charge $30 per month at a minimum for a streaming subscription (more when bundling with Hulu and Disney+), and even cable subscribers will get ESPN streaming access.

As we look out to 2026 and beyond, how big will ESPN streaming get, and where will ESPN/Disney sit in the smiling curve, especially when it comes to sports?

ESPN+ has 24.1 million subscribers today. Netflix has over 300 million.

We’re not going to see ESPN reach 300 million households, but is 50 million, or about 20% of Disney+’s reach, possible? Let’s say ESPN attracts an incremental 30 million subscribers with streaming at $30 in total revenue per month (probably low with advertising) for a total of $2.7 million in incremental revenue.

That would be on top of ESPN’s $4.5 billion in revenue today. And ESPN is also more profitable than any of the major streaming services.

Subscribers | Revenue (mrq) | Operating Profit/EBITDA (mrq) | |

|---|---|---|---|

ESPN | *ESPN+: 24 million (Hulu: 55 million *Disney+: 126 million | $4.5 billion (ESPN’s total revenue) | $687 million (ESPN operating income) |

Peacock | 41 million | $1.2 billion | ($424 million) |

HBO Max | 122 million | $2.7 billion | $339 million |

Paramount+ | 79 million | $2.0 billion | ($109 million) |

What makes the Smiling Curve so powerful is how it becomes a reinforcing loop.

You can see clearly that ESPN is in the best position in sports streaming with the most subscribers, the highest price, and the best content. How do we see the reinforcement?

Who can bid the most when UFC rights come up? Who would offer the widest reach for the sport?

ESPN

Who can bid the most and offer the most reach to F1?

ESPN

If the NFL opts out of its TV deal after the 2029 season, as expected, who will be able to pay for rights?

Not NBC and Peacock

Not CBS and Paramount+

ESPN will be there!

HBO Max lost the NBA, and the company is splitting into two, making this a poor partner for any sports league looking for a long-term partner.

Paramount+ is in the middle of a messy merger, and CBS is the only major rights holder with an NFL package. There’s some rugby, golf, and soccer in the mix, but nothing to become a sports streaming player.

Peacock is a mess, losing money and struggling to attract subscribers. The Olympics couldn’t save Peacock, and this is a doomed service.

I haven’t mentioned Netflix, YouTube, Amazon, or Apple, which have all played a role in streaming sports rights. I think they’ll all continue to pay up for premium content, but sports are a marketing tactic and a churn mitigation tool, not core to their strategy.

ESPN is about sports. It has to win. And when it wins, ESPN will be the first place to go to watch the game. And if it isn’t there, we may give up and move on.

For leagues, a question to ask in the next rights deal will be who can offer the widest reach? A big check is great, but if taking the biggest check means you’re the next MLS on Apple TV+…they may opt for less money and more eyeballs.

You want more, and I’ve got it for you! Find out what I’m buying for the Asymmetric Portfolio every month by joining premium and you’ll also get insightful emails on Friday and Saturday, plus the portfolio buys.

You can join below. Or don’t. I’ll buy stocks next month and crush the market long-term either way.

Healthcare’s Aggregator?

The healthcare market in the U.S. alone is a $4.9 trillion business.

And for decades, it has been dominated by suppliers.

Big pharma.

Big medical device companies.

Big insurance.

It’s a mess. And there’s often little choice involved for those of us who are healthcare users.

What if that wasn’t the case? What if there was an app you could choose to go to to get healthcare answers and get diagnosed if you (or a child) have an ear infection, strep, asthma, allergies, etc.

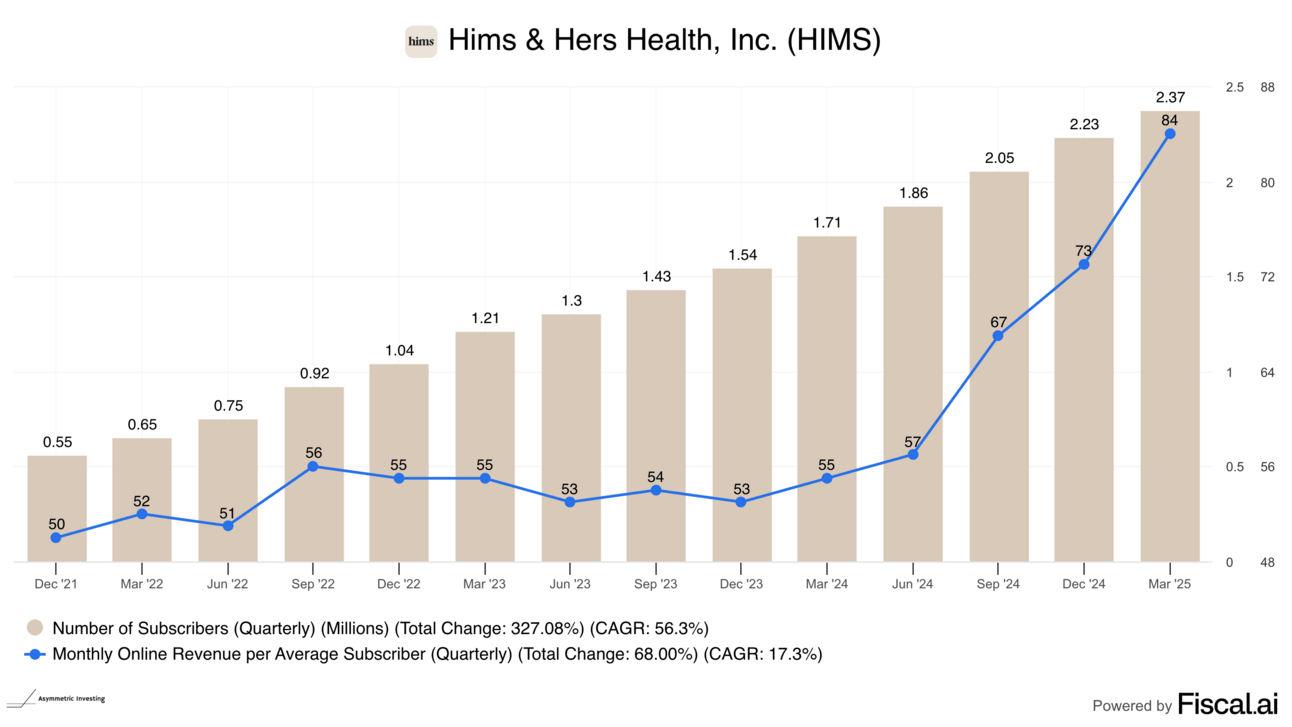

We aren’t “there” yet, but this is why I’m so intrigued by Hims & Hers $HIMS ( ▼ 6.92% ). Unlike Teledoc, where employers provide plans, Hims & Hers users have chosen to interact with the company instead of going to a traditional doctor.

That’s not nothing.

Pharma may be upset, but keep in mind, in this scenario, they’re the supplier who is going from power position to a commodity.

Eli Lilly in 2025 is Budweiser in 2005, looking at the boom in microbreweries on the horizon.

Novo Nordisk is Disney making a deal with Netflix in 2013.

They see the writing on the wall, and working with the disruptor may be the best option.

The number of subscribers for Hims & Hers is a show of how many people choose to go back to the company and is equivalent to Netflix’s subscribers early in streaming. If it keeps growing like this, Hims & Hers will be the healthcare aggregator and potentially a trillion-dollar company.

Someone is going to be the go-to app in healthcare. My money is on Hims & Hers for now, but I’ll keep an eye out for other players.

Finance Is Fun Again

How do Wells Fargo and JPMorgan Chase get disrupted?

With silly little apps that make it easier to interact with money.

That’s what Robinhood $HOOD ( ▼ 4.53% ) and SoFi $SOFI ( ▼ 7.02% ) are doing with great apps, and they’re taking market share at a rapid clip.

How do the incumbents respond? By building more branches!

Disruption comes from the lower end of the market, where lower costs attract a customer that’s undesirable to the incumbent. The day trader with a $1,000 account. The small business owner who wants a $10,000 personal loan. These aren’t customers the big banks want.

But Robinhood and SoFi have started at the bottom with these customers and are now moving up market with a cost structure big banks can’t compete with and usable apps people like.

In finance, people are choosing Robinhood and SoFi over Wall Street banks, and that should tell you something.

Housing

Housing is another multi-trillion-dollar market where I think we can see the winner clear as day.

More people choose to open the Zillow $Z ( ▼ 4.35% ) app than any other housing app, whether they’re looking to buy or sell a home, or they want a rental. Zillow doesn’t own all of the demand yet, but it’s getting there.

I’m going to write more about Zillow specifically tomorrow, but this is one where I think we see desperation setting in with realtors and competitors, and that’s good news for Zillow.

Investing In the Future

It should be no surprise that many of the companies I mentioned are also the biggest positions in the Asymmetric Portfolio.

I think it’s clear that companies that win by owning supply have poor futures. And I won’t be investing in them.

And companies that own demand have bright futures that could lead to multi-trillion-dollar businesses.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.