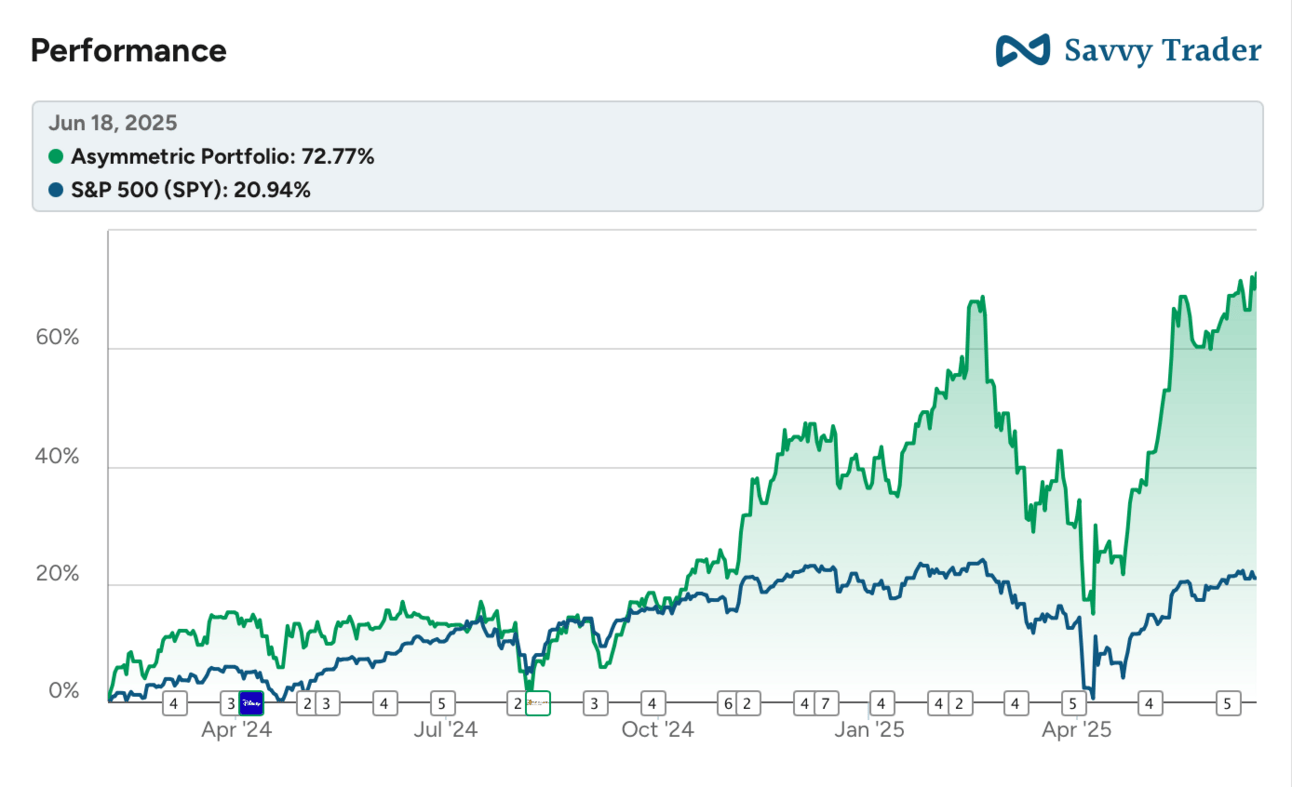

Before we get started, I wanted to highlight the incredible run Coinbase $COIN ( ▲ 1.04% ) has been on since “Disruption in Real Time: Payment Rails Are Changing“ was published on Sunday.

This week, Coinbase stock is up 21.4% and is now the 5th biggest position in the portfolio. The catalysts were:

JPMorgan Chase $JPM ( ▲ 1.51% ) will soon launch blockchain deposits on the Base blockchain with the help of Coinbase. You can read the full paper here.

The GENIUS Act passed the Senate with a 68-30 margin and is expected to pass the House of Representatives and ultimately be signed into law. The bill provides a framework for stablecoins, which is a $1 billion+ business for Coinbase already.

Coinbase is looking for approval from the SEC to “tokenize equities,” something I’ve talked about regularly as a logical use case, and I think this will ultimately extend to more bonds and even real-world assets on the blockchain.

The Coinbase Spotlight was written when the stock was $63.57 and on Wednesday shares closed at $295.29. I’m not selling now, but this is getting close to being a 10x stock for long-time Asymmetric Investors.

One of the frameworks of Asymmetric Investing is to over-index on founders.

That’s an amorphous framework because it leaves open the option to invest in non-founders and doesn’t really define what kind of founder I’m looking for.

But that’s the point.

The value founders create is intangible.

I know it when I see it…or that’s the idea.

And that’s where the recent discussion about Apple $AAPL ( ▲ 3.17% ) and Tim Cook is so interesting.

In his book Apple in China: The Capture of the World’s Greatest Company, Patrick McGee wonders if Tim Cook is this generation’s Jack Welch.

It’s not a compliment.

Welch was considered a business icon in the late 1990s. And then his business — General Electric — fell apart during the financial crisis and has now been broken into pieces. His hand-picked successors were also…less than impressive as company leaders.

Cook may be heading down a similar path. He’s an incredible manager, and Apple wouldn’t be the company it is today without Tim Cook.

But Apple may be a better company in the future if he steps aside. And it’ll likely never regain the magic the founder provided.

Founders Think Different

It’s hard to explain how founders think differently unless you’ve been a founder. To be clear, I’m no Steve Jobs, no Brian Chesky, no Elon Musk, and I never will be.

But I have started a few businesses (including the one you’re interacting with right now) and have learned a lot along the way.

What I’ve found as a common theme is the founders’ ability to see further in the future than managers of a business. Critiquing the screws that put together an iPhone wasn’t just Steve Jobs being maniacal, it was a tactic in-line with the overall strategy.

You can call this seeing the forest for the trees.

You could see this as founders being a little crazy.

When you build something from scratch, you have to think about the 5, 10, and 20-year vision. But you also have to make minute decisions day after day that pave a path to that vision.

Founders also have the authority to make demands that drive the vision, AND sometimes seem insane, something we see time and time again.

Costco’s $1.50 Hot Dog

Jim Sinegal is the iconic co-founder of Costco, which is known for its low prices and membership model. I covered Costco’s differentiation here, and there are a lot of ways Costco is different than other retailers. But the signifier of what Costco does is a $1.50 hot dog, a price that hasn’t changed since the 1980s.

If you raise (the price of the) effing hot dog, I will k*** you. Figure it out.

Imagine Target CEO Brian Cornell saying that. He couldn’t! He doesn’t have the authority/respect of Target’s employees to say something that crazy. Because he’s not a founder!

It’s not about the hot dog.

It’s about what the hot dog represents.

It’s the vision of Costco that Sinegal is engraining in the culture of the company.

Jobs And the 2×2 Matrix

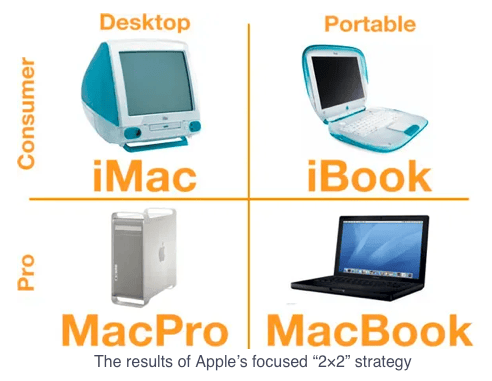

Under CEOs Michael Spindler (‘93-’96) and Gil Amelio (‘96-’97), Apple floundered with a growing lineup of uninspiring products. When Steve Jobs came back in 1997, he famously drew a 2×2 matrix of desktop and portable computers for pro and consumer users. That matrix became these products, and they were to be the only focus for the company.

Image from Unwritten Business Guide

That’s a founder’s vision and authority in a single image that changed the world.

Howard Schultz And Starbucks Magic

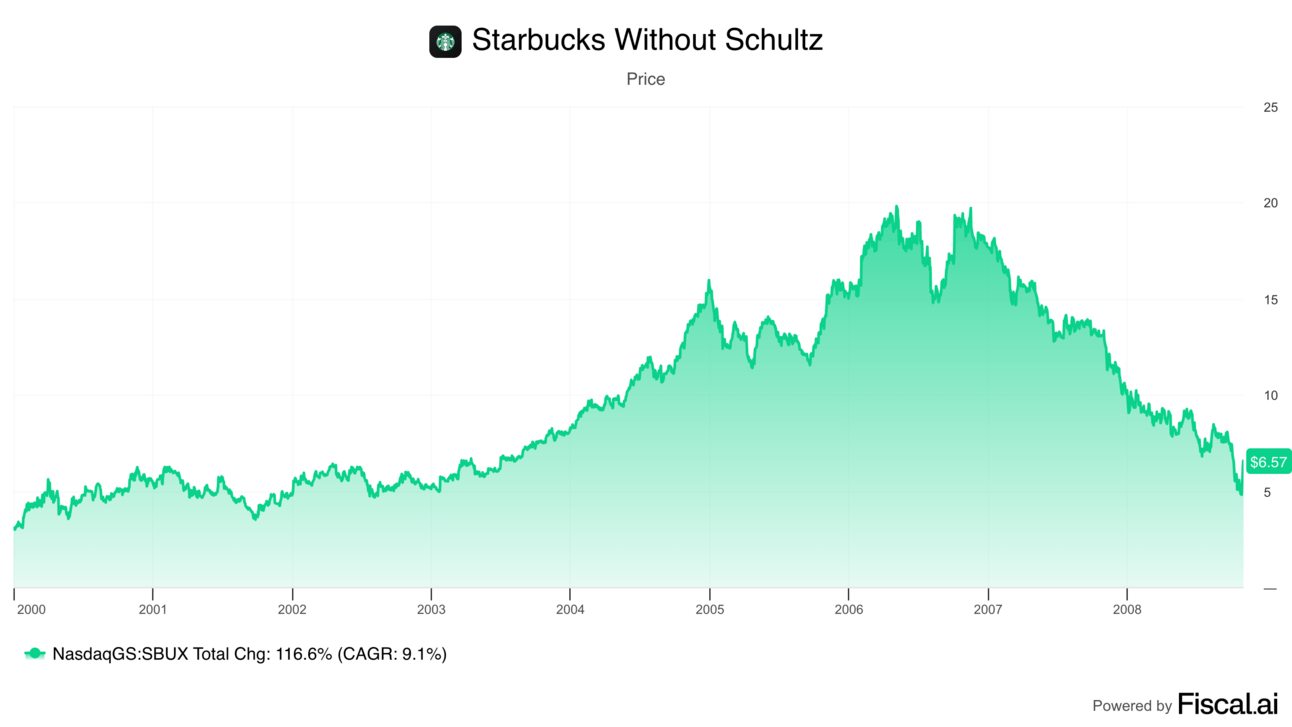

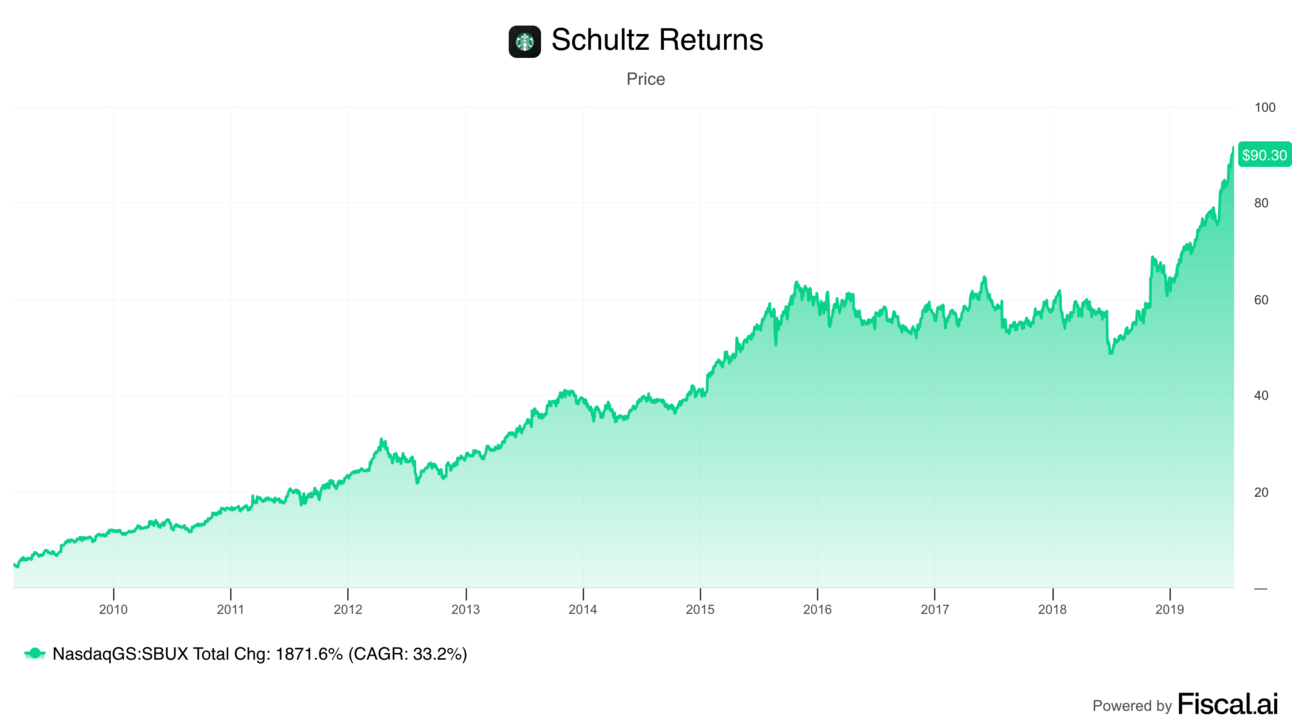

Starbucks $SBUX ( ▲ 1.71% ) found that Howard Schultz has had two comebacks to the company, one in 2008 and the other in 2022. In 2008, the company’s stock had plunged 50%, and Starbucks had begun losing ground to competitors.

Schultz revived the company, and investors were rewarded.

Schultz may be the best example of a founder’s magic because I can’t point to a simple matrix or a one-liner that exemplifies his brilliance. But he makes Starbucks coffee shops feel more like a home away from home across tens of thousands of locations.

Founder are just different.

Founders like Andrew Dudum, Brian Armstrong, and Vlad Tenev have driven the Asymmetric Portfolio to new heights. And I’m investing in founders like this every month. Join Asymmetric Investing premium to get more analysis, all of my stock picks, and every buy straight to your inbox.

Managers…Manage

Apple wouldn’t be where it is today without Tim Cook. He’s been arguably the most effective manager of our generation. Just like Jack Welch before him.

So, why isn’t Welch remembered as an icon of business?

When Welch retired in 2001, GE was worth about $450 billion. Today, it’s worth $250 billion, albeit after some spin-offs.

His three hand-picked successor who duked it out for his job were also less than impressive. Jeff Immelt took over for Welch and promptly led GE’s fall from grace. Jim McNerney went to 3M (where I worked at the time) and then Boeing, which have both struggled. Bob Nardelli took over at Home Depot and that was a disaster from Day 1.

Cook risks the same fate as Apple’s reliance on China is exposed, the company flounders in AI, and key staff leaves to join more exciting companies like OpenAI (Jony Ive’s Love From is primarily old Apple engineers).

Tim Cook’s job under Jobs wasn’t to have a vision. It was to make Steve Jobs’ and Jony Ive’s visions a reality. And he was brilliant at it.

But when he took over, the job changed.

The execution and ruthlessness of Apple continued. But his vision was about being more of a health company, hence the Apple Watch’s health features that scratch his itch as a health nut.

He focused on privacy, which is a great tagline but is more fraught when you realize Apple’s pictures and messages are less encripted by default than competitors like WhatsApp or Signal.

He bet big on autonomous vehicles and virtual reality, which have flopped.

From a product standpoint, Apple is essentially the same company it was when Steve Jobs died.

The vision hasn’t moved forward because Tim Cook isn’t a visionary.

And he shouldn’t be. He’s a manager.

Investing In Founders & Managers

I’m making the argument here that I want to over-index on founders, but this isn’t a hard and fast rule. Like anything, there’s nuance.

At Uber $UBER ( ▲ 0.77% ), Dara Khosrowshahi has been an incredible manager after taking over for Travis Kalanick. Uber needed an adult to run the show and Dara was the man for the job!

Anthony Noto at SoFi $SOFI ( ▼ 0.51% ) is another example of a needed adult in the room for a startup wanting to get into the big leagues of banking.

But the biggest upside comes from founders who have an expansive vision of the business they’re trying to build and can execute the tactics to get there.

When you listen to Andrew Dudum at Hims & Hers $HIMS ( ▼ 0.18% ), Brian Armstrong at Coinbase $COIN ( ▲ 1.04% ), or Vlan Tenev at Robinhood $HOOD ( ▼ 0.7% ), they don’t talk about what will get them an incremental point of market share. They’ll talk about disrupting healthcare, finance, and investing respectively.

They have a multi-decade vision.

They think differently and in hindsight that becomes obvious.

Who else could have led Netflix $NFLX ( ▲ 0.17% ) from DVD deliveries to streaming but a founder like Reed Hastings?

Who could have invested a decade building CUDA for an unknown use case (ultimately AI) other than someone as visionary as NVIDIA’s $NVDA ( ▲ 1.18% ) Jensen Huang.

The examples go on and on.

If you want asymmetric returns, you have to trust founders.

They’re a little crazy.

And that’s the point.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.