On Tuesday, Tesla reported one of the worst quarters I’ve seen in years and Elon Musk doubled down on products that don’t have a proven business model or track record (FSD and Optimus). As Elon Musk said, the auto company “should be thought of as an AI or robotics company“. 🤷

Investors overlooked the flat revenue, falling margins, and negative free cash flow, pushing Tesla’s stock up 12.1% on Wednesday.

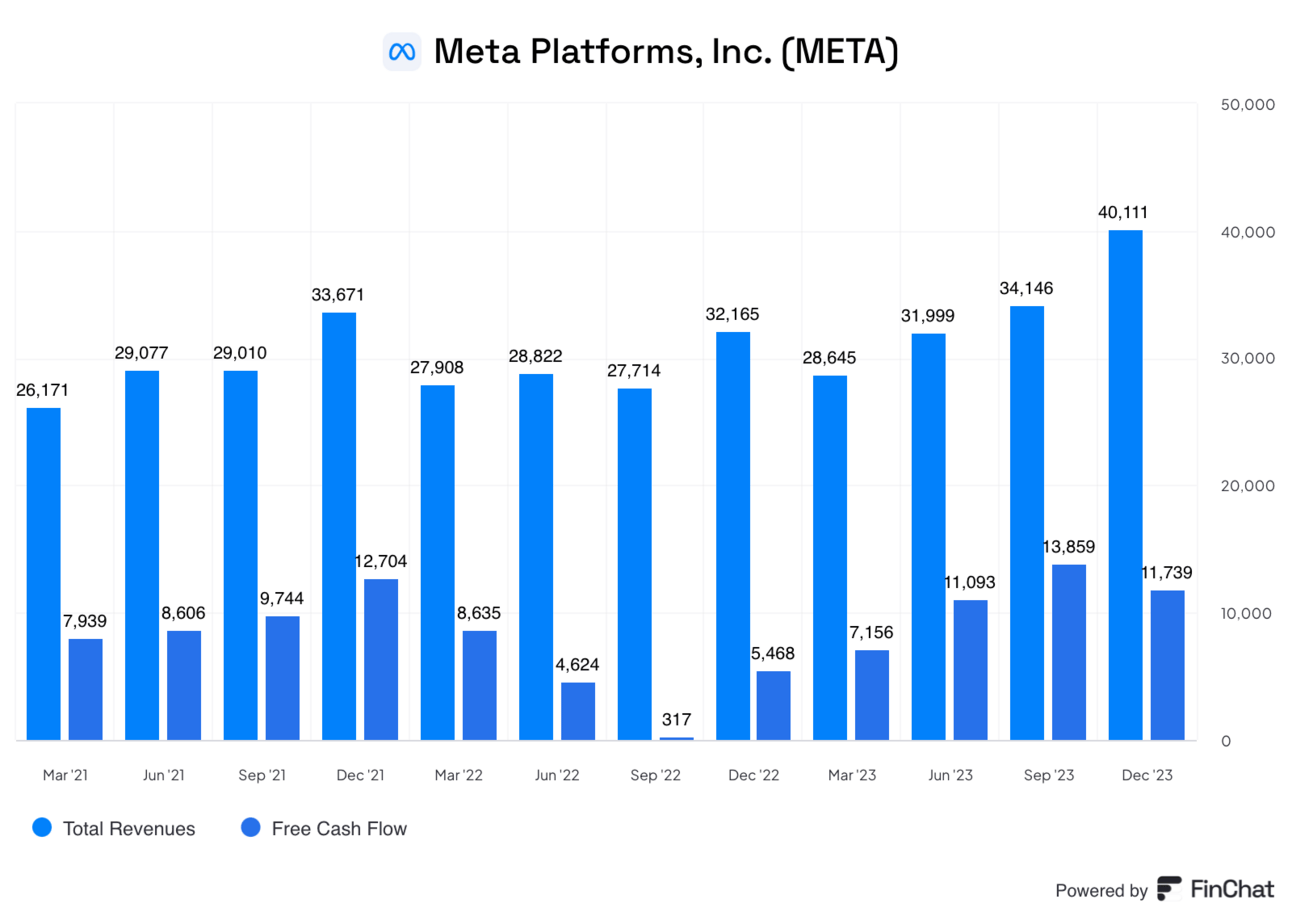

24 hours later, Meta Platforms announced a phenomenal quarter and doubled down on being a leading AI company…which it already is. The stock is down 12.8% as I’m writing.

Gif by theoffice on Giphy

To go ad-free, you can sign up for premium here.

Want to get the most out of ChatGPT?

Revolutionize your workday with the power of ChatGPT! Dive into HubSpot’s guide to discover how AI can elevate your productivity and creativity. Learn to automate tasks, enhance decision-making, and foster innovation, all through the capabilities of ChatGPT.

Does Anything Matter?

Speculation and FOMO are back and it’s impossible to ignore. Financial results and fundamentals are a sideshow to this market.

Don’t believe me?

This is the price chart of a crypto token called dogwifhat — YES, YOU READ THAT RIGHT. It has a fully diluted market cap of $2.9 billion!!!

Solana’s meme coin Bonk has a $2.3 billion market cap.

*I say this as a Coinbase shareholder: The only reason these tokens exist is to speculate on what someone will pay you for the token in the future. THAT’S IT!

We are early in earnings season, so we don’t have the full picture yet. However, I’m increasingly baffled at how much appetite there is for speculating on companies that trade for obscene valuations or tokens that have no use case, real or imagined. And there’s almost no appreciation for…cash flow.

Logically, you would think the market would be focused more on profitability and punishing companies with weak financials given slowing GDP growth and rising interest rates. But alas.

Nothing Matters…Until It Does

It’s valuable to observe what’s taking place in the market but that doesn’t mean we need to participate.

It’s OK to say, “That’s not for me” or “I don’t understand that stock.” It’s hard, but often the best move.

Remember what 2021 and 2022 felt like when it seemed wrong that the market kept going up despite being completely out of whack with fundamentals? Then the market (especially crypto) collapsed in 2023 and a lot of hyped stocks fell 90%+.

The best companies didn’t just survive the crash, they thrived.

We can participate in the madness or take a long-term view.

I saw the reaction to Tesla’s earnings and shrugged.

Meta’s drop intrigued me because there may eventually be a buying opportunity in a great company.

The meme coin pop? I don’t care!

Asymmetric Investing is about finding long-term investments that can 10x over a decade or more.

Over 10+ years, moods will shift, and speculation will rule the narrative short-term, but what drives stock performance is revenue growth, free cash flow, and building a durable business.

Anything else is noise.

This week, it may not seem like fundamentals matter, but they will…eventually.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.