Last week, I wrote about the massive pay packages being offered in Silicon Valley, specifically those provided by Meta Platforms $META ( ▲ 1.69% ). This week, we learned that some even bigger checks in the neighborhood of billions of dollars may be given to Daniel Gross and Nat Friedman.

Those names may not mean a lot to you, but Friedman was key to Github Copilot, arguably the first widely used AI tool, and Gross has had stints leading Apple’s AI efforts and was an eary Y-Combinator AI investor and is currently CEO of SSI, a $32 billion startup that’s not even a year old.

What we saw this week may have been some of the products they’re meant to make into hits at Meta, and it all comes down to glasses. More on Meta’s broadening glasses ambitions in a moment.

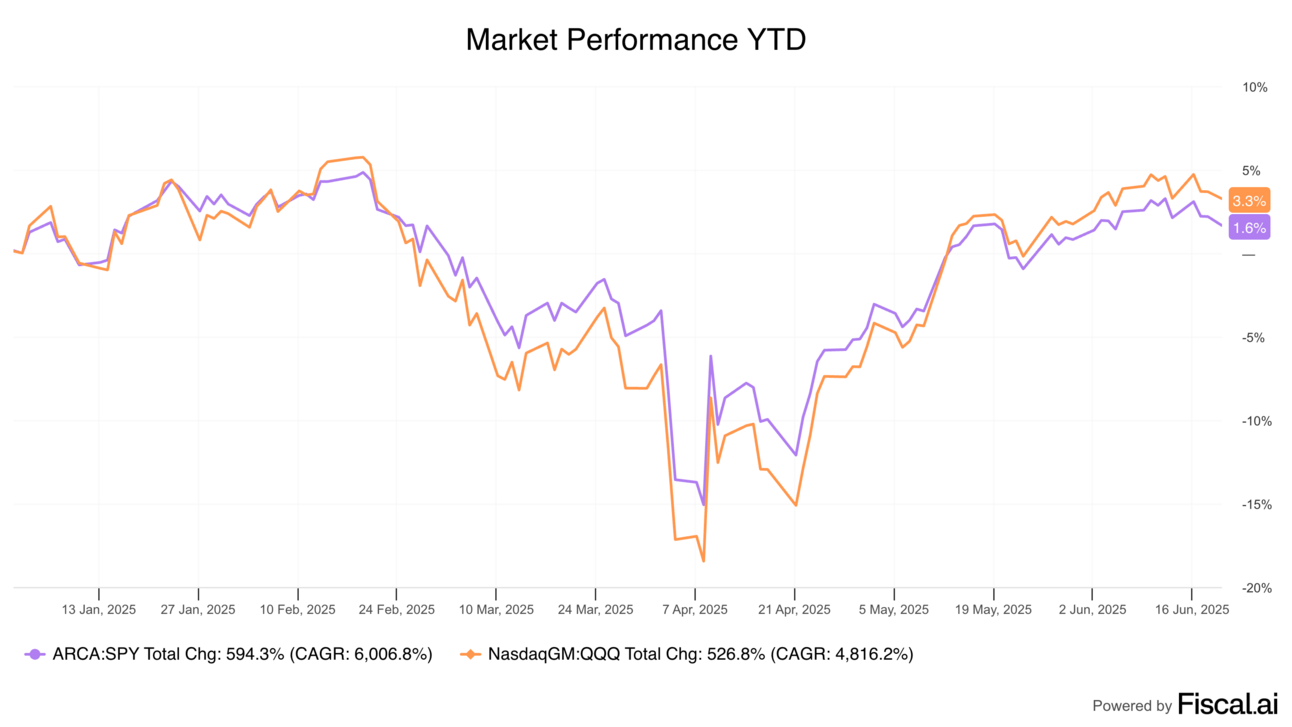

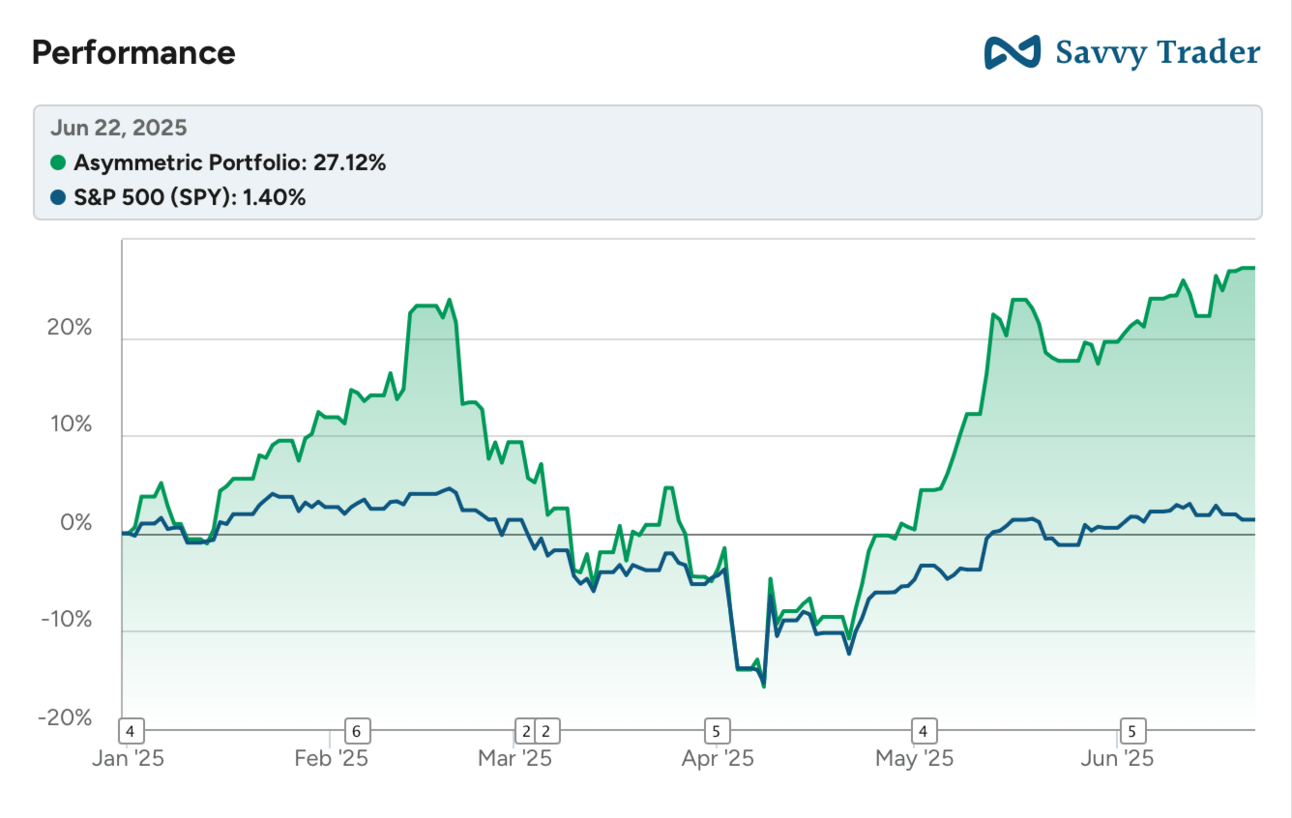

As for the market overall, the week was down a bit as tensions rose in the Middle East. It looks like the U.S. is now involved, so uncertainty continues to go up, which will likely lead to more volatility.

The Asymmetric Portfolio was up nearly 5% this week, helped by big gains for Coinbase $COIN ( ▲ 3.26% ) and Hims & Hers $HIMS ( ▼ 1.2% ). I discussed Coinbase’s move briefly here.

All of the charts you see here are easy to make with Fiscal.ai, the first place to go for all of my research. I can’t say enough how much easier it’s made my research, and you can start with 2 weeks free. 👇

In Case You Missed It

Here’s some of the content I put out this week.

Founders vs Managers: Why to founders outperform managers?

Owlet, MGM, Autonomy, and Hers Update: Time to catch up on some of the big news happening throughout the portfolio.

Is It Time to Sell Spotify Stock?: One of the biggest winners in the portfolio has gotten expensive, but is that a reason to sell?

AI’s Form Factor

When a new technology paradigm comes along, it’s usually accompanied by a new form factor.

Mainframe → PC → Mobile

And the “winners” of the era are often new as well.

IBM → Microsoft/Intel → Apple

So, what will the hardware of AI be?

This is the trillion dollar question Silicon Valley is trying to answer. And Meta thinks they have something on their hands.

In 2023, the company introduced Meta Ray-Ban Smart Glasses, which were the first glasses to interact with Meta AI. I wouldn’t call the product revolutionary, but it was a good start.

They also announced the Orion AR glasses, which aren’t ready for prime time in form factor, price, capability, or manufacturability.

This week, they announced the Oakley Meta HSTN glasses that connects to the Meta AI app. There’s a camera that can record images and video, a microphone, speakers, and a touch screen to interact with the device.

Color me impressed. It’s the lowest friction AI product I’ve seen to date and while I’m not ready to go all-in on Meta stock because of a pair of glasses, they seem to be pushing on an area with promise.

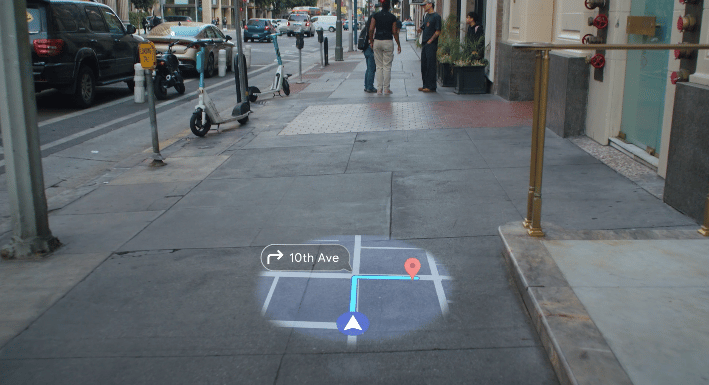

And Meta’s not the only company looking at glasses as the best path forward for AI. Alphabet’s $GOOG ( ▲ 3.74% ) Android XR platform allows for headsup displays in AR/VR headsets and multimodal interactions with Gemini.

I could see maps or pop-up text as a useful addition to my life. And with kids, a way to capture moments without pulling out a phone would be amazing.

There are clearly areas where Google’s products could fold into AI or AR glasses seemlessly.

As skepticaly as I am of some of the AI hype, glasses are an area that may be under-hyped at the moment.

Where the Money Goes in a Hardware Revolution

In new hardware paradigms, there’s often a vertically integrated solution that’s first to market because they have to create everything themselves. See Apple with touch interface smartphones or Tesla in EVs.

Then, there’s modular players with more commoditized offerings. This is the Android ecosystem following Apple or GM and VW in EVs following Tesla.

If there’s a “winner-take-all” market or some kind of lock-in, the vertically integrated company can have an advantage. But if the growth phase comes when modular players get involved, it’s usually difficult for an integrated player to compete.

We don’t know how this plays out, but I can’t help but think Meta and Alphabet are the best positioned to be modular operating systems for glasses. Both can monetize with advertising and both have leading AI built in-house with their own clouds. Will Meta be happy modularizing and becoming a “platform” so it can get maps, music, other messaging services, and whatever else developers think of?

What Alphabet has is experience building an operating system that developers and manufacturers will adopt. And Android could extend from your pocket to your face.

I like where Alphabet sits strategically, but Meta’s products are becoming pretty compelling.

At the very least, I hope Meta pushes the industry forward because this could be a new layer of innovation and one that could bring a level of utility that could change the world.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your research before acquiring stocks.