The market hasn’t been happy with Portillo’s over the past year and I think the blame squarely falls on two factors.

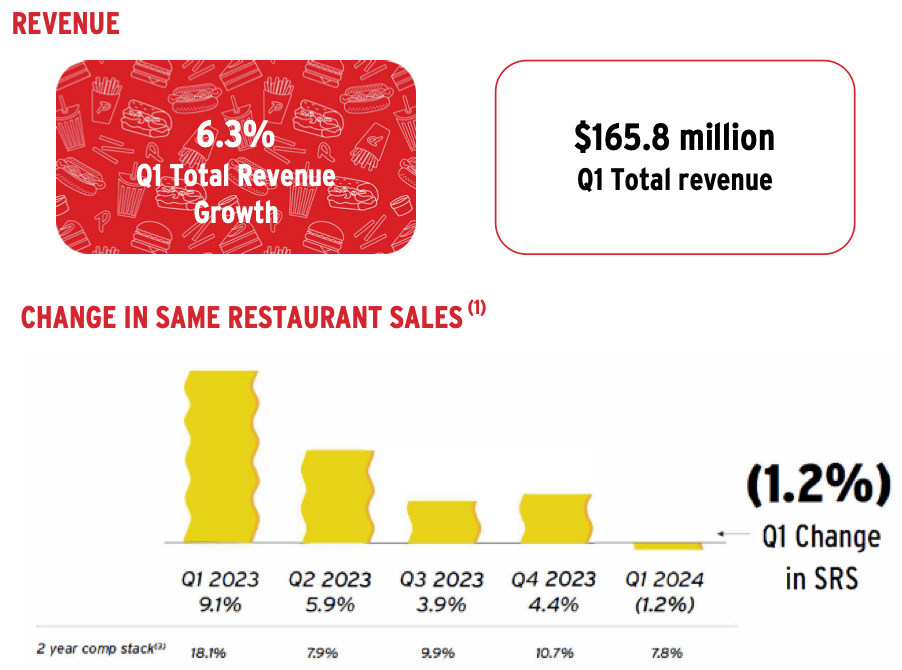

Same-store sales growth has slowed and was slightly negative in Q1 2024.

The stock was overvalued and is now falling closer to value territory.

On the second point, I ended the Portillo’s Spotlight article with this:

If Portillo’s can expand into new markets and generate in excess of $8 million in sales per restaurant, this could be a phenomenal stock over the next decade. I would like to get in at a better valuation, so I’m not going to over-allocate this month, but I hope to steadily build a position over the next few years.

Now that we have a few more quarters under our belts and the overhang from Berkshire Partners is nearly gone, it’s time to take a fresh look at Portillo’s and its valuation.

If you know Portillo’s or understand the cult following it has, you’ll see why I see this stock as an incredible value for long-term investors.

Restaurant Ups and Downs

Investors were focused on the declining same-store sales comp in the first quarter of 2024 and I never like to see a drop in sales. But this was a relatively modest decline and you can see below that the 2-year comp is up sharply and comps in general have been up and down.

The core question is whether or not Portillo’s has lost its popularity. I see no sign of that.

I do see signs that eating out has generally gotten more expensive and people are choosing less expensive options more often. Again, these are the ups and downs of the economic cycle, not a fundamental concern about the business.

Magin matters

The other factor investors are concerned about is commodity prices and how much any cost increase can be passed on to customers. You can see below that Portillo’s has seen immense margin pressure specifically from beef prices and commodities in general have been moving higher.

Prices haven’t kept up with commodity and labor increases recently but management is slowly raising prices.

During January and at the end of March, we increased certain menu prices by approximately 1.5% in each period. To offset the implementation of the FAST Act in California and in connection with our new sale of launch, we accelerated the pricing decision we would have made in Q2 to the end of March. These actions, combined with the lapping of previous pricing actions put us at an effective price increase of approximately 6% at the end of the first quarter. Subsequently, another 3% of prior year pricing just rolled off last week, which puts us at an effective price increase of 3% today.

But restaurants don’t want prices fluctuating daily, so they’re generally slower to raise prices than the speed of commodity changes.

I don’t see any structural challenge with prices or Portillo’s value proposition, but short-term investors can quibble about margins while long-term the ups and downs will even out, and Portillo’s will be able to charge enough to make a nice profit.

Berkshire Partners Exists Stage Left

One of the confusing aspects of Portillo’s has been the Class A shares owned by the public and Class B shares owned primarily by previous private equity owner Berkshire Partners.

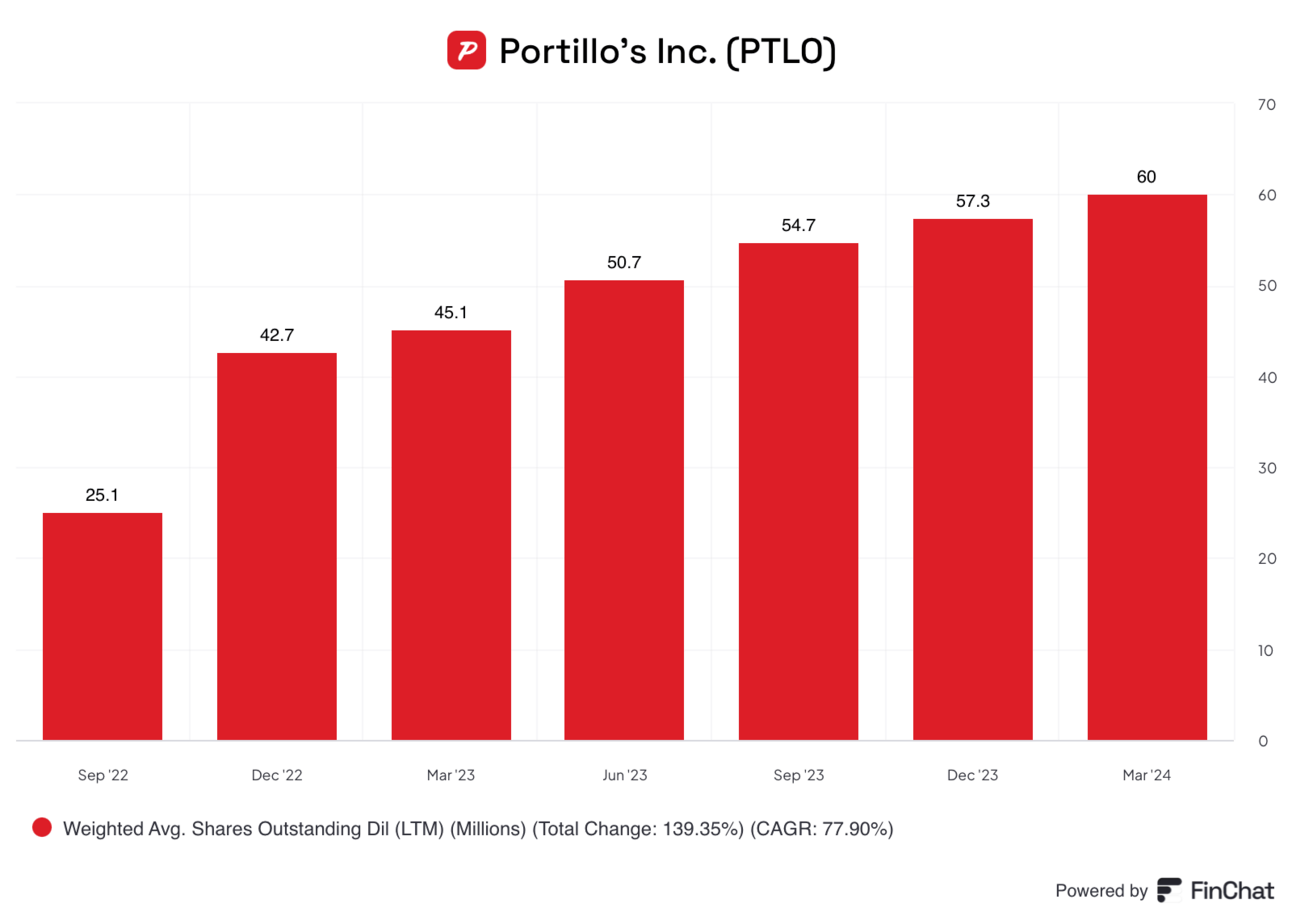

Most data firms (like Finchat below) only pull the Class A shares when looking at share count, which makes it look like management has been issuing shares like crazy.

In reality, they’ve been doing a synthetic swap of Class A shares for Class B shares. From the conference call:

I want to recap our recent secondary offering. This quarter, we completed the offering of 8 million shares of the company's Class A common stock at an offering price of $14.37 per share. All of the shares sold in the offeringrepresented Class A and B shares owned by pre-IPO members. We used the proceeds to purchase shares from Berkshire Partners, the private equity firm that acquired Portillo's in 2014, and subsequently sponsored our IPO in 2021. As of May 7, 2024, Class A shares represented 84.1% and Class B shares represent the remaining 15.9% of the 73.2 million in total outstanding shares. Since the IPO, there have been 4 secondary transactions, which have collectively reduced Berkshire's beneficial ownership to approximately 19.3% of the company from over 60% at the time of the IPO. Over this time, we've more than doubled our public float.

This is a look at the numbers from the earnings release.

Class A Common Stock: 61,561,592 on March 31, 2024.

Up from 55,502,375 at the end of 2023.

Class B Common Stock (Berkshire Shares): 11,640,555 on March 31, 2024.

Down from 17,472,926 at the end of 2023.

In reality, shares outstanding were up 0.3% in the quarter. Berkshire Partners only owns 15.9% of the shares outstanding, reducing a point of confusion and what I think was a big overhang on the stock.

By the end of this year, I could see Class B shares being eliminated.