Happy Mother’s Day!

The stock market continued its march higher this week despite a mixed week for earnings. Some companies were punished for even small earnings misses and many companies issued weak guidance, but that was overshadowed by weak economic indicators that caused stocks to rise.

How does that make sense? I’ll get to that below.

Despite a rising market overall, the week wasn’t very good for the Asymmetric Portfolio after a few earnings reports were met with disappointment by the market.

Asymmetric Investing has a freemium model. Sign up for premium here if you want to skip ads and get double the content, including all portfolio additions.

Steal our best value stock ideas.

PayPal, Disney, and Nike all dropped 50-80% recently from all-time highs.

Are they undervalued? Can they turn around? What’s next? You don’t have time to track every stock, but should you be forced to miss all the best opportunities?

That’s why we scour hundreds of value stock ideas for you. Whenever we find something interesting, we send it straight to your inbox.

Subscribe free to Value Investor Daily with one click so you never miss out on our research again.

In Case You Missed It

Here’s some of the content I put out this week. Enjoy!

Peloton Earnings and Buyour Rumors: Earnings were terrible, but cost-cutting measures and rumors of a potential buyout have Peloton stock moving higher.

Disney’s Vision vs Disney’s Reality: Disney’s current performance isn’t great, but a look at its strategic position tells the story of a company built to be a leader in streaming.

Portillo’s Earnings Recap: The market didn’t like the results, but the ebbs and flows of the restaurant industry are what hurt Portillo’s most.

Rivian’s Cash Problem: Rivian has built compelling vehicles, but it won’t survive if the current level of cash burn keeps up.

Everything Is Terrible. Buy Stocks?

As we’ve gone through earnings season and more economic data has come out, I have been surprised to see the market react so positively.

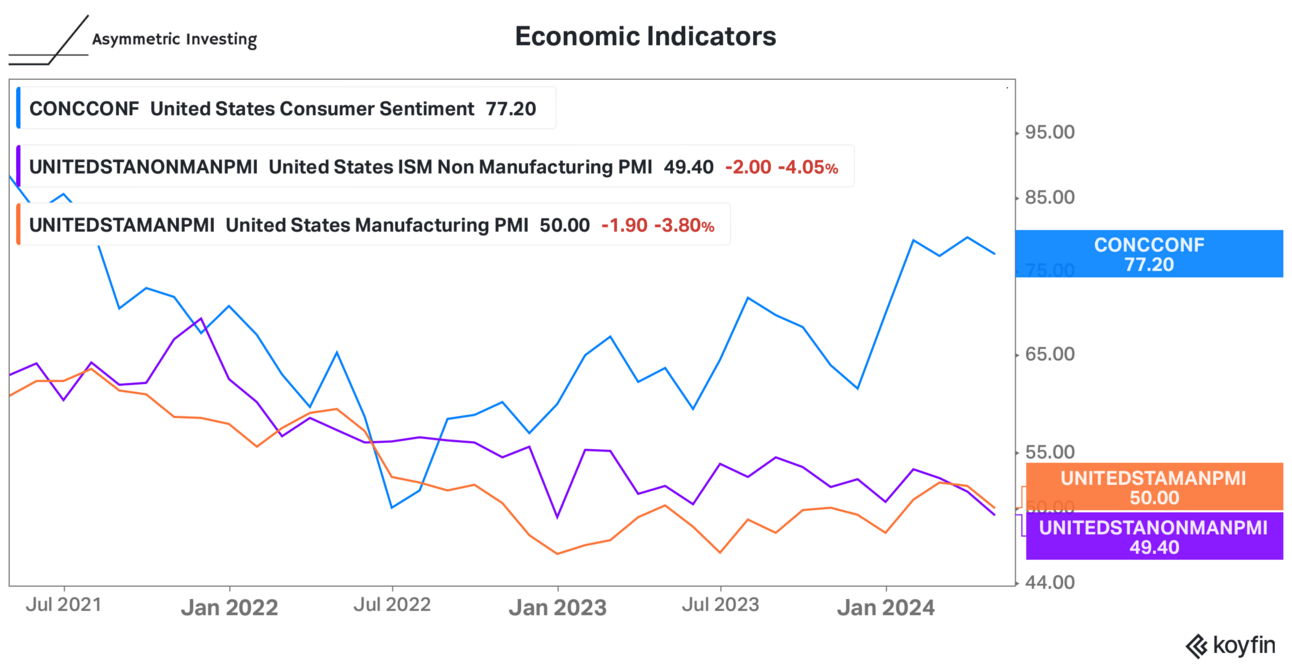

Consumer sentiment (blue line below) fell to the lowest point in six months (67.4 which is not on this chart) last week and is at a level comparable to March 2008 and April 2020.

Both manufacturing (orange line below) and non-manufacturing (purple line below) surveys indicate producers are anticipating a contraction in the economy.

I can’t read every earnings report, but I’ve seen a lot of companies give relatively weak guidance for the second quarter and the rest of 2024, especially companies that sell high-ticket items.

And yet the stock market continues to rise.

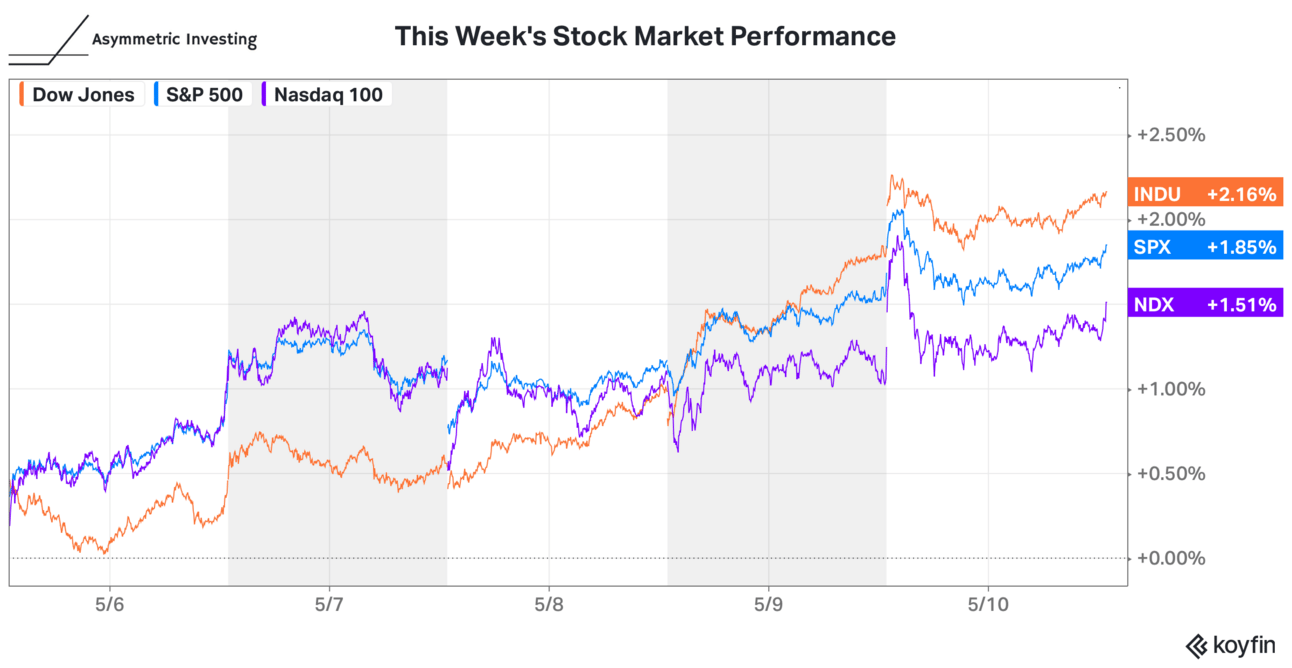

Stocks mostly rose to end the week, with the Dow extending its winning streak to eight days.

Consumer sentiment tumbled to its lowest point in half a year in May, dragged lower by concerns about inflation, unemployment, and higher interest rates.

The yield on the 10-year Treasury note was up to 4.503%.

Investors digested on Friday a survey on consumer sentimentthat was weaker than Wall Street expected, but that did not derail the U.S. stock market's climb for the week.

Why?

The easy answer is that investors are hoping the Federal Reserve will cut interest rates, which is often seen as a bullish sign for stocks. But the Fed will cut rates for two reasons:

The economy stinks (bad for earnings) and needs a jolt from lower rates.

Inflation has turned into deflation (also mostly bad for earnings).

And here you have the collision between traders looking for the catalyst for stocks and the long-term investors who are scratching their heads as to how the market can be peaking when inflation is high, consumer confidence is falling, and manufacturers are expecting a contraction.

The reality is what Main Street sees — skyrocketing food prices, unattainable housing, high interest rates — is not what Wall Street sees — record profits, an AI boost, and endless government spending/stimulus.

Speculation on rate cuts won’t drive the market forever. As investors, I think we need to keep three things in mind:

1. Profits are Up Because of Cost-Cutting

This earnings season's theme is so-so revenue growth and great profits because of cost cuts made during 2023. We see this from Meta Platforms to Kellogg.

Stocks are valued based on future earnings, so overlooking the top line in favor of the bottom line makes some sense at times. But you can only squeeze costs so far before it’s counterproductive.

Maybe efficiency has been the trend of the last year on Wall Street, but it’s not going to drive the market forever.

2. Pandemic Catch-Up Is Still Happening

I think there’s more catch-up after the pandemic than we realize. It was only a little over a year ago that Target was warning profit would be weak because they ordered inventory that sold during the pandemic like home outdoor furniture instead of “we’re going back to the office” products.

In the auto industry, it’s only now feeling “normal” for buyers. Some companies are offering good financing to move inventory, there are products on lots you can buy today, and automakers are building base models, not the premium versions to inflate sales. But this change has only happened in the last 6-9 months.

Three factors driving revenue and earnings that may not be sustainable are:

Inventory catch-up: Re-stocking shelves and showrooms will drive sell-in to the channel and help manufacturers as inventory fills to normal levels, but it’s sell-thru to end customers that matters.

Increased liquidity: Consumers are still spending the liquidity injected into the market during the pandemic and seem happy to take out debt to keep their spending up instead of cutting back as inflation eats more of their salaries.

People going back to work: A cohort of people stopped working during the pandemic and they’re slowly coming back into the workforce. But this tailwind for the economy doesn’t have much room to improve from here.

3. Lagging Indicators Are…Lagging

Some macro factors should also be slowing down the economy, but they’re not…yet.

Higher interest rates should slow down auto sales and home purchases. We’ve seen small indicators that both are starting, but it could take years for higher interest rates to take a toll on large purchases when consumers have more liquidity and more people are working (see above).

You’ve probably noticed that food prices are rising, but have you cut back on going out to eat or changed what you buy at the grocery store? I’m starting to and we’re hearing more about people trading down to save money, but this doesn’t happen overnight.

Housing is another area where costs are unsustainably high in some regions and parts of the market. Still, it’ll take years to work through true price discovery with millions of people sitting on a 2.75% mortgage rate they’re not willing to trade in for a 7.5% rate.

How I’m Adapting To This Stock Market

I recently wrote that I’m looking at companies that have good balance sheets and trade for relatively low multiples in this market because they can use a defensive position to play offense in a downturn.

That strategy still holds and where I can find net cash-positive companies trading for under 15x earnings I am happy to buy more.

But what I’m selling and what I’m avoiding might be even more important.

I recently sold shares of Apple in a personal account because the stock trades for nearly 30x earnings and Apple’s growth is essentially zero.

As interested as I am in disruption, I’m avoiding the AI companies that are trading for 36x sales and 75x earnings (ahem, NVIDIA) because historically buying at those multiples doesn’t lead to market-beating returns long-term.

I’m also building that list of companies I want to own eventually if the market does take a turn lower. That’s why I build the Asymmetric Universe of stocks I cover so I can pick out the best opportunities each month.

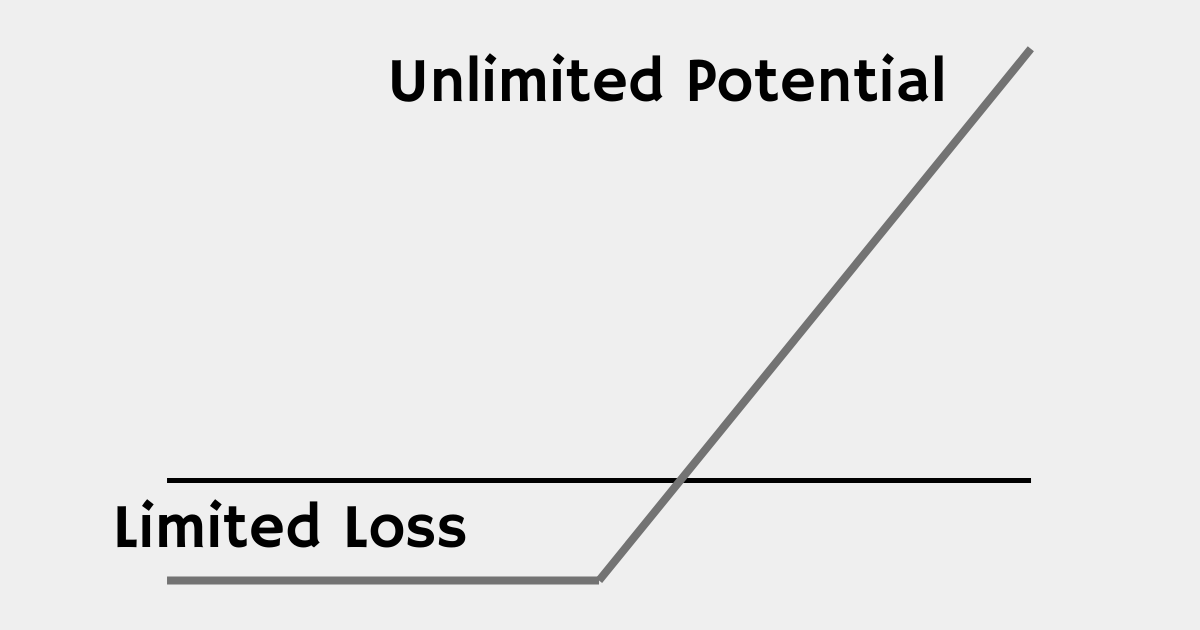

The immediate opportunities look more like value stocks, but that will change in the future when the reward outweighs the risk I see in growth stocks.

What are you waiting for?

You can get all Asymmetric Investing content, including deep dives, stock trades before they’re made, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.