The opening ceremonies for the Olympics are tomorrow and for the first time, every event will be streamed live. NBC Universal is airing taped content on NBC each night, but 5,000 hours of live content will be shown on streaming platform Peacock.

It’s a game-changer in streaming and will put Peacock on the map for tens of millions of Americans. Or will it?

Comcast announced this week that Peacock LOST 500,000 subscribers during the second quarter of 2024, a shocking result as the company prepares for its biggest event of the year. By contrast, Netflix ADDED 8 million subscribers in the quarter because it had…Bridgerton.

I’m simplifying, of course, but the dynamics we’re seeing in streaming are real.

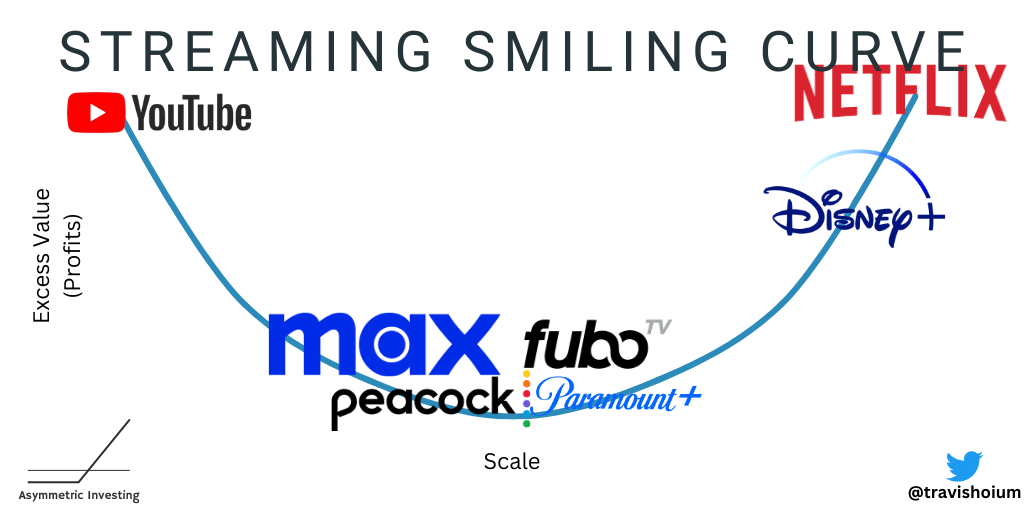

What we’re seeing is the manifestation of a concept called the “smiling curve”. Longtime readers will know this is central to my thesis behind stocks like Spotify and Disney and for good reason. The smiling curve explains why Netflix continues to win in streaming and why — even with the Olympics — Peacock is doomed for failure.

The Smiling Curve and Streaming

The smiling curve states that value will accrue to either a company with scale (Netflix) or a niche offering (YouTube’s aggregation of small creators).

Note: Weird Canva error making this image. AI support…wasn’t helpful.

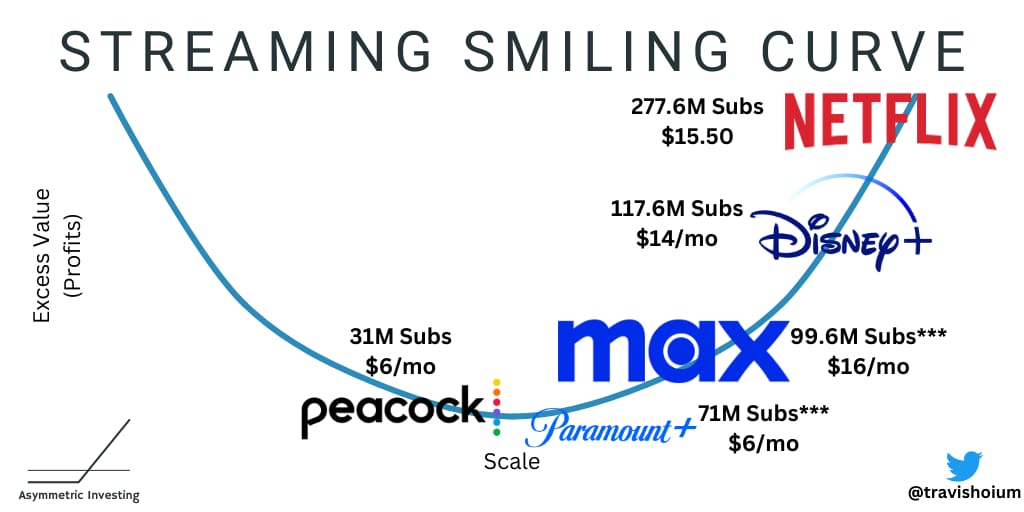

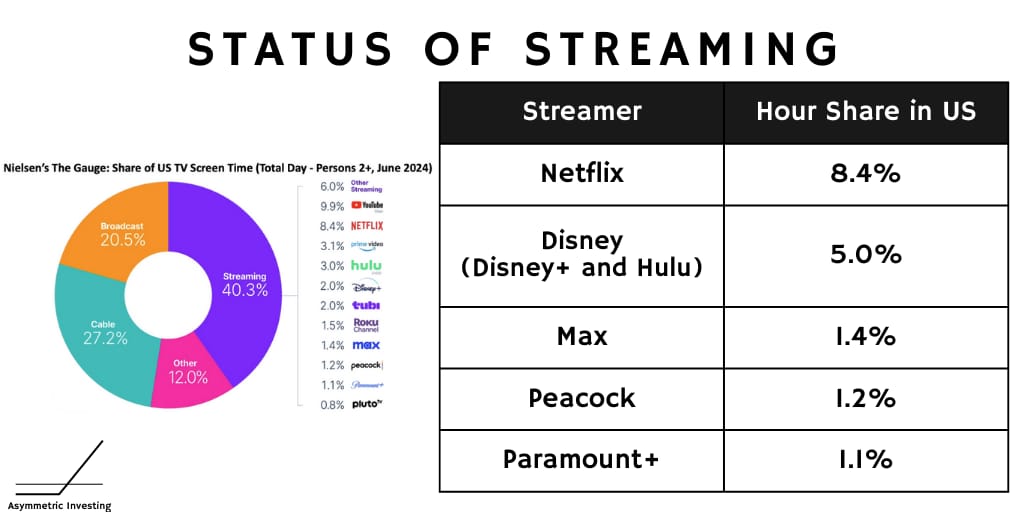

In a very simple sense, I see the smiling curve looking like this for streaming. Netflix and YouTube have won the right and left corners of the curve, respectively. Disney is trying to catch up with tentpole and sports content as its differentiation. The flounderers at the bottom include Max, Peacock, and Paramount+.

What makes the smiling curve so powerful as a concept is how it explains the economic realities in an industry. Not only does Netflix have more subscribers than Peacock, it can charge more for those subscriptions. This has a multiplier effect on the business, allowing companies with scale to create/acquire even better content and attract more talent.

There doesn’t seem to be any clawing out of the bottom once these dynamics take hold. Just ask Snapchat in its battle with Facebook.

In anticipation of the Olympics, Peacock was begging customers to sign up for an entire year. I got a deal for just $1.66 per month! Even this didn’t goose the Q2 numbers.

If Peacock can’t convince subscribers to sign up with the Olympics, what hope is there for the future of Peacock?

Follow the Asymmetric Portfolio this earnings season with a premium subscription. This week alone you’ll get:

Breakdown on Spotify’s outstanding quarter and why the stock is up 150% since the Spotify Spotlight.

Why General Motors (yes, that General Motors) is outperforming Tesla.

No ads in any article

Next week, I’ll be buying stocks from the Asymmetric Universe again. Join now to find out what I’m buying.

The Downward Spiral

If a streamer can’t reach scale, losses mount and eventually cost cuts are demanded by investors.

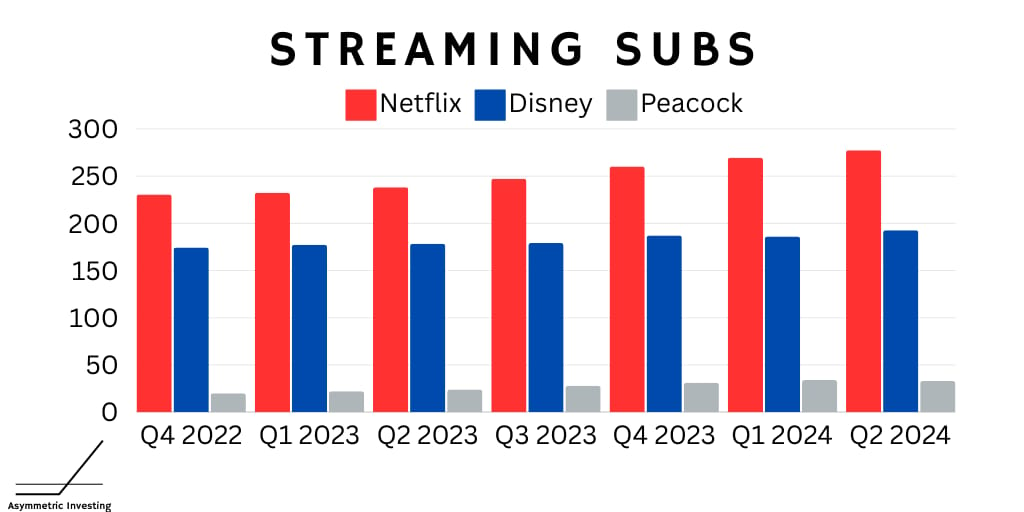

The canary in the coal mine is subscriber numbers. Below is the subscriber base of Netflix, Disney’s services combined, and Peacock. How do you crawl out of that hole and 5x the subscriber base if you’re Peacock?

If they can’t grow significantly over the next month, the strategy will have to change. And there’s no doubt investors will demand cost cuts because management is throwing good money after bad. There’s plenty of precedent here.

Max was forced to cut costs — in part because of streaming losses — and lost NBA rights as a result.

Paramount is merging with Skydance and not only does that put the business in limbo over the next year while the merger is worked out, but the deal promises $2 billion in cost cuts, which will come from less content spending.

Meanwhile, none of these streamers are capturing a significant share of the market.

What happens when Peacock doesn’t attract 20 million new subscribers for the Olympics? The streamer burned $348 million just last quarter and if the Olympics doesn’t turn the business around (and why would it?) I’m willing to bet cost cuts will be announced within weeks of the end of the games.

Disney Could Be the Exception

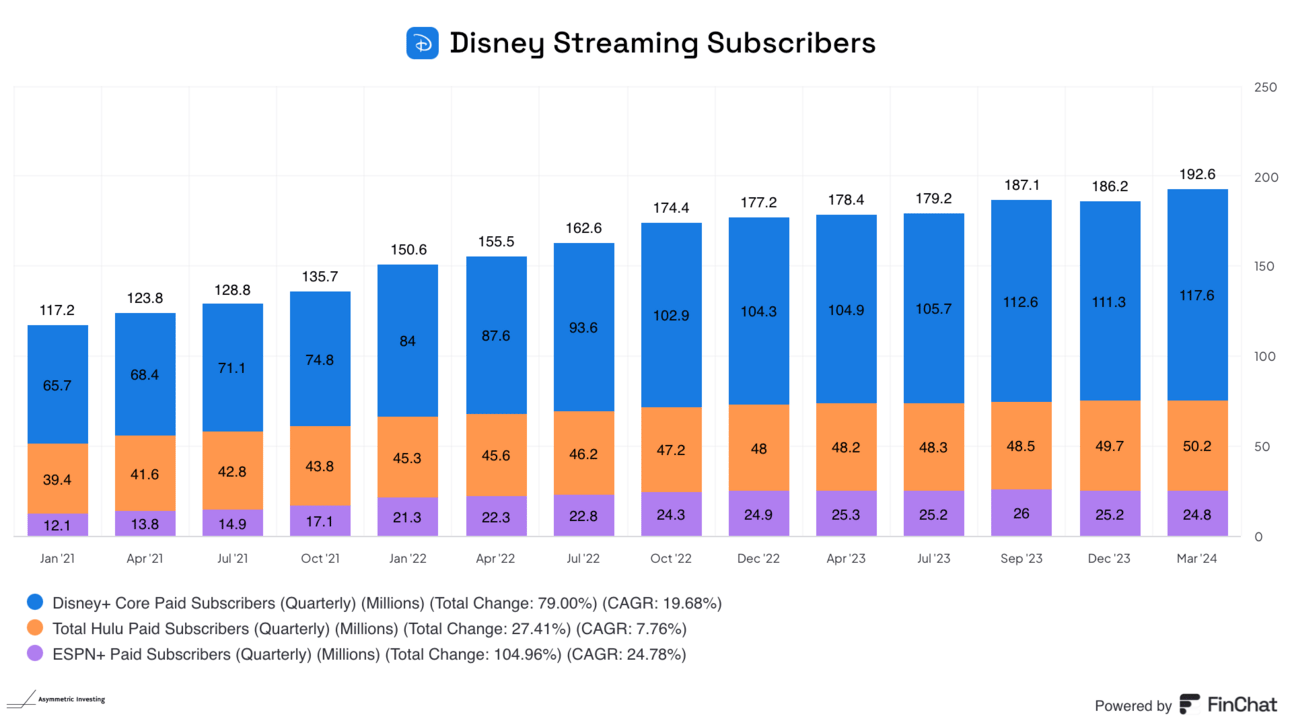

Disney went through the cost-cutting phase when Bob Iger took over again in late 2022, but by then Disney had established its streaming position with 177 million subscribers between Disney+, Hulu, and ESPN+. Disney’s back catalog, which is where Disney+ built its foundation, has been a point of strength and now the company is lining up the rights to be the streaming sports leader with the NBA, college football, and NFL all in one place.

Disney hasn’t reached the Netflix scale, but it’s gaining subscribers and having success bundling the three streaming services you see below.

Disney is in the Asymmetric Portfolio because I think it will join Netflix in the top right corner of the streaming smiling curve as we see competitors like Max, Peacock, and Paramount+ fall to the wayside.

Winners Keep Winning

Winning and losing in streaming is a reinforcing cycle. Adding subscribers and raising prices allows companies to increase revenue and afford more/better content, which attracts more subscribers.

And the opposite is true.

We know Netflix has taken the #1 position in streaming and isn’t giving that up soon.

I think we can also surmise Peacock is dying a slow death. As is Paramount+. And maybe even Max….

If there are two winners in streaming I think the other place is left for Disney.

We will find out on August 7, 2024, if Disney’s streaming business looks more like Netflix or Peacock. The answer could determine the direction of the stock for the next decade.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.