Nine-figure pay packages have become commonplace in professional sports, which makes sense for a business driven by a handful of exceptional athletes who drive the sport’s value.

But a nine-figure pay package for a corporate employee? That’s unheard of!

Big pay packages may become commonplace in a world of AI, though. Those who can leverage their knowledge to build artificial intelligence may be worth any amount of money thrown at them. More on that in a moment.

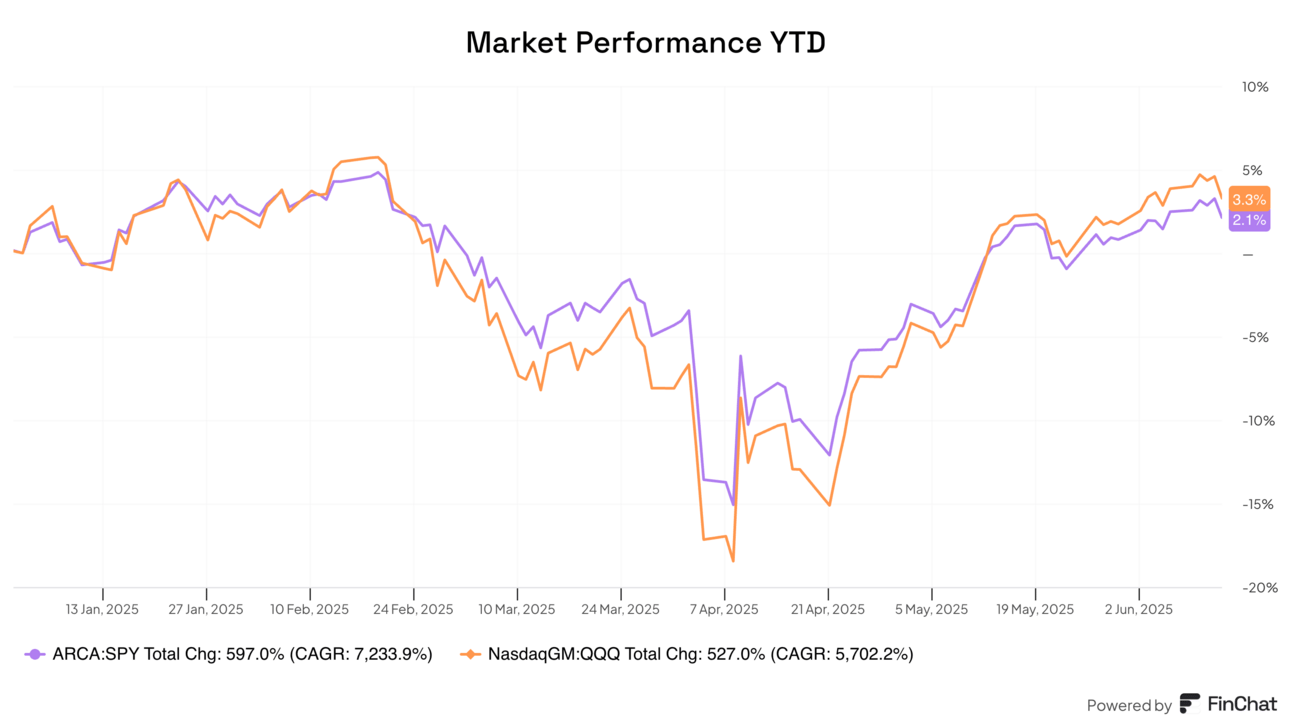

The market this week was more resilient than I would have thought, given what’s going on in the Middle East. And as I’m writing, futures are green. Nothing to worry about…I guess?

The Asymmetric Portfolio continues to hold its gains despite some volatility in the past week. Some of the smaller investments in the portfolio have bounced, giving a surprise boost.

All of the charts you see here are easy to make, research like finding transcripts and insider buys is easier than ever, and you can even ask an AI about earnings transcripts. I can’t say enough how much easier it’s made my research, and you can start with 2 weeks free. 👇

In Case You Missed It

Here’s some of the content I put out this week.

The Market’s Cognitive Dissonance: The market seems to think we’re both in for a big economic downturn and poised for growth, depending on where you look.

Now Is NOT the Time to Panic: As the news freaks out about war in the Middle East, investors need to keep a cool head.

Disruption in Real Time: Payments are changing faster than you might think, and crypto is at the center of the changes.

Big Pay Packages in Silicon Valley

This week’s big AI news was Meta Platforms $META ( ▲ 1.69% ) investing $14.3 billion in Scale AI to essentially acquire the team. Scale’s business will likely be decimated (Google announced it would stop using Scale), and key employees have already said they will join Meta full-time.

But the payout for Scale’s employees is only part of the story. Meta has reportedly been offering pay packages of over $10 million — and as much as nine-figures — to key AI researchers.

Big payouts aren’t new in Silicon Valley, but AI have pushed them to a new level. Alphabet $GOOG ( ▲ 3.74% ) spent $2.7 billion late last year to essentially re-hire Noam Shazeer and Daniel De Freitas, who left the company to start Character.AI.

OpenAI has been known to pay up to $10 million for top talent.

If you thought the battle for NVIDIA chips was intense, AI talent looks like it’s the most important commodity in the industry.

Brain Drain and the War For Talent

What we want to watch as investors is where talent is congregating and where there’s a drain of talent. If people are leaving, it can be a downward spiral.

For example, I don’t know quite what to make of Tesla’s AI chief leaving only days before the launch of Robotaxi and ahead of the Optimus ramp.

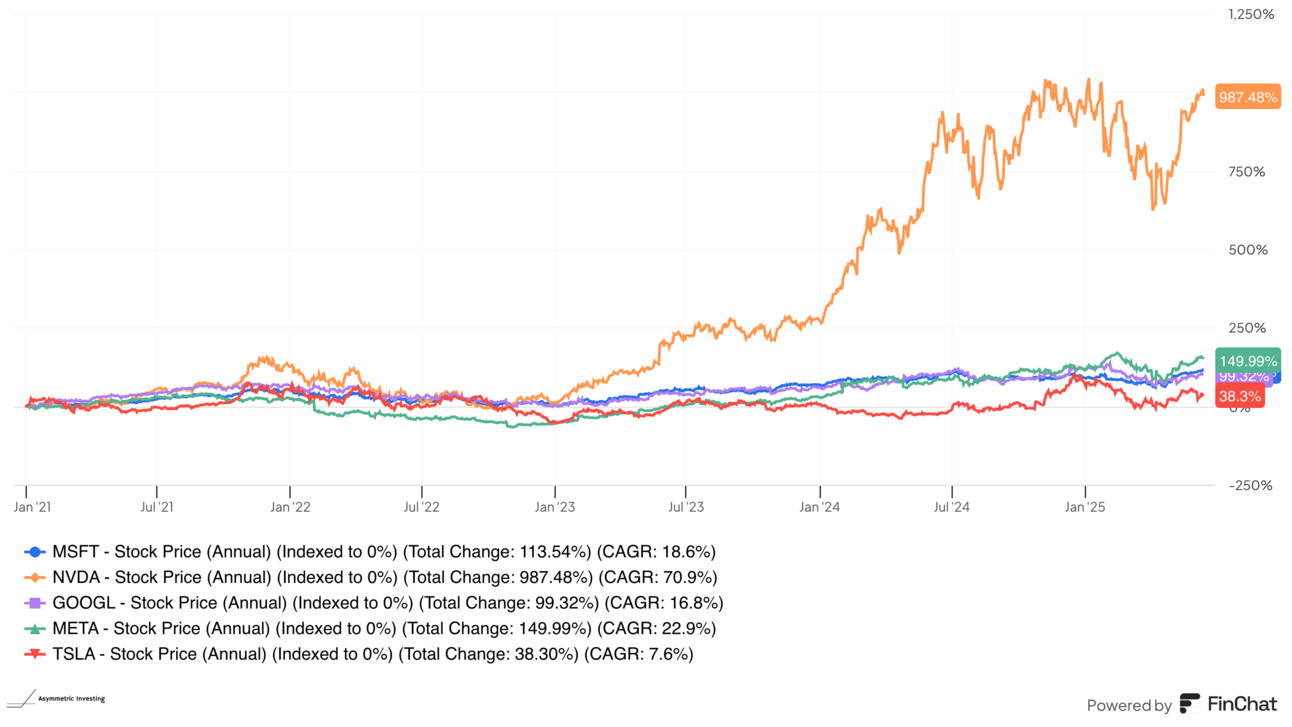

Brain drain isn’t new for Tesla, but if this is a battle that’s going to be waged with big checks, Tesla isn’t going to win.

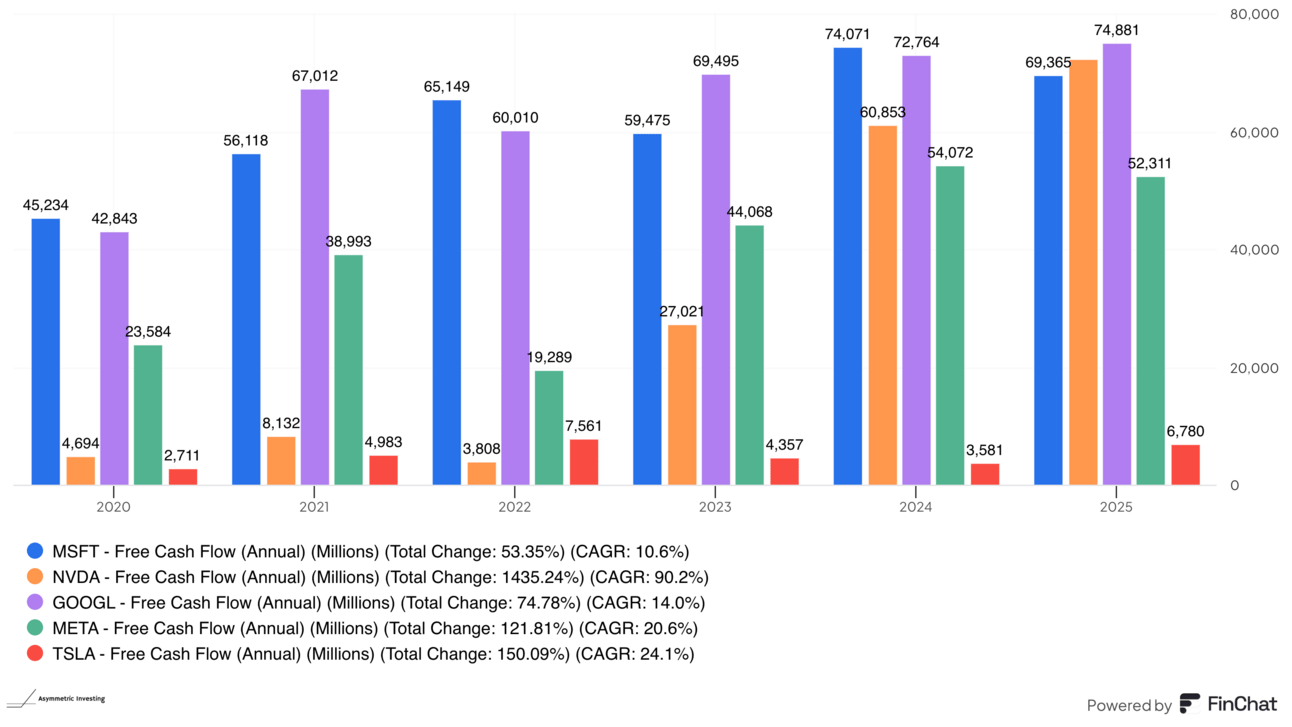

Stock based compensation is the other tool companies can use to lure talent, and Tesla is once again a laggard since the depths of the pandemic.

Brain drain isn’t a Tesla-only problem.

Google lost the creators of NotebookLM late last year, and I mentioned above that they’ve spent big to pull AI leaders back into the organization.

As the valuation of startups has gone to eye-popping levels, the brain drain may get worse. OpenAI’s Ilya Sutskever raised $1 billion at a $5 billion valuation for his startup SSI before the company was off the ground. A few months later, the company got another $2 billion at a $32 billion valuation.

What’s a $100 million pay package when you can be worth billions in months and then get acqui-hired?

All of this seems unsustainable to me, but I don’t know who that favors. For employees, get what you can while the money is good. But for AI companies, it seems fraught to pay this much money to employees unless your business model supports it.

My money is on Alphabet coming out ahead in AI because they have the infrastructure and distribution to compete and a balance sheet most companies would envy. But outside of them, this may be a back-and-forth battle to attract talent and build products that leaves everyone’s profits worse off as all of Silicon Valley pursues the mythical artificial super intelligence.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your research before acquiring stocks.