Second quarter 2025 results from Hims & Hers $HIMS ( ▼ 1.2% ) had a little something for everyone.

Bulls got great revenue growth, expanding margins, and a vision for healthcare disruption that includes memberships.

Bears got a “core” business that shrank ever so slightly from a quarter ago, and Novo Nordisk $NVO ( ▼ 2.13% ) going scorched earth with 140 lawsuits against compounders and telehealth companies.

What’s the truth about Hims & Hers’ future?

The answer likely depends on your time horizon. Over the next couple of quarters, the company may face some headwinds. GLP-1s are a question mark, and lawsuits could be costly.

But over the next 10-20 years, I think we’re seeing the vision of a true healthcare platform being built. And incumbents like Novo Nordisk are terrified that their power position in the market is collapsing. That’s why they’re going to court. GLP-1 patents are running out, and their control of the supply chain from doctors to pharmacies is slipping away.

If the future is controlled by demand aggregators that have an incentive to provide the right solution to customers that considers outcomes AND cost (gasp), big pharma is in trouble.

Let’s get to it!

The Bad

Let’s start with the negative.

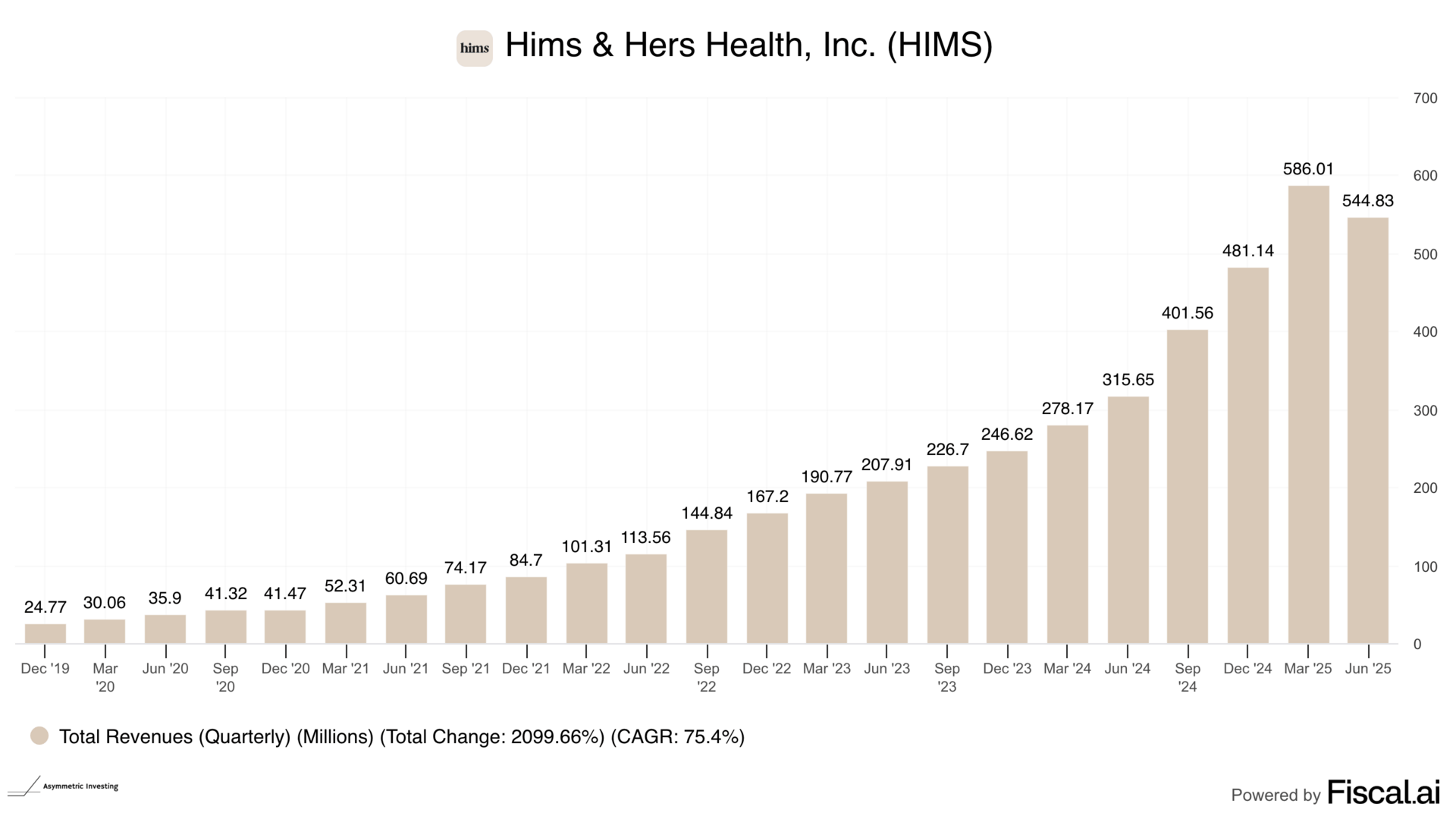

Revenue fell sequentially for the first time as a public company.

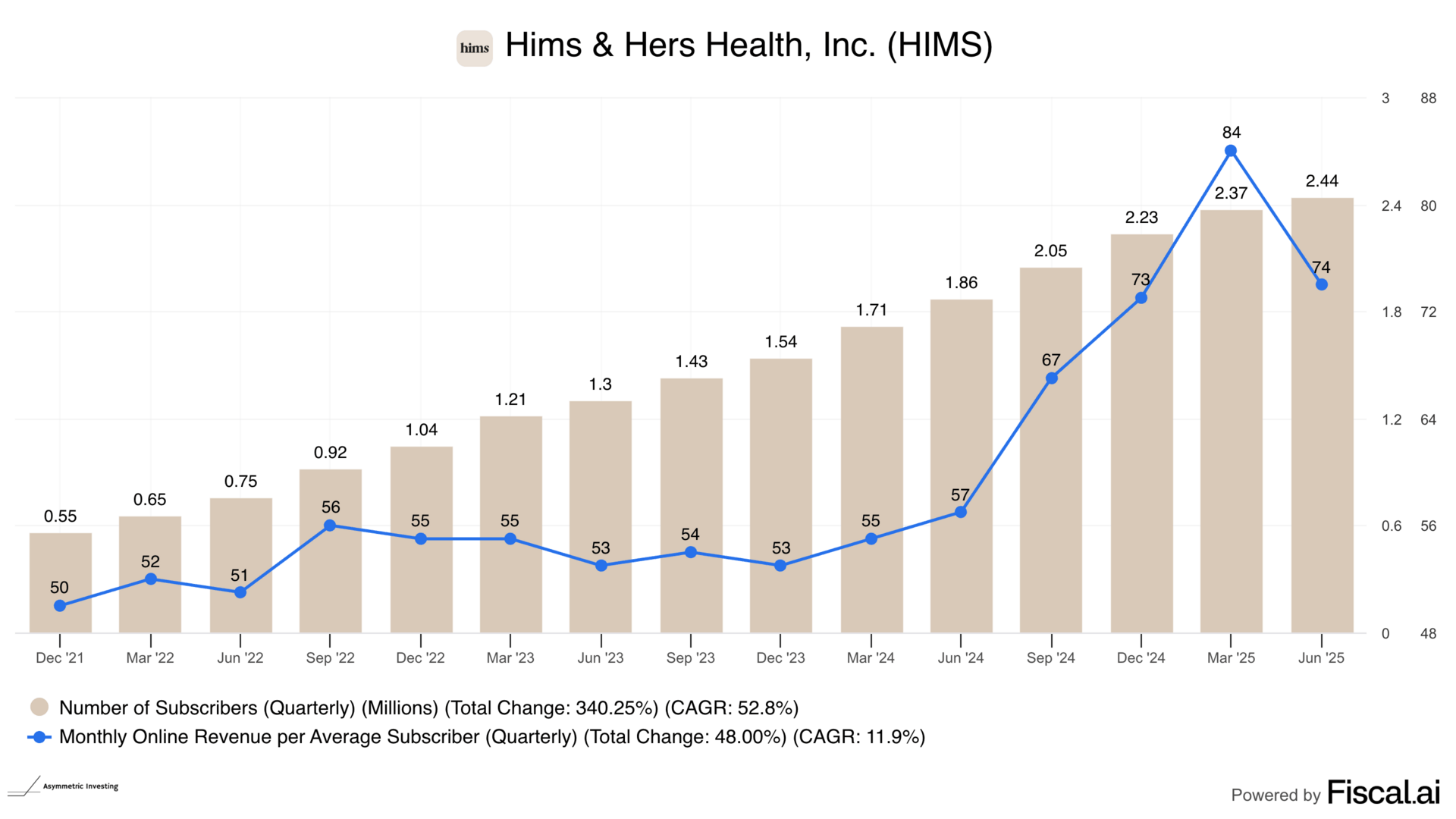

No surprise, GLP-1s were to blame and also brought down average monthly online revenue per subscriber to $74.

Non-GLP-1 revenue fell from $356 million in Q1 to $355 million in Q2. Any drop or deceleration in sales is a warning sign, so this should be watched closely.

The reality is that Q3 2024 to Q2 2025 numbers are messy because of GLP-1s. It was a boom and bust that not only put the company on the map but also resulted in the decline you see today.

And you can see above that management also took this quarter to invest in hiring new talent, upgrade facilities, and bring new products to market, which led to lower free cash flow.

Novo Lawsuit News

The other big news was Novo Nordisk filing 140 lawsuits against compounders and telehealth companies. But Reuters reported, “Novo has not filed a lawsuit against major telehealth firm Hims & Hers.“

A big piece of the short thesis around Hims & Hers — and 34.3% of shares are sold short right now — is that Novo or Eli Lilly $LLY ( ▼ 1.34% ) will sue the company into oblivion. But this week’s news could end up helping Hims & Hers.

Lawsuits against smaller, less capitalized companies may be successful, pushing them out of GLP-1s, but Hims & Hers has the balance sheet and incentive to fight through discovery and potentially challenge Novo’s patents depending on the suit.

This could leave Hims & Hers with fewer competitors, unintentionally improving the company’s position in the market.

Hims & Hers’ drop in revenue indicates that it’s indeed generating less revenue from GLP-1s in Q2 than in Q1, when it could legally sell compounded GLP-1s to any patient. This undercuts Novo’s claims that Hims & Hers was pushing GLP-1s it couldn’t legally sell.

The level of personalization Hims & Hers prescribes may not make Novo Nordisk happy, but proving over-prescribing in court got harder with the drop in revenue.

NOT suing Hims & Hers indicates Novo doesn’t have enough evidence to prove the company used illegal ingredients, prescribed illegally, or any of the other flashy accusations made in Novo’s announcement.

For context, here’s the meat of Novo’s announcement terminating its agreement with Hims & Hers:

In late April, the FDA resolved the Wegovy® shortage based on its conclusion that Novo Nordisk is fully meeting current and projected nationwide demand for this medicine. In support of transitioning patients from knock-off compounded versions to authentic, FDA-approved Wegovy® through NovoCare® Pharmacy, Novo Nordisk began collaborating with telehealth companies. Over one month into the collaboration, Hims & Hers Health, Inc. has failed to adhere to the law which prohibits mass sales of compounded drugs under the false guise of "personalization" and are disseminating deceptive marketing that put patient safety at risk.

"Novo Nordisk is firm on our position and protecting patients living with obesity. When patients are prescribed semaglutide treatments by their licensed healthcare professional or a telehealth provider, they are entitled to receive authentic, FDA-approved and regulated Wegovy®," said Dave Moore, Executive Vice President, US Operations of Novo Nordisk Inc. "We will work with telehealth companies to provide direct access to Wegovy® that share our commitment to patient safety – and when companies engage in illegal sham compounding that jeopardizes the health of Americans, we will continue to take action."

Novo Nordisk is deeply concerned and is continuing to take proactive measures to keep US patients safe from knock-off drugs made with foreign illicit active pharmaceutical ingredients. Based on Novo Nordisk's investigation, the "semaglutide" active pharmaceutical ingredients that are in the knock-off drugs sold by telehealth entities and compounding pharmacies are manufactured by foreign suppliers in China. According to a report from the Brookings Institute, FDA has never authorized or approved the manufacturing processes used by any of these foreign suppliers to make semaglutide, nor has FDA ever reviewed or authorized the quality of the "semaglutide" they produce. The report also found that a "large share of [these Chinese suppliers] were never inspected by FDA, and many of those that were [inspected] had drug quality assurance violations." US patients should not be exposed to knock-off drugs made with unsafe and illicit foreign ingredients.

That sounds scary. And if it’s true, Novo Nordisk should sue Hims & Hers.

But they haven’t…yet.

Maybe that’s telling us Hims & Hers isn’t the terrible operator Novo accused it of being in a press release?

Writing a press release is very different than proving something in court.

The Good

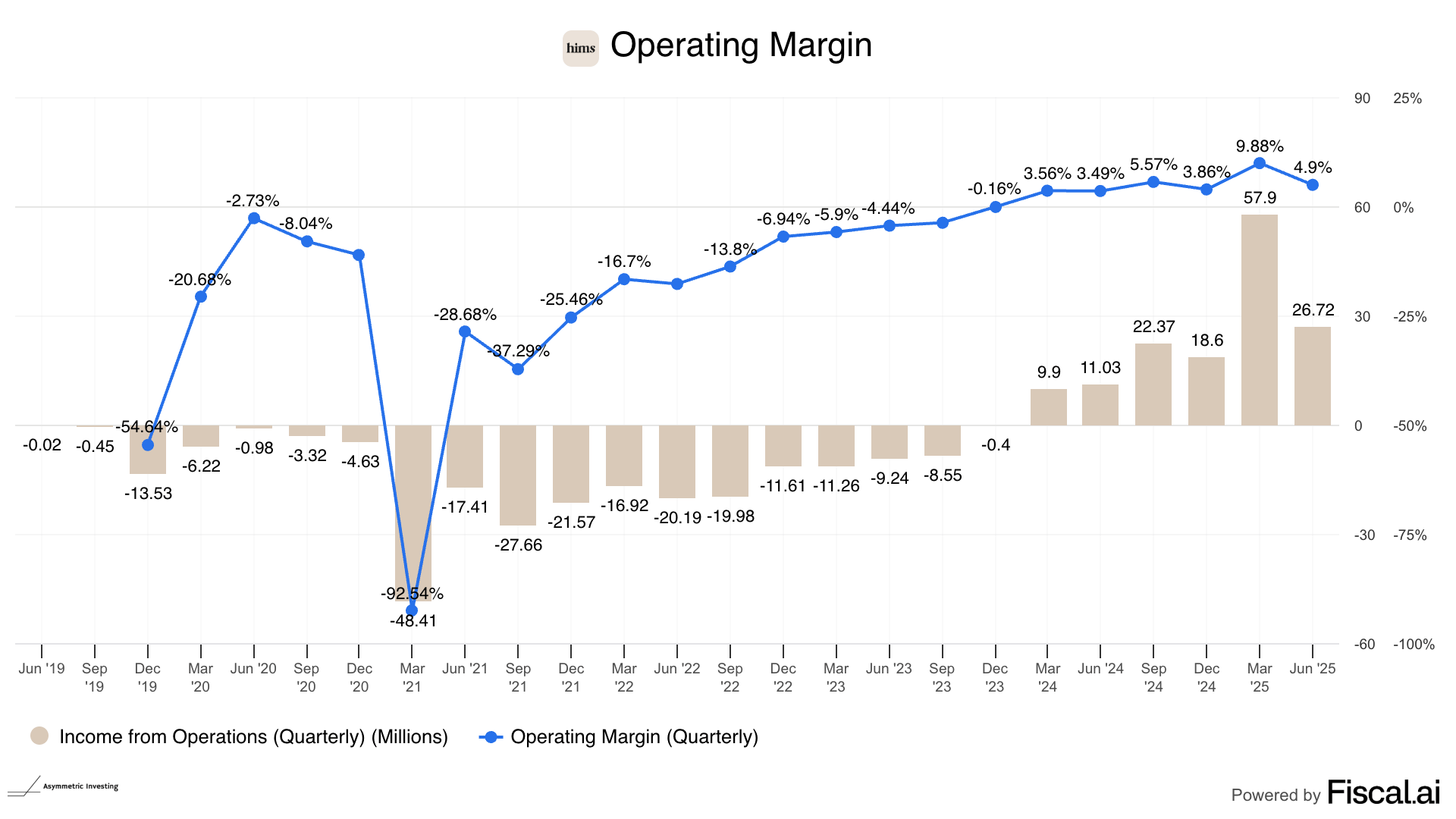

Despite the drop in revenue, Hims & Hers showed solid improvements in margins versus a year ago.

Management continues to expect a 1% to 3% improvement in operating margins each year, and we’re still on that path.

Is that it? Is that all that was good about operations?

Yeah, that’s about it!

Margins holding up is good, but with revenue down, I have more questions about Hims & Hers’ operating results over the next few quarters than I do points to brag about.

The Unknown

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Exclusive access to all premium content

- 1-2 company deep dives each month

- Timely updates on Asymmetric Universe stocks

- Asymmetric Investing portfolio (including trades before they're made)