How many stocks should you own?

How much of your portfolio should you put into your highest conviction idea?

Should you sell a good idea from a few months ago to buy a better idea today?

I don’t have perfect answers, but I have thoughts and frameworks.

Diversification is important for an investor like me because I need to have the breathing room to be wrong.

Remember, in Asymmetric Investing, being wrong is expected and will be tolerated!

In my Frameworks for Asymmetric Investing, I over-index to not selling, in part because:

Selling for a stock for a 100% gain and watching a stock become a 1,000% gain is excruciating.

This week, we saw a few reasons why I don’t like to sell stocks unless my thesis is completely broken. I’ll get to why below.

As for the market, the stock market overall had a good week on the back of a few solid earnings reports and relatively few bombshells in company guidance.

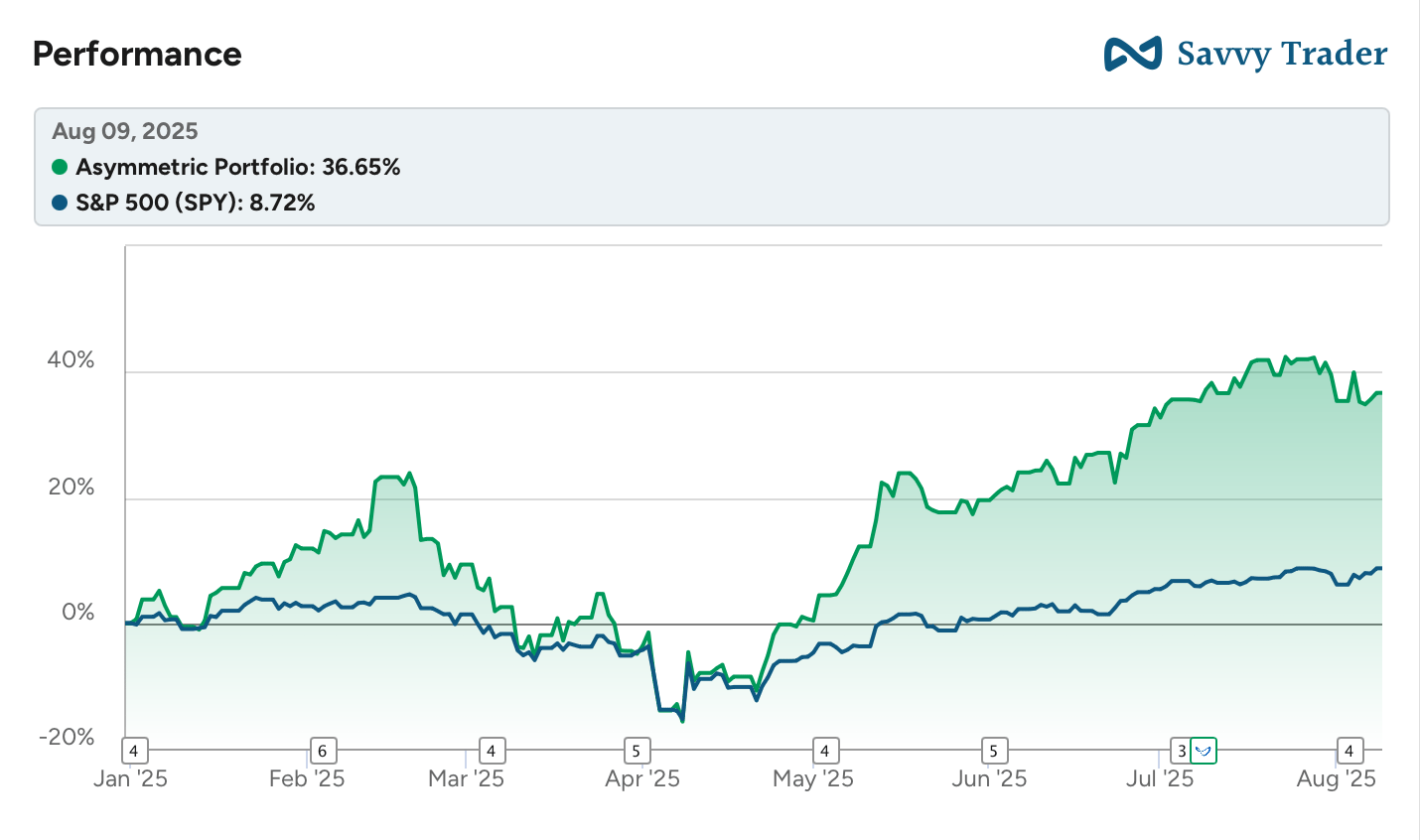

The Asymmetric Portfolio was up and down, and at the end of the day, has been sideways for the last month. Earnings season hasn’t been good, but it hasn’t been a disaster either.

If you want to learn about every stock I buy for the Asymmetric Portfolio before I buy it, sign up for premium here.

In Case You Missed It

Here’s some of the content I put out this week.

Hims & Hers Earnings Recap: It’s crazy Hims & Hers only reported six days ago, but that’s all it was, and a lot has happened since then.

Autonomous Driving’s Inflection Point: Autonomy is here, and it won’t be a winner-takes-all market.

Earnings Season Catch-Up Part 1: This is just the start of catching up on earnings season, with more coming next week.

The Art of Diversification

There’s no right answer to diversification. Don’t listen to anyone who tells you the exact number of stocks you should own or what percentage of your portfolio you should buy or sell.

I know great investors who own fewer than 10 stocks.

I know great investors who own over 100 stocks.

You could spend a career studying the “right” way to diversify your portfolio.

Where I land is owning somewhere between 20 and 40 stocks. Right now, the Asymmetric Portfolio is at the low end of that but will likely rise over time. Here’s why I want to be in that range.

Owning more than a handful of stocks allows for a more diverse industry or macro trend.

For example, I own 3 stocks where autonomous driving is a major tailwind.

I can buy a basket of ideas in a sector, increasing my odds of hitting a potential 10x opportunity and lowering the odds I miss it entirely.

Owning stocks in multiple industries allows me to be right in one, while being wrong in another.

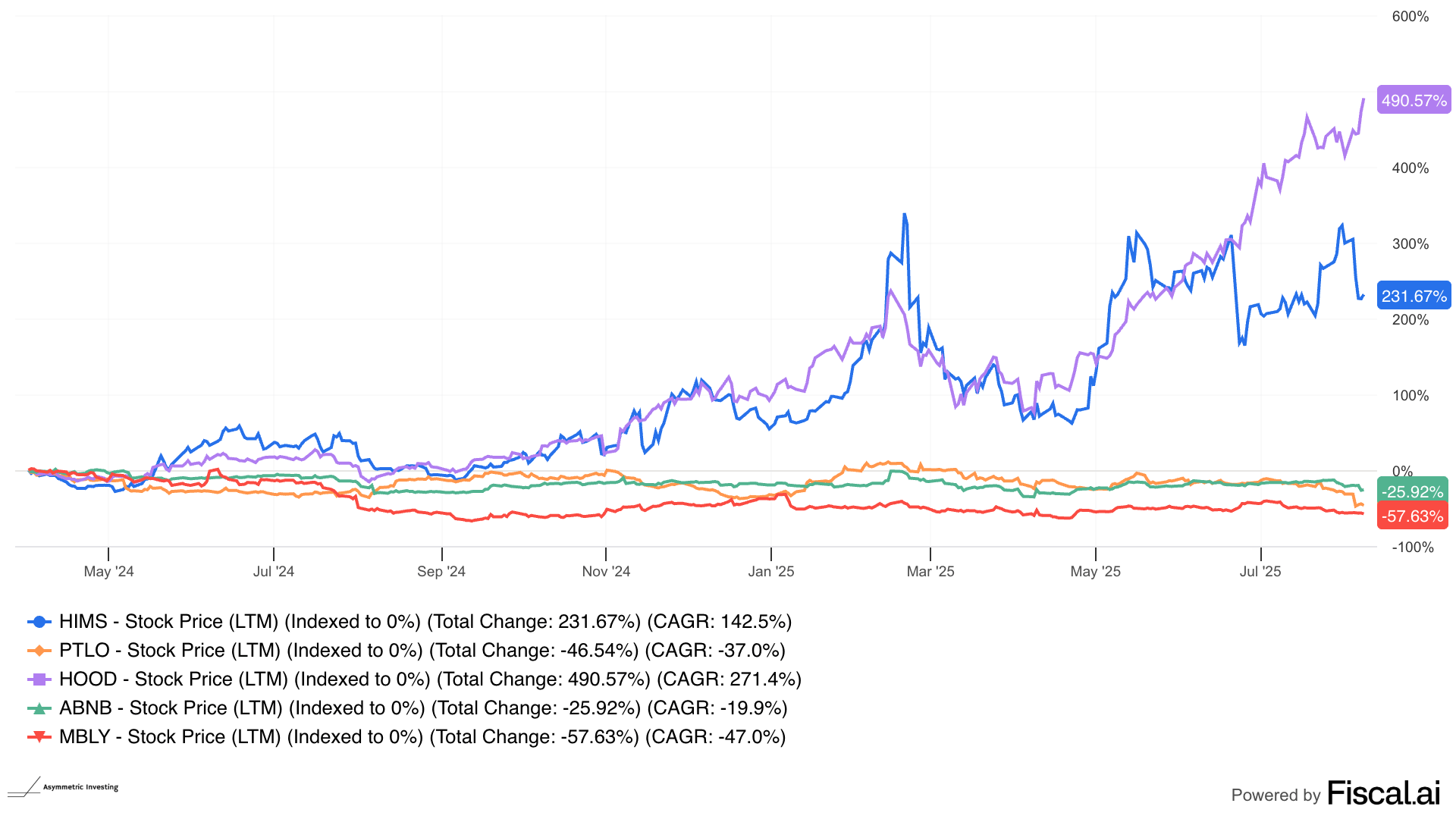

I’ve been “right” about growth stocks like Hims & Hers and Robinhood, while being “wrong” about MGM Resorts and Crocs.

In my opinion, owning too many stocks takes focus away from those I own.

Ex. I can’t follow 100 earnings reports 4x per year, so that’s too many for me.

In general, my approach to investing involves relatively big swings that may pay off handsomely.

But I would like to take more swings than a more concentrated portfolio would allow.

This also allows me to be “wrong” on a single stock while being “right” for the portfolio.

For example, I’ve invested more money in Portillo’s, Airbnb, and Mobileye combined than I have in Robinhood and Hims & Hers. Yet, gains from Robinhood and Hims & Hers have overwhelmed any losses from the others, and even this small basket of five stocks would have outperformed the market over the past two years, with 40% of picks outperforming the market.

There’s a balance between thinking I’m right about any single investment and knowing I’m probably wrong about over 50% of my investments.

Taking more shots on goal is the right strategy in that case, and that means diversifying with over 20 stocks.

Why I “Never” Sell

I do sell stocks.

But if at all possible, I want to never sell.

The reason boils down to keeping myself from making mistakes. And most of my biggest mistakes involve selling.

Valuations Can Always Go Higher

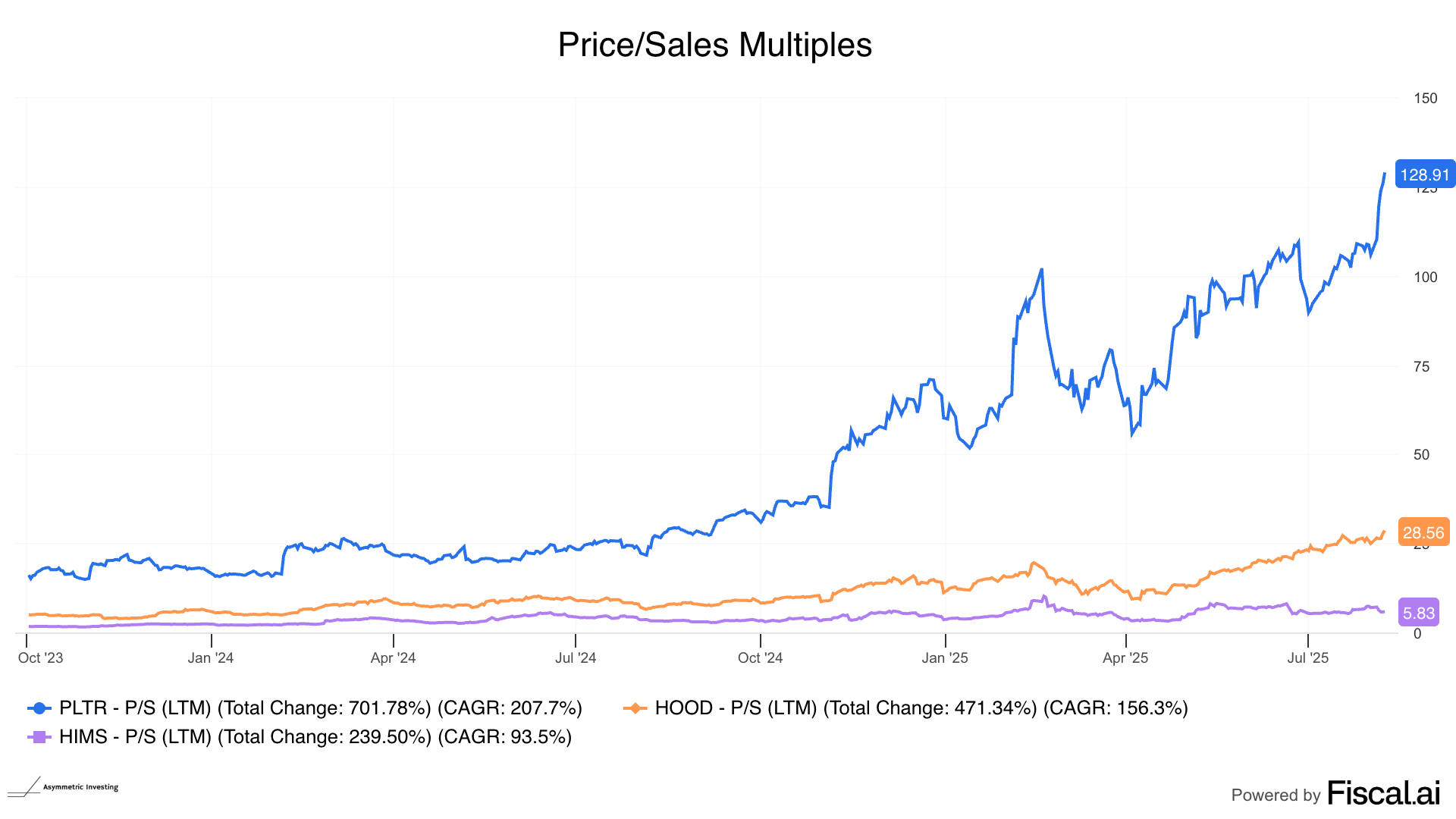

Robinhood $HOOD ( ▼ 0.31% ) has become the biggest position in the Asymmetric Portfolio by a wide margin, and I’ve been worried about its valuation for some time. In a past life, I would have probably sold some of my shares by now.

I wrote in early July that I was worried about the stock’s valuation and multiple compression (a stock dropping simply because P/E or P/S multiples fall). But I ended the article by deciding to do nothing.

I just held the stock.

Since then, the stock is up 22%.

Should I sell now?

Robinhood could 4x in value and still not be as expensive as Palantir. Hims & Hers $HIMS ( ▼ 2.64% ), another large holding, could 20x in value and be cheaper than Palantir on a P/S multiple.

I want to buy at good valuations, but I don’t want to sell just because valuations get high.

They can always go higher.

You Never Know When the Market Will Agree With You

I also don’t want to sell because we never know when a company will turn around and/or the market will suddenly agree with us.

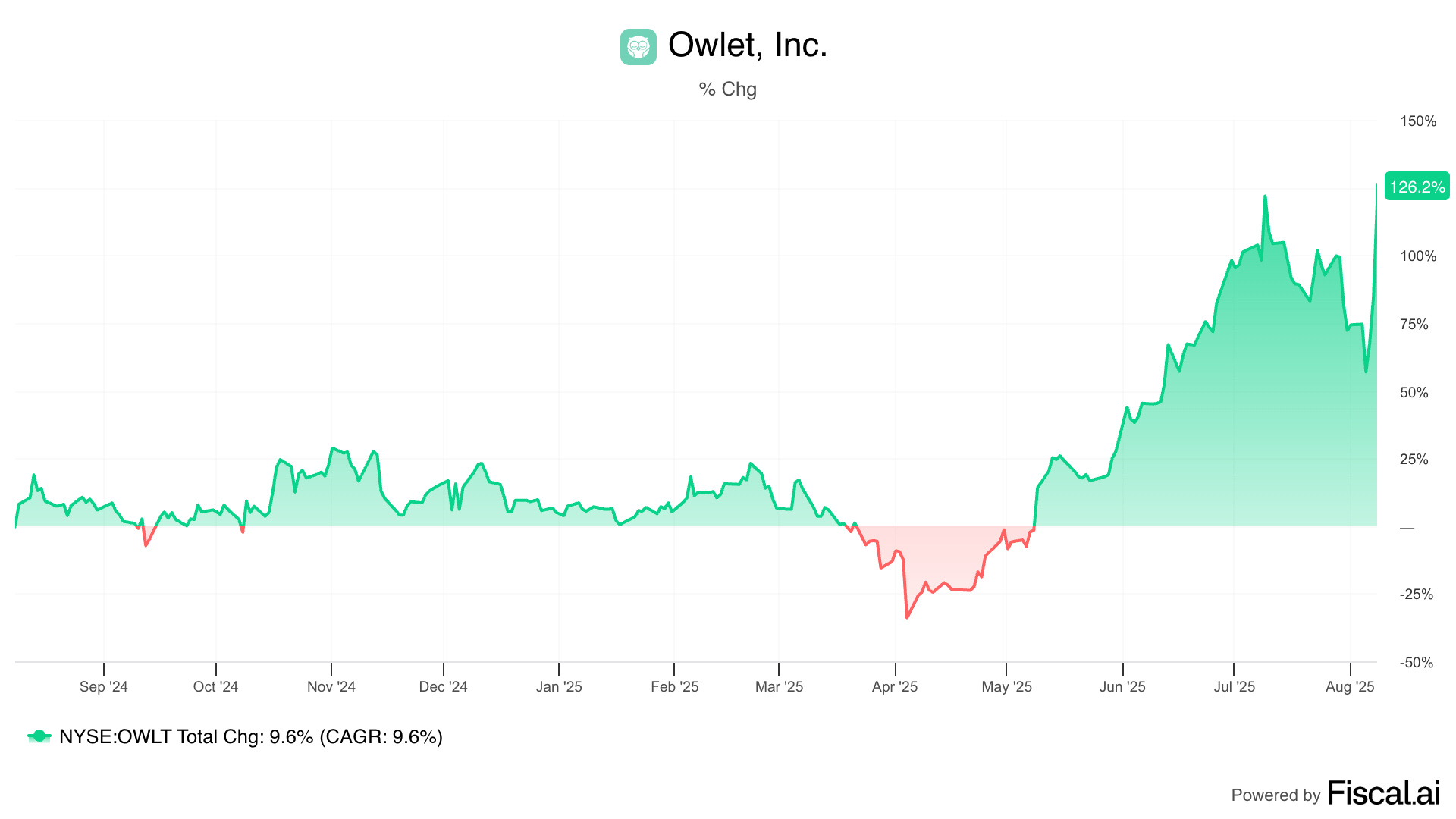

I last bought shares of Owlet $OWLT ( ▲ 0.28% ) nearly a year ago, and I haven’t done anything since because the company has been improving, but not impressing me each quarter. In other words, the thesis isn’t broken.

In April, the stock suddenly took off like a rocket ship, and I’m now up nearly 100% on the stock.

Almost every stock I own that has underperformed the market over the past year or two falls in a similar boat.

I’m watching operations get better, and in some cases, buybacks reduce the market cap quarter after quarter. But the market doesn’t care.

Eventually, the market will care, I just can’t time when it will. So, I wait and focus on fundamentals and making good buying decisions.

My weakness is selling, and I have invested long enough (30 years) to know I’ll never sell at the top.

This is my way of putting one of the smartest things ever said about investing into practice.

The first rule of compounding: Never interrupt it unnecessarily.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your research before acquiring stocks.