Note: I’m not going to lie. For some reason, I thought it was Wednesday all day yesterday, and that’s why this update is late. My apologies.

Whether the market realizes it or not, the biggest news of the week was Alphabet’s $GOOG ( ▲ 3.74% ) earnings report. The company told us search continues to grow, Gemini is taking market share, and Google Cloud is becoming a behemoth.

Despite the momentum, Alphabet stock trades at the lowest P/E multiple of any Mag7 stock and about one-third than owning the market overall. The market’s perception is that Alphabet is being disrupted.

I disagree.

This is the fourth largest position in the Asymmetric Portfolio, and I think a decade from now, this will be seen as one of the “no-brainer” winners in AI. But that’s not the conventional wisdom today.

Search Isn’t Dead

Let’s start with search. The theory is that search will be disrupted by ChatGPT and Perplexity, which are artificial intelligence applications that some people use like search is used.

To respond, Google has launched AI Overviews and AI Mode, which bring AI answers into search results. And you can see that search shows no signs of stopping. The chart below shows search revenue since ChatGPT was launched.

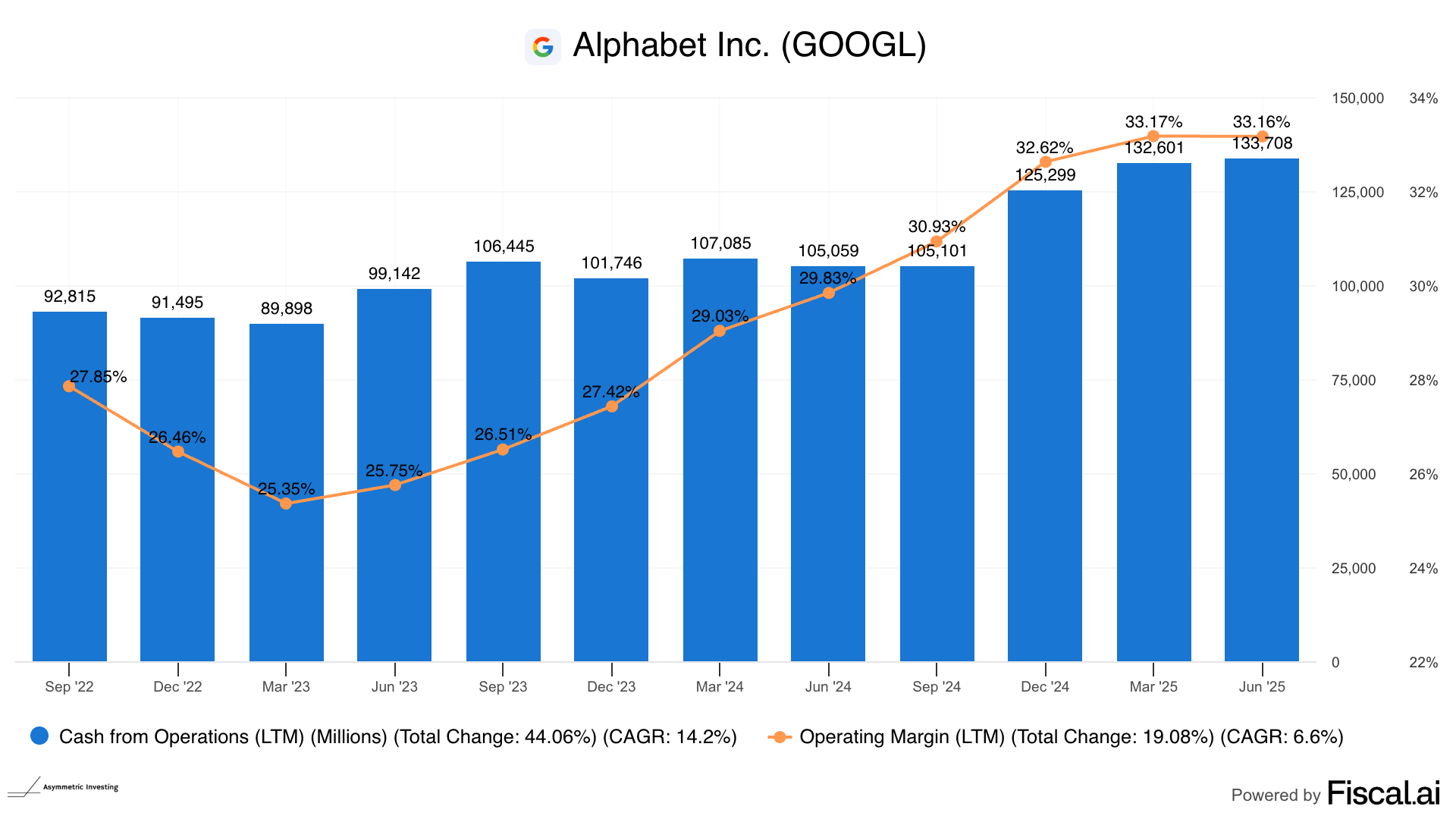

Search remains strong, and that’s helping drive record operating cash flow and operating margins.

The core is strong, but the future is looking bright because AI products are taking market share from the disruptor — ChatGPT.

ChatGPT vs Gemini

The last major user update from ChatGPT was 400 million weekly active users as of February 2025 (someone let me know if that’s incorrect). That’s a lot of people, but we’ve seen signs that adoption is slowing since 100 million people used the product within two months of launch in November 2022.

Google’s Gemini app has been more of a slow burn, but we’re seeing the quality of Gemini models, access to more advanced models for free or through an existing Google subscription, and Google’s distribution paying off.

Here was the most telling statement from the entire conference call for me:

At IO in May, we announced that we processed 480 trillion monthly tokens across our surfaces. Since then, we have doubled that number, now processing over 980 trillion monthly tokens, a remarkable increase. The Gemini app now has more than 450 million monthly active users, and we continue to see strong growth in engagement with daily requests growing over 50% from Q1.

Tokens process has doubled in two months, and nearly as many people use Gemini as ChatGPT.

On top of that, some of ChatGPT is being run on (you guessed it) Google’s Cloud.

I’m going to be clear here. There is no longer a question about whether ChatGPT is going to disrupt Google search and upend Google’s dominance.

It’s not.

Gemini will continue to get better faster than ChatGPT because Google can spend the money to make it better.

Eventually, that will translate to better monetization through advertising, but for now, that doesn’t matter. Google’s AI products should expand and monetize later. We know they can execute when it’s time to turn clicks and user attention into $$$.

ChatGPT’s days of leading AI are over. Now, it’s about building the best models and having the best infrastructure. And Google isn’t going to lose that battle.

Cash As a Weapon

There are three tactical advantages Alphabet is going to use to maintain an advantage over the competition.

The best cloud: Alphabet has the best-performing cloud infrastructure, which has been built to serve search results. That’s now being leveraged by AI products and Google Cloud to serve the best products. And Alphabet is putting more into cloud infrastructure than anyone else.

Hire the best people: Meta isn’t the only company spending billions on talent; Alphabet is as well.

Leverage the best distribution: Starting a new app and attracting users is hard, but Alphabet is beginning with the biggest mobile operating system (Android), biggest streaming service (YouTube), most used browser (Chrome), and search to get products into people’s hands.

It’s becoming clear that spending on GPUs and talent will be critical to winning in AI. Alphabet hasn’t pulled out the massive paychecks Meta has recently, but the company has acqui-hired talent and arguably has the best talent benches in the industry.

The Capex Gauntlet

Right now, the measure of power in the AI industry comes down to how much capital you’re spending. And the numbers are getting crazy. Here’s the current capex budget for

Alphabet - $85 billion

Microsoft - $80 billion

Amazon - $100 billion+, which includes delivery warehouses and robots

Meta - $72 billion

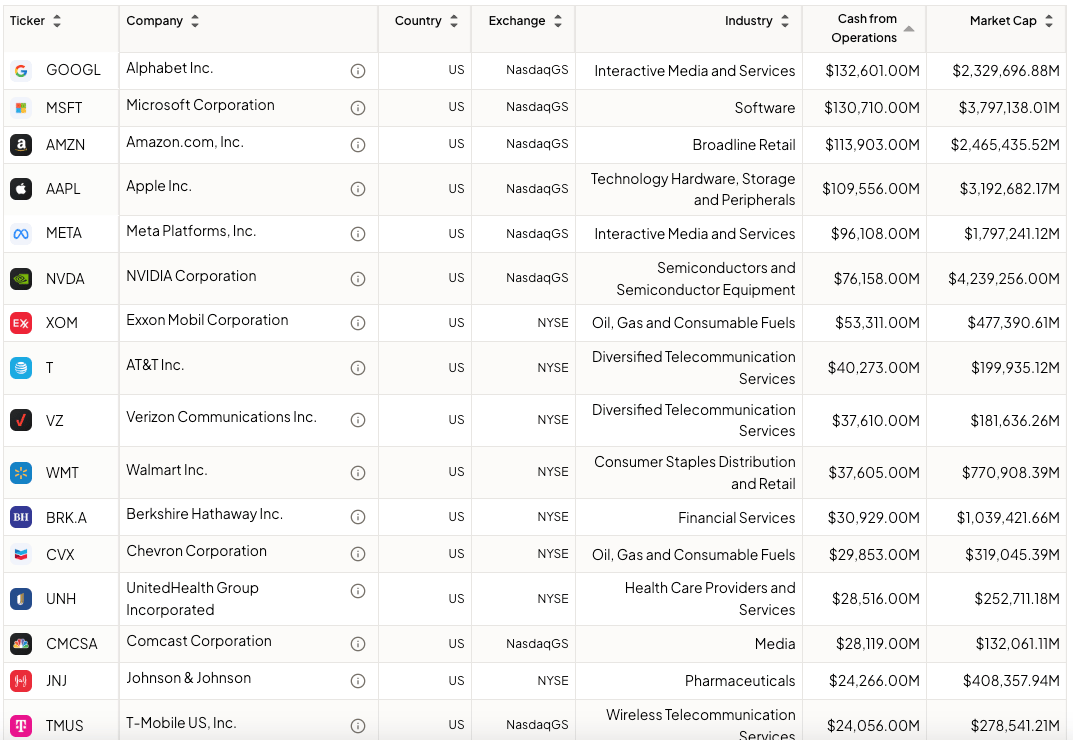

I want to put how astonishing these numbers are into context. There are literally only five companies that could afford to fund $85 billion in capex with their own cash flow. Those companies are Alphabet, Microsoft, Amazon, Apple, and Meta. THAT’S IT!

Apple is a non-factor in AI.

Microsoft is partnering with OpenAI, but using other models, and has stopped funding OpenAI. Between Microsoft and OpenAI, there doesn’t seem to be a clear strategy.

Amazon wants to play in AI, but that’s not its forte, and a partnership with Anthropic isn’t likely to answer the problem. A “We Have GPUs” sign hanging on AWS doesn’t make AWS an AI powerhouse.

Meta is the only company left, and it wants to build AI for its own purposes. And the company is so far behind, it’s spending billions to acquire AI talent on top of buying GPUs.

Who is the big tech company left standing in AI?

Who has the cash flow to fund data centers and talent acquisition indefinitely?

Who has the will the outlast the competition?

Google. Aka Alphabet.

This seems clear.

And yet, the stock trades for 20x earnings, a multiple reserved for dying companies in today’s market?

Am I the crazy one?

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.