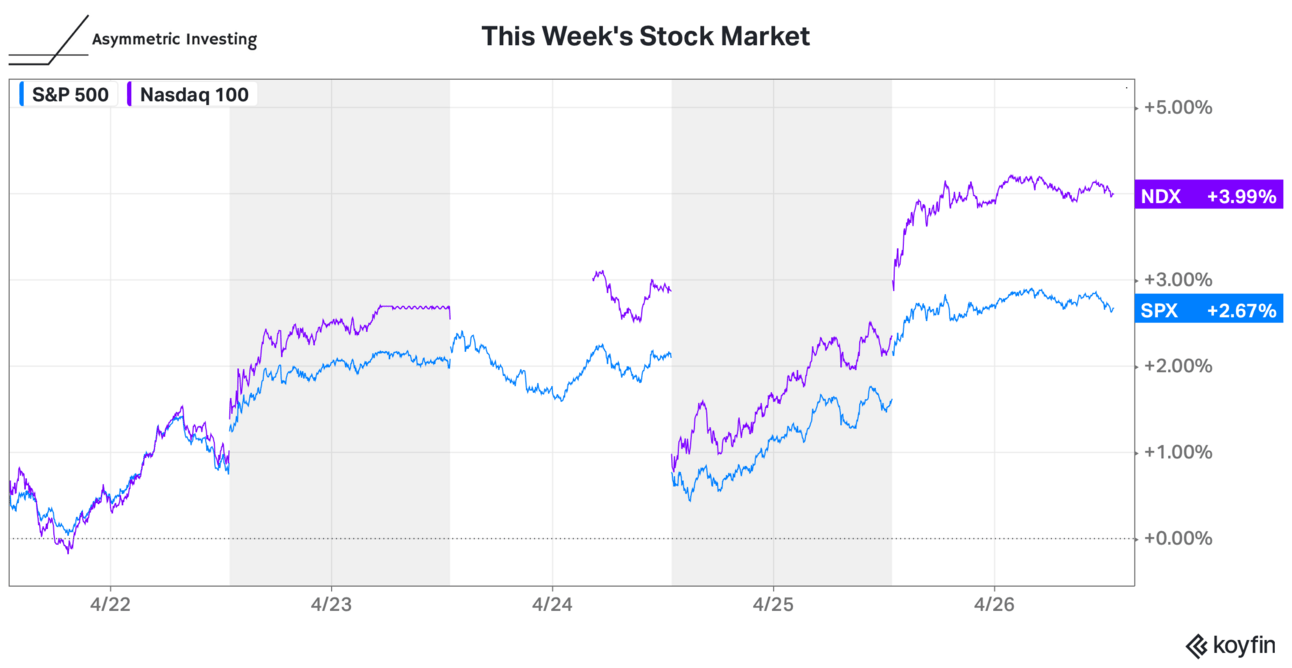

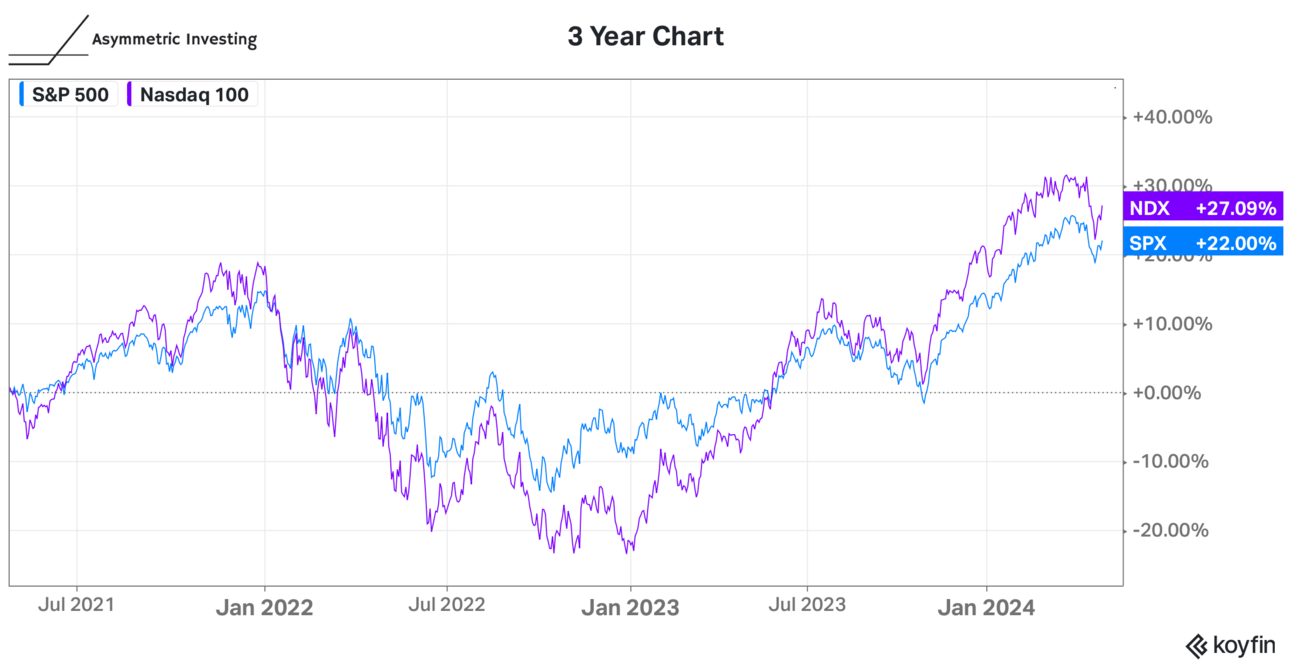

It was an outstanding week for the stock market with the S&P 500 up 2.7% and the Nasdaq 100 climbing 4.0%. The week was dominated by earnings, which were solid for the most part. However, weak economic data and higher inflation seem to have been ignored, which I’ll get to in a moment.

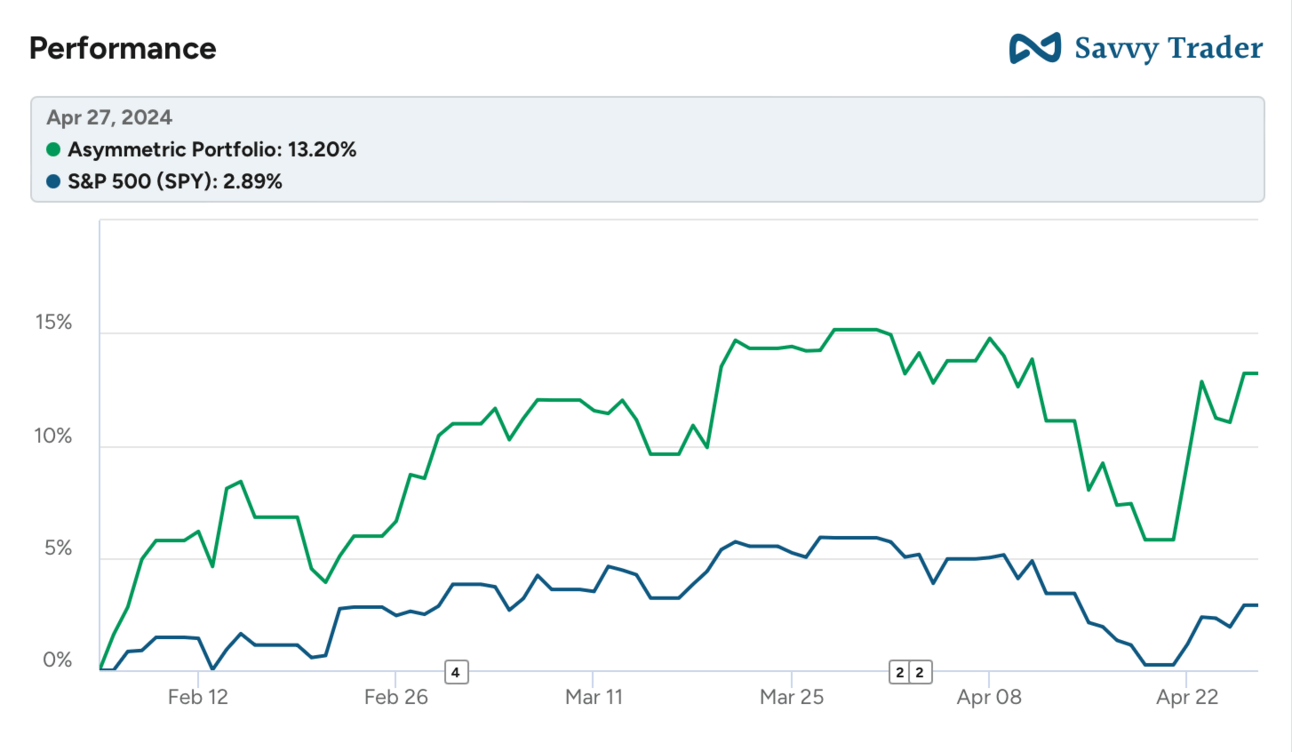

The Asymmetric Portfolio also had a good week, helped by the Matterport acquisition announcement and a few good earnings reports. Next week, the earnings floodgates open, so we may see more volatility.

Asymmetric Investing has a freemium model. Sign up for premium here if you want to skip ads and get double the content, including all portfolio additions.

Learn how to become an “Intelligent Investor.”

Warren Buffett says great investors read 8 hours per day. What if you only have 5 minutes a day? Then, read Value Investor Daily.

Every week, it covers:

Value stock ideas - today’s biggest value opportunities 📈

Principles of investing - timeless lessons from top value investors 💰

Investing resources - investor tools and hidden gems 🔎

You’ll save time and energy and become a smarter investor in just minutes daily–free! 👇

In Case You Missed It

Here’s some of the content I put out this week. Enjoy!

The Stock Market Has Lost Its Damn Mind: The reactions to Tesla and Meta’s earnings reports were the opposite of logical.

Spotify, Alphabet, and GM Earnings Recap: I recapped the first reports from the Asymmetric Portfolio.

Stripe Coinbase and the Future of Payments: The blockchain may finally be gaining adoption by payment solutions after Stripe said it would support USDC.

Matterport’s 216% Buyout Premium: Matterport announced this week it is being acquired for a huge premium.

Playing Defense AND Offense

I’ve never liked the term risk management. You’re either taking a risk or you’re it’s not, so “managing” risk seems like an oxymoron for investors.

Instead, I like to think about understanding and taking an appropriate amount of risk for the moment in time. Right now, I am avoiding some of the most hyped names in the market trading for 50x earnings and 10x sales and instead adding companies trading for low multiples who may not be as impacted if the market turns south.

If everyone else is being greedy, I want to be fearful.

And with the U.S. economy growing at a paltry 1.6% in the first quarter of 2024, inflation remaining at 2.8% in March, personal debt at an all-time high, and government deficits with no end in sight there are plenty of signs risk is rising as fast as the stock market.

But how do you buy inherently risky stocks without taking too much risk?

Good Defense Is the Best Offense

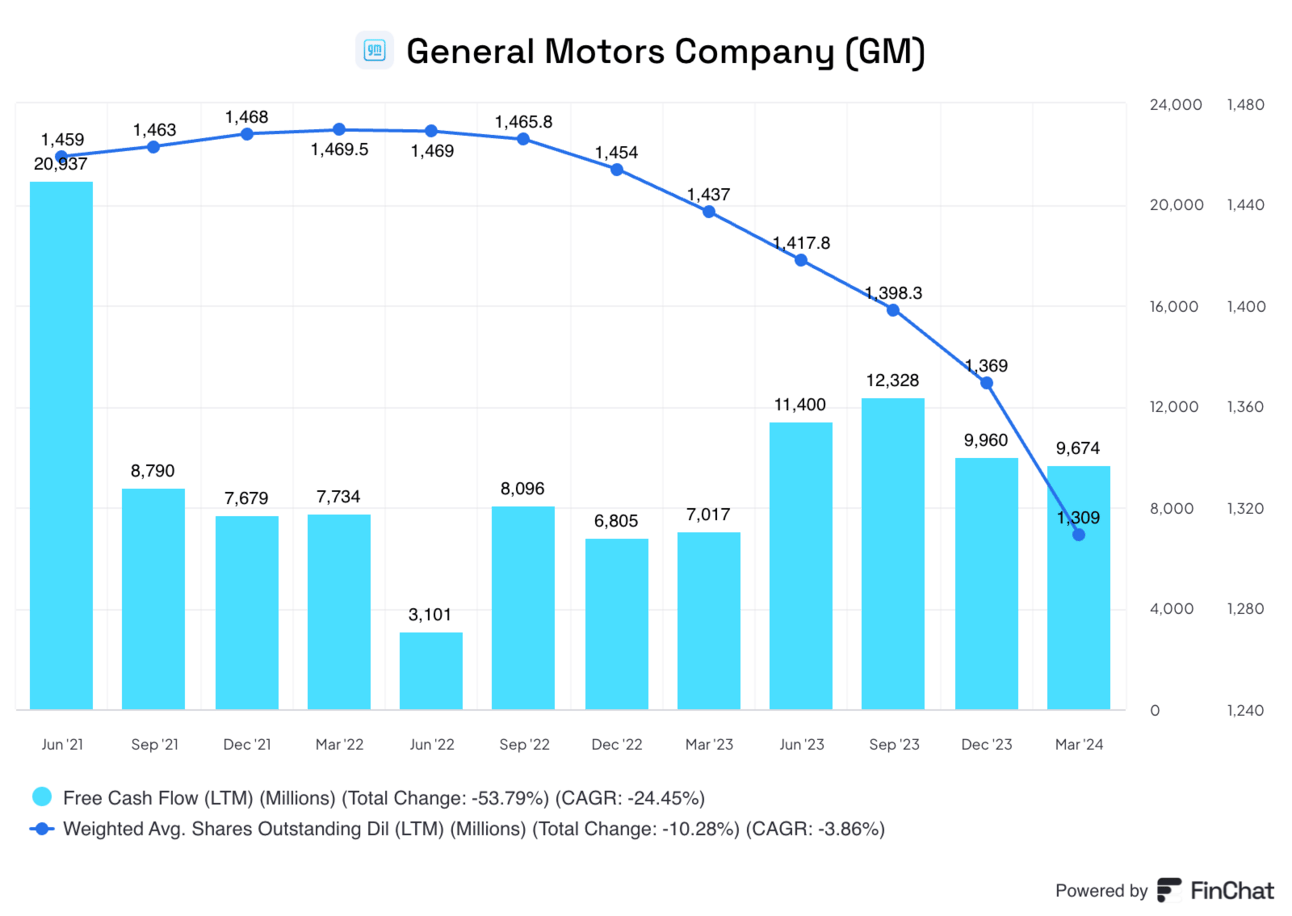

I know GM isn’t the most popular company on the market, but that’s kind of the point of owning it. Investors think EVs are the future — and they are — but in the meantime there are plenty of people who want trucks and SUVs. And this is big business for GM.

Management is playing offense by investing in new EV models and Cruise, but the defensive position of using strong free cash flow as a weapon to buy back stock has been the reason shares have outperformed over the past year.

Buying shares of GM at 4.5 times 2024 earnings — which is where they trade today — allows me to take a lower risk than buying a stock like Tesla at 60x earnings estimates and it allows management to aggressively buy back stock.

If an EV competitor like Rivian, Lucid, Canoo, or Fisker gets desperate or goes bankrupt GM could also swoop in and buy them for cheap. Defense becomes offense.

Cash Is King

I’m also shifting toward companies with more cash on the balance sheet. One of the reasons I liked Matterport before the buyout offer was the $600 million market cap with $400 million in cash. The core business was only trading for $200 million and was nearly free cash flow positive. What a great risk/reward!

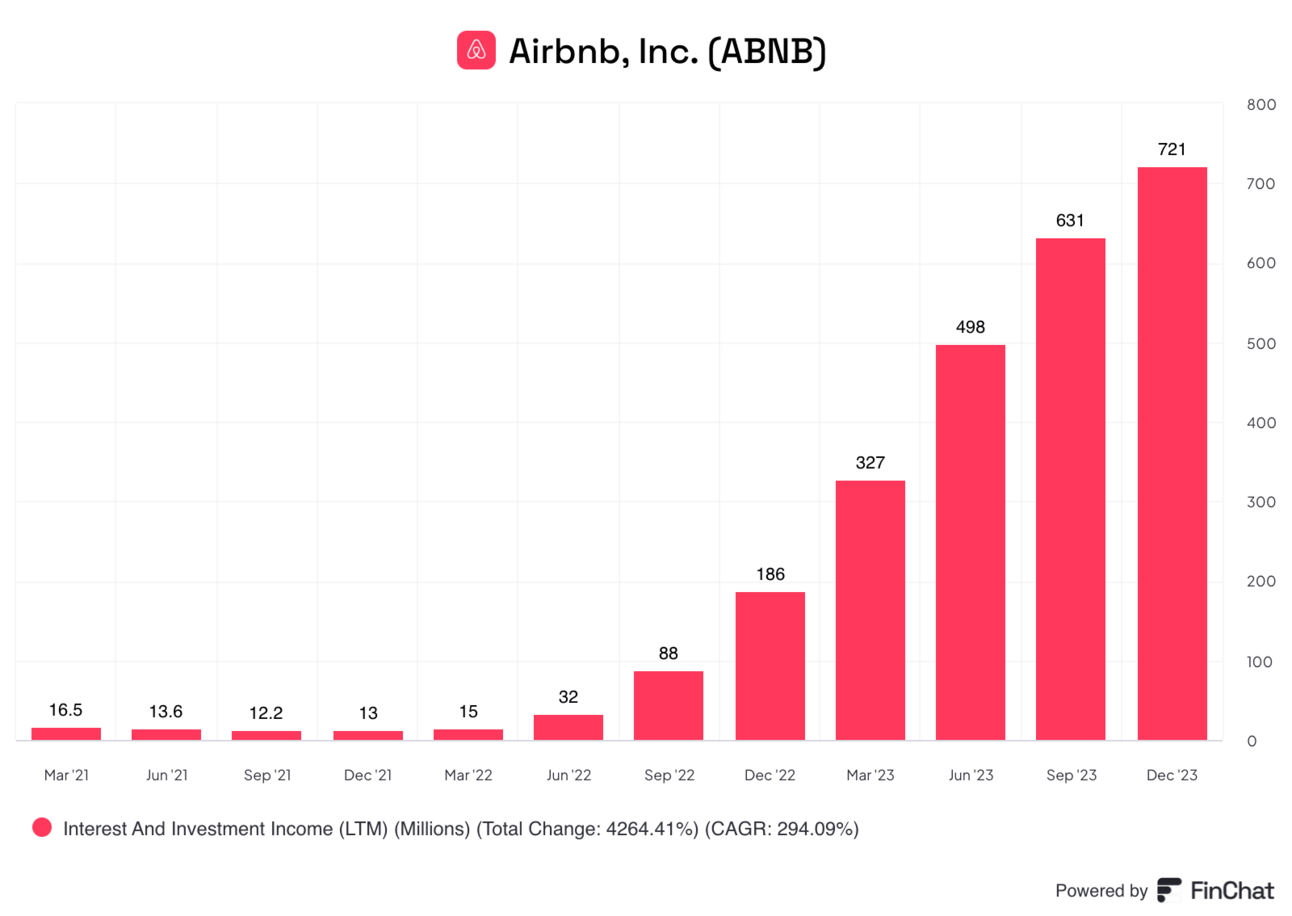

Airbnb has a unique business model that allows it to take customer deposits (which are paid in advance) before they’re paid to real estate owners (paid at the time of a stay) earning interest on the cash.

Over the past year, this has become a huge business and rising interest rates will only grow interest income over time.

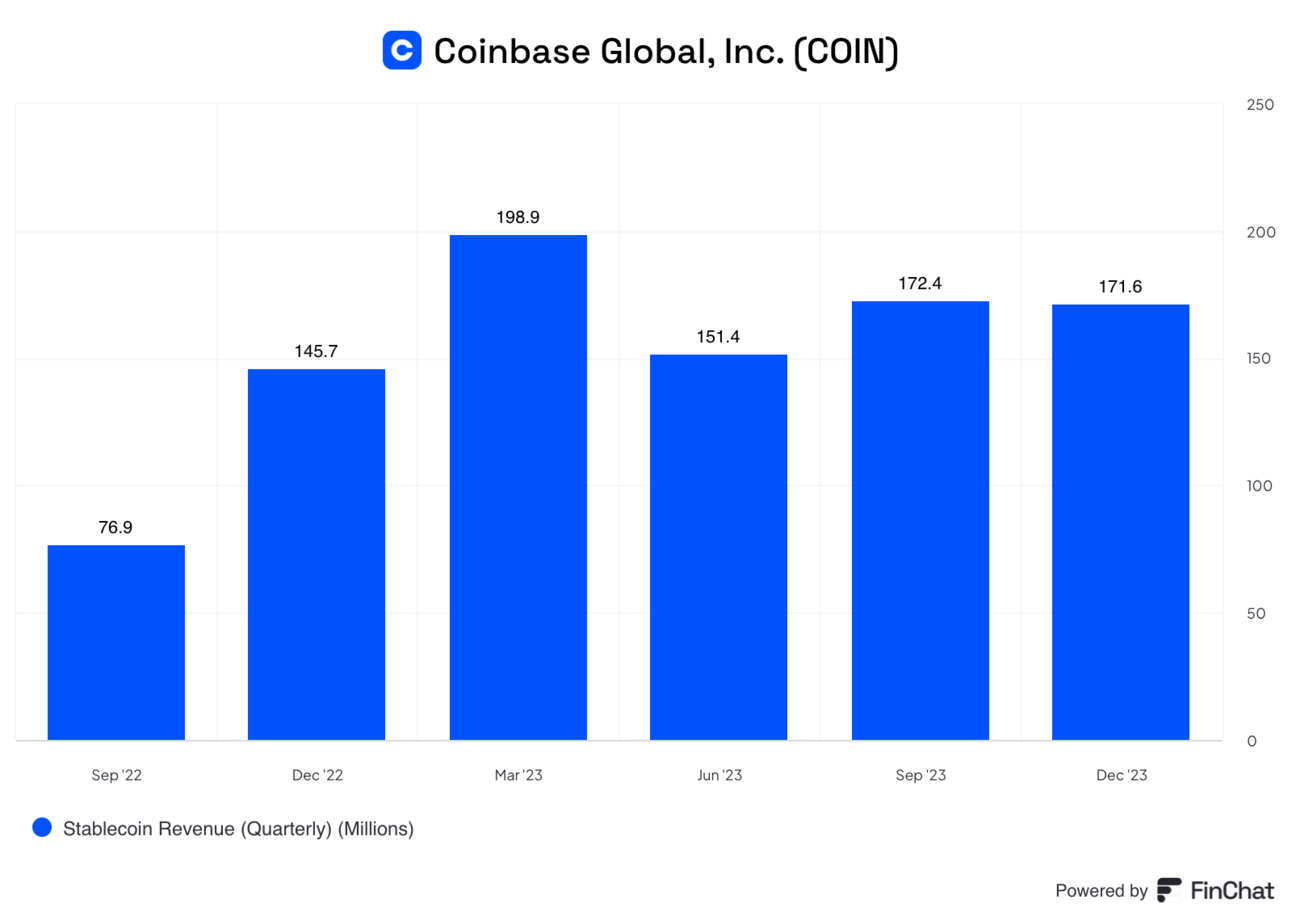

Coinbase has gotten similar tailwinds from stablecoins, which generate revenue from interest income.

The risk of higher interest rates and inflation has become a tailwind. Defense to offense.

Investing is inherently risky and full of uncertainty. We can’t manage the risk of the economy, the federal reserve, wars, or the election just to name a few. But we can buy companies with understandable risks for reasonable prices and they may even be able to use a downturn as a point of strength.

Offense In a Downturn

How does an economic or industry downturn end up being a point of strength and add value long-term? There are a few things companies can do in a downturn:

Buybacks: Sometimes the best use of capital is buying back your stock (see GM).

Expansion: Acquisitions can be cheap during an economic downturn and companies with cash flow and cash on the balance sheet can use it as a buying opportunity.

Attrition: Sometimes survival is enough. Coinbase did this during the 2022/2023 crypto winter and has come out bigger and stronger while competitors have vanished (FTX) or lost market share.

Investment: Companies who have to cut back on R&D and capital expenditures in a downturn rarely come out the other side stronger. A good balance sheet allows for investment in a downturn.

I have set a guardrail for the Asymmetric Portfolio of buying stocks each month because I have no idea if the market is going higher or lower short term. But I am investing with more defense in mind given signs the economy is slowing and interest rates will remain high. Because eventually, that defense will turn into offense.

What are you waiting for?

You can get all Asymmetric Investing content, including deep dives, stock trades before they’re made, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.