Google search has been the week's topic after Apple executives said in court that Safari searches fell for the first time in April, and AI could eventually replace Google as the default in the Safari browser.

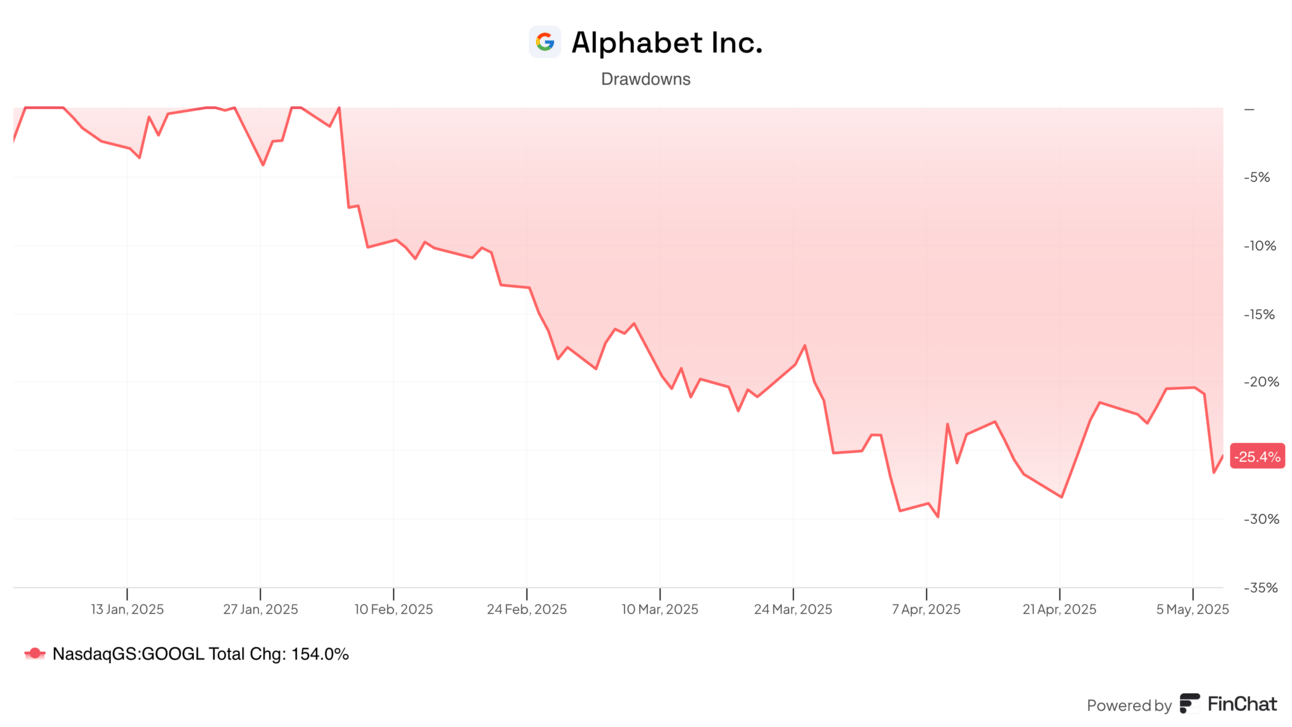

Shares of Alphabet have fallen 6.2% in the past five days and are now down 25.4% from their peak earlier this year.

Is Alphabet in trouble, or is a tech giant trading for 18.2x trailing earnings a buying opportunity?

The history of transformational disruptions can help guide us here.

Building On What Came Before

What I think investors are missing is the fact that disrupted businesses don’t typically disappear.

AI Agents and chatbots aren’t going to eliminate search.

Rather, they’re likely to build on top of search or advertising as a revenue source. In most cases, paradigm shifts in tech build on top of what came before.

PCs didn’t kill the mainframe (which IBM still sells)

Mobile phones didn’t kill the PC

The cloud didn’t destroy PC or mobile phone demand

AR/VR isn’t going to kill mobile phones

I think history shows that Alphabet will not only be fine, but the company will eventually thrive.

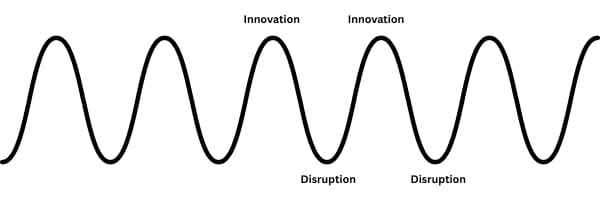

Big Tech’s Sine Wave

Tech companies seem to always be in a state of rapid growth or existential disruption. Companies succeed in one paradigm, miss the next paradigm, and then lead the third paradigm, like a sine wave of success and failure.

Typically, success makes a company either blind or structurally incapable of succeeding in the next paradigm. It isn’t until you’re desperate that a shift in the business can take place. IBM, Dell, Apple, and Microsoft are simple examples.

IBM

Dominated mainframes in the 1970s

Gave away most of the value of the PC to Microsoft, who made the operating system for “IBM compatible” computers

Transitioned to consulting services for big businesses

Dell

Grew to prominence on the online ordering of easily customizable PCs in the 1990s

Missed mobile almost entirely for structural reasons

Reinvented as an enterprise provider and infrastructure company selling servers to AI data centers

Apple

Early leader in PCs with a vertically integrated model

Missed the PC boom that was dominated by Microsoft and Intel

Dominated the mobile market after Microsoft was incapable of building a compelling mobile phone, despite being very early

Currently missing AI…

Microsoft

Dominated PC operating systems in the 1980s and 1990s

Modular/horizontal business model

Missed mobile operating systems

Blind to the new consumer-focused market

Extending the PC to the phone wasn’t a point of leverage

Transitioned to cloud and AI growth

Leveraged business relationships to build a cloud business

Backed into a leading position in AI

Vertical to Horizontal

One of the common themes is that structural forces cause companies to miss the next paradigm.

A horizontal services company like Microsoft, which is used to serving lots of developers and lots of PC manufacturers, couldn’t see how a more locked-down, focused, power-sensitive mobile phone would win the market. Apple’s vertically integrated model was more suited for mobile.

You could extend this to the reason Intel missed mobile and AI while TSMC thrived.

Now we have an AI boom, and the vertically integrated models of the last paradigm (Apple) may be at a disadvantage when serving a model to more users (horizontal model) gets leverage on investment.

The vertical and horizontal business models companies bring to the market contribute to the sine wave dynamic.

Blind Spots in Tech — The Innovator’s Dilemma

What typically happens when companies are disrupted is a blind spot to the disruption, intentional or unintentional.

Blackberry

BlackBerry famously thought the multi-touch screen on the iPhone was impossible to produce.

Compounding their mistake, Co-CEO Michael Lazaridis thought the company’s physical buttons were a differentiator for business users.

BlackBerry was both unable and unwilling to adapt until it was too late.

Microsoft

I mentioned earlier that Microsoft saw mobile early. But they tried to shove Windows onto a phone, which created a terrible user experience. Their business model and momentum made the company incapable of building a product or mobile software that people wanted.

BlackBerry rethought the phone early, but Apple got it right with the iPhone, leaving Microsoft in the dust.

Apple

We are seeing Apple’s blind spots in real time.

The company talks about AI, but stinks at it because the last 18 years have been focused on squeezing developers with their market dominance, a “privacy” focus, and vertically integrating its hardware and software.

Nothing about the previous paradigm sets Apple up well to be the winner in an AI paradigm. They can see the opportunity, but they’re structurally incapable of seizing it.

One Trick Ponies

What allows a company to survive through a period of disruption, like Microsoft, Apple, IBM, and Dell have done over the decades?

They do more than one thing.

Microsoft’s Windows operating system lost power, but it still had Office, which was a core application for businesses around the world. It was Office that led Microsoft into the cloud.

BlackBerry sold…phones. That was it.

When Blackberry missed the iPhone moment and its market share dropped, the company was dead.

Comparing Alphabet today to Blackberry, which I’ve seen, is disingenuous.

Is Alphabet The Same, Or Different?

There are similarities to previous disruptions. ChatGPT and AI in general have certainly taken mindshare away from Google search.

But there are some unique dynamics in this case.

Google has hardly been caught off guard by artificial intelligence. The company invented the transformer architecture that underpins modern AI.

Google’s Gemini models are currently the best in class in AI.

There’s a dilemma in Google’s business model, but the company is neither incapable nor unwilling to innovate in AI.

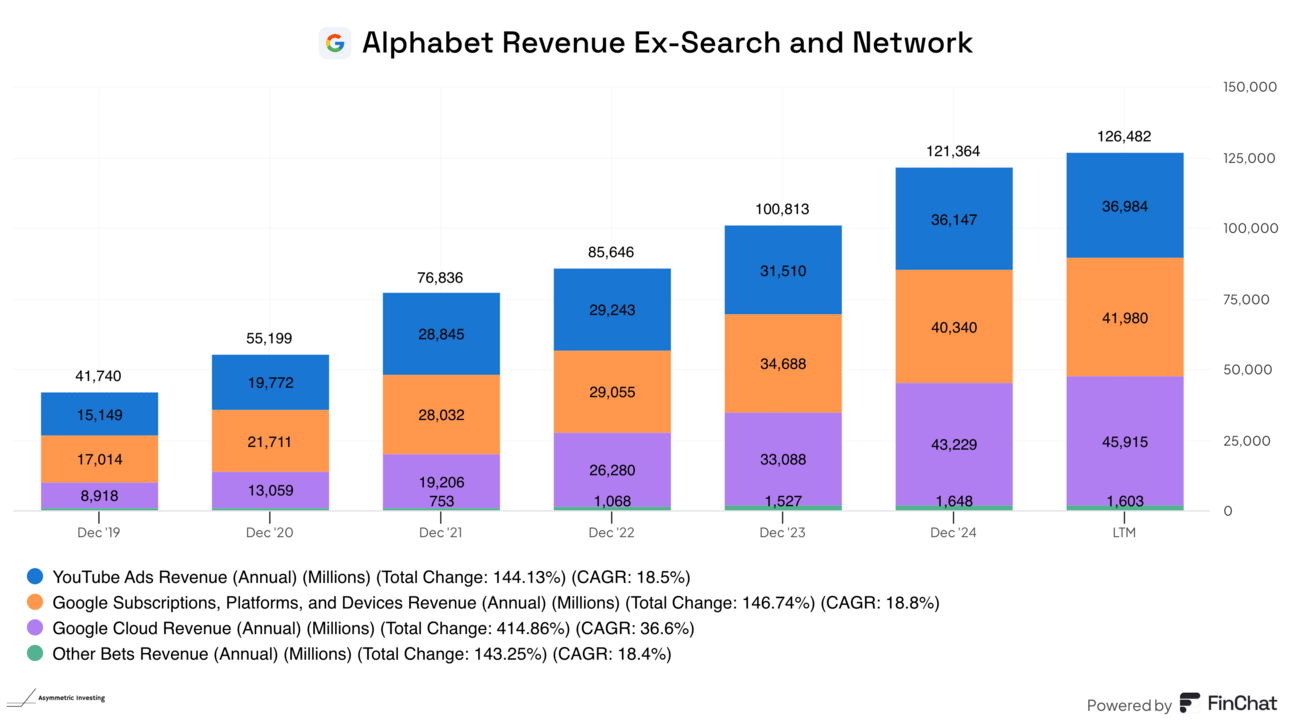

Alphabet has multiple businesses that won’t be disrupted by AI, like G-Suite, YouTube, Android, Maps, and Cloud. Even if search dies, the business that’s left is pretty amazing (see the image below).

Somehow, Alphabet has gone from being a horizontal business in search (serving everyone) to a vertical position in AI (models, cloud, and distribution like Gemini and Android).

Alphabet doesn’t have a blind spot in AI.

Search may not be the growth driver it was a decade ago, but it’s also not dying tomorrow. And color me skeptical that Apple is going to give up ~$20 billion in pure profit to replace Google search with OpenAI or Perplexity’s money-losing AI search.

History tells us that a product like search isn’t going to die; it will just fade in importance, and growth will come elsewhere.

If Google were caught sleeping (like Blackberry was) it would be easy to argue the company is screwed.

But Google isn’t sleeping.

It’s well-positioned in AI from models to infrastructure to distribution.

Maybe the way to think about it is Google’s search business will be disrupted, but searching isn’t what makes money — ads are.

The surface area of the ad business is what we should be looking at. And AI could provide an expanded surface area for ads.

That’s the foundation for Google, and I don’t see it going anywhere.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.