This free article builds on the Disney Spotlight published on August 19, 2023. Since then, shares are up 22.6%, beating a 19.0% return for the S&P 500.

You can upgrade here if you want full access to spotlight articles, monthly buys, and the Asymmetric Portfolio.

The stock market isn’t fond of even the slightest sign of weakness at the moment. A small miss on guidance can send a stock down 10% and even a whisper of uncertainty is punished.

Long-term, these points of stock weakness are opportunities for investors who can look past a quarter or two to what a company is building over the course of the next decade. For Disney investors, there’s no better time for that vision than today.

Vision vs Reality

In the Disney Spotlight, I laid out the long-term vision I see for Disney:

Parks and Experiences are the foundation and a cash machine to fund a move into streaming.

Linear TV will provide scale and cash flow but is ultimately a dying business.

Streaming is the future and Disney can build a #1 or #2 position in the market.

Owned content (Pixar, Marvel, Star Wars, Disney Animation) provides a tentpole for Disney’s streaming business.

General entertainment (Hulu) fills in general entertainment or filler content.

ESPN rounds out the streaming bundle as the “must-have” sports streamer through ESPN over the top (coming in fall 2025)

If the strategy comes together, Disney could monetize through subscriptions and advertising to have compelling price points and economics. A decade from now, I think Disney could have 250 million subscribers on its platform.

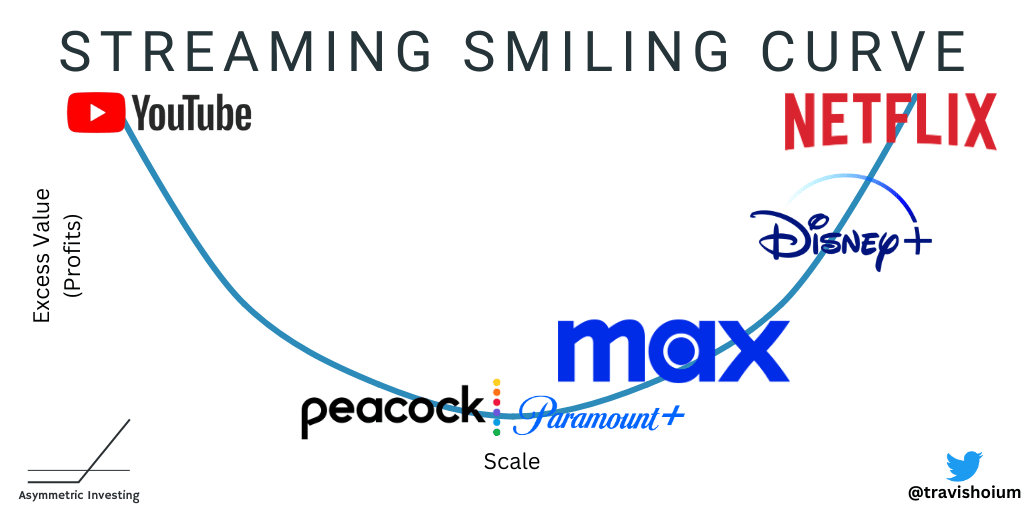

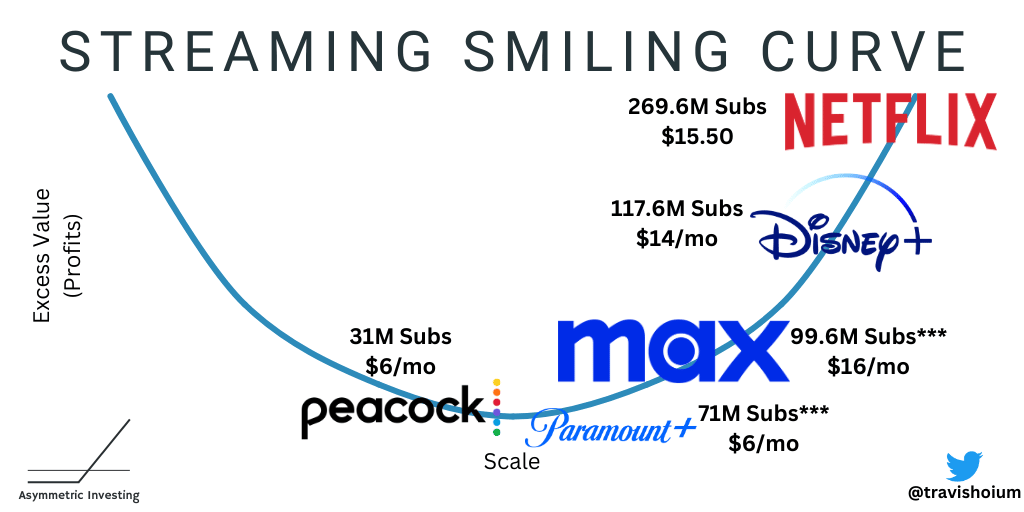

I like to use the smiling curve as a visual representation of how I think the market will play out. Value will accrue to the streamers with scale and Disney’s streaming business needs to be comparable to Netflix in terms of scale and revenue. If it’s competing with Peacock, we have a problem. And Disney may be sitting better in streaming than you think.

Asymmetric Investing is a freemium business model, which means free content is supported by ads like this. Avoid ads and get double the content including what I’m buying each month with a premium subscription here.

Missed out on Ring and Nest? Don’t let RYSE slip away!

Ring 一 Acquired by Amazon for $1.2B

Nest 一 Acquired by Google for $3.2B

If you missed out on these spectacular early investments in the Smart Home space, here’s your chance to grab hold of the next one.

RYSE is a tech firm poised to dominate the Smart Shades market (growing at an astonishing 55% annually), and their public offering of shares priced at just $1.50 has opened.

They have generated over 20X growth in share price for early shareholders, with significant upside remaining as they just launched in over 100 Best Buy stores.

Retail distribution was the main driver behind the acquisitions of both Ring and Nest, and their exclusive deal with Best Buy puts them in pole position to dominate this burgeoning industry.

Parks Are Coming Into Focus

I want to start with the foundation of Disney and that’s the parks.

The vision for parks is to be the premium destination for family experiences. $7.99 per month for Disney+ is nice, but an all-in $1,000 per day for a family to stay and visit Disney World is even better.

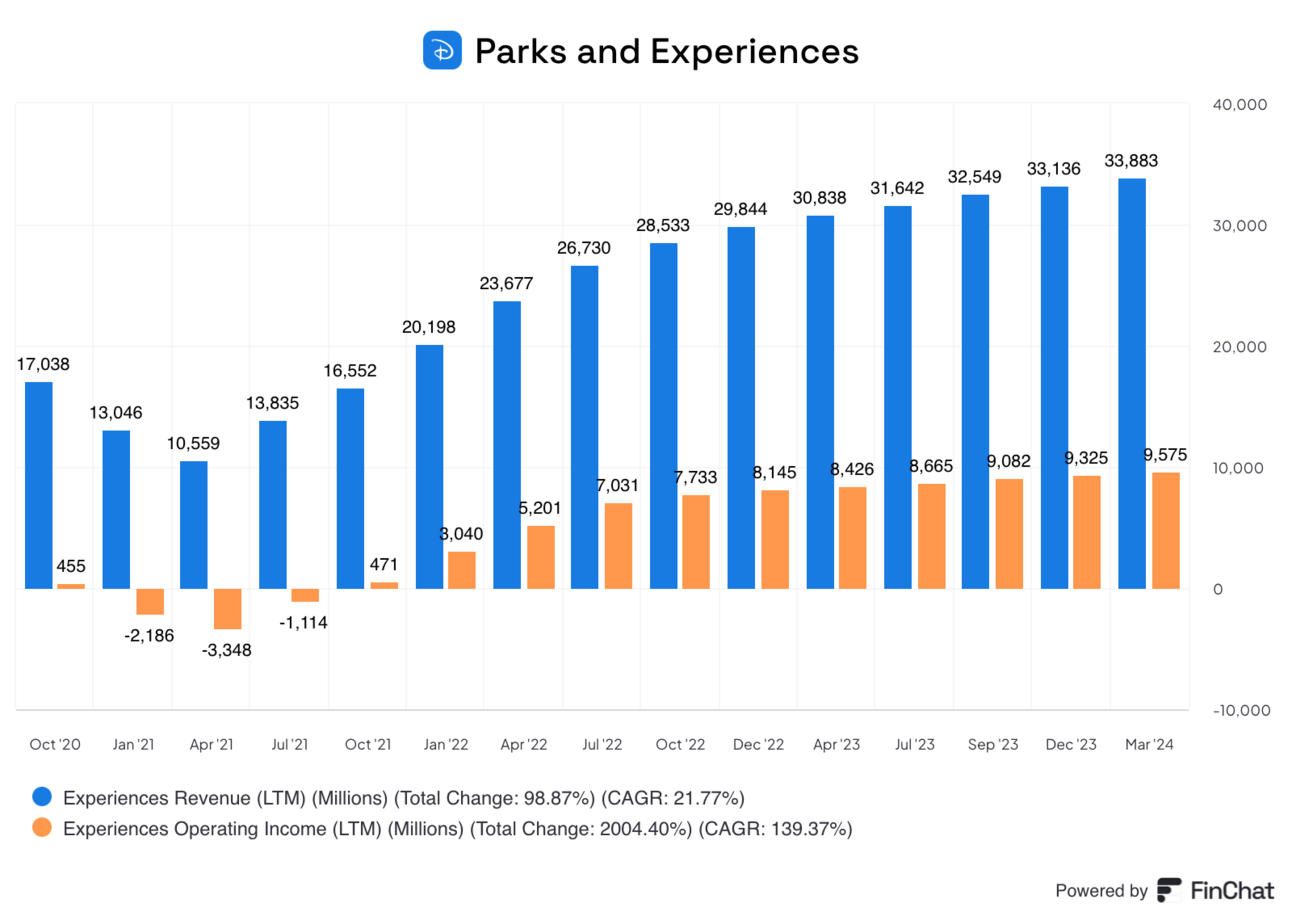

You can see below that parks and experiences are doing well, growing on the top and bottom lines since the pandemic. The market may quibble about the growth rate from quarter to quarter, but this is a major cash flow generating business for Disney.

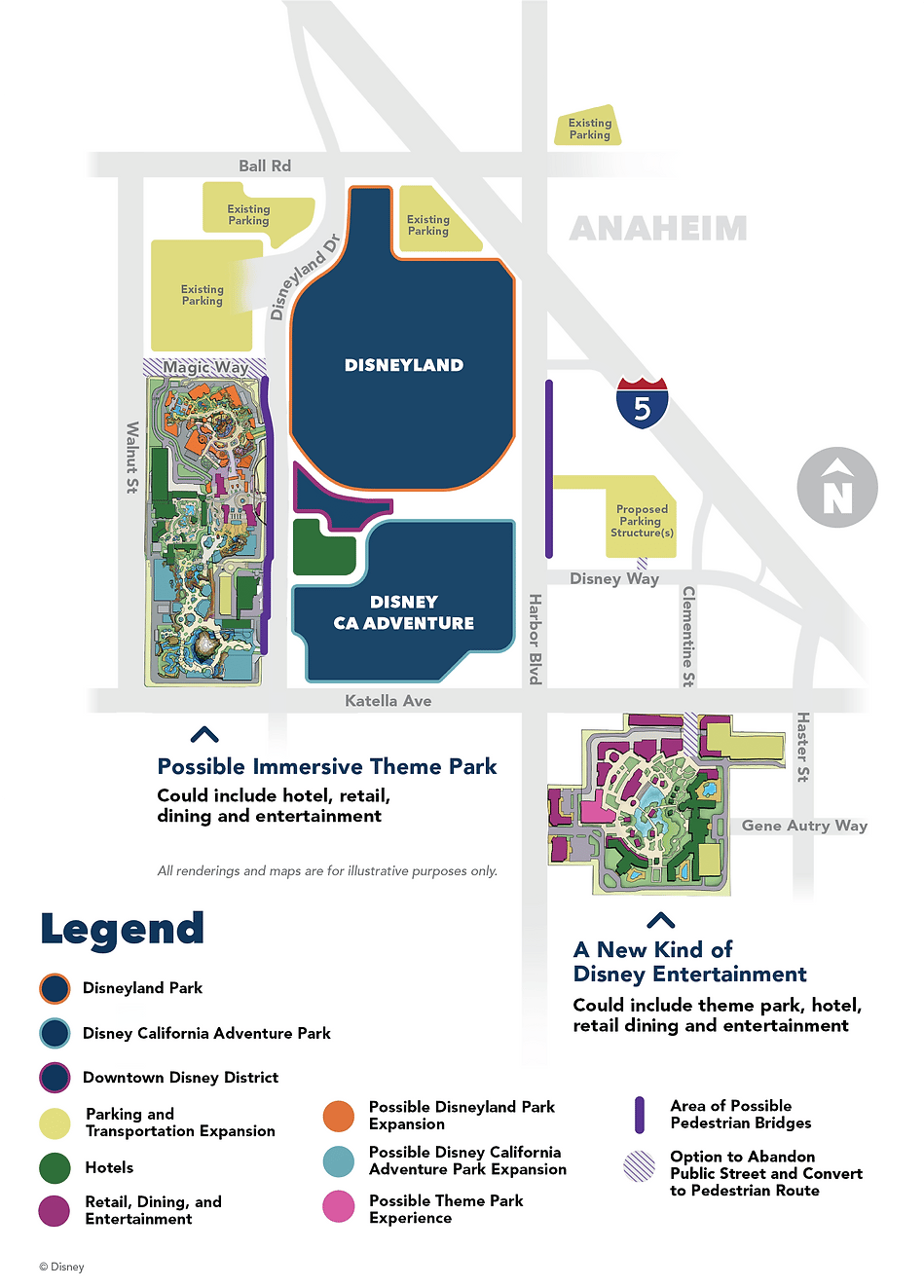

And Disney isn’t stopping. There’s a plan to invest $60 billion to expand parks over the next decade, $1.9 billion of which could be spent to grow Disneyland. Disney got approval this week to push this project forward and experiences featuring Frozen, Coco, Black Panther, Tangled, Peter Pan, Zootopia, Toy Story and Tron have been floated.

There are also two new cruise lines expected by the end of 2025 on top of the six operating today.

Experiences are the core for Disney and I think we can see near double-digit growth over the next decade. Better yet, there’s little chance of disruption given the scale of investment to compete.

As great as the parks and experiences are, the asymmetric potential for Disney is in streaming.

Linear Reality To a Streaming Vision

Today, Disney’s media bottom line is still dominated by linear TV, but it’s hard to deny how difficult this business has become.

In fiscal Q2 2017 media networks generated $2.2 billion in operating income. In fiscal Q2 2024 linear networks made just $752 million.

Let’s face it, we all know linear TV is dying, but who will make a transition to streaming?

The streaming smiling curve image above provides a good framework for thinking about the streaming business.

Companies that can reach scale in the top right corner of the smiling curve will be able to afford better content and attract more advertising dollars. That will translate to both more subscribers and more revenue per subscriber, which allows them to pay for better content, perpetuating the cycle.

The challenge is getting from here to there.

What we want to watch is:

# of subscribers

Revenue per subscriber

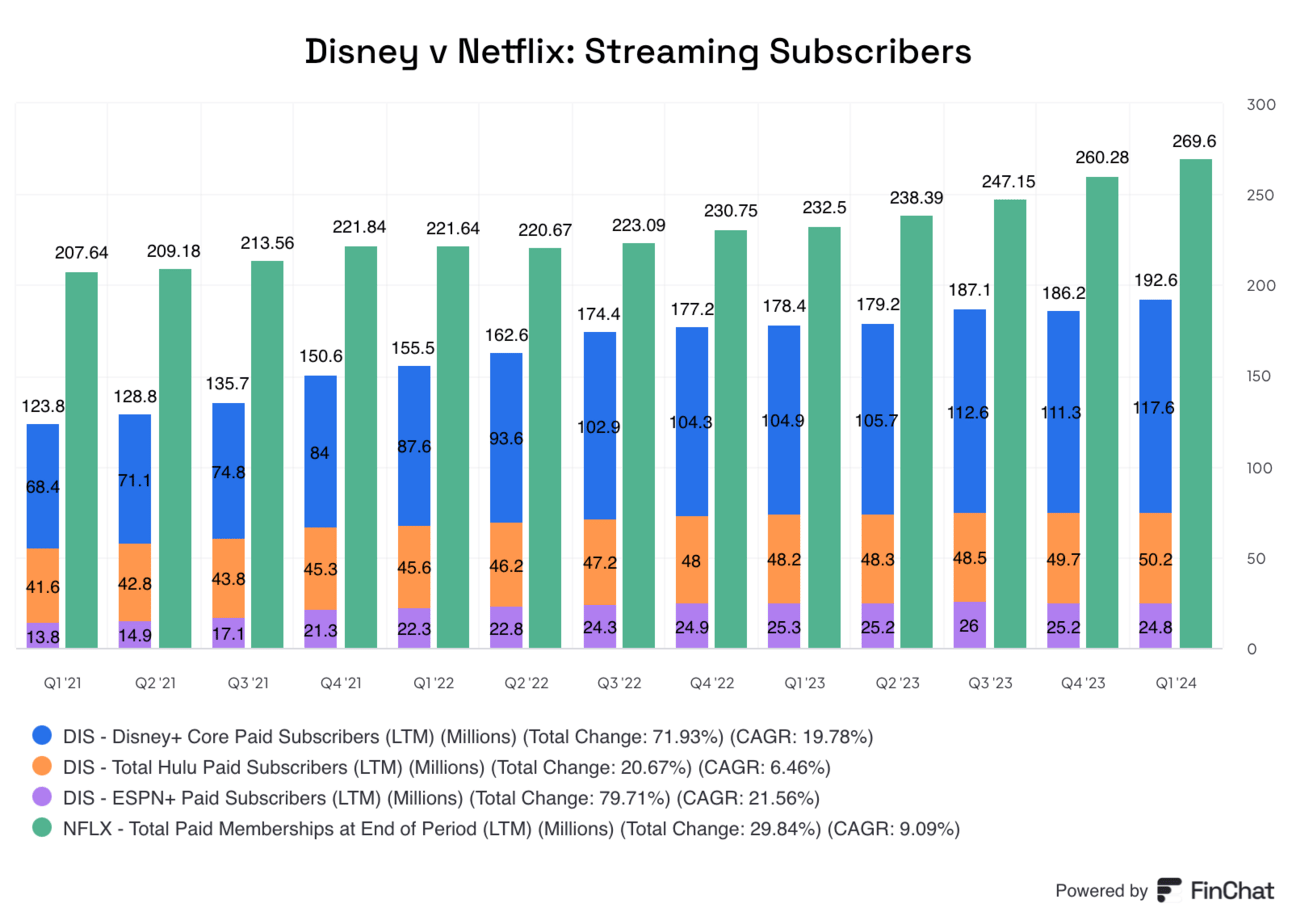

The chart below isn’t a perfect comparison, but it shows the scale Disney has already reached in streaming. Disney+, Hulu, and ESPN+ subscriber numbers are within striking distance of Netflix.

And revenue isn’t far off either. In the most recent quarter, streaming revenue looked like this:

Netflix revenue: $9.37 billion

Disney streaming revenue: $6.19 billion

Netflix is on top, but Disney isn’t far away and it’s pulling away from competitors.

The chart below includes the number of subscribers for competing streaming services and the listed price per month. A few caveats:

I’m only including Disney+ in this chart. Hulu and ESPN+ would add 50.2 million and 24.8 million subscribers respectively and Disney+ Hotstar has another 36 million subscribers.

Max reports 99.6 million subscriptions but this includes discovery+, HBO, HBO Max, Max, and premium sports products. Max-only subscribers are probably closer to 50 million.

Paramount+ is given away free with Walmart+ memberships, inflating their numbers.

When you take the streaming landscape as a whole, Netflix is clearly #1 and I think it’s clear Disney’s bundle of assets is #2. Peacock and Paramount+ are unsustainable and Max is…I’ll get to that in a moment.

ESPN Over The Top

The image above shows where we are today, but remember Disney wants to move up and to the right on the smiling curve.

A great way to do that is to incorporate streaming sports, like ESPN. We know an ESPN over-the-top product (which will be more extensive than ESPN+) will launch in fall 2025, which will have several benefits.

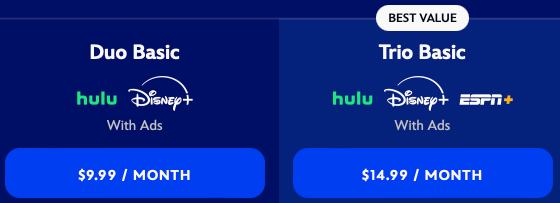

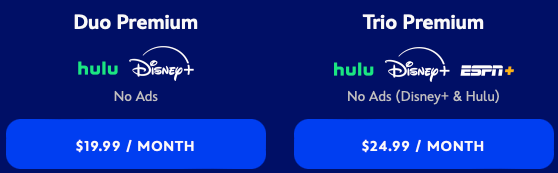

ESPN could be a success on its own, but the ultimate goal is to build a bigger bundle that will cause customers to churn less. You can see the current bundle offerings, which are compelling compared to ad-free Disney+ at $13.99/mo, Hulu at $17.99/mo, and ESPN+ at $10.99/mo.

The current version of ESPN+ isn’t particularly compelling, but the full ESPN over the top including college football, NBA, NFL, MLB, NHL games, and much more would be a huge addition to the bundle. I could see the trio price above go to at least $25/mo with ads and $40/mo without ads. Maybe even more!

Max Joins the Fold

We know the Disney+/Hulu/ESPN bundle will be the cornerstone with ESPN going over the top, but yesterday we learned Max is joining the fold too.

Beginning this Summer in the U.S., the streaming services will be offered together, providing subscribers with the best value in entertainment and an unprecedented selection of content from the biggest and most beloved brands in entertainment including ABC, CNN, DC, Discovery, Disney, Food Network, FX, HBO, HGTV, Hulu, Marvel, Pixar, Searchlight, Warner Bros., and many more.

The new bundle will be available for purchase on any of the three streaming platform’s websites and offered as both an ad-supported and ad-free plan.

Early reporting is that Disney will take a cut of any Max subscription sold through Disney bundles. Again, scale matters in this partnership.

Bundles can be sold on any of the platforms, but Disney+ has 117.6 million subscribers, Hulu has 50.2 million subscribers, and Max likely has closer to 50 million subs (after backing out HBO, discovery+, etc). I am willing to bet the number of people who bundle through the Disney platform outnumber the people who bundle through Max by 3:1 or more.

Disney was clearly the power player in these negotiations and Max will make Disney’s bundle stronger. Not coincidentally, the economics of any incremental sales or reduction in churn will disproportionately flow to Disney.

The Streaming Vision Will Take Time

We know what we’re getting with Disney’s experience business. But the upside for investors is Disney’s streaming business not only rivaling Netflix but becoming bigger and more profitable than Netflix over time.

Strategically, the pieces are falling into place. Disney+ and Hulu are in one app with Max coming this summer and ESPN next fall. The home of some of the most popular content in the world will live in the Disney+ app. And Netflix isn’t even competing with Disney in sports streaming (yet), leaving Disney to win the sports streaming market.

It’ll take years for the bundle to mature, weaker players to fall out of the market, advertising to grow, and costs to get in line with revenue. A question on the recent conference call about reaching double-digit operating margins in streaming was punted by Iger, but I think it’s clear that’s the ballpark we should expect in the future.

In 10 years, if Disney’s streaming business is in 250 million homes and averages $33 per month in revenue that’s a $100 billion business. That may seem like a stretch, but streaming is already a $25 billion/year business for Disney and that’s before ESPN goes over the top and before the impact of most bundles.

Take a long-term view and Disney is well positioned in parks and streaming. And that’s why it has asymmetric potential for investors.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium has a long position in all stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.