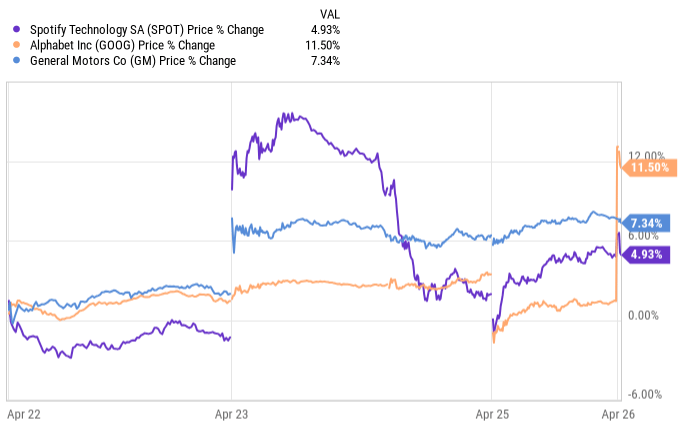

Earnings season couldn’t have started much better for the Asymmetric Universe of stocks. Spotify, GM, and Alphabet reported better-than-expected results and shares bounced higher after earnings.

On average, these three stocks are up 7.9% this week. Not a bad start to earnings season!

Here’s what you need to know.

Spotify

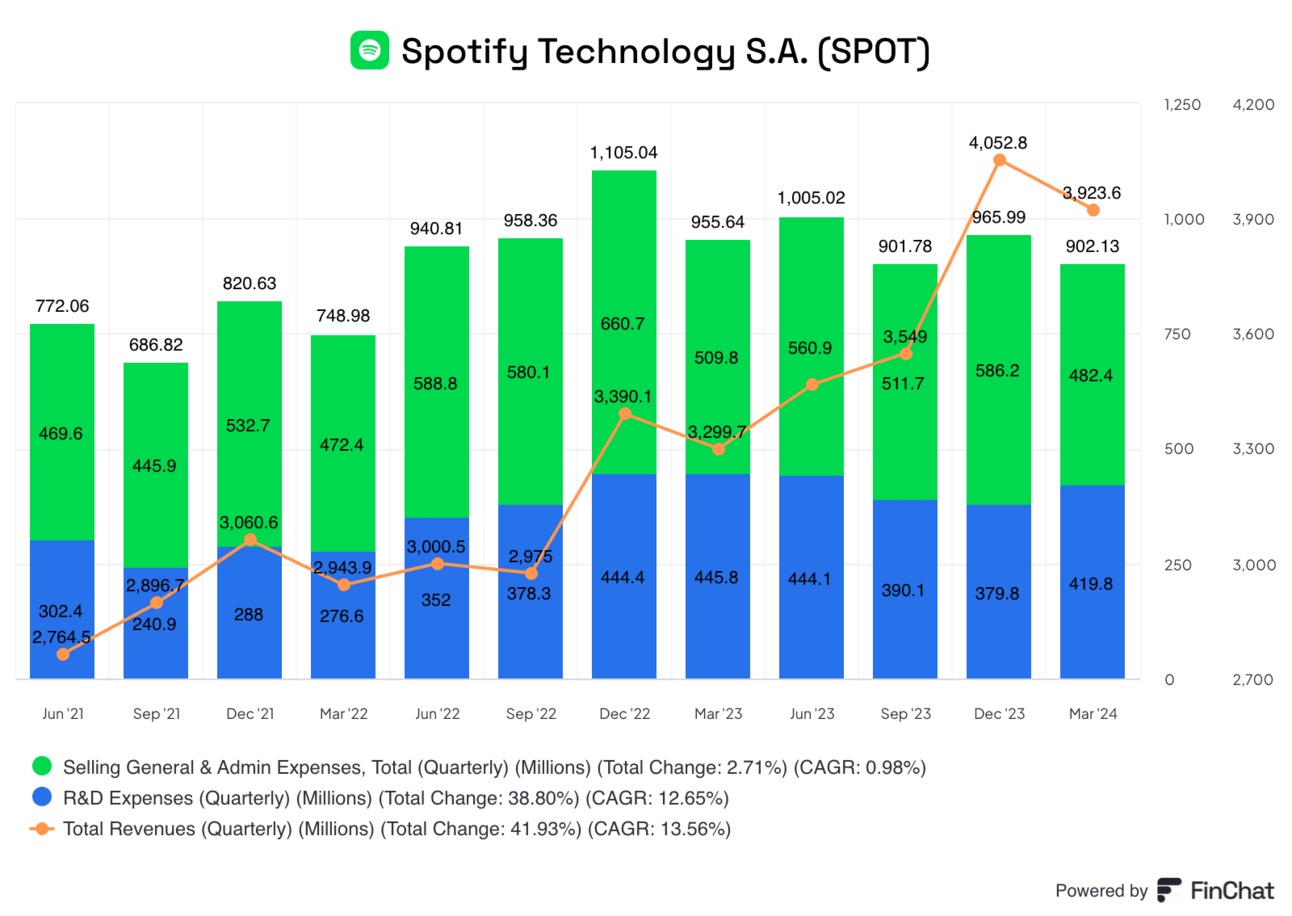

Results were solid for Spotify and the market cheered the company’s expanding margins and lower operating expenses.

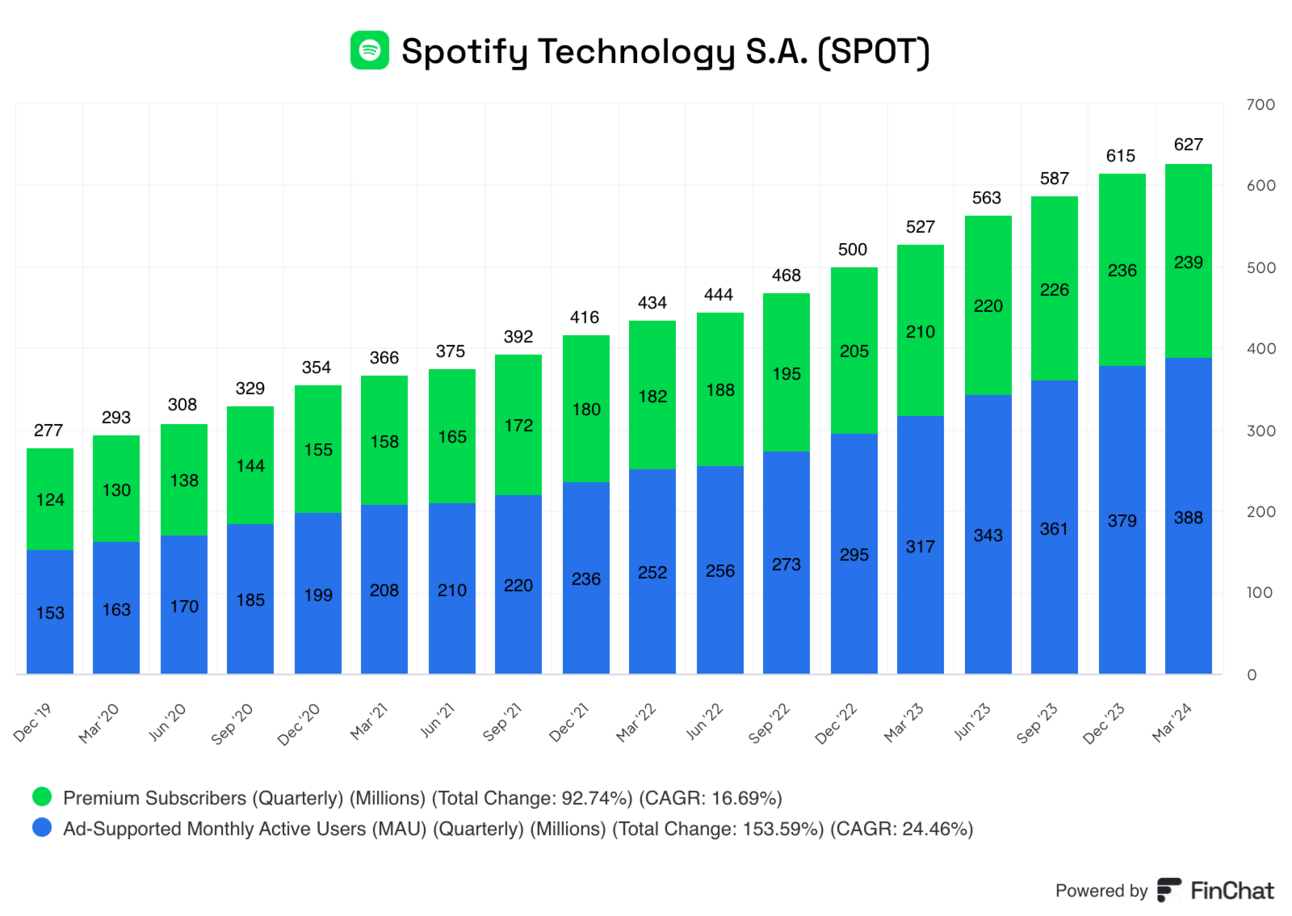

I want to start with monthly active users, which continued to grow, but at a slower pace than 2023. Management blamed this partly on the reduction in sales and marketing costs, but it could also be less enthusiastic customers after the $1 to $2 price increases implemented late in 2023.

Operating costs did fall sharply and we are seeing real operating leverage (revenue growing faster than operating expenses) in the business. As I mentioned above, that involves tradeoffs, and with lower marketing costs we see lower user growth. For now, the market is fine with that, but look for this to be a point of tension in the future.

There was also gross margin expansion to 30.2% for premium subscriptions and 6.4% for advertising. We need to see advertising revenue and margins improve dramatically for this to be a 10x stock, but it will take time.

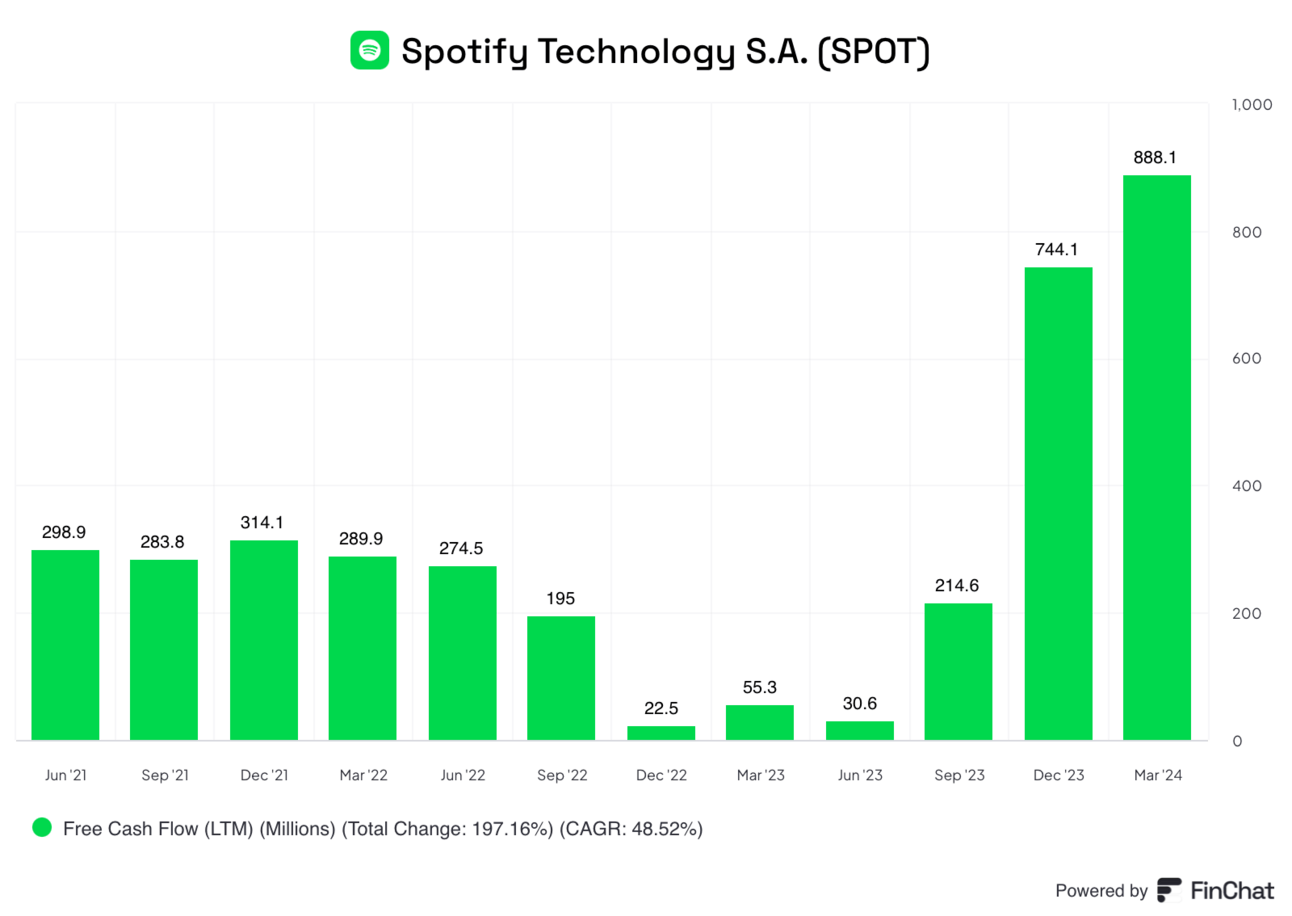

Here’s the big shift for Spotify and why the stock has done so well over the past year. Free cash flow is not only improving, it seems sustainable.

Spotify seems to be making all the right moves and is now starting to use its position to bundle audiobooks with music and talked about moving into education and video. Results will be lumpy as management balances growth with profits, but I love what I’m seeing.

General Motors

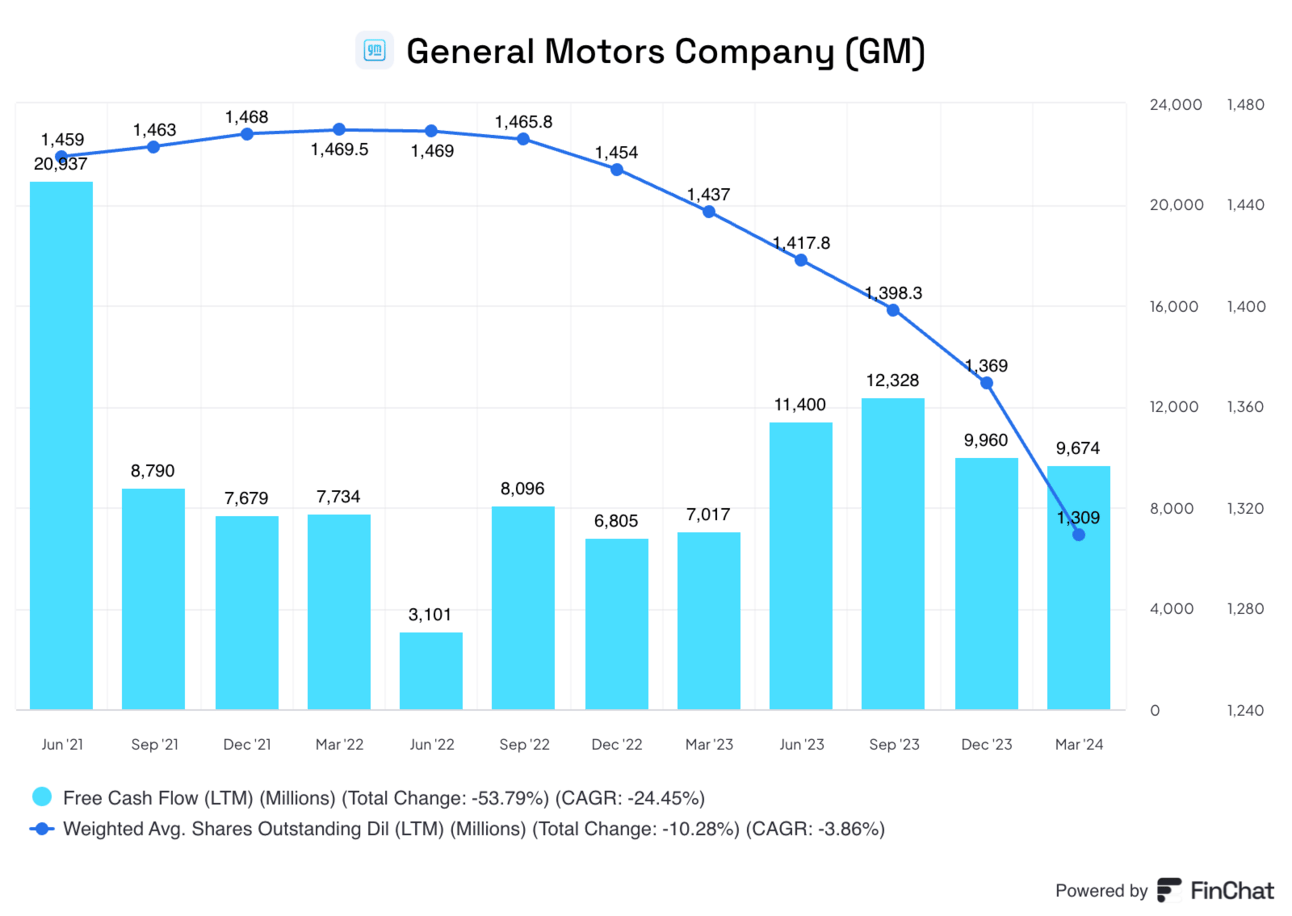

This chart is the only one that matters for GM right now. Free cash flow remains strong and management is buying back shares aggressively. The share averaging in this chart doesn’t quite do buybacks justice because diluted shares outstanding were 1.162 billion on March 31, 2024.

Struggling sales for EV makers has gotten a lot of media attention and part of the reason EVs are struggling is people are buying trucks and SUVs from GM. Even the low-cost Chevy Trax and Buick Envista, which start at around $25,000, have been selling well.

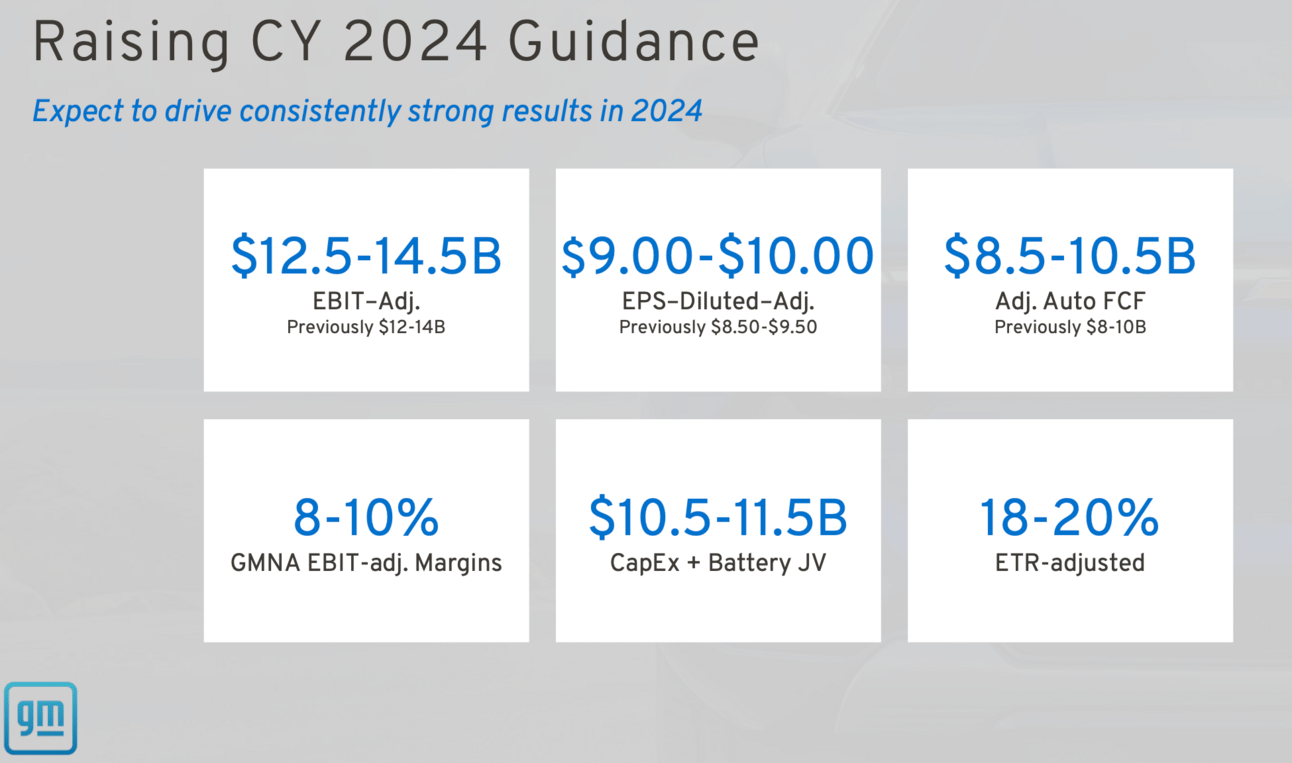

You can see below that GM raised guidance for the year and at $45.62 shares are trading for 4.8× 2024 earnings guidance. Gotta love buybacks at that price!

We didn’t get much of an update about Cruise, so I’ll keep an eye on that. In the meantime, I’m happy to have a great value stock doing buybacks with upside potential from Cruise for free.

Alphabet

The narrative around Alphabet has changed quickly in 2024. The company has gone from being disrupted by ChatGPT to being a leader in the AI cloud with some of the most compelling new AI products in the industry.

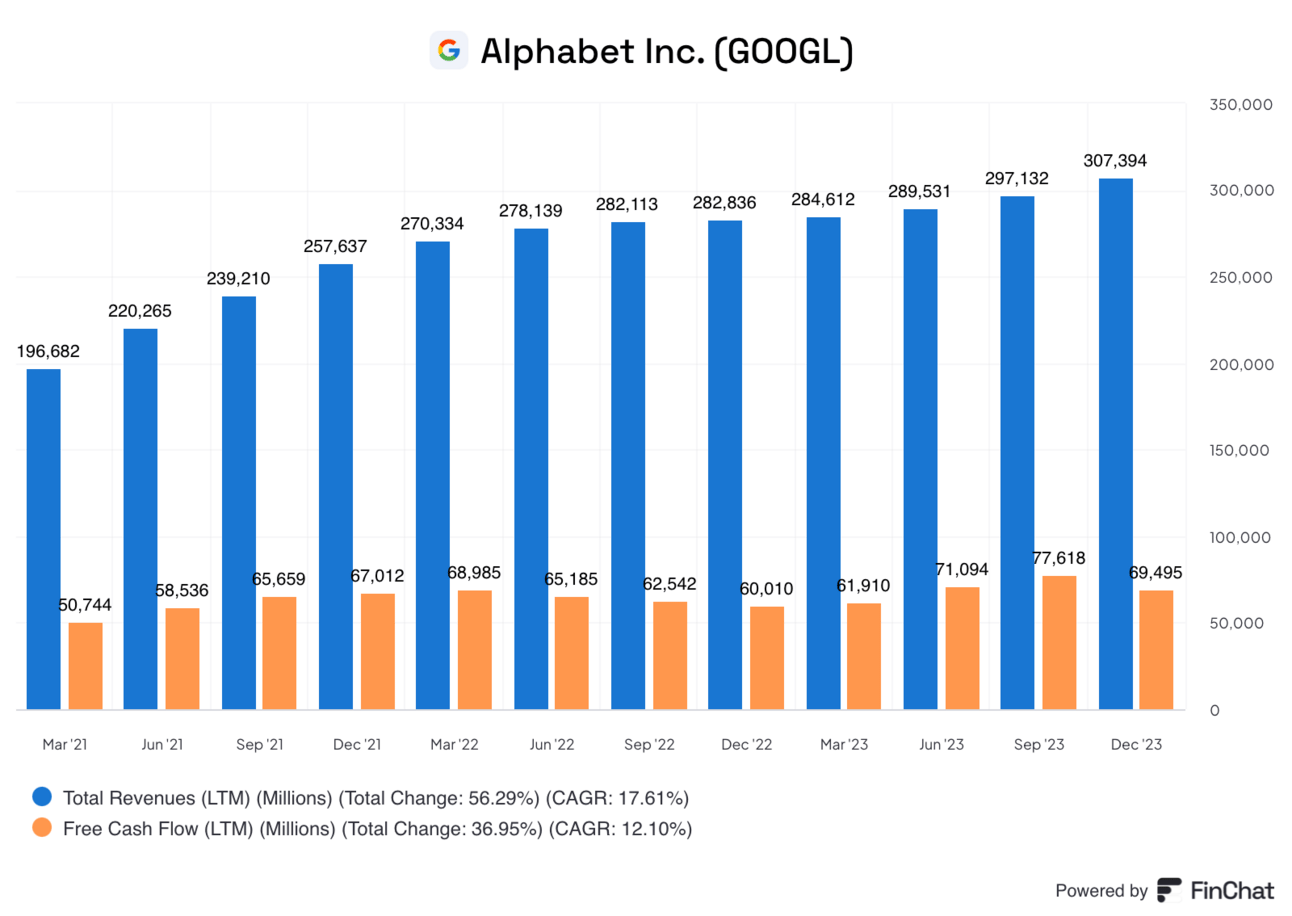

The headline numbers were solid and you can see revenue growth re-accelerating and free cash flow remaining strong despite large investments in AI infrastructure.

Google Cloud

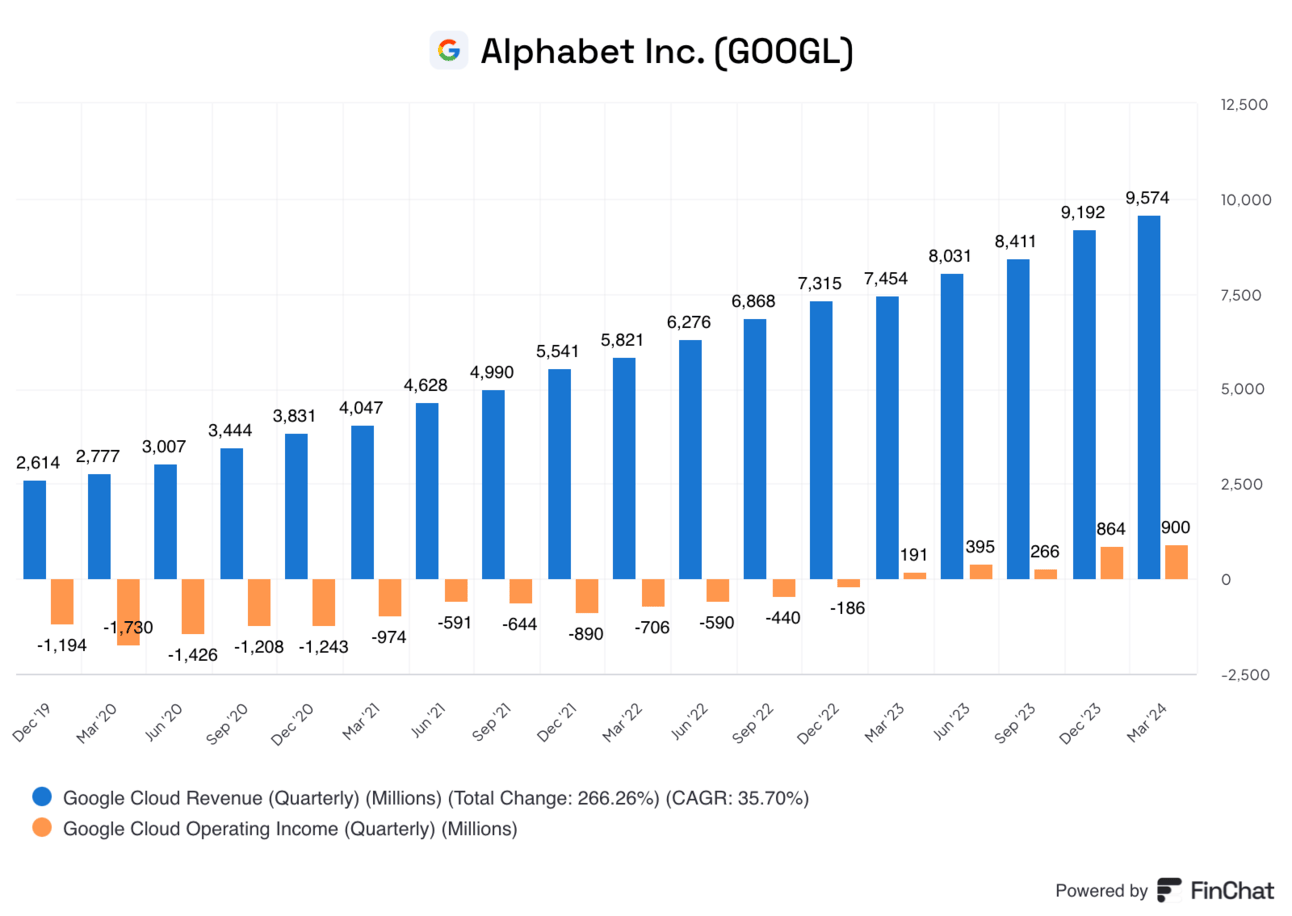

I’ve been focused on the cloud segment and management doubled down on its potential on the conference call. Investment in the cloud will dominate the ~$48 billion in capital expenditures expected in 2024.

What’s most impressive is the continued improvement in profitability. An operating margin of 9.4% is still less than half of the other cloud giants, but Google Cloud is on the right track.

Google Cloud may grow 25%+ for the next decade and if the business gets to a 20%+ operating margin this could be the main driver of the stock long-term.

Returning Cash

One of the reasons the market reacted so positively to this report was the introduction of a dividend.

Alphabet’s Board of Directors today approved the initiation of a cash dividend program, and declared a cash dividend of $0.20 per share that will be paid on June 17, 2024, to stockholders of record as of June 10, 2024, on each of the company’s Class A, Class B, and Class C shares. The company intends to pay quarterly cash dividends in the future, subject to review and approval by the company’s Board of Directors in its sole discretion.

That’s a modest dividend yield of 0.5%, but it’s a sign the company is maturing and moving into a cash-harvesting phase of its lifecycle. On top of the dividend, an additional buyback was authorized and it’s big!

Alphabet’s Board of Directors today authorized the company to repurchase up to an additional $70.0 billion of its Class A and Class C shares in a manner deemed in the best interest of the company and its stockholders

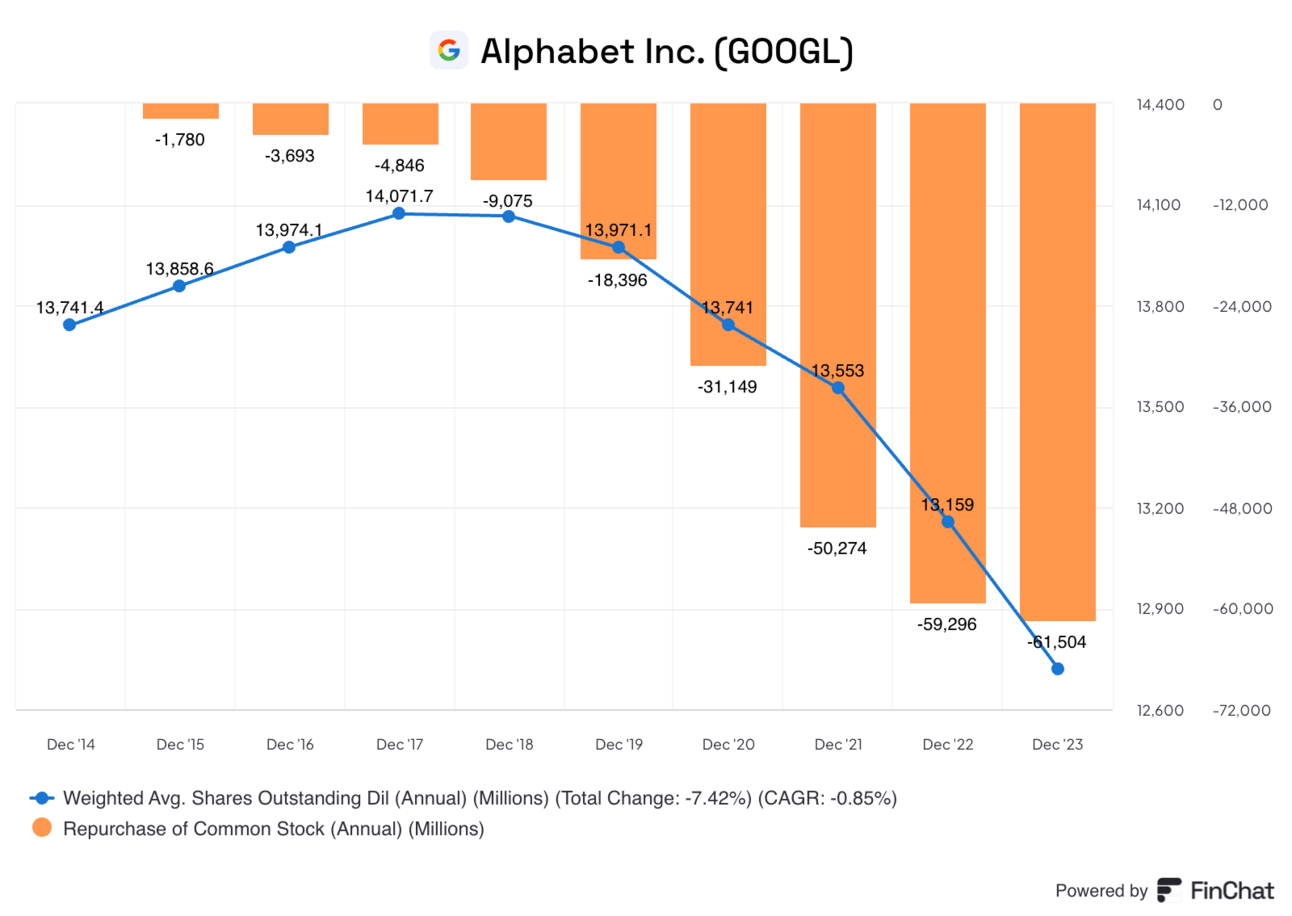

Buybacks aren’t new to Alphabet, but the buybacks haven’t been particularly aggressive. Since peaking in 2018, management has bought back about 2% of shares per year.

Alphabet showed in Q1 that it’s not under the disruptive threat investors thought existed in 2023 and may now be playing offense. That’s great news for a stock trading for ~25× forward earnings estimates and still growing revenue double-digits per year.

I’m not buying shares unless there’s a dip in the stock, but this is a juggernaut that’s worth holding on to and riding the wave of growth.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.