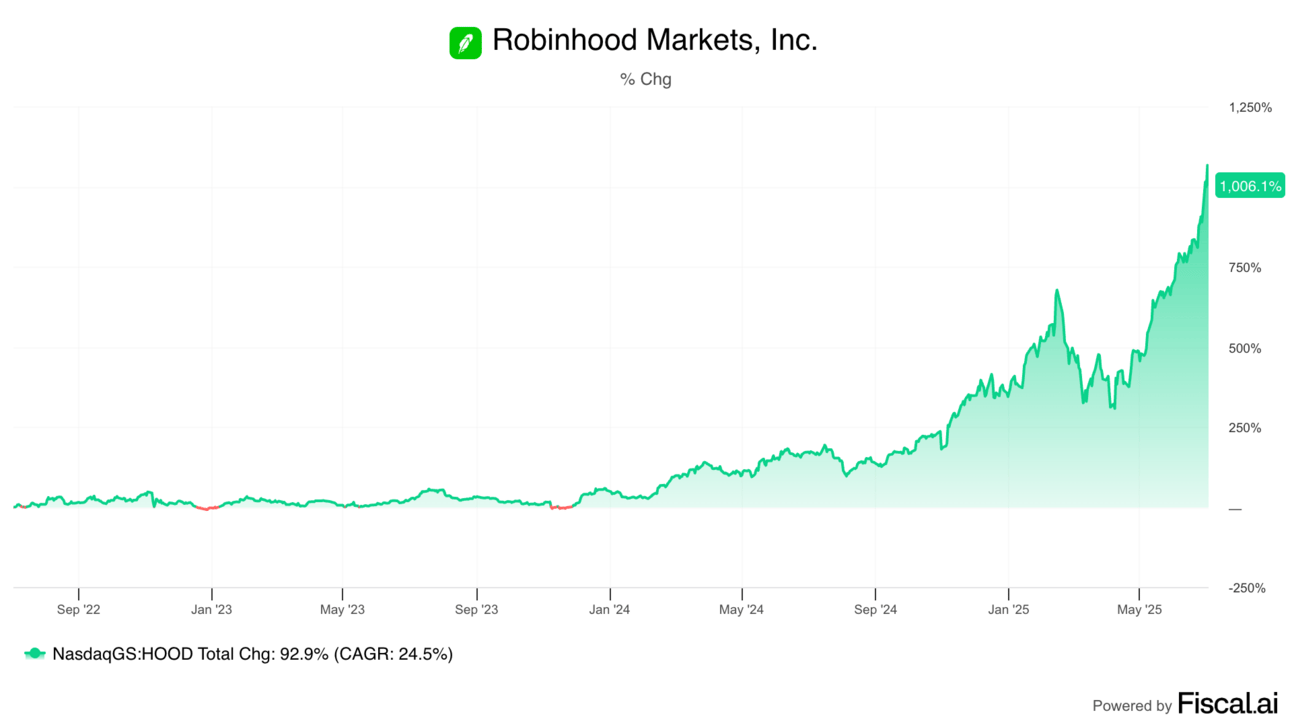

3-Year Robinhood Stock Chart

Two things can be true.

Robinhood’s $HOOD ( ▼ 5.64% ) business can be on an absolute heater.

AND Robinhood stock can be incredibly expensive.

In the Asymmetric Portfolio, shares of Robinhood are up 405% since the spotlight article just over a year ago, and shares are up 302% in total in the portfolio. Much of the thesis behind Robinhood has played out, and I think this is a great company to own long-term. However, has the stock gone too far too fast?

I don’t want to be held back by valuation, but valuation is something we need to consider as investors. When we buy stocks, we want valuation multiples to be a tailwind, not a headwind.

Today, I want to balance Robinhood the business with Robinhood the stock, and how I feel today.

Robinhood’s Heater

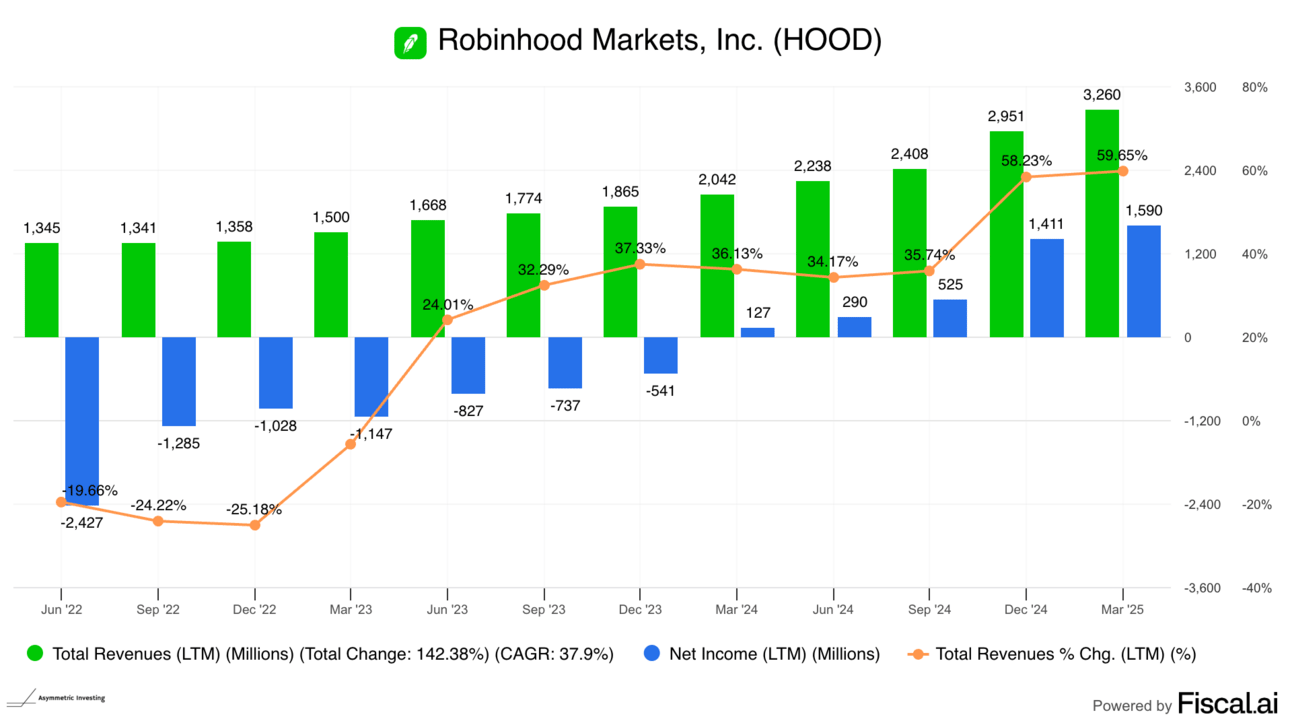

It’s hard to argue with Robinhood’s results. The company is growing revenue over 50% year over year, and operating leverage on the business has been astounding, even after pulling out $424 million in one-time benefits in Q4 2024. It’s hard to over-value that kind of growth rate, even when you know it won’t last forever.

New products like the Robinhood Gold Credit Card and Robinhood Legend have attracted more customers and increased the “wallet share”, or percentage of a customer’s financial activity, on the platform.

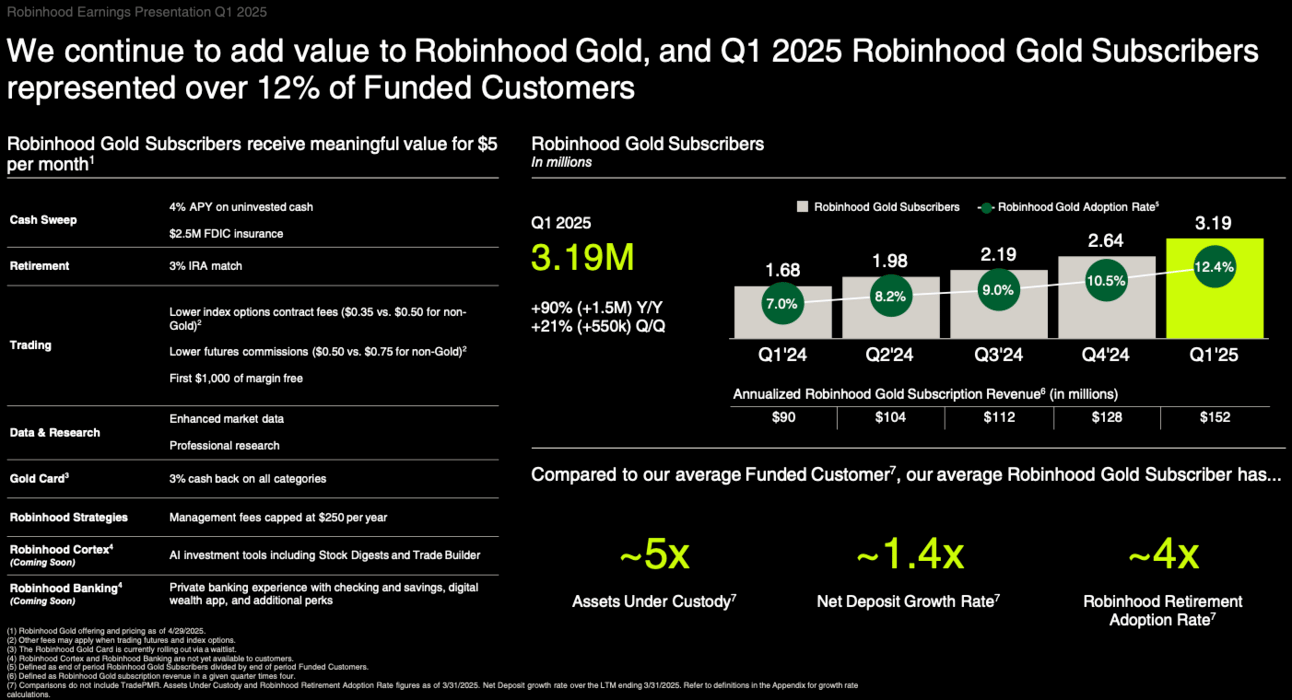

I highlighted Robinhood Gold as a differentiator and core part of the investment thesis in the spotlight, and the momentum for that product remains robust. This will help grow and diversify the business long-term because products like credit cards and retirement accounts are less volatile than the trading that drove Robinhood in 2021.

Robinhood is innovating faster than the competition and growing faster, with plenty of opportunity ahead.

Long-Term Tailwinds

What Robinhood is doing is building products that lean into its natural tailwinds. I put the tailwinds behind user and revenue growth for Robinhood into three buckets:

Product expansion

Geographic expansion

Generational tailwinds

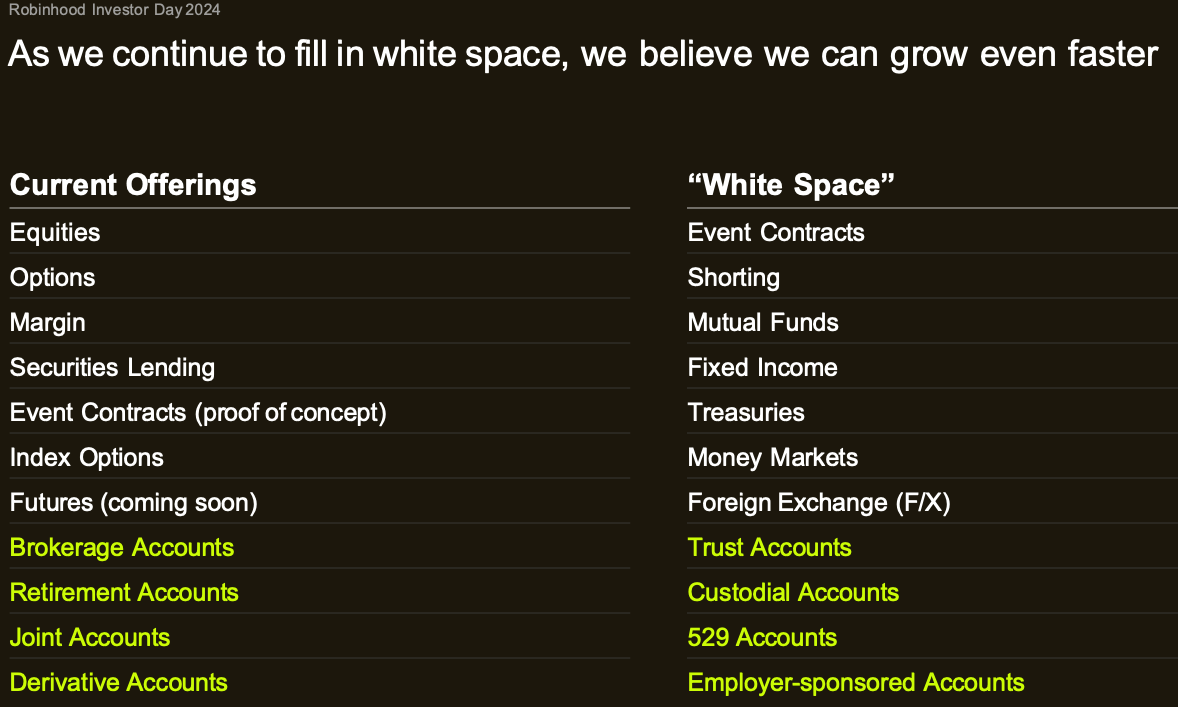

Even the near-term product expansion opportunities are vast. Custodial, 529, trusts, and employer-sponsored accounts would increase the addressable market dramatically. Here’s how the company outlined the near-term white-space in late 2024.

The geographic tailwinds are obvious. Robinhood is almost entirely a U.S. business today, but could expand around the world.

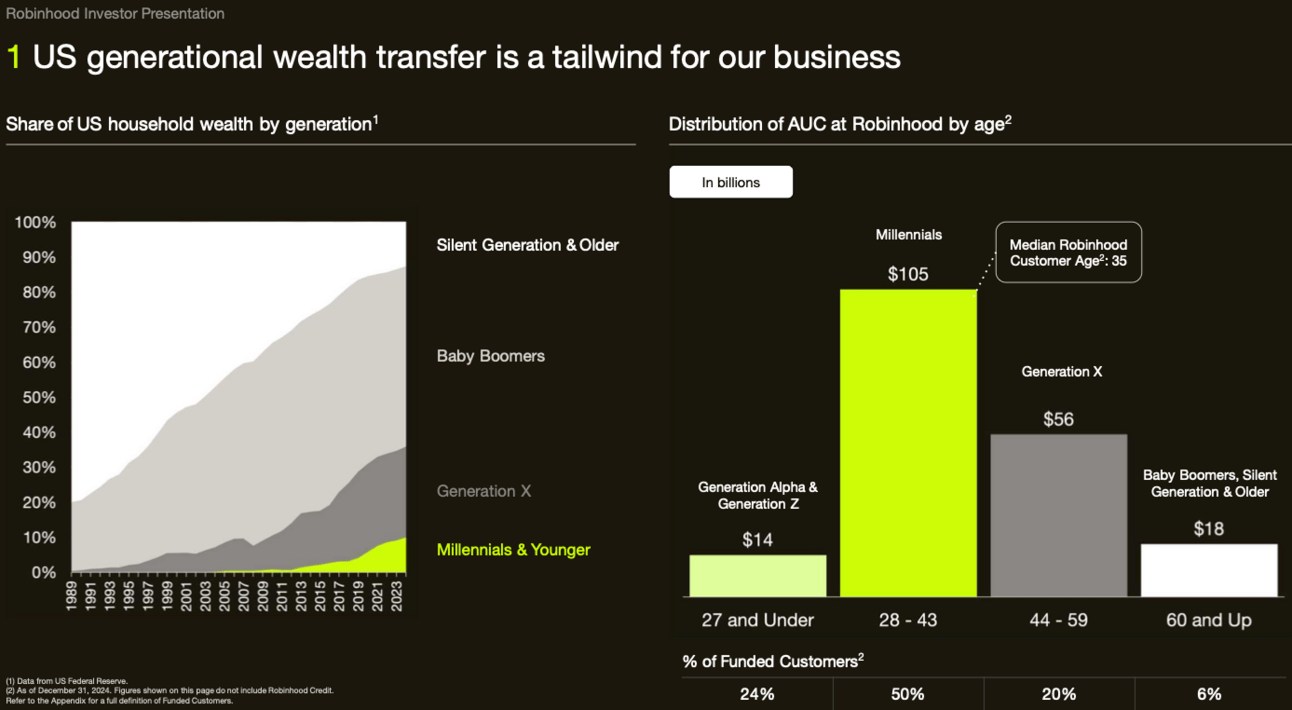

What I think is most exciting is the opportunity for Robinhood to grow with its customers. The company’s assets under custody are dominated by Millennials (age 28-43), who account for less than 10% of household wealth today. As these customers increase their earnings power and inherit funds from older generations, Robinhood will be the beneficiary.

It’s easy to see how the tailwinds are behind Robinhood even without expanding the market beyond common financial products.

Breaking the Rules

But Robinhood’s path forward doesn’t just involve making an app better than the competition (which it is). This is an innovation platform, and we saw that this week when Robinhood introduced equity tokens on the blockchain for European customers, and even tokens that will track the value of OpenAI and SpaceX.

This is pushing the boundaries of what’s legal today, but that’s the kind of innovation we want to see from an asymmetric opportunity. But that doesn’t mean innovation will be easy.

I don’t know where these specific private company tokens end up, but the goal is clear. A token can represent a stock or a bond or a piece of real estate, or business formation ownership and contracts. And Robinhood wants to be a player in innovating to push those products forward.

Long-term, this may open up new markets and new ways for Robinhood to make money. That could mean lending against a token of real estate or a private company stake. It may mean being able to own a piece of art and an Airbnb, and a startup all in one account. Technology is pushing the boundaries of regulation today.

I understand this can be uncomfortable for investors. But living in the uncomfortable gray is where the money is made.

The Market’s Irrationality

I can’t say enough about Robinhood’s operations. It’s a product I’m using more and more…and I try EVERYTHING I can get my hands on, including SoFi, Interactive Brokers, Public, Charles Schwab, Wells Fargo, Wise, and others where I have accounts. Hands down, Robinhood is the best, and that matters.

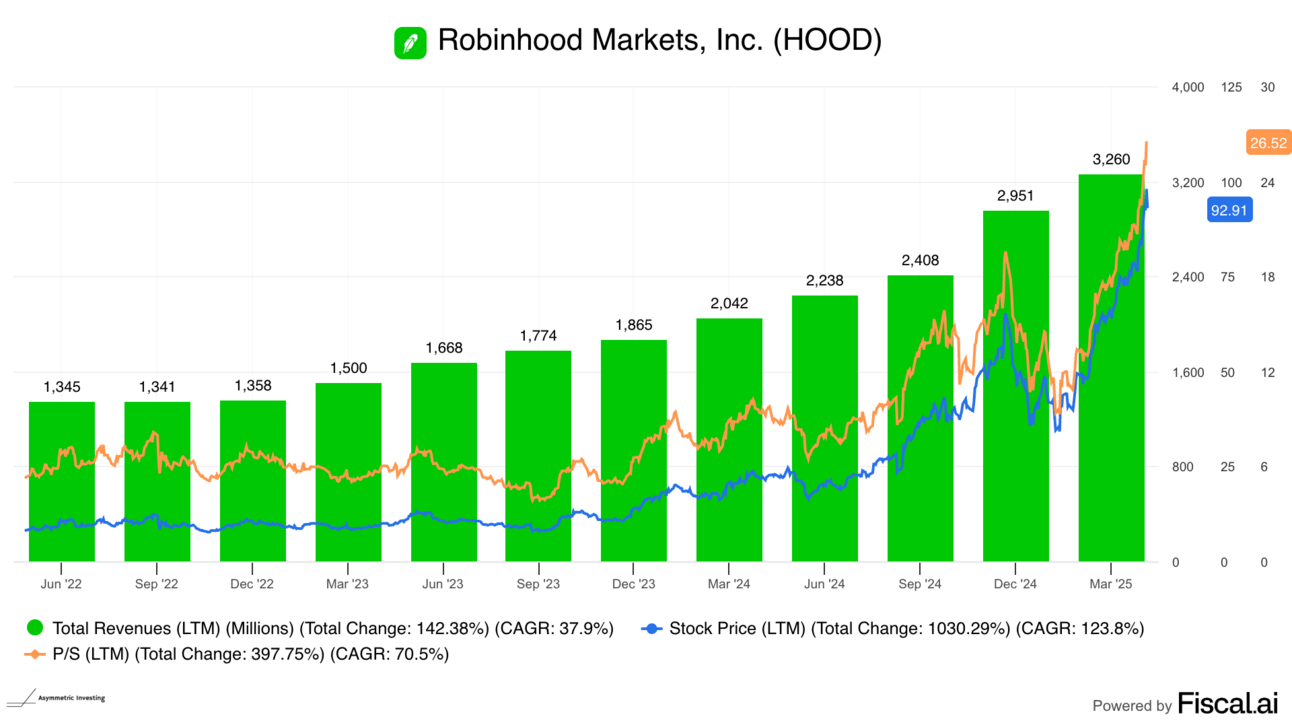

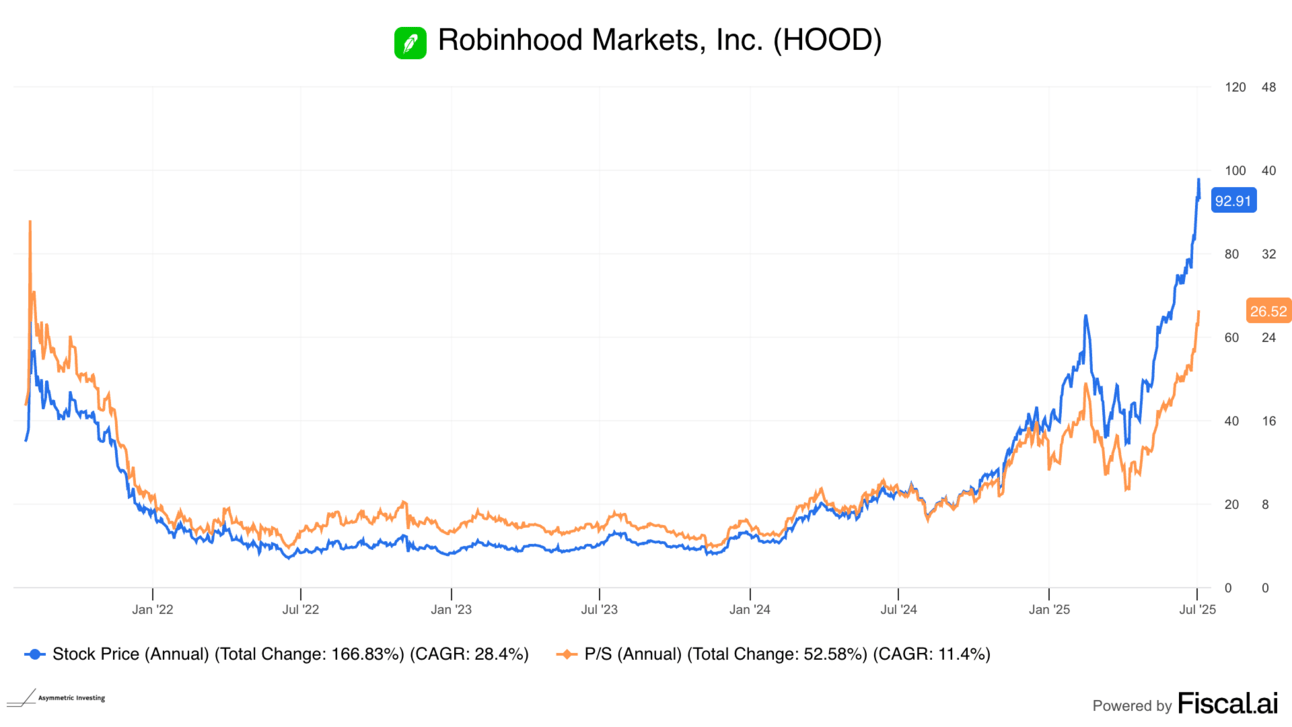

That said…the stock is getting crazy expensive. You can see below that the price to sales (P/S) multiple is now 26.5x, up from 8.3x when the spotlight was written. The revenue CAGR of 37.9% is great since June 2022, but the P/S CAGR of 70.5% shows that most of the stock gains have been multiple expansion, not fundamental improvement.

Multiple expansions can go on for a while. Palantir trades for 100x sales, so there’s more expansion to be had.

But the odds of multiple expansion driving returns in the future are dwindling. At a 26x P/S multiple, I’m more worried about multiple compression, where a company can spend years “growing into their valuation.”

Multiple Tailwinds vs Headwinds

Why do I worry about multiple headwinds?

This is a chart of Microsoft’s stock price, net income, and revenue change from 2000 to 2013. In 13 years, the stock returned 21% (less depending on the dates picked), despite revenue more than tripling.

An example of a company riding (valuation) multiple tailwinds is Apple. Apple stock has increased at a 14.5% compound annual rate (despite a recent drop) even though earnings have been down since 2022, and revenue has grown slower than inflation.

Are the multiples we’re paying a tailwind or a headwind?

Look for that question to be one I discuss regularly in the future, and right now, I worry Robinhood’s valuation looks more like Microsoft in 2002 than Apple in 2022. It may take years to live up to the current price.

I’m Not Buying Now, But…

I love Robinhood’s business and the trajectory. But we also need to be honest that everything is going well for the company right now. Stocks are going up. Crypto is going up. The economy is growing.

Anything going wrong with the market or economy could send operations south quickly. And while I don’t see a post-2021-style collapse in the business, there’s still risk.

And what would happen to the P/S multiple of the growth rate went from 50%+ to flat?

It would drop! Fast!

Investing is all about risk and reward. Right now, the risk in buying Robinhood stock is that operations don’t keep growing and multiples contract in the future. That risk is significant.

But I’m also not selling. I’ve learned time and time again that selling winners is a fool’s errand. Chipotle in 2008, Microsoft in 2015, and Apple in 2011 are just a few examples of opportunities lost by selling winners.

When would I buy more Robinhood?

A P/S multiple under 10x seems to be a much better risk/reward balance. Until shares reach that point, I’ll likely do nothing with the shares I own.

I’m not a buyer right now.

But I’m not a seller either.

Sometimes, doing nothing is the right answer for a long-term investor.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.