This week’s CES was full of slow but steady advancements to a world of fully autonomous vehicles. I’ve covered this extensively with autonomy playing a major role in my thesis around Lyft, Uber, Mobileye, and to a lesser extent Alphabet (Waymo).

Today, I want to explain why Mobileye is a company you should watch as a major player in autonomy. It doesn’t make vehicles itself, but it makes the hardware and software that enables autonomy and with those systems could grow from a company with $1.8 billion in revenue today to an order of magnitude more than that by the end of the decade.

Mobileye at CES

Most of what I’m going to cover is based on Mobileye CEO Amnon Shashua’s presentation at CES. If you have time, it’s worth watching. Shashua isn’t a showman, but we’re talking about autonomous systems that can determine the life and death of riders and unsuspecting people in the world. I’ll take a dry academic over a showman in those conditions. (Yes, this was a shot at Elon Musk)

Mobileye’s Product Lineup

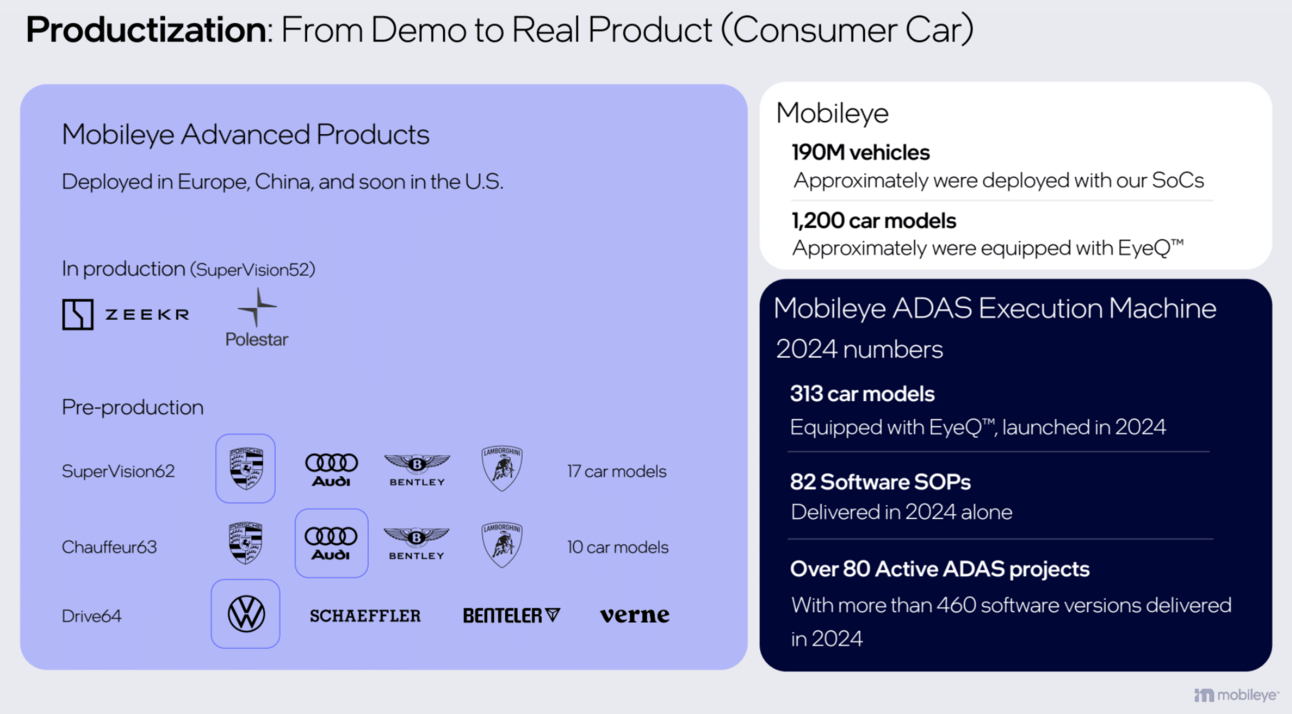

I’ll start with the products Mobileye sells and they’re ordered from least complex (left) to most complex (right). Most of their current revenue comes from the single-camera ADAS product that only costs about $100 for automakers. Surround ADAS will roll out this year and SuperVision, while in production, is only in production with Zeeker and Polestar at low volumes.

The idea for the business is that it will move up the curve from a $100 product to $4,000 or more over the next 4-5 years, potentially as a standard on nearly every vehicle. That’s the context in which to view the company’s presentation.

Getting to Full Autonomy

The presentation was framed around getting vehicles to full autonomy at scale, which would “revolutionize transportation”.

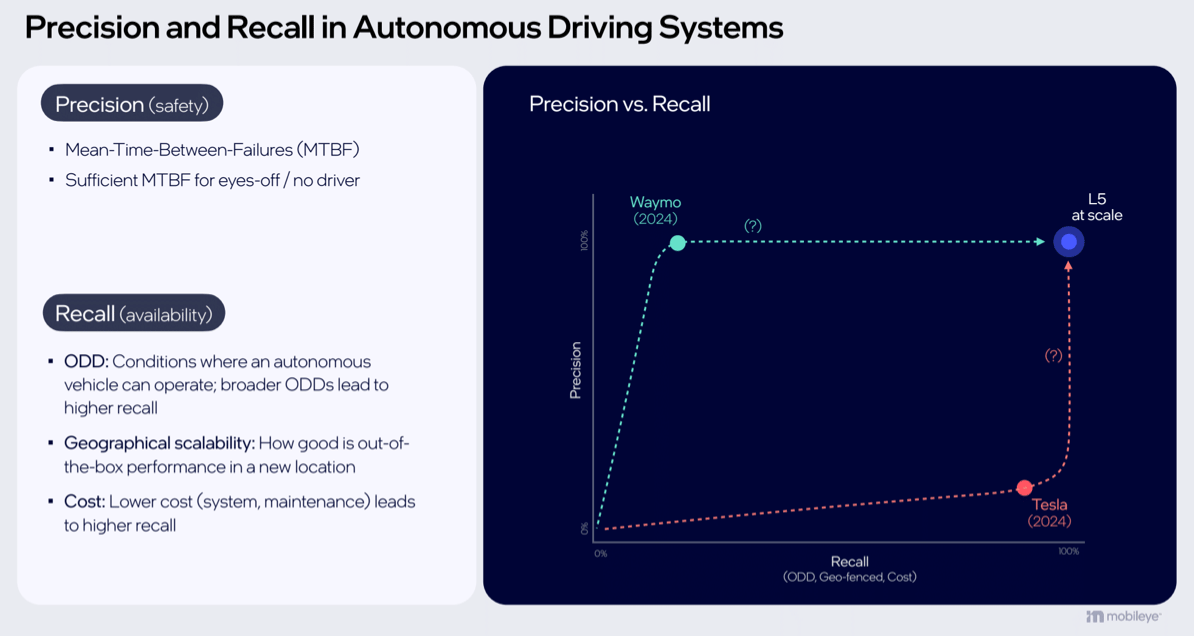

What I appreciate is Mobileye giving the most sober assessment of the autonomy market as it exists today and the tradeoffs everyone has made in their designs. You can see in the slide below that autonomy requires both precision and what they refer to as recall, or the ability to scale both from low costs and wide availability. Waymo is extremely precise but isn’t yet scalable because of the need to map each city and the high cost of vehicles. Tesla is scalable, but not yet precise enough to be L3, L4, or L5 autonomous.

The question is, how quickly will both improve their deficiencies?

Where is Mobileye?

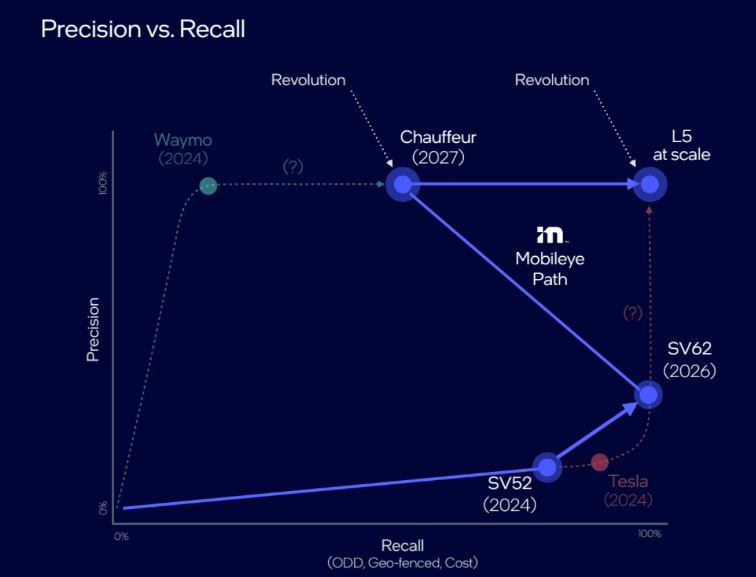

Today, Mobileye is on a Tesla-like path with SuperVision (SV52) but is only available in certain locations, like highways.

The next version of SuperVision (SV62) will go into production in the next year in 17 car models, including Porsche, Audi, Bentley, and Lamborghini.

A step further will be the Drive product that’s being tested in Texas and Europe. This is the product that could allow anyone to build a fully autonomous fleet of vehicles, a la Tesla’s vision. And Mobileye’s partnership with Lyft could give Lyft a leg up in getting these fleets into ride-sharing.

Getting to Full Autonomy (in 2027)

The best outcome for Mobileye would be getting Drive into millions of vehicles around the world, just like it has its ADAS system in millions of vehicles. The economic idea would be that automakers could build their own systems (NVIDIA is helping in this respect) and vertically integrate, but few would have the scale to make hundreds of millions in cost make sense to spend in-house. Or, they can make autonomous systems a variable cost of somewhere around $20,000 per vehicle, a fraction of the cost of a Waymo system.

And that $20,000 estimate would likely come down as the cost of hardware like Lidar and imaging radar come down.

Here’s what Drive entails from a hardware standpoint. And this is why it would be expensive. Hardware alone would be several thousand dollars.

Why is all of this hardware necessary rather than the cameras and chips Tesla uses? REDUNDANCY!

Redundancy was a large portion of the discussion, but the short story is that Mobileye believes autonomous systems need levels of redundancy with different failure modes to be safe enough to launch in the real world. This is shown in part below with cameras (glare, fog, snow) and imaging radar (fidelity) having different failure modes, for example.

Are these redundancies necessary? Probably.

Tesla is under investigation by the NHTSA for crashes, including a fatal collision with a pedestrian, that involved sun glare, fog, and dust. These aren’t black swan conditions…they’re normal.

I firmly believe that redundancies will be necessary in autonomous driving systems. It’s the engineer in me. Tesla is the ONLY company that disagrees.

Time will tell what the right answer is, but this lays out why and how Mobileye is building redundancies into their systems from the outset.

The Modular Autonomous Driving Company

Every automaker will want to appear to be making their own autonomous driving systems. But we’ve seen time and again that auto companies will outsource the pieces of the system they can’t specialize or do cost-effectively.

For example, Ford uses Mobileye’s REM, or Road Experience Management technology, for BlueCruise. VW, on the other hand, is leaning more heavily into Mobileye’s technology for its autonomous products.

Mobileye says companies can use different components of its system to build their own autonomous programs and that’s exactly how a modular company should be built. Mobileye won’t win every contract in the next few years, but if it can build more scale than competitors (VW is the biggest automaker in the world) it could have cost advantages as the industry scales.

And even mild success would be huge for Mobileye.

I mentioned the company’s $1.8 billion in revenue, primarily from a product that costs ~$100 per vehicle. If we bump that up to $5,000 per vehicle for Chauffer the company would only need to be equipped on 360,000 vehicles per year to match current revenue levels.

VW Group sells about 9 million vehicles globally each year, including:

Audi sells about 900,000 vehicles in the U.S. and Europe annually.

Porsche sells about 100,000 vehicles annually.

The volume will add up quickly for existing deals and management says more are in the pipeline.

By the end of the decade, I wouldn’t be surprised if Chauffer-level autonomy is standard on most vehicles. And that could unlock tens of millions of units of volume for a product that sells for thousands of dollars.

We’re just starting to see the opportunity unlock at Mobileye.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.