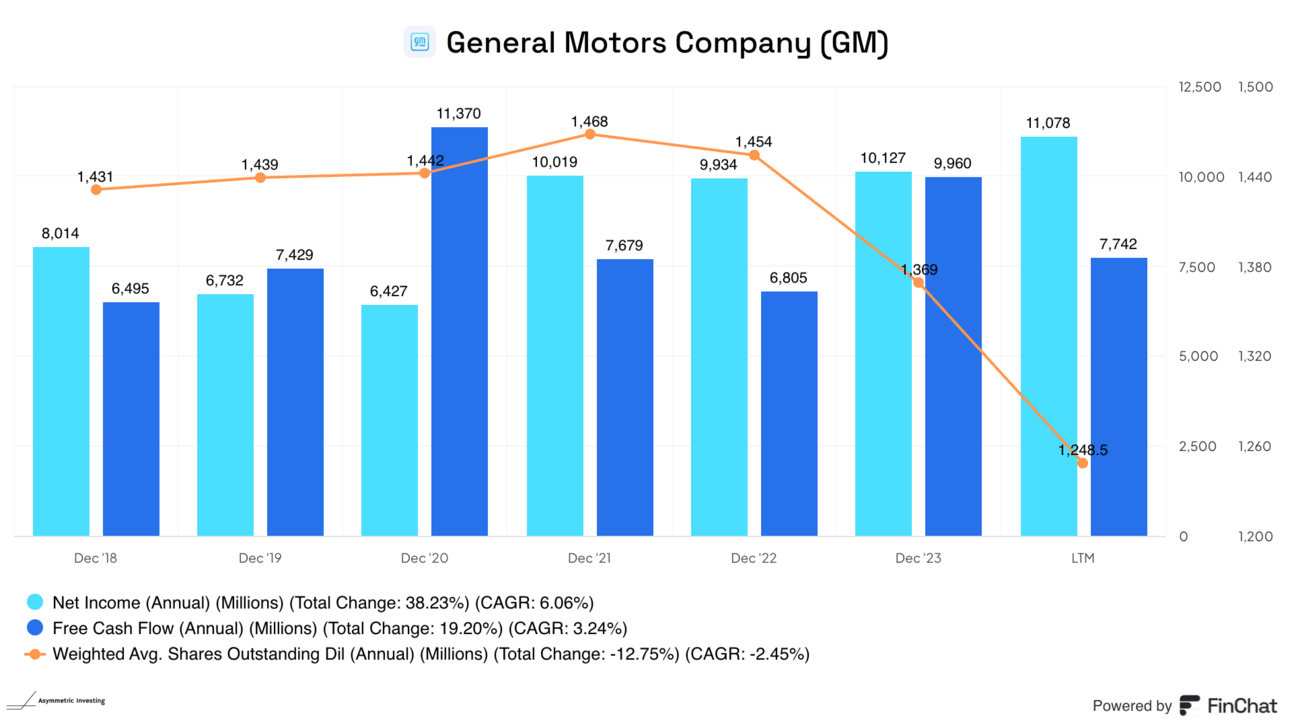

The battle between fundamentals and stories continues this week, with General Motors giving investors a peak into its manufacturing operations, pricing plans, and EV growth. If — like me — you think fundamentals eventually win, GM’s position as a leader in trucks and SUVs with less discounting than competitors, the #2 position in EVs in the U.S., and leading autonomous driving business is a good place to be.

Where GM and Mary Barra have always failed is telling a great story.

If you’re more into stories, the auto market storyteller is Elon Musk.

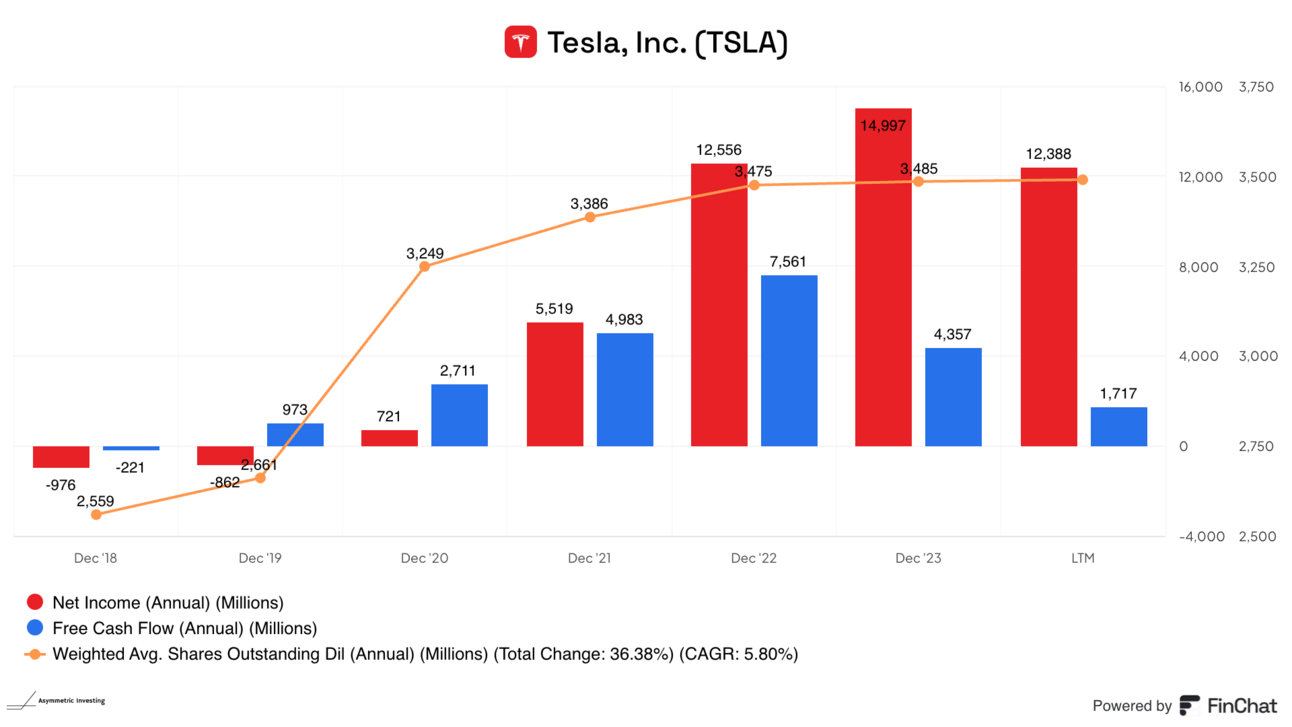

He’s convinced investors and the media that Tesla owns the future of autonomous driving (despite being years behind in many respects) and pivoted from the auto business being profitable to this being a robotics and AI company overnight.

Falling margins and free cash flow don’t matter if the story is intact.

Today, I want to lay out why GM’s fundamentals are where I’m putting my money and what I want to see from Tesla’s Robotaxi event.

Efficiency and GM’s Truck and SUV Dominance

The theme of GM’s Investor Day was showing off the company’s manufacturing operations and philosophy transformation. The buzz words were “winning with simplicity,” which sounds like corporate jargon until we see it in action. Evidence is mounting that simplicity is indeed winning.

I want to start with pricing and how GM is thinking about an increasingly competitive environment. During the pandemic, pricing power was in the hands of automakers, but now we’re more fully supplied, and automakers need to make decisions about vehicle supply and the prices they need to charge.

We’ve seen Stellantis (Jeep) and Volkswagen be two of the most aggressive in giving buyers incentives, and their financials have been hurt as a result. VW is even considering closing a German plant for the first time.

GM is holding a stronger line. In response to an analyst question about competitors discounting and whether or not GM will be forced to do the same, CFO Paul Jacobson said:

Well, I think, first of all, I appreciate the question, and I understand the sentiment that's out there. And every time somebody is trying to break out of a historical cycle, you've got to actually prove that the cycles are different this time, or you're going to behave differently. So what we've really been uniquely focused on is our product portfolio, and you look at the work that Mark and the whole commercial team that's here today is -- we're out there meeting customer expectations. So, rising incentive levels isn't something that's brand new, or is it going to hit us by surprise next year? They've been going up steadily over the last 2 to 3 years. But what's changed significantly is the pace at which that. I think historically, we would have probably matched that immediately and been out there in the market, but now what we're focused on is how do we just continue that steady demand and ultimately, price to it.

And that starts with great products. So we saw, at the beginning of the year, we saw Ford significantly kick up their incentives as they had a flood of pickup trucks come out. We kept ours consistent. We gained market share. We saw Stellantis start to make headway in their inventory burn down in the second quarter. What did we do? We kept ours pretty constant, and we picked up market share over that time period. So, I'm not saying that we're going to be able to do all of this flawlessly. Our incentives have gone up, too. But they haven't gone up nearly at the level of the industry, and that gap to industry average has actually been widening as we consistently bring our vehicles to market.

This was Jacobson’s stated strategy a year ago, but it seems to be holding. Discounts aren’t nearly as big as competitors, and that should help GM’s margins. We will see what Q3 2024 looks like, but early indications are solid.

One of the reasons margins may remain high is GM’s focus on simplicity over the past few years. And by simplicity, I mean literal simplicity in manufacturing.

2,700 unique part numbers were eliminated on the Equinox EV

10% reduction in Traverse and Lyriq parts

35% reduction in full-size truck and SUV trims, 60% reduction in selectable options, and 80% reduction in buildable combinations

These are just a few of the examples management gave of simplifying manufacturing operations. It sounds simple, but building that culture isn’t easy, and doing it while also designing great vehicles is no small task.

GM’s EV Transformation

More than half of the day was focused on GM’s electric vehicle business and software. It’s hard to distill that into a few words, but here are my takeaways:

GM is on track to sell 200,000 EVs in the U.S. this year

GM has the #2 market share in the U.S., with 9.8% of the market

EVs will be “variable profit” positive this quarter

Growth in EVs will result in $2,000 to $4,000 in cost savings for EV credits

What’s impressive is GM’s ability to build EV flexibility into its supply chain. It has battery manufacturing in-house through joint ventures, which offsets some of the risk, and assembly plants can produce EVs and ICE vehicles on the same line back to back. Wherever demand goes, GM can be there.

Margins could fall in the near term as the EV transition picks up, but what will be most important to watch is how EVs impact GM’s addressable market. 60% of GM’s EV buyers live on the coasts compared to 40% of ICE buyers. Non-GM trade-ins are also trending toward choosing EVs.

Maybe GM can hold share in ICE vehicles while using EVs to grow market share overall?

Asymmetric Investing has a freemium business model. Sign up for premium here to skip ads and get double the content, including all portfolio additions.

Trade Smarter with these Free, Daily Stock Alerts

It’s never too late to learn how to master the stock market.

You’ll receive daily trade alerts sent directly to your phone and email detailing the hottest stock picks.

The best part? There’s no cost to join!

Expert insights will be at your fingertips instantly.

Super Cruise Is Going Mainstream

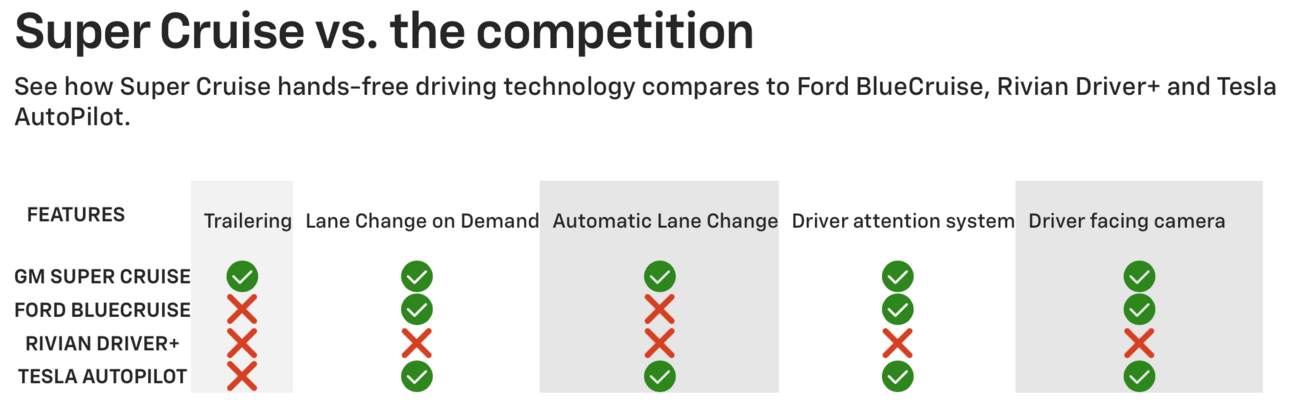

Autonomy continues to be an elusive unlock for most automakers, including Tesla, which has less than 5% adoption of FSD. But GM may have a small win with Super Cruise.

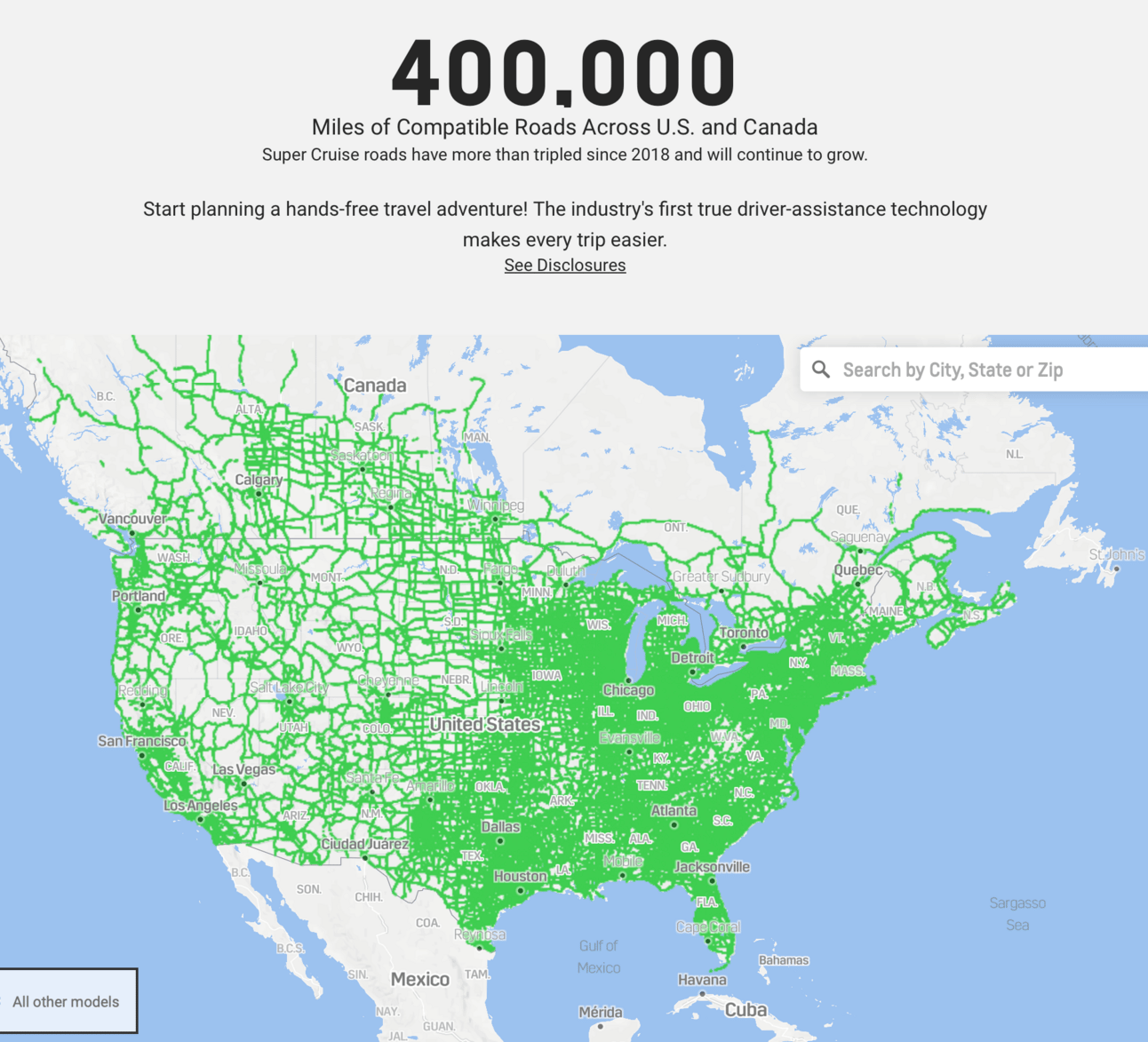

If you’re not familiar, Super Cruise is similar to Tesla’s FSD but limited to about 400,000 mostly highway miles in the U.S. Basically, GM maps the areas it can operate to increase the safety of the system.

Features are slightly more advanced than Ford and Rivian’s offerings.

And here’s a map of where Super Cruise can currently operate. It’s almost all highways.

While this isn’t a fully autonomous system and wouldn’t qualify as a “must have” for most drivers, it’s a compelling price point at just $25 per month compared to 4x that for Tesla’s FSD. I could imagine turning it on for a long road trip if not everyday driving.

Most Super Cruise-enabled vehicles currently include 3-years for free (which GM calls pre-paid), and then the subscription would move to monthly or annual plans. It seems nearly a quarter of customers find the product compelling enough to keep.

Taking our learnings from a Blazer EV, we've seen a major improvement in software quality. These innovations have rapidly increased the efficiency and rigor of software testing, catching 10x, 10x the number of defects in development and doing it earlier in the process. More importantly, this has translated into successful and timely launches of the Traverse, Acadia, Silverado EV, Equinox EV, Sierra EV, and Enclave. Our over-the-air capabilities will continue to allow for more consistent and regular software updates, including new features and functionality, and one of our most liked features is Super Cruise. As you recall, earlier this year, we announced that hands off, eyes on Super Cruise is expanding to 750,000 miles mapped. That's like traveling from the earth to the moon 3x or taking a coast-to-coast trip from New York to San Francisco and back nearly 130x. Super Cruise is a great product that makes driving easier, safer, and less stressful. GM customers have driven more than 280 million miles with Super Cruise engaged. Currently, we offer Super Cruise in 22 models, and we anticipate having more than 380,000 equipped vehicles on the road by the end of the year. But that's not it. We expect to double that number by the end of 2025. And today, we are generating recurring revenue streams by implementing 3-year prepaid service options plus tiered subscription plans. The data is early, but we're already seeing attach rates in the 20% to 25% range.

Autonomy will continue to get more attention in the coming years, with Level 2 systems advancing and Level 3 proliferating. Super Cruise is a compelling product that’s proving a business model that could be high-margin incremental revenue for GM in the future.

Cruise Gets the Stiff Arm

I was hoping to hear more about Cruise but wasn’t expecting a lot. Mary Barra said this near the opening of her comments, and this was as deep as the discussion was about Cruise:

At Cruise, Marc Whitten, an experienced leader at companies like Sonos, Amazon, Unity, and Microsoft, recently joined Cruise as CEO. In recent weeks, Cruise has begun supervised driving in Phoenix, Dallas, and Houston and recently commenced driverless testing in Houston, always gated by safety. We will continue to be disciplined with our investments in Cruise, and we'll provide more updates as we move forward, including updates on our ongoing discussions with potential partners. We have come a long way in a relatively short amount of time. Of course, a transformation as significant as this never happens in a straight line. We never thought it would. We've learned a lot along the way, and we've made adjustments, and we will continue to be agile and flexible as we move forward. Our goal today is to show you how we will continue to build on our growing EV strength and our ICE leadership.

I expect more when the 2025 Chevy Bolt is announced. There could even be a Cruise version without a steering wheel…

Tesla’s Robotaxi Event

Sometime this evening, Elon Musk will take the stage in Los Angeles to announce a Tesla Robotaxi. I’m going to be watching this closely for a few things:

Is there a plan to get to full autonomy (which Tesla doesn’t have today)

Tesla would need to start by testing FSD with a safety driver and report data to regulators

Where would a robotaxi launch, and what’s the regulatory timeline?

Is the vehicle legal (remember, GM canceled the Origin because regulators drug their feet approving its innovative design)

What’s the business model for customers owning a Tesla and putting it in the Robotaxi fleet

I come to the Robotaxi with plenty of skepticism because it’s a product that’s been promised for nearly a decade now, and Tesla still doesn’t have an autonomous system that’s capable of driving on its own without a safety driver.

But Musk does have the opportunity to demonstrate the company’s technology and show a viable business model.

I’ll be back tomorrow with reactions to the event.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.