Earnings season starts for most of the market this week, so expect a few more fireworks than we’ve seen recently.

As for last week, stocks were up, but it was a strange ride because of a higher-than-expected inflation reading on Thursday, which I’ll cover below.

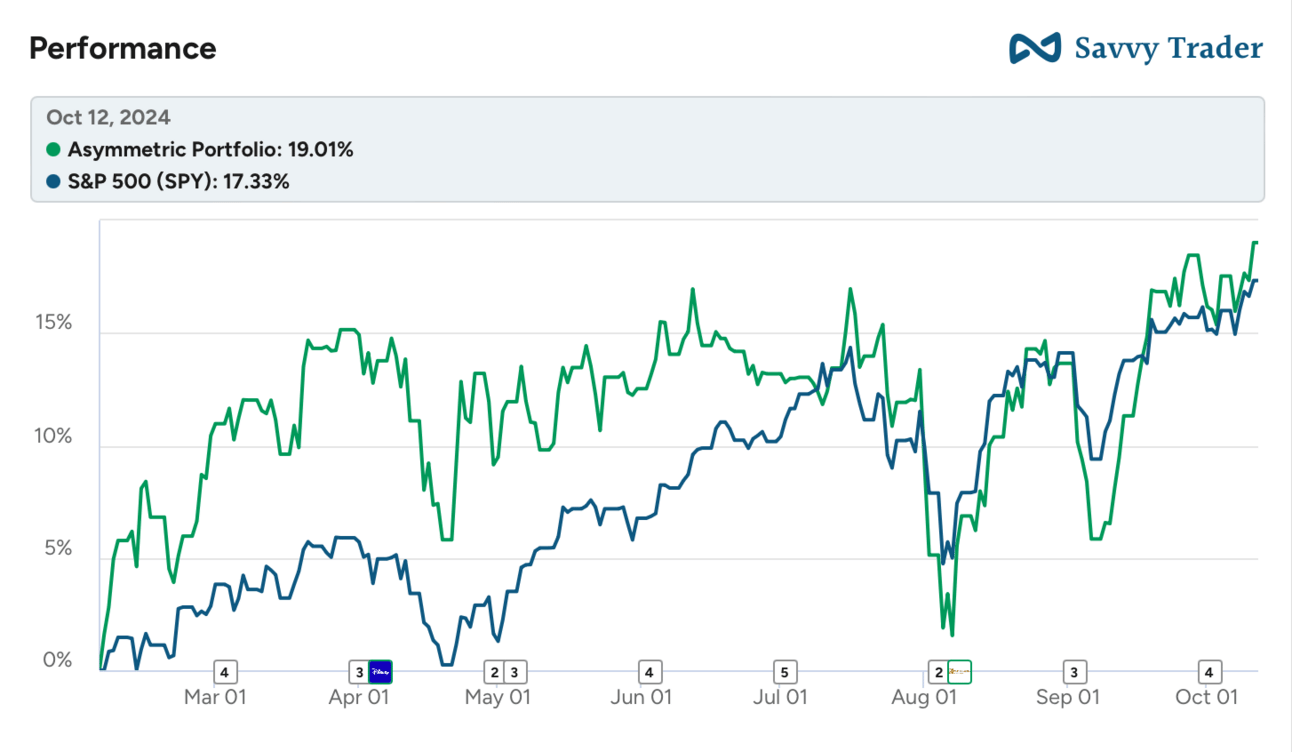

The Asymmetric Portfolio ended at an all-time high on Friday. I’m feeling good about the portfolio heading into earnings. Plenty of opportunity for upside surprises from beaten-up stocks and a steady pace of buybacks from the cash-flow companies that I think are undervalued. I will begin sending out earnings preview articles this week to premium members.

Asymmetric Investing is a freemium business model, which means the free version is made possible by ads like this one. Sign up for premium here to avoid ads and get 2x the content and access to the Asymmetric Portfolio.

Receive Honest News Today

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

In Case You Missed It

Here’s some of the content I put out this week.

GM Investor Day and Tesla 10/10 Preview: GM looks like it’s hitting on all cylinders in the core business and is up to the #2 market share in U.S. EV sales. But Cruise’s future is still up in the air.

Tesla Robotaxi Event Recap: What did we learn? Not much. What’s more important is the simple questions that Tesla didn’t answer.

Does the Spotify Story Still Have Legs?: Spotify is up 180% since I covered it in a spotlight article, but what’s the upside from here?

The Real Inflation Story

For the last two years, the stock market has been obsessed with inflation. The market dropped when inflation went up, and the Federal Reserve started raising interest rates. Stocks rose when it was apparent inflation was cooling, and interest rates would eventually come down.

I’m not obsessive about interest rates or the Fed, but it’s worth understanding how this dynamic works from a macro perspective. Interest rates will have an impact on how many cars are sold (GM), the pace of loan sales (SoFi), borrowing rates, and the extra money people have to take vacations (Disney and MGM).

I don’t think a basis point here or a basis point there is all that important, but directionally, that’s how interest rates affect the economy and earnings.

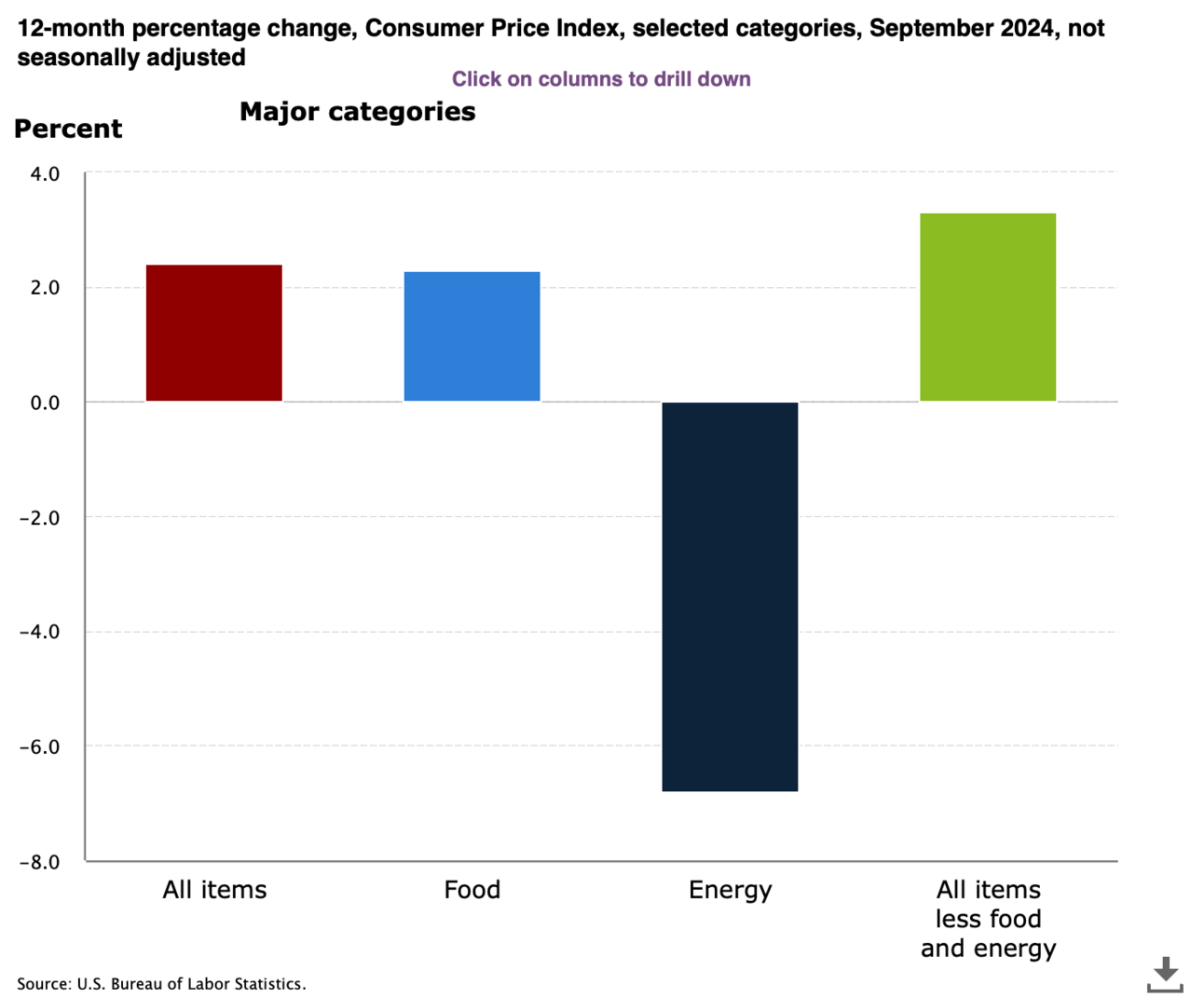

The headline number is usually what gets reported in the media, and by that metric, prices were up 2.4% from a year ago, slightly higher than the 2.3% economists expected. But here’s a breakdown of that number.

Headline CPI: 2.4% year-over-year increase.

Food: 2.3% increase.

Energy: 6.8% decrease.

CPI Less Food and Energy: 3.3% increase.

Here’s a visual look at September’s data.

The big takeaway is that falling energy prices are helping lower inflation. That’s great, but it’s also a bit of a band-aid on the prices we pay for goods overall. And it may not be sustainable.

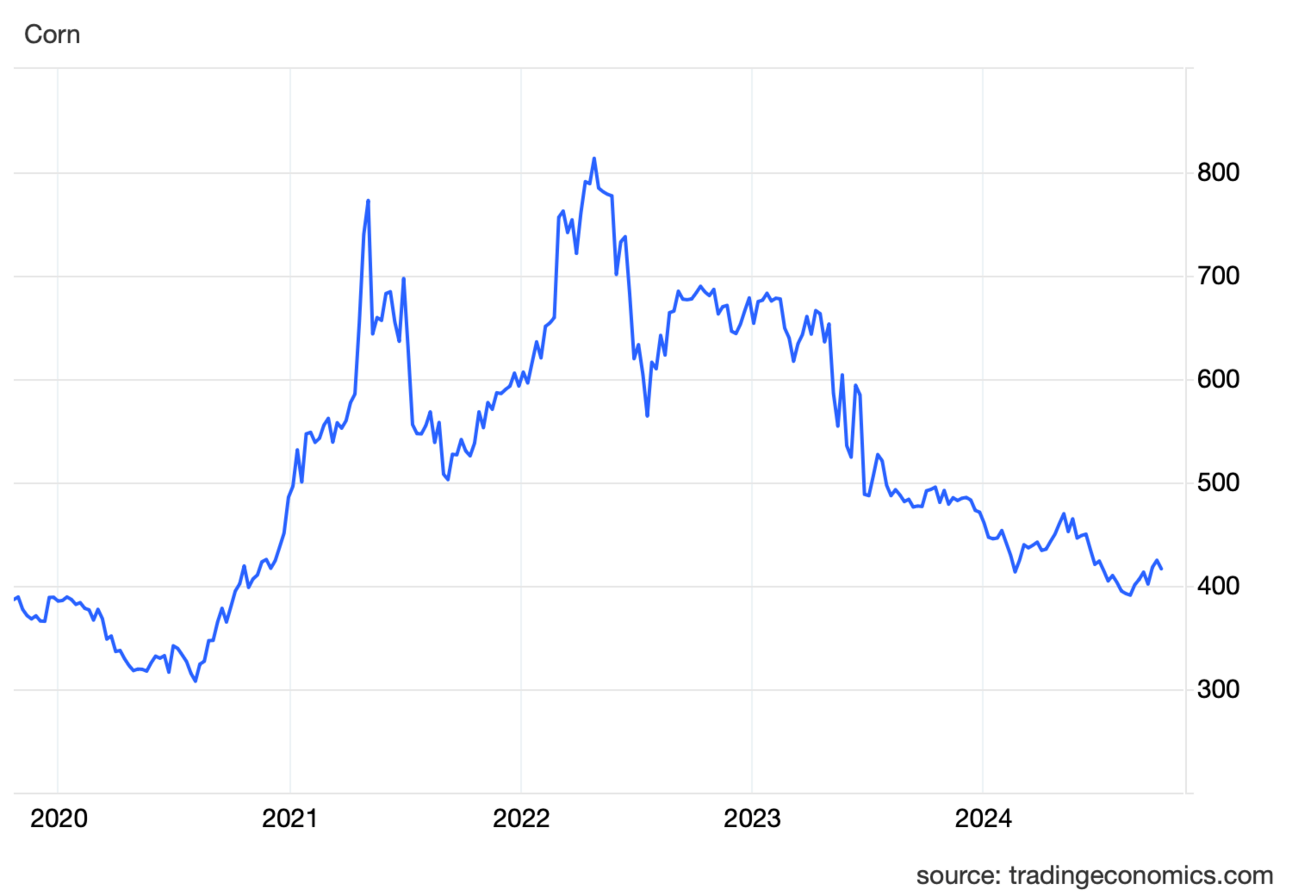

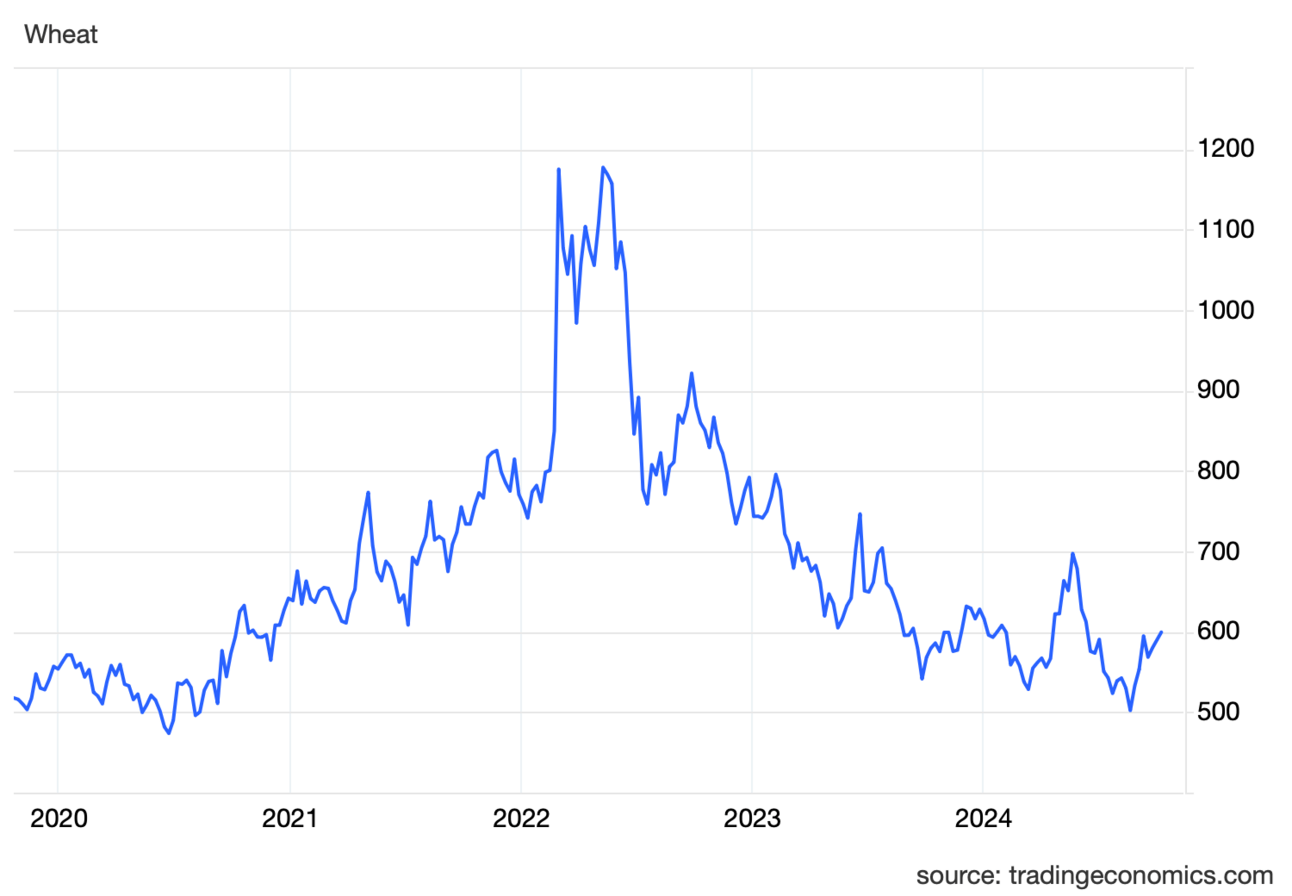

What I see here is that commodity prices are below headline inflation. Food falls into this category, and the jump in prices during the pandemic and now crash in prices after the pandemic is stark.

Here’s a look at the price of corn:

And wheat:

And soybeans:

Not every commodity follows this trend, but the big food ingredients do. And that’s one of the reasons you’re seeing prices fall at the grocery store.

It also makes me think the core inflation that’s driven by higher property values and labor costs may not go away soon. Those prices are much stickier than a fungible item like oil or corn.

The inflation story may not be behind us after all.

Why isn’t this bad?

We have to look at what’s driving prices for non-commodity goods and services higher. One factor is higher wages (putting more money in people’s pockets), but the more important driver is where goods are being made.

The U.S. is manufacturing more than ever and increasing manufacturing investment faster than at any time this century. Short-term, this investment will make prices higher than buying goods from China and India, but it will also make the economy more durable because the jobs exported over the last 50 years are now being imported.

For the market long-term, it’s better to have a healthier economy built on diverse industries from tech to services to manufacturing than outsource production to low-cost countries. Higher prices are the price we pay, and the market seems to be realizing the tradeoff is worth it.

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your own research before acquiring stocks.