The greatest teacher, failure is.

I’m increasingly viewing Asymmetric Investing as a diary about my investing journey. My research is simply public documentation of the analysis I was already doing before writing it down for others to read. And the Asymmetric Portfolio is just…my portfolio.

With that in mind, I think it’s important for you as a reader to understand how I got here.

This journey from buying my first stock at 13 to today hasn’t been a straight line.

There have been ups.

There have been downs.

And along the way they’ve been failures.

But as Yoda says, failure is the greatest teacher.

What I’ve realized is the success and failure I’ve experienced in investing and business have led me to the analysis and frameworks I bring to you each week.

The concepts I cover aren’t an accident.

They’re an outcome of nearly three decades of investing and entrepreneurship.

They’re an outcome of my first investment when I was 13 (Medtronic), my first stock blow-up when I was 18 (JDS Uniphase), and the successes and failures of attempts at entrepreneurship over the last 25 years.

This won’t be a regular post and it won’t be for everyone. But I hope it helps explain some of the foundational experiences that drive my analysis each day. If you’re interested in how the sausage is made in my mind, here’s the story from failure (today) to frameworks (coming on Sunday).

Failures and Asymmetric Outcomes

I wanted to write this in part because we need to celebrate and normalize failure, not just success.

Some of the most successful entrepreneurs in history have had massive failures.

Sam Walton’s first retail store was a Butler Brothers chain that he ran before being pushed out in 1949 because he didn’t include a standard renewal option in the lease.

Only 9 years after founding Apple, Steve Jobs was pushed out, spending the next 12 years building NeXT Computer which was largely a failure. After returning to Apple in 1997, the company teetered on the brink of bankruptcy.

Henry Ford’s Detroit Automotive Company went bankrupt and he left his second venture, Henry Ford Company, before eventually founding the Ford Motor Company we know today.

Benjamin Graham, mentor to Warren Buffett and known as the founder of value investing, lost everything in the stock market crash of 1929 before finding wealth and fame as a value investor.

Uber founder Travis Kalanick was also a co-founder of the search engine Scour which went bankrupt in 2000. He also founded and sold peer-to-peer file-sharing company Red Swoosh to Akamai Technologies for a relatively modest $19 million in 2007. But those were all precursors to Uber.

Sam Altman, who is counting win after win over the last 2 years, wasn’t always seen as a genius.

What you notice with each failure is the lesson they learned that made them smarter and more effective in the future.

Speaking of business models, I’ve built Asymmetric Investing to have a free ad-supported tier and a premium tier with all of my individual stock research and portfolio. If you don’t want ads like this one, you can upgrade here.

Following In the Footsteps of Great Failures

I give these examples to lay the foundation for failure being not only acceptable but necessary in many cases. It’s what these great investors and entrepreneurs learned from failure that led to their greatest success.

Here’s a little bit of my story and why I may look at the world of investing differently than many other analysts.

Two Face Poker

In 2006, I started a poker chip company called Two Face Poker. I spent ~$30,000 of my own money to build a custom poker chip mold and manufacture 20,000 poker chips that were of casino-level quality.

I built the website. I set up drop shipping for cases and cards on the site. The branding was amazing.

Poker was still booming, and I thought I had done everything to build a great poker chip business.

I sold very few chips and the mold still sits on my desk today.

What I didn’t know at 24 was how important marketing was, especially on the internet. We didn’t have social media in the same way back then and I wasn’t good at being active on poker boards or advertising on Google.

I thought a great product was enough.

It wasn’t.

The silver lining was my friend Marc, who was involved in Two Face Poker in the idea phase, watched what could be built on the internet without much infrastructure and learned from my successes and failures. He launched Marco V Cigars a few years later and is still successful today. The difference was, that Marc understands sales and marketing. (And he makes great cigars 👇 )

Investments in Apple, Chipotle, Tesla, and Microsoft

Two Face Poker died slowly around 2008, but I kept investing in individual stocks.

I owned a large position in Chipotle in 2007 and sold it in 2008.

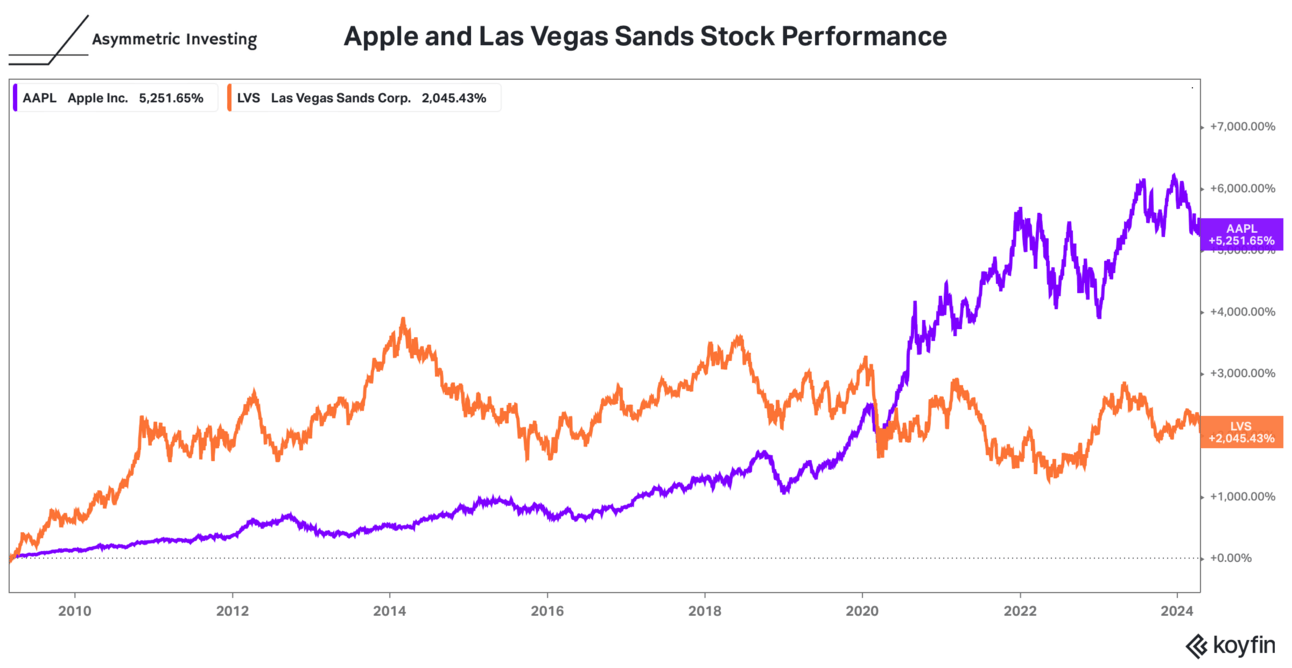

I bought Apple and Las Vegas Sands days before the market bottomed in 2009, only to sell both within a few years.

And I bought Microsoft when it was cheap in 2012 only to sell when I had doubled my money.

I bought the right stocks.

But I didn’t hold onto them, so I didn’t generate asymmetric returns.

In each case, the businesses weren’t broken, but I was blinded by a distraction like “I’m already up 100%” or my favorite, “Apple is the biggest company in the world, how much bigger can it get?”

That logic was dumb.

I’ll get to the frameworks that came out of these mistakes on Sunday, but this should give you an idea of why I err on the side of not selling stocks.

REM5 Virtual Reality Laboratory

In 2017, the entrepreneur bug hit again and I co-founded REM5 Virtual Reality Laboratory to bring virtual reality to the world. My co-founder and I saw virtual reality as an amazing technology that could be the next computing platform. But no one was thinking about the “last inch” of distribution. aka. Putting VR headsets on people for the first time.

At that time, you could try an Oculus Rift in the middle of Best Buy on certain weekend hours if you were lucky enough to fend off the 13-year-olds who were camped out there all day.

Our idea was to trick people into coming to REM5 for pizza and beer and show them VR when they got there. From there, we had optionality in education, corporate events, content creation, and so much more.

REM5 was a smashing success by VR standards. From a small warehouse in St. Louis Park, MN we built a business that was on its way to making over $1 million in revenue in 2020. We were even searching for new, bigger locations to expand to and considering when we would grow to more states.

And then the pandemic happened.

On March 13, 2020, we met with staff to discuss the coronavirus that had been spreading and what we wanted to do. We decided to operate as normal that weekend and shut down on March 16, 2020, for a week or two.

Little did we know, we would go from a $1 million run-rate to $0 overnight.

After two years of struggling to keep the business afloat, I stepped back and my co-founder continued building and expanding into a content studio called REM5 Studios. REM5 VR Lab still exists, and REM5 Studios is doing amazing work with the Gates Foundation, but it wasn’t big enough to support everyone involved and my kids were young.

The reality of life collided with the demands of entrepreneurship.

What I took away from the REM5 experience is maybe the most impactful to my view of investing today.

In 2017, we knew we were up against giants like Facebook (now Meta), HTC, and eventually Apple, but we thought we had a unique view of the industry and we were riding a wave of growth that would last a decade. And a business model with lots of optionality was the right way to go into the industry.

In hindsight, we had the right business model, and “the last inch” is still a problem for the industry. But we overestimated the rate of adoption for VR and never saw a pandemic coming. Without the pandemic, we would likely have multiple locations and be extremely profitable.

I could look back and be upset at this, but I don’t. I tell the story that I think exemplifies how crazy you sound being a founder.

The Warehouse Interview

We had about 6 months from getting the keys to our location to opening, so we did staff interviews while we were under construction.

REM5 is a converted warehouse space that now includes a small kitchen and 10 VR pods, which you rent out based on time. Each pod has a headset and seating area, like a bowling lane but VR.

However, staff interviews didn’t include any of the equipment you see in the video above. Instead of walls, we had tape on the floor to show where the walls would eventually be. Instead of working headsets and furniture, we needed staff to imagine what the experience would be like.

There was no playbook, no instruction manual, and no “right way” to do things in VR. We were making it up as we went.

The people who saw the vision during those interviews became our best staff members and some still work there today. But I remember discussing that interview and the vision we sold with one person a year later.

“I thought you were crazy, but everything you said would happen has happened. People came in to get pizza and that led to birthday parties, which led to corporate events, and is now driving content discussions.”

We were crazy, but we had a vision and knew the steps to make the vision a reality. Not unlike every successful founder I invest in for the Asymmetric Portfolio.

I didn’t become Brian Armstrong (Coinbase), Brian Chesky (Airbnb), or Daniel Ek (Spotify) but I would like to think that starting a business and everything that goes into it is a better background for investing in disruptive companies than putting a suit on each morning and driving to a downtown office to work at a bank.

Both the success and the failures at REM5 — including my own — have been formative in the analysis and outlook at Asymmetric Investing.

This background helped inform the frameworks I use in Asymmetric Investing, so come back on Sunday for more on that topic.

Thank you for subscribing!

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.