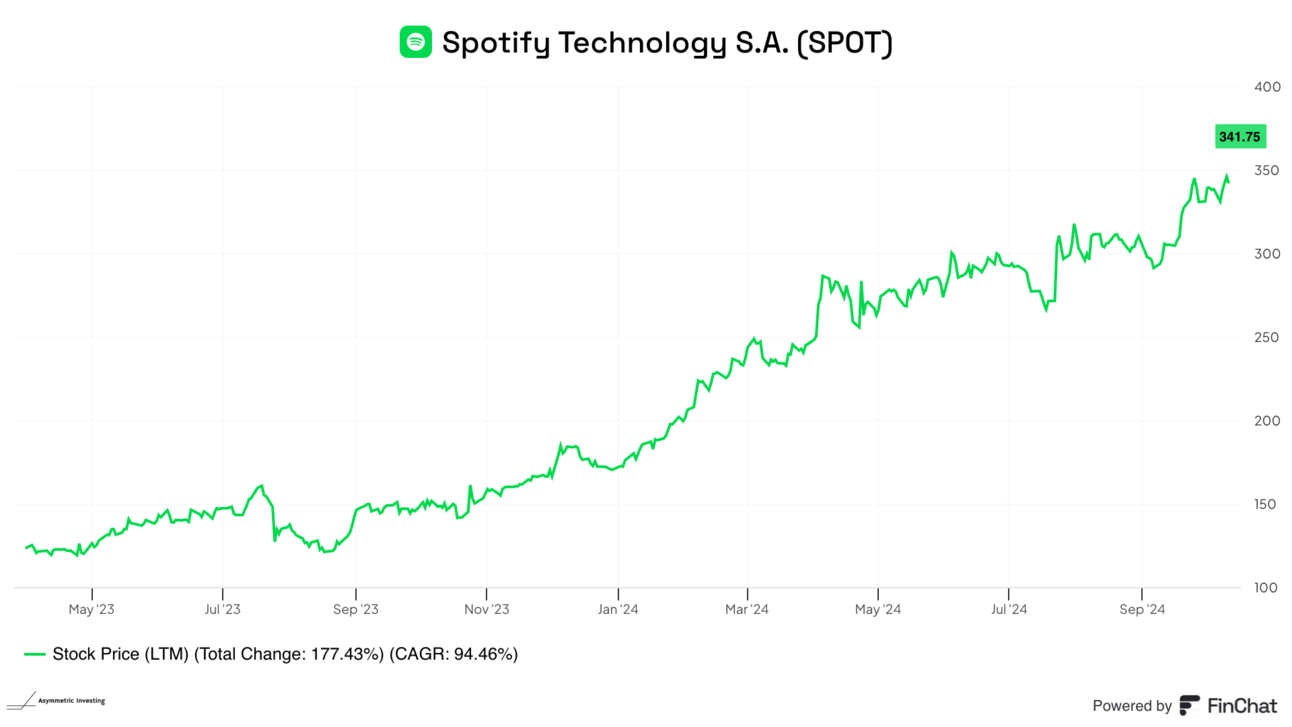

Spotify may be the quietest market outperformer I can remember. Over the past year, shares are up 139%, and the stock is now up 180% since the Spotify Spotlight was published.

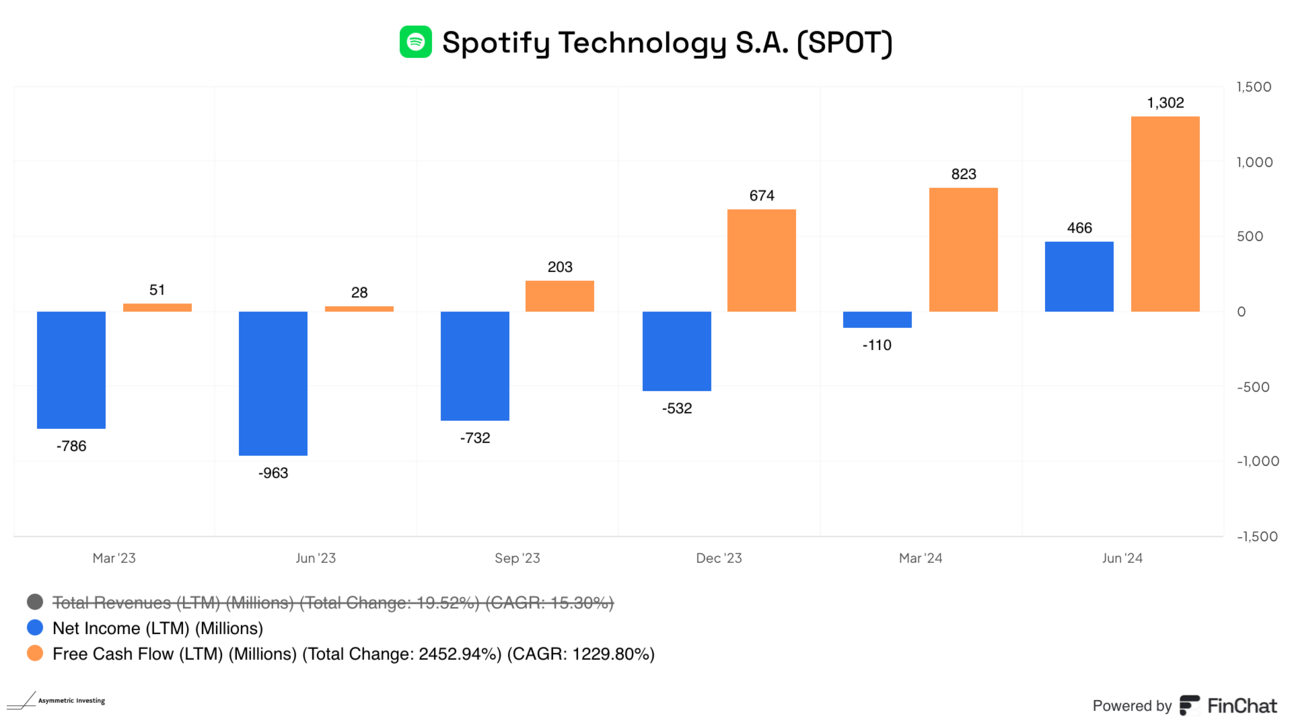

The reason for the performance is the company leaning into the leading position it had built in streaming music and exploiting the operating leverage of its digital business.

Spotify raised prices, in some places, more than once in the last 18 months.

Spotify cut operating expenses, particularly in sales and marketing.

The result was the financial inflection you see below.

While this bottom line performance is encouraging, it has limits. Spotify needs to license content, and gross margins in the music business will probably peak at between 30% and 35%. There’s more juice to squeeze, but not much.

Price increases have helped operating margins, but like gross margins, there are limits. Spotify probably can’t raise prices again for a year or two without facing a revolt.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Exclusive access to all premium content

- 1-2 company deep dives each month

- Timely updates on Asymmetric Universe stocks

- Asymmetric Investing portfolio (including trades before they're made)