Quick scheduling update before we get started.

Monday, November 3, before the market opens, I will publish my buys for November.

I will be on a 10th anniversary trip with my beautiful wife for most of the week, so publishing will be hit or miss. I will likely send a few earnings takes when I can to premium subscribers, but I will not be on the normal Thursday - Sunday schedule.

Chipotle’s sales are in decline.

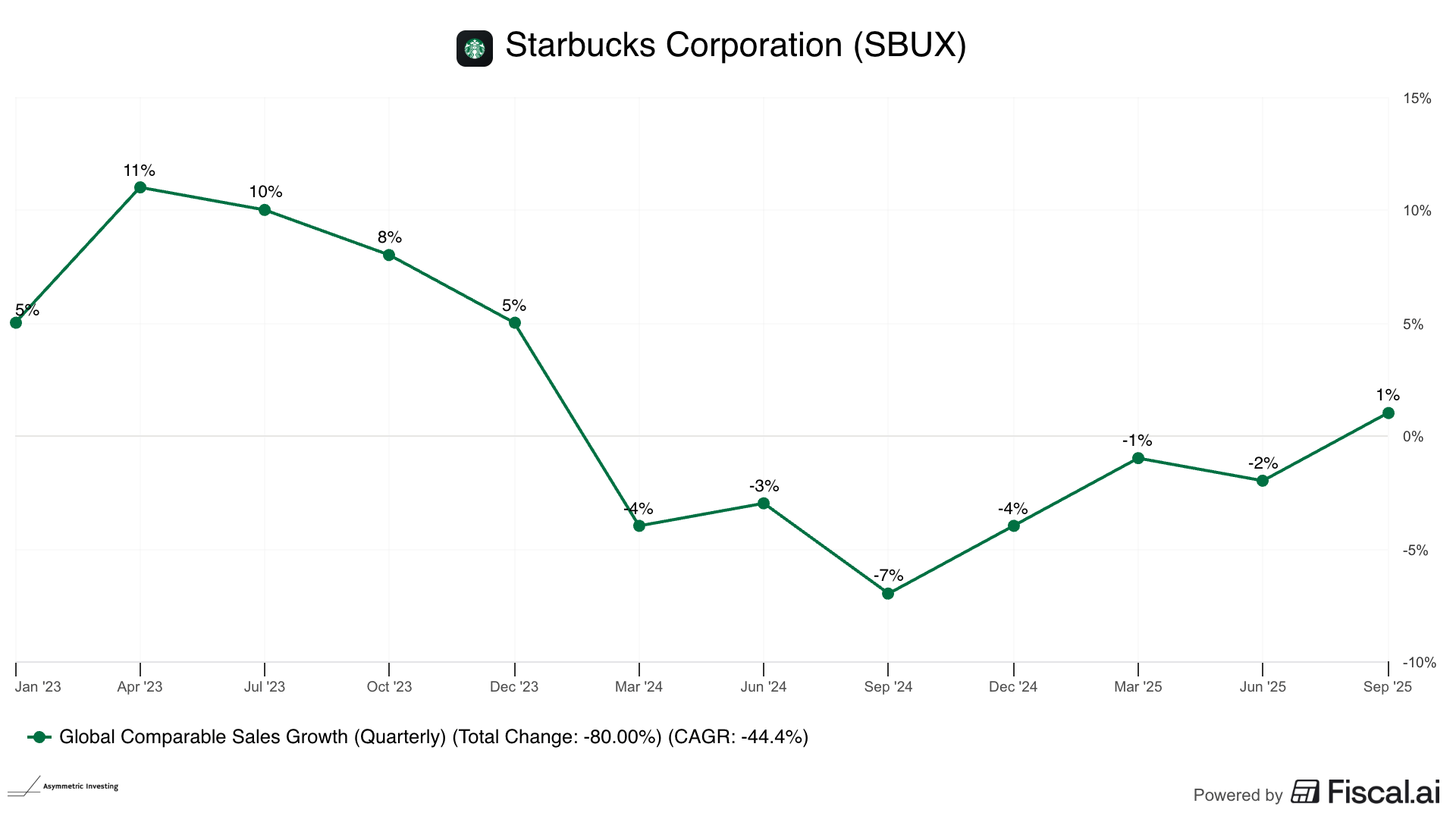

Starbucks is losing customers.

But steakhouses are crushing it?

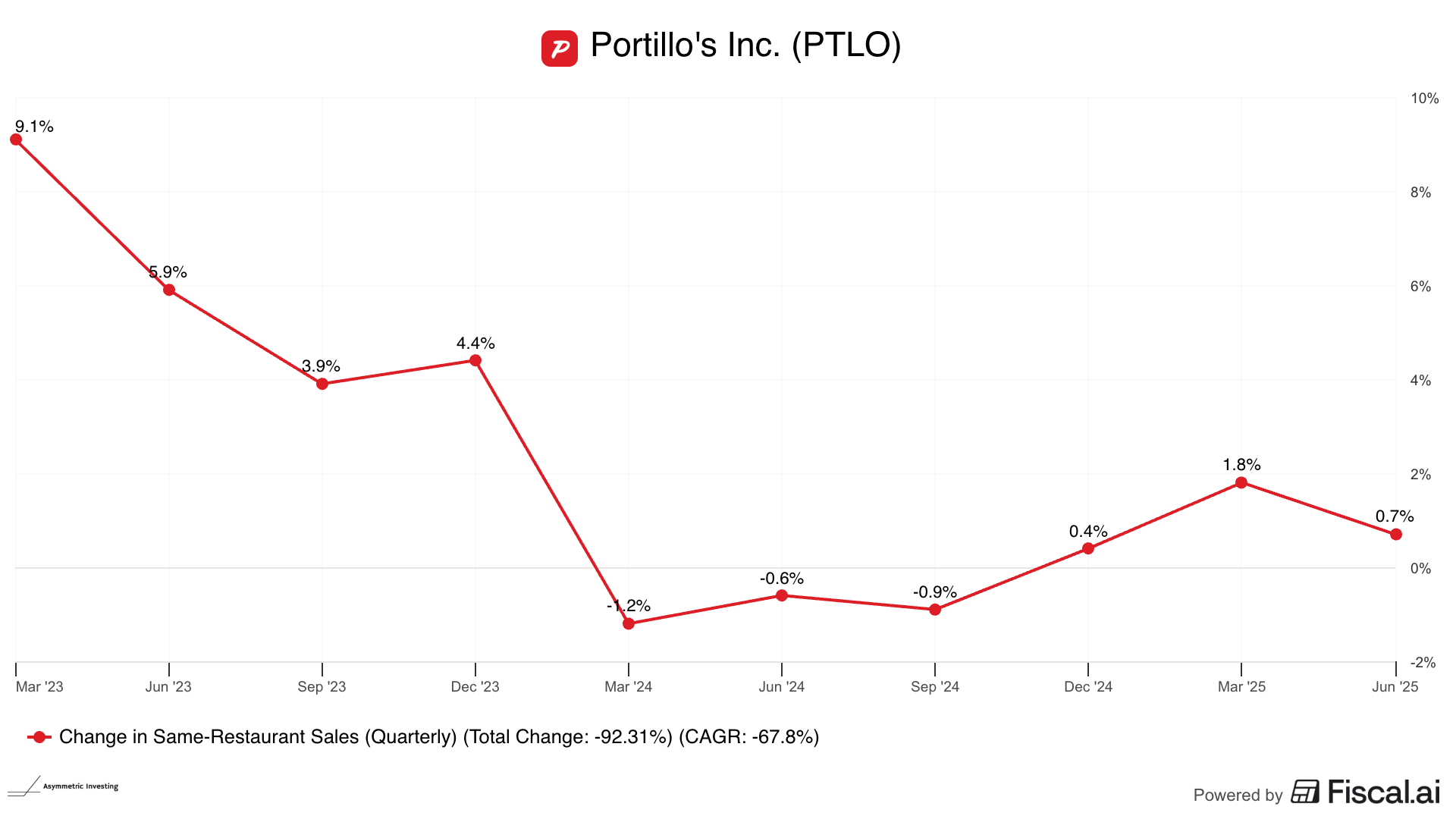

It’s hard to make sense of the restaurant industry today, and with a vested stake in understanding how consumer spending is trending and an investment in the struggling Portillo’s $PTLO ( 0.0% ), I am trying to figure out if there’s upside or risk in the industry.

More on that in a second. But first, the market ended up for the week and looks to be continuing its streak next week after a trade “deal” between the U.S. and China.

s

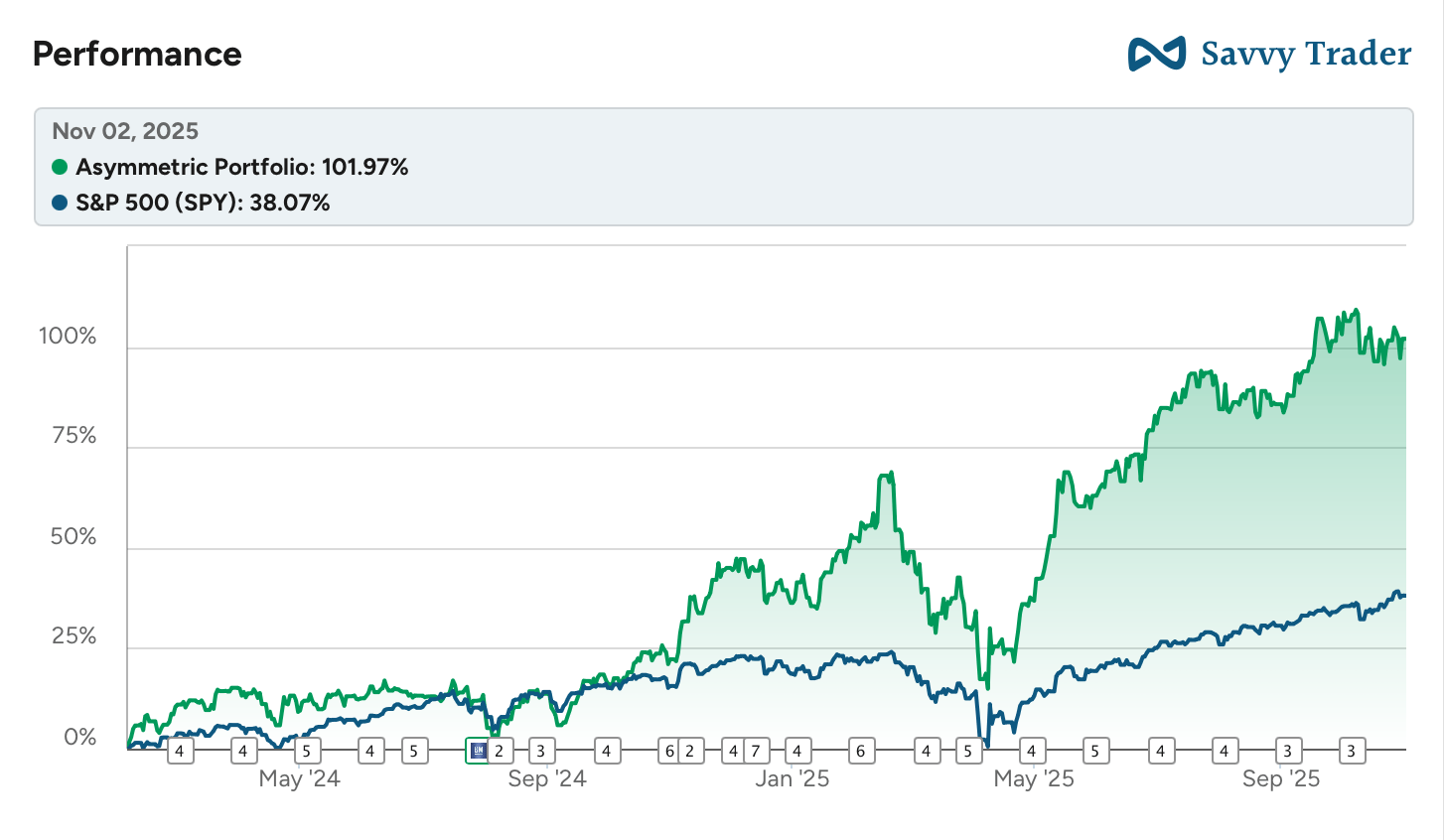

The Asymmetric Portfolio was up slightly, but this week the rubber really hits the road as earnings season enters frenzy mode.

In Case You Missed It

Here’s some of the content I put out this week.

Google: The AI King: We aren’t seeing disruption from artificial intelligence, and Google may come out even stronger than before the “ChatGPT Moment.”

MGM’s Ho-Hum Quarter: MGM’s quarter had some holes, but the long-term picture looks better than ever.

Zillow’s Quiet Dominance: The housing market is still struggling, but Zillow is taking share in all the right places.

The State of the Restaurant Industry

One of the more unusual segments of the market right now is the restaurant industry. I look at restaurants in part to see how consumers are behaving.

Are consumers trading up? Trading down? Spending more or less on each trip? Is there regional strength/weakness?

Sometimes, you can draw a clear picture of the health or weakness in consumers by looking at restaurants. Today, there seem to be contradictory things going on when you look at same-store sales trends at restaurants.

First off is Chipotle, which has long been a steady growth company but suddenly saw sales crater over the summer. Is this a Chipotle-specific problem or something bigger?

Starbucks is another former stalwart that seems to be heading in the wrong direction. Maybe consumers are getting weaker?

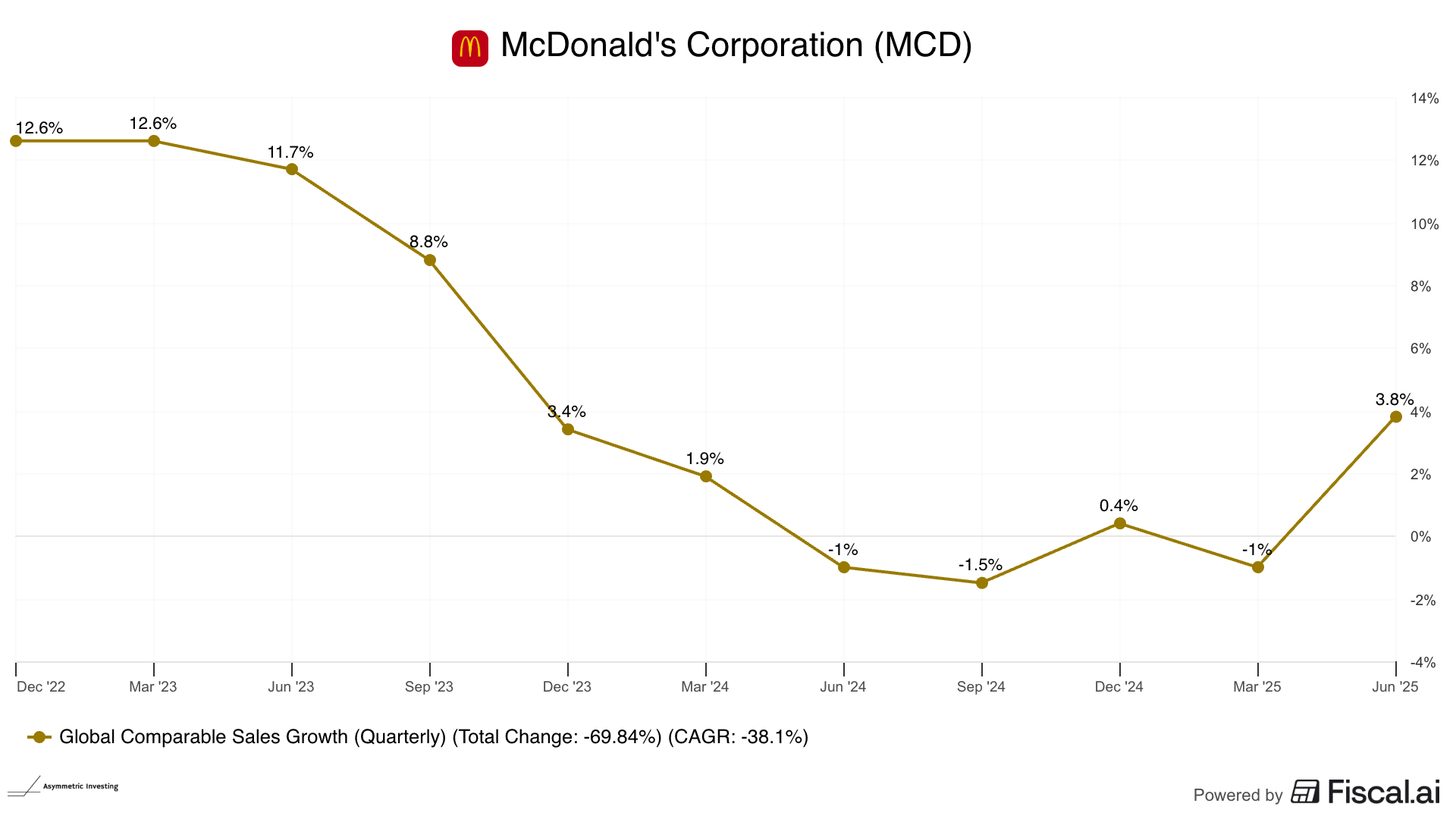

If the consumer is weak, it would make sense that McDonald’s would be seeing growth, as we saw in 2008 when same-store sales jumped 6.9% despite a deep recession. But that wasn’t the case until the last few months.

And Portillo’s, the one stock I own, appears to be struggling, but compared to the companies above, perhaps things aren’t so bad.

The story seems clear. Consumers have started struggling over the last 2-6 quarters, depending on the restaurant you look at.

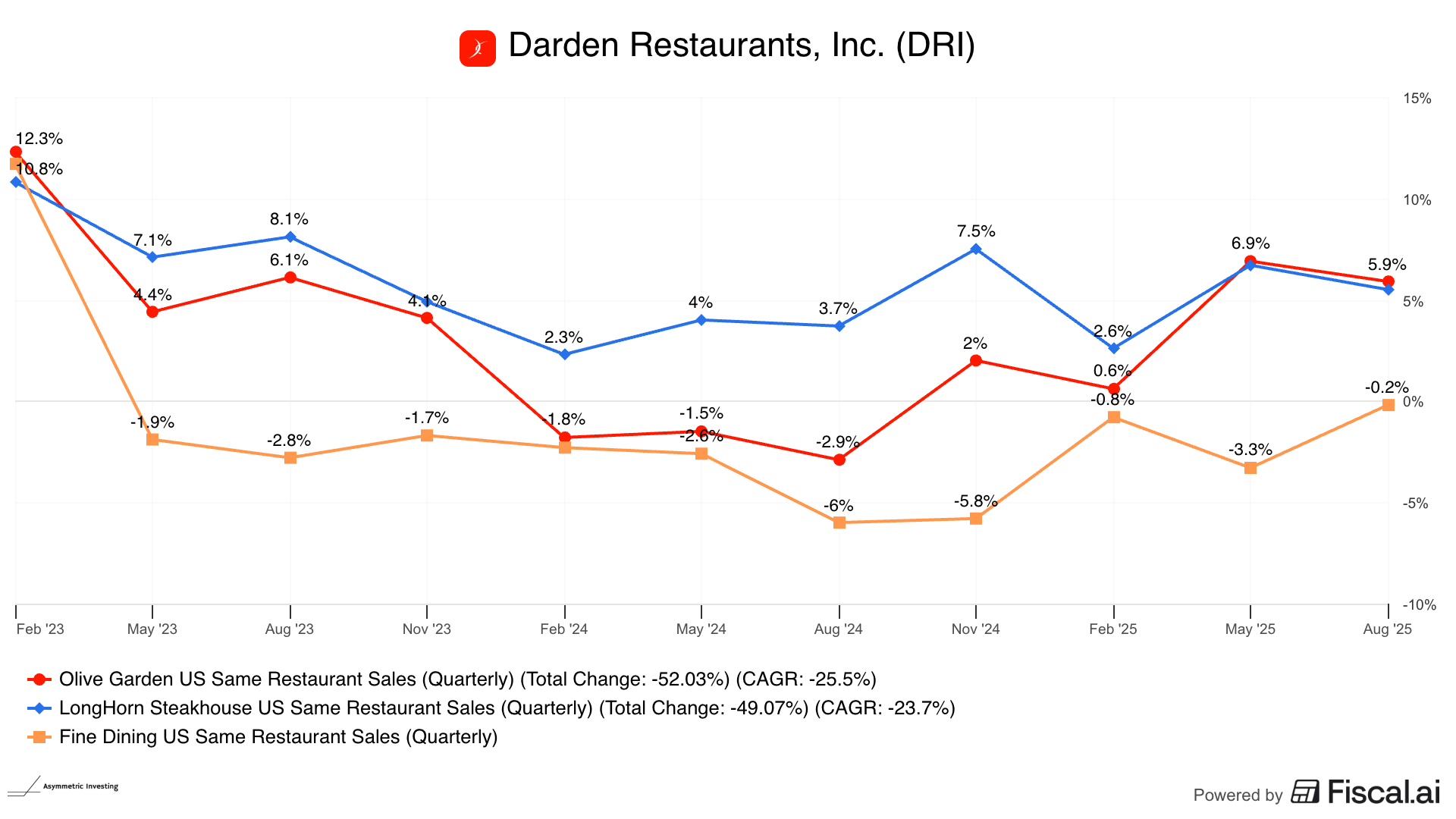

The downtrend makes sense until you get to Darden and some of the steakhouses, like LongHorn Steakhouse. It’s had mid-single-digit same-store sales growth for years, and it is outperforming every company I showed above.

Texas Roadhouse has been similar outside of the April quarter.

In general, it looks like restaurants have struggled a bit more over the past year as costs rose and consumers started to pull back their eating out habits.

But people are willing to spend more to go to a steakhouse…which seems contradictory to the struggling consumer narrative. And not every steakhouse is improving, as we see with Darden’s “fine dining” segment in decline.

There’s no consistent through line, which seems consistent with the consumer environment today. There are areas of weakness and areas of strength. Maybe that’ll mean a recession to some, but not a recession for the entire country/world, as we may have feared only a few months ago.

But if we start to see negative same-store sales comps across the board at restaurants, it’s worth paying attention to. And if McDonald’s is outperforming the market, watch out.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your research before acquiring stocks.