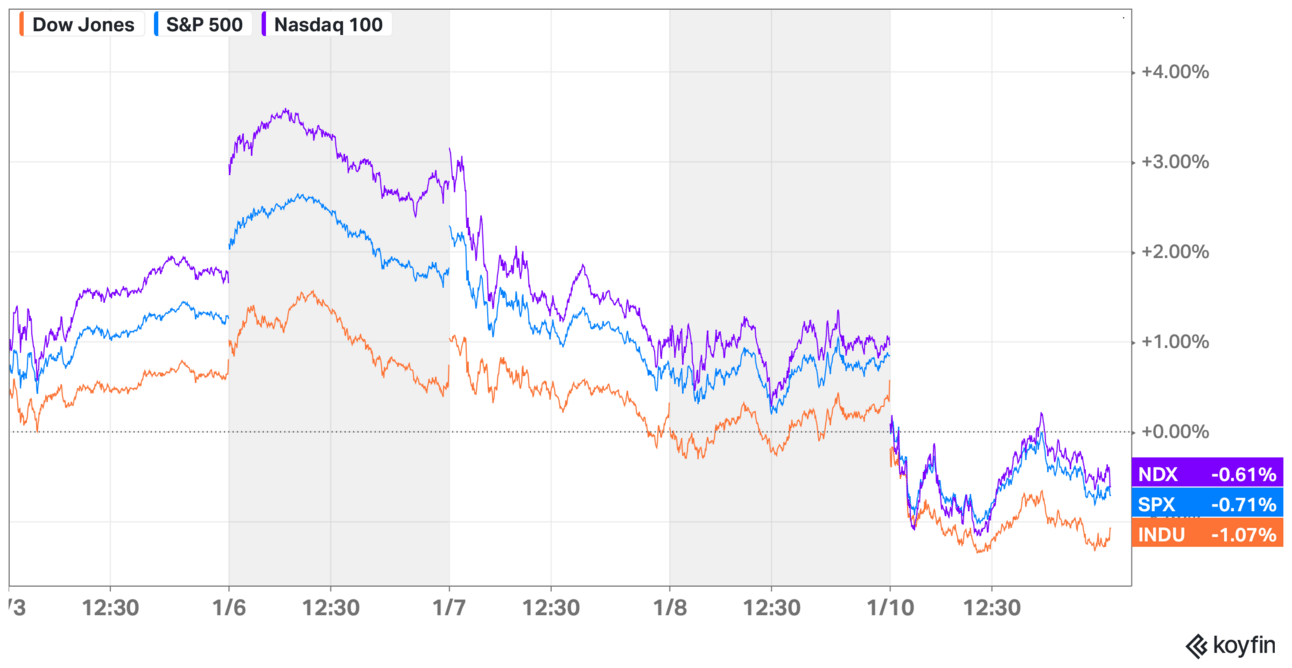

Economic data was strong last week, leading to a sharp decline in the stock market.

If that’s confusing, you’re not alone. Long-term investors should love a great economy, but short-term traders are looking at the data’s impact on the Federal Reserve and interest rates. For now, it looks like rates aren’t going much lower with at least one Fed official saying December’s cut would be the last in this cycle.

The Asymmetric Portfolio fell into negative territory for the year, along with the S&P 500, but zoom out and this is normal volatility. Some of the more value-oriented stocks I own have saved the portfolio from even bigger losses. As always, I’ll buy more of my favorite stocks in February and I’m hoping some of the high-fliers pull back and give me some “no-brainer” opportunities.

Business models matter in investing and they matter for businesses like Asymmetric Investing, which is a freemium business model, meaning ads like the one below make the free version possible. You can sign up for premium here to avoid ads, get 2x the content, and gain access to the market-beating Asymmetric Portfolio. What are you waiting for?

Try Artisan’s All-in-one Outbound Sales Platform & AI BDR

Ava automates your entire outbound demand generation so you can get leads delivered to your inbox on autopilot. She operates within the Artisan platform, which consolidates every tool you need for outbound:

300M+ High-Quality B2B Prospects, including E-Commerce and Local Business Leads

Automated Lead Enrichment With 10+ Data Sources

Full Email Deliverability Management

Multi-Channel Outreach Across Email & LinkedIn

Human-Level Personalization

In Case You Missed It

Here’s some of the content I put out this week.

AI & the End of Silicon Valley’s Money Factory: For 50 years, Silicon Valley has been built on a high upfront investment and low marginal cost business model. AI could change that to high marginal costs with reasoning models and we’re not ready for the shift.

Hims & Hers: From GLP-1s to Menopause: GLP-1s get all of the focus, but it’s a small business for Hims & Hers and now menopause is part of the mix.

Mobileye Is Taking on Waymo & Tesla: I dig into why Mobileye has massive potential making every car autonomous.

5 Bold Predictions for 2025: In this video, I made 5 predictions about the market, including where the vibe shift will leave the S&P 500 this year.

Disney’s Plan to Take On YouTube TV

I’ve written extensively about Disney’s plans to bundle Disney+, Hulu, and ESPN to make a new streaming bundle in 2025. I think that could also include more content than we see today like a potential deal to include Fox’s sports programming on ESPN streaming, which would be compelling competition to Netflix.

What Bob Iger has done is create a clear streaming strategy on the scale side of the Smiling Curve. But this streaming strategy doesn’t address what happens to legacy assets, non-core assets, or how to squeeze value from over-the-top cable. Until this week.

Disney announced a plan to trade its Hulu+ Live TV asset for a 70% stake in Fubo to create the #2 vMVPD (virtual multichannel video programming distribution) in the U.S. Investors were, unsurprisingly, pleased.

Instead of struggling to survive, Fubo could have a solid business with 6.2 million subscribers and a deal to distribute Disney’s content to boot.

This continues several moves to simplify Disney’s business and unlock significant value. Just look at three deals over the last couple of years that unlocked about $7.5 billion in value.

Penn Deal: Disney agreed to a sports betting deal with Penn Entertainment, including $1.5 billion in payments to Disney over 10 years and $500 million in warrants for Penn stock.

India Deal: Disney traded its Indian streaming business for a 36.84% stake in a joint venture between Reliance Industries, Viacom18, and Disney. The stake was estimated to be worth about $3 billion.

Fubo Deal: Traded Hulu + Live TV for a 70% stake in Fubo, creating $2.5 billion in value.

That’s value from content space and streaming assets with little to no value within Disney. Love him or hate him, Iger is better at this than anyone in Hollywood.

The Start of M&A Madness?

The timing of this deal was interesting because it comes just weeks before a new administration takes over in Washington DC. FTC Chair Lina Kahn has been notoriously anti mergers and acquisitions during her tenure, which essentially froze the M&A market on Wall Street.

Is that about to change?

In Hollywood, a shift would be welcomed. Peacock, Paramount+, and Max are all struggling to make money and likely need to merge to stay afloat as streaming options. Warner Bros. Discovery has said it’s open for business and Comcast is making deals too. Expect fireworks in 2025.

Tech would love to see more M&A, giving them the ability to acquire both technology and talent, which drive the Silicon Valley ecosystem.

Then there’s industrial America, which would benefit from both more scale and a lower cost of capital that scale can often bring.

I think M&A will be a theme in 2025 as executives see how far they can push to expand their businesses. Disney may have just gotten the ball rolling.

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your own research before acquiring stocks.