On Tuesday, U.S. District Court Judge Amit Mehta said Alphabet $GOOG ( ▼ 0.13% ), while still a monopoly, could keep Chrome and Android in-house and could continue paying for default status on browsers like Apple’s $AAPL ( ▼ 1.43% ) Safari.

Google will have to share some data with competitors and can’t have exclusive agreements with partners, such as smartphone makers, but that’s unlikely to upend Google’s search dominance or its business model.

The details of the case are interesting, but the lesson for investors is clear. Look at the long-term trends and buy companies when sentiment around them is bad.

I’ve been something of a broken record (see here, here, here, here, here, and here) about Alphabet’s value and potential. I think this is one of the best companies in the world, and artificial intelligence isn’t going to disrupt the business…it’s going to make Google and Alphabet stronger.

The market finally seems to agree, and there may be much more upside ahead.

OpenAI Saves Google

In a twist I didn’t expect, OpenAI may have saved Google from a breakup. Judge Meta pointed to the rapid competitive changes taking place with the launch of ChatGPT, Perplexity, and Claude, to name a few.

Much has changed since the end of the liability trial, though some things have not. Google is still the dominant firm in the relevant product markets. No existing rival has wrested market share from Google. And no new competitor has entered the market. But artificial intelligence technologies, particularly generative AI (“GenAI”), may yet prove to be game changers. Today, tens of millions of people use GenAI chatbots, like ChatGPT, Perplexity, and Claude, to gather information that they previously sought through internet search. These GenAI chatbots are not yet close to replacing GSEs, but the industry expects that developers will continue to add features to GenAI products to perform more like GSEs. The emergence of GenAI changed the course of this case. No witness at the liability trial testified that GenAI products posed a near-term threat to GSEs. The very first witness at the Case remedies hearing, by contrast, placed GenAI front and center as a nascent competitive threat. These remedies proceedings thus have been as much about promoting competition among GSEs as ensuring that Google’s dominance in search does not carry over into the GenAI space. Many of Plaintiffs’ proposed remedies are crafted with that latter objective in mind.

The scale of investment is also notable. If Google were a monopoly in need of a breakup, no one would invest billions in building a competitor.

Still, the court thinks allowing Google to continue making payments is more palatable now than when the liability phase concluded. Then, venture funding in “Internet search” was considered Silicon Valley’s “biggest no fly zone.” Today, established technology companies are making, and start-ups are receiving, hundreds of billions of dollars in capital to develop GenAI products that pose a threat to the primacy of traditional internet search. The money flowing into this space, and how quickly it has arrived, is astonishing. These companies already are in a better position, both financially and technologically, to compete with Google than any traditional search company has been in decades (except perhaps Microsoft).

And so Google will keep Chrome and Android. The default deals with Apple Safari, Mozilla Firefox, and others are safe.

Data sharing related to what people are searching for on what devices will also need to be shared, but competitors will need to build a business model that entices distribution. That’s not something I see happening at scale without a new vector of competition, like a chatbot, which I’ll get to below.

This is…a nothingburger.

Why Chrome and Android Matter to Google

When I started using the internet in the 1990s, search engines were a destination. You needed to type in Google.com into the address bar to get to Google.

Then, a search bar popped up in the top corner next to the address bar.

And eventually, the address bar became the search bar.

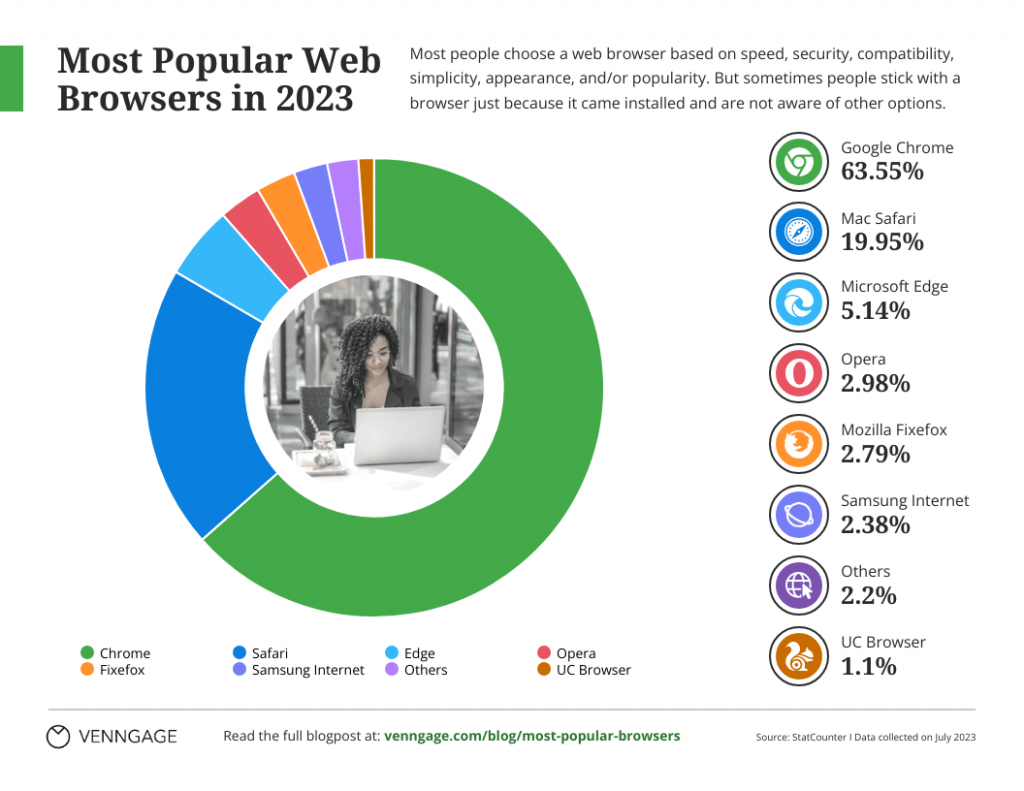

Search took over the browser. And that makes sense because it was the economic driver for most browser companies. This data from Venngage is a couple of years old, but it still holds true today. Chrome is the most popular browser in the world, followed by Safari, which also has a revenue share deal with Google, as does Mozilla Firefox.

You can have the best search engine, but if it doesn’t reach customers, it doesn’t make money. Through owning Chrome and deals with Apple and Mozilla, Google has search distribution on lockdown.

The next monetization engine to win was the phone. Google did that with Android and a default deal with Apple. Sure, $20 billion is costly to be the default search engine for iOS devices, but that check size shows how valuable distribution is for Google.

The reason Judge Meta was hesitant to split up some of this distribution power was that competitors have grown so quickly. ChatGPT has become commonplace and doesn’t need a default place on a phone or computer. The challenge is, people who aren’t heavy ChatGPT users, competing products like Gemini are catching up quickly and maybe surpassing ChatGPT in capabilities.

Set For the Future

What’s unique today is that search isn’t the end state for Google. As courts were debating about what the do about Chrome, Google has been building new products.

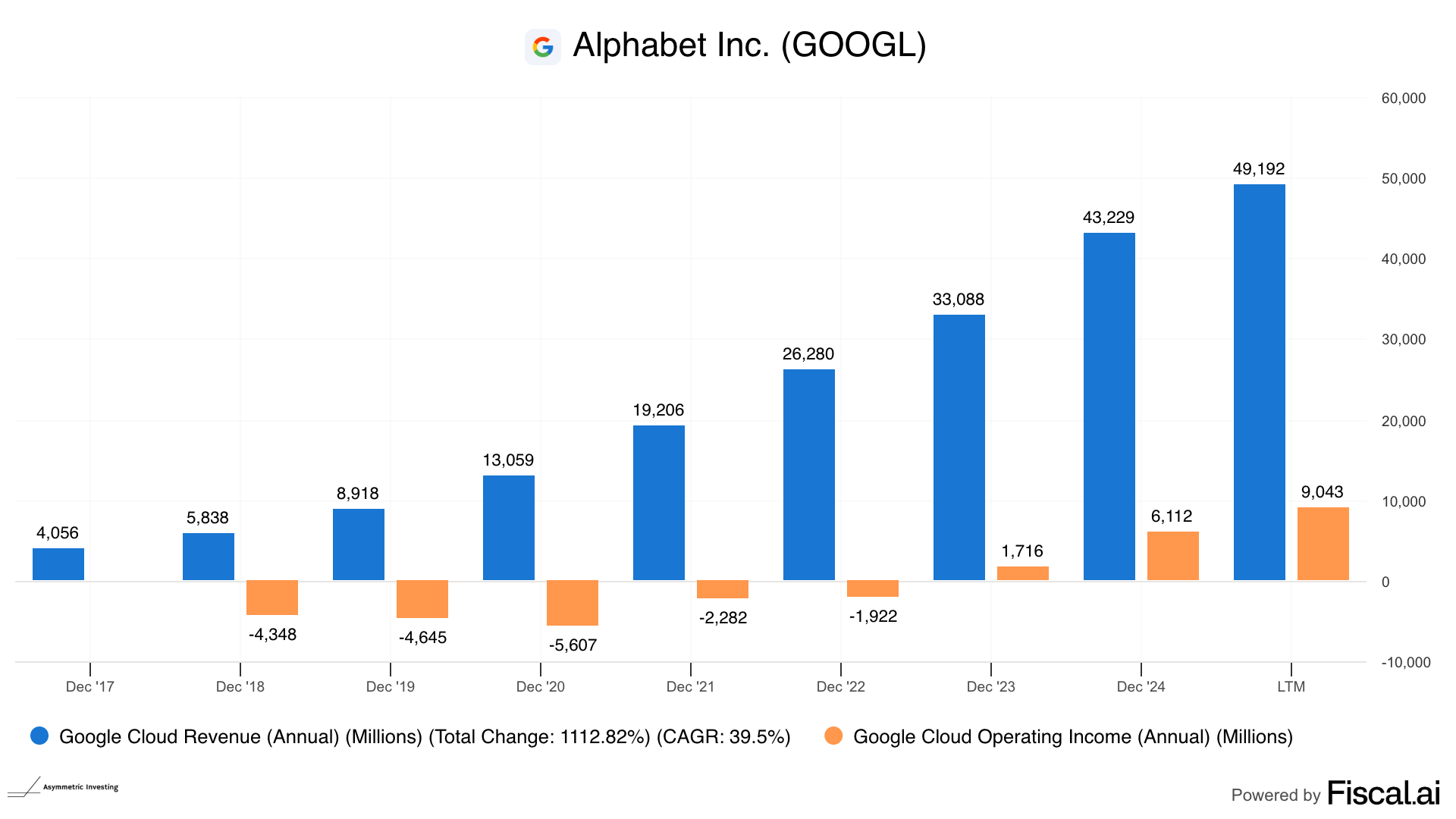

The Gemini app now has over 400 million monthly active users. Google Cloud is growing like crazy and now counts Meta and OpenAI as customers. And it’s no small feat; this is a profitable business as quickly as it’s growing.

I think Alphabet’s assets will become a key point of distribution, but even with that, this is an AI powerhouse.

The tests bringing AI into the browser and search also seem to be going well. As it turns out, Alphabet can simply use traditional searches to bring more Google AI to market.

It’s a brute force strategy, but having a way to leverage existing user preferences to the “next thing” will be key for Google.

Patience & What the Market Overlooked

I don’t want to diminish what a big deal this ruling was. But I also want to point out that nothing in the ruling is surprising, and as investors, we need to be comfortable with uncertainty when buying high-quality stocks like Alphabet at attractive prices.

Six months ago, we didn’t know if Chrome would need to be spun off or if AI would disrupt the business.

But evidence was pointing to neither being a detriment to Alphabet, and we could see the company’s model and product velocity increasing. That story hasn’t changed.

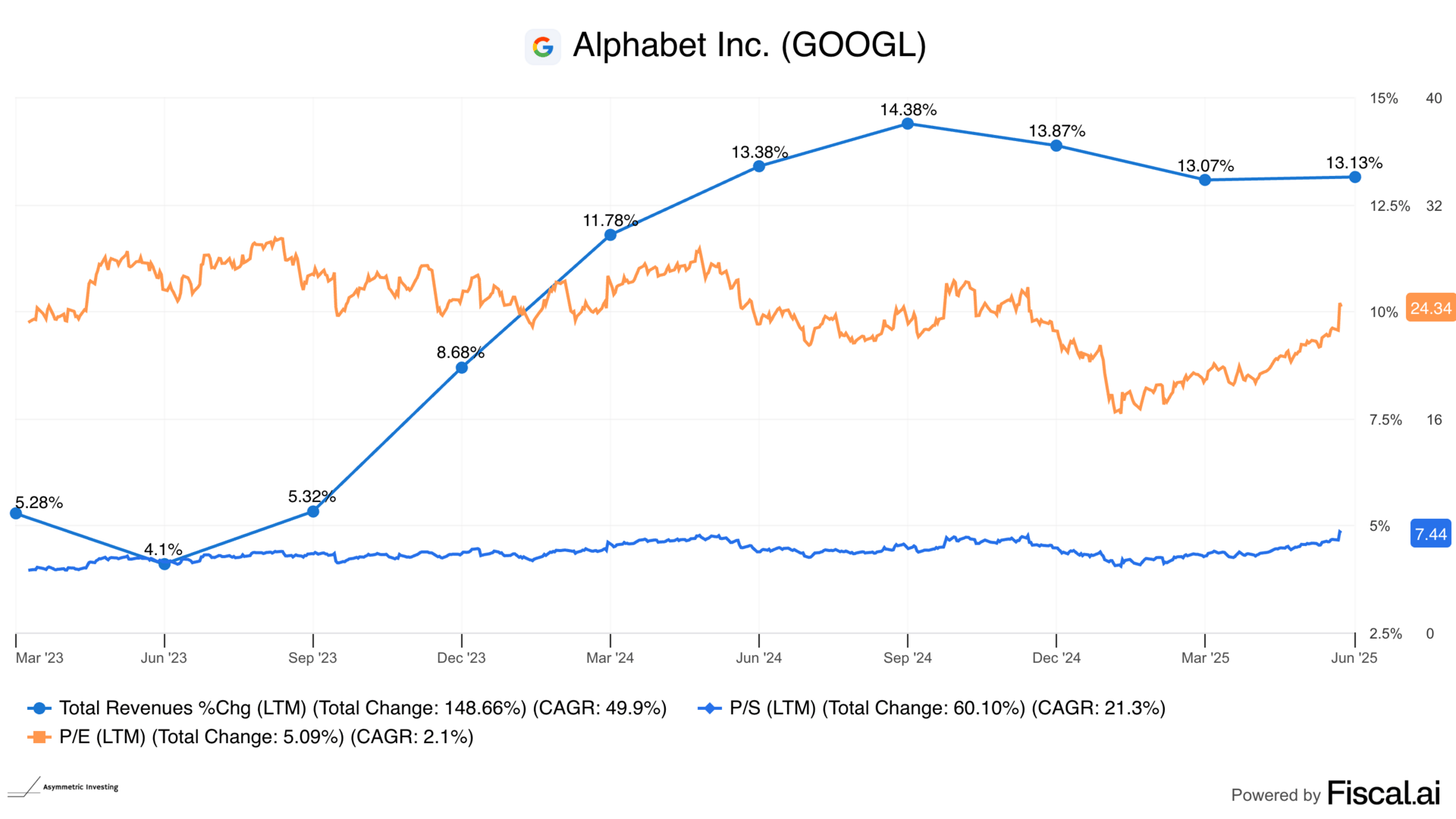

Follow the evidence that flew in the face of uncertainty, and Alphabet stock was a screaming buy under 20x earnings, as it has been most of the year.

Even today, Alphabet stock is relatively inexpensive at 24x earnings and 7.4x sales.

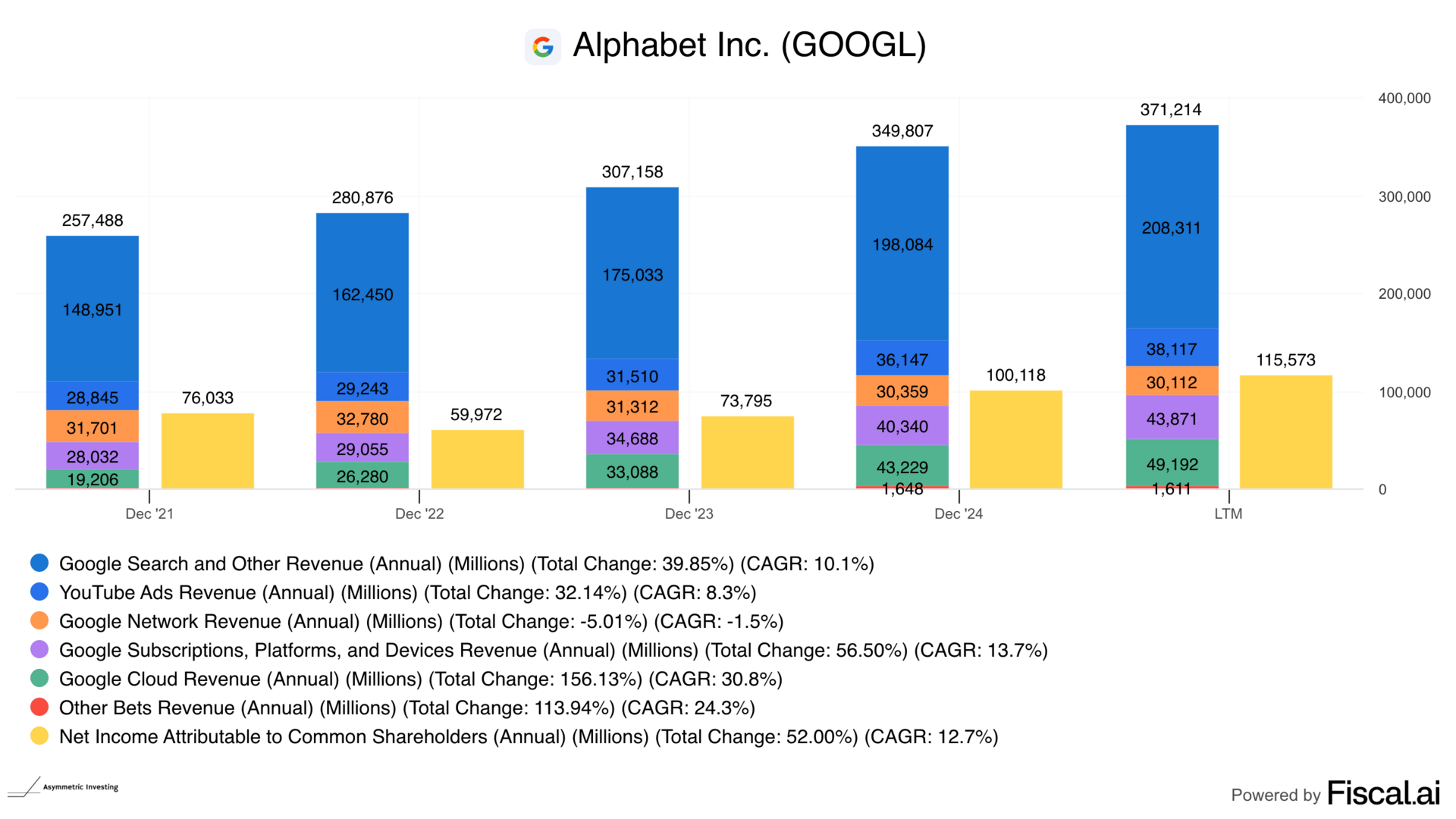

If Alphabet continues to execute well in core businesses like search and YouTube (bolstered by Chrome and Android), it will allow researchers the time to develop superior AI models and lean into their distribution advantage.

I’m happy Alphabet is one of the biggest holdings in the Asymmetric Portfolio because I think the market is underestimating the company’s opportunities. Alphabet is a rock-solid business with growth opportunities in the cloud, AI, and autonomous driving with Waymo.

This is a hidden gem hiding in plain sight.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.