Note: Premium subscribers can expect the updates originally intended for Friday and Saturday to be delivered on Monday and Tuesday. Sorry for the delay.

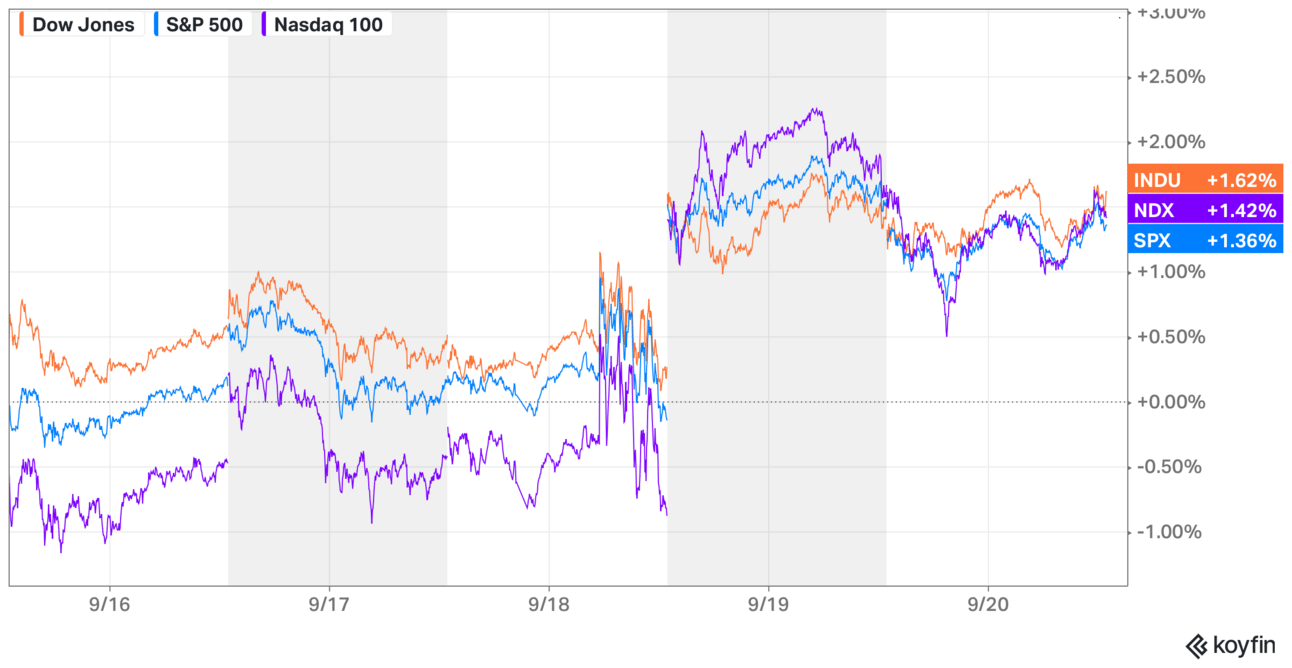

The Federal Reserve officially cut the fed funds rate, or short-term risk-free interest rate, by 50 basis points (0.5%) last week and the market initially reacted negatively before rallying on Thursday. I have explained why I don’t think rate cuts are all that important for long-term investors here, but the short-term move in the market was notable.

What I want to examine today is the impact of the market’s reaction on Asymmetric Investing. The Asymmetric Portfolio is back beating the market in no small part to this week’s rally. What’s working? I’ll get to that below.

Asymmetric Investing is a freemium business model, which means the free version is made possible by ads like this one. Sign up for premium here to get 2x the content, access the Asymmetric Portfolio, and avoid ads.

Quickly identify market opportunities w/ the #1 A.I. for asset selection.

In Case You Missed It

Here’s the content I put out this week.

The Danger in Perfect Product Market Fit: AI is the perfect product for Silicon Valley’s elite. And that may be driving a bubble.

My Interview on Chit Chat Stocks: I sat down to talk EVs and Rivian with Brett and Ryan of Chit Chat Stocks.

Motley Fool Money Interview: I talked Crocs on Motley Fool Money this week. The pertinent section starts at 18:41.

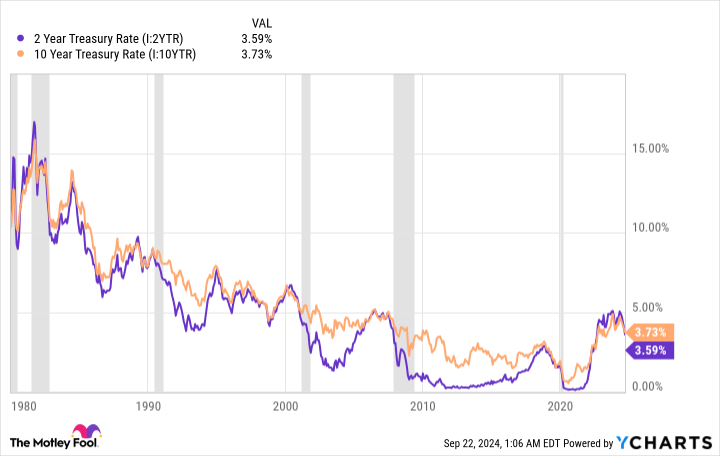

Rate Cuts and the Market

For context, the downside of rate cuts is they normally indicate a recession is coming. The chart below shows the 2-year and 10-year rates in the U.S. since 1980 and corresponding recessions. Will the same trend follow this time around?

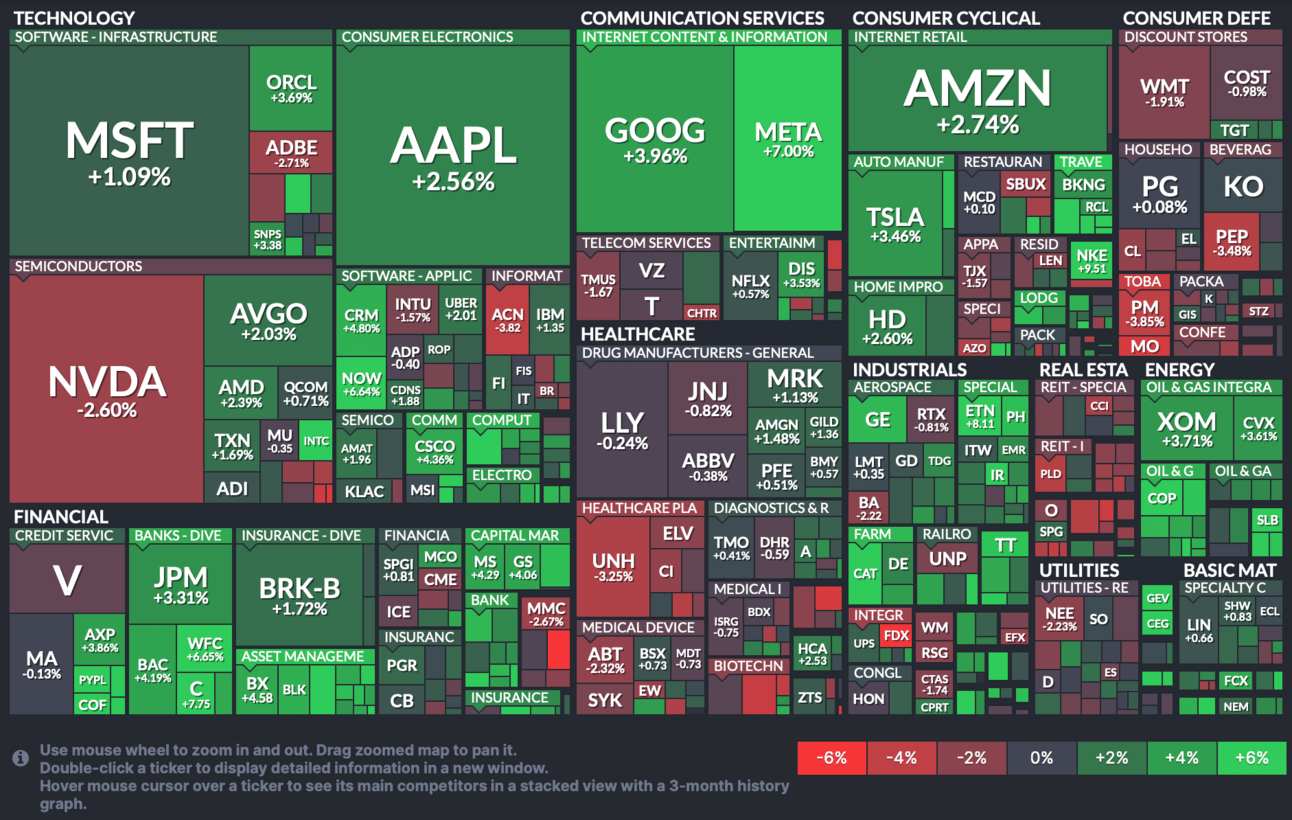

The recession concern is important for the Asymmetric Portfolio because it’s caused concern about the overvaluation of some high-flying stocks. NVIDIA, Adobe, and Visa are just a few of the stocks that dropped this week despite the market rising. Meanwhile, value plays like oil stocks were up and bank stocks rose.

I’ve stressed on the Asymmetric Portfolio that I want to buy great companies, but I also want to pay an attractive price. NVIDIA trading for 30x or 40x sales isn’t an attractive price, no matter how amazing the business is.

I would rather buy General Motors at 5x earnings and get Cruise’s upside for free.

Or Spotify when the market had left it for dead.

Or buy Celsius when it’s trading for 30x earnings and still growing.

Even On Holding was relatively inexpensive when I was buying, despite expecting to grow around 30% per year for the foreseeable future.

Some of the moves last week were a flight away from hype to stocks that looked like a value. That trend will be good for the Asymmetric Portfolio if it continues.

Short and sweet. I’ll be back with more next week.

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.