In 2015, Sam Altman and Elon Musk founded OpenAI in part out of fear that Google $GOOG ( ▼ 0.13% ) $GOOGL ( ▼ 0.16% ) would dominate AI if someone else didn’t get there first.

When the ChatGPT moment hit in November 2022, the conventional wisdom was that Google’s moment of disruption had arrived. The company was behind in AI models, didn’t have compelling products, and was slow and unimaginative in releasing products.

The criticisms were valid at the time.

What Google did have was infrastructure and distribution. If it caught up on models and product, the threat could be snuffed out.

The question was: Could ChatGPT become the go-to application for artificial intelligence before Google turned the search bar, Chrome, and Safari on iPhones into an AI assistant?

Conventional wisdom was that “10 blue links are dead” and so was Google. And the stock traded like it was a dead company walking with shares in the mid-teens P/E range until a few months ago.

I took a different view from the market.

I’ve argued Google is very well positioned for AI in articles like Sustaining Innovation on Steroids, Alphabet's AI Chapter, Google Search and the History of "Dying" Tech Businesses, and Google Flexes Its AI Muscles.

This week, I think we saw why Google is the powerhouse in AI, and it’s OpenAI that should be worried.

Bludgeoning the Competition

My thesis behind Alphabet stock has been pretty simple. The company has advantages in technology (TPUs), infrastructure (Google Cloud), and distribution (search, Android, YouTube) that it can leverage to both build better AI models and distribute AI products more profitably than the competition.

What’s key about this is scaling laws, or the logarithmic nature of AI spending. Spending $1 billion to build a model was cool in 2022 and would get you to a certain level of intelligence. But the next level of intelligence is $10 billion and the next $100 billion, and so on.

It’s a big-money race that requires a constant infusion of cash investment.

That money has to come from somewhere, and I’ll get to the challenge OpenAI faces in a moment. But for Alphabet, the money question comes down to the core business. If search and YouTube, and other legacy products, are indeed being disrupted, then the business would be in decline as the need to invest in new AI infrastructure and models is going up exponentially.

This is how disruption happens.

Do you protect cash flow from the core business?

Or do you invest in new products that may disrupt the core, but will ultimately be more profitable than the core?

Alphabet doesn’t have that problem.

Search and YouTube both grew at 15% in Q3 2025, and subscriptions, platforms, and devices revenue was up 21%.

You can see below that legacy Google is steadily growing, and operating income is going up. Ten blue links may be changing, but they’re not being disrupted.

The improvement in the core business means Alphabet has more cash flow coming from operations than ever before.

This cash flow is critical because it’s what Google will use to bludgeon the competition.

If OpenAI wants to stay on the frontier, it needs to outspend Google. Can it?

Google’s Money Machine vs OpenAI’s Money Pit

This recent exchange between Patrick O'Shaughnessy and Dylan Patel of SemiAnalysis on Invest Like the Best summarizes why I think ultimately Google will win in AI. Notice how Patel talks about OpenAI NEEDING to invest exponentially more year after year or risk irrelevance. It’s a long quote, but worth your time.

Dylan Patel: The compute precedes the build-up of business. You have to have the cluster before you can run models on it for inference. You have to have the cluster to train the model that's good enough that it unlocks new use cases which then can be adopted. And there's an adoption curve there for any new use case.

So you have to have all these things sequenced. This is a game of the richest people in the world, or rather the biggest tech giants in the world, right? It's Zuck, it's all the biggest people in the world, it's Elon, right? Google, Larry and Sergey - constantly in the business now again. There's very much a risk of OpenAI being too small to matter, which is crazy to say because they've got 800 million users.

But where's the revenue? Where's the compute? They could easily get swamped in terms of how much compute they have if they don't move fast enough. And if they don't have the most compute or among the most compute, they will get beaten.

The magic of OpenAI was that they just spent way more compute on a single model run on GPT-3 and GPT-4. And they had the foresight and the vision and the execution, but they made that bet and they were able to secure it. And at the time, it was a few hundred million dollars, whatever, right? That's a ton of money.

But now it's sort of Mark Zuckerberg sees how much compute he's going to have to get, even though he has this insane cash flow that he's going to sign a deal with Apollo for $30 billion on this data center in Louisiana. This mega data center I'm going to build. It's wait, why don't you just fund this with cash flows? You have so much cash flow. It's that's just the physical data center now.

What am I to put in it is so much money. It's the amount of capital that people are going to have and are dumping into this is insane. Google was slow to wake up, slow to pivot.

Their data center operations are slow to do everything. While they could have way more compute than anyone by a humongous degree and then they have how much they allocate to search. And generative search is not really necessarily competing with OpenAI. It's the mega models.

So if you have this tremendous vision of what's going to happen with AI, you know that it takes a ton of compute to build them, you know, pretty much the amount of compute you could dedicate to these models is limitless and they will get better. Now it's a log-log scale, right? That is you need 10x more compute to get to the next tier of performance. You might think of it as diminishing returns, but what if the next tier of performance is a 6-year-old versus a 16-year-old?

A 6-year-old you can't get to do much, right. And this is not exactly the way to think of AI, but this is the conundrum that OpenAI is in. They have to race with the giants. These giants are trillion-dollar businesses.

So how does OpenAI get there? Well, it's partnering with Microsoft. Well, that soured some, right? It's partnering with Oracle. Well, Oracle can do a lot, but Oracle doesn't even have a balance sheet like Google and Microsoft and Amazon and Meta and Elon.

Patrick: Sport of kings.

Dylan Patel: Yeah, this is very much the Pascalian wager nature of all of this with the tech giants. Oracle can be part of it. But OpenAI needs allies. They need people to effectively spend the capex ahead of the curve and trust that they'll be able to pay the rental income, because that's what it is.

At the end of the day, OpenAI is committing to 5-year deals. These 5-year deals cost X amount of money. It's $10 to $15 billion per gigawatt of data center capacity that you pay a year. And then that $10 to $15 billion for a gigawatt of data center capacity, you're paying that for five years, okay, that's $50 to $75 billion of cash that goes out the door to OpenAI for one gigawatt of capacity.

And you talk about what Sam's saying is hey, I need 10 gigawatts, more than 10 gigawatts, then you end up with this challenging aspect of how do you pay for that? And hey, that's only the rental price. If I were to actually do the capex because it's front-loaded, right? It becomes who is the balance sheet for this.

That's the reason these deals are coming about. Oracle is making a massive bet. Larry, he's getting good margin off of it, but he's making a massive bet that this capex that he's going to pay for OpenAI will actually be paid because he signed a $300 billion deal with OpenAI.

It's your revenue is $15 billion ARR this month. Maybe on a run-rate basis it'll get to $20 billion by the end of the year pretty clearly. Maybe it's $16 billion now, but it's very tough to get to. How do you pay $300 billion of revenue if the bet works out? They've just made $100 billion of profit, pure cash profit.

It's crazy, but if it doesn't work out, they've got this huge liability and they're starting to raise debt. There was a small deal they signed recently, but they're going to start raising more and more debt now. Nvidia's $NVDA ( ▼ 0.04% ) kind of got the same conundrum, right?

It's Google and Amazon are doing these deals, whether it's to other vendors for TPUs or for Trainium, whether it's Anthropic or others. They're trying to court OpenAI, they're trying to court other companies. How do I get into this game? Right, okay, fine, I can rely on Microsoft somewhat, I can rely on Oracle somewhat, but at the end of the day, if I want GPUs to be king, part of it is just my chip is the best, but part of it is also who's going to pay the capex upfront.

Google and Amazon will pay the capex upfront if it's for TPUs or Trainium, they won't pay the capex upfront necessarily for that same capacity of GPUs. So you've got this challenging aspect and so that's where this Nvidia and OpenAI deal comes from.

Is OpenAI going to be able to come up with the money to beat Alphabet if Alphabet decides to spend $150 billion a year on capex?

It has to!

And eventually, OpenAI has to pay for all of that compute with a business model that doesn’t yet exist.

Alphabet has the business model. It has the capacity. It has distribution. It has models.

From a revenue perspective, is OpenAI already “too small to matter?”

Alphabet is spending to make sure that’s eventually the case a growing core business enables Google to bludgeon OpenAI with better models, infrastructure, and distribution.

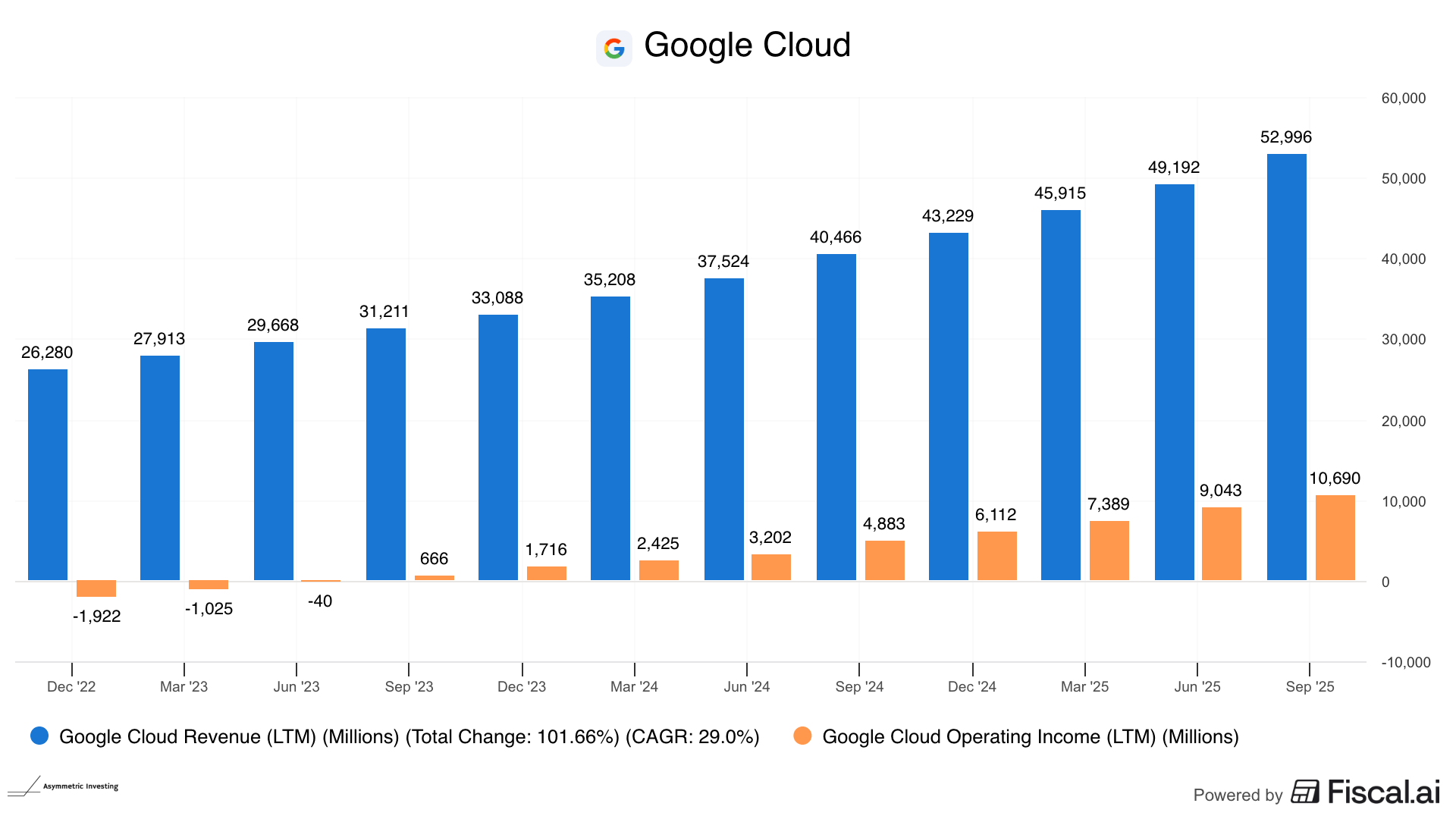

Google Cloud’s Incredible Quarter

Everything I’ve discussed above is Alphabet’s core business, and I haven’t even touched on its biggest growth business. Google Cloud is essentially Google allowing third-party access to the cloud infrastructure that the company has spent 25 years building.

In a world before AI, this business was an afterthought. But with AI, it’s a massive growth driver.

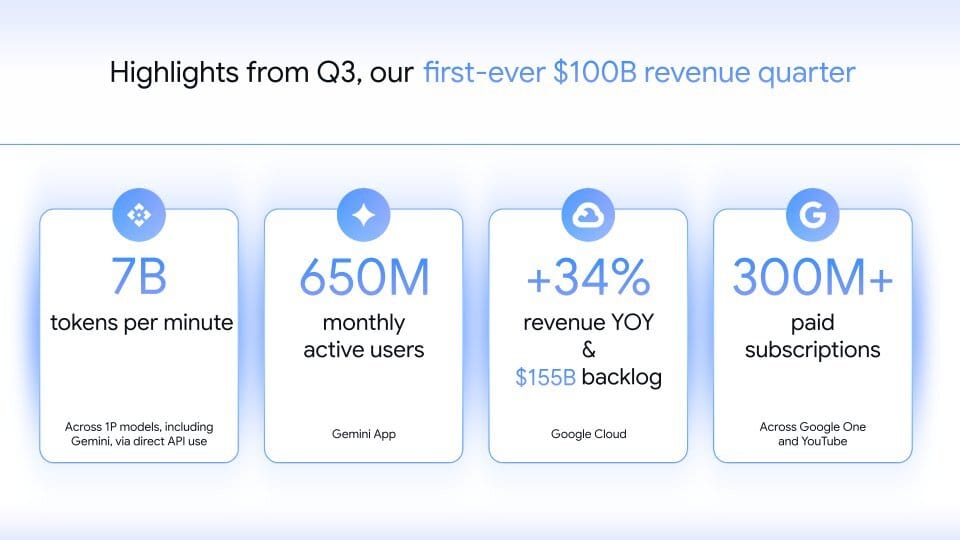

In Q3 2025, revenue was up 34% to $15.2 billion, and operating margin jumped to 23.7%.

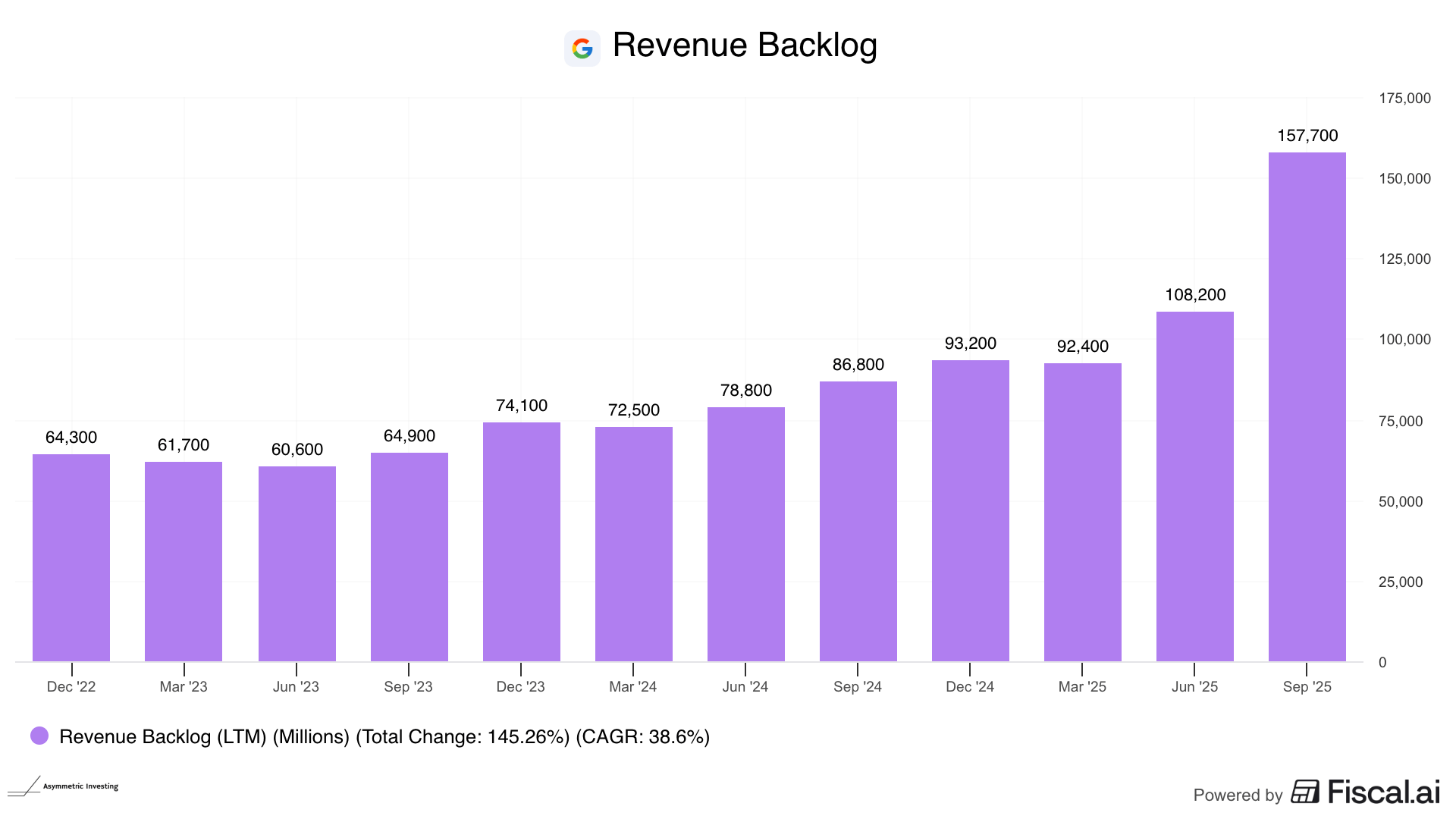

And customers are coming onto Google Cloud faster than the company can build capacity, a problem any company would like to have. Backlog was up nearly 50% sequentially to $157.7 billion.

Google Cloud alone may already be worth $1 trillion, and given the momentum, I don’t see how the growth stops anytime soon. Unlike Oracle’s backlog, which is almost entirely OpenAI, Google Cloud has hundreds of customers, which makes it “antifragile”.

As Oracle and Microsoft tie themselves more and more to OpenAI, Google Cloud becomes an attractive alternative. Models are arguably better than competitors, and pricing is often lower than everything I’ve seen because Google is an integrated company.

The Only No-Brainer in Big Tech

Today, the market is starting to wake up to Alphabet’s differentiation in AI. Yes, ChatGPT is bigger with 800 million weekly users, but Gemini is close behind with 650 million monthly active users, and it’s growing faster. That doesn’t include the people who use AI in search.

While investors thought search would be the victim of ChatGPT, it may be ChatGPT that’s the victim of Google waking up and using its infrastructure and cash flow to beat the competition.

I think Alphabet is the best big tech stock by a mile and wouldn’t be surprised if we see the entire company’s growth continue to accelerate, powered by AI.

Business models matter. That’s why my money is on Alphabet.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.