Note: I am writing this as a “strong opinion, loosely held”, as Jeff Bezos called it. I’m documenting my thinking about artificial intelligence technology and business models today and reserve the right to change that opinion in the future.

We all tend to over-index on our own experiences. As Morgan Housel said:

Your personal experiences with money make up maybe 0.00000001% of what’s happened in the world, but maybe 80% of how you think the world works.

I can’t help but think that’s happening today in artificial intelligence. Silicon Valley is full of two kinds of people — computer programmers and investors — and both see incredible value in AI.

The view makes sense on the surface. If I’m a computer programmer and I’m 50% more productive with AI, EVERYONE is going to be 50% more productive with AI….right?

Maybe. Eventually?

But what do we know for certain?

After all, there are hundreds of billions of dollars being invested in artificial intelligence businesses with very little known payoff today.

I’m worried that AI has found the perfect product-market fit with a niche of users in the most valuable industry in the world and investors who control the most money in the world, which inflates the value they think AI will create.

How these AI leaders think the world works may be very divorced from how the world works.

And there’s precedent for over-fitting to early product market fit.

The Perfect Product Market Fit

Two of the most successful product launches in the history of technology were Twitter and ChatGPT.

Twitter was such a perfect tool that management spent all of their time trying to keep up with demand rather than figuring out what Twitter’s business model was.

As it turned out, it was a perfect product with no business model. Twitter was great at raising capital because it had all of the talking points investors wanted — user growth, data, engagement, and mind share — but none of the revenue or profits to back up the money it raised. Elon Musk’s $44 billion buyout didn’t turn the business around and banks are already writing down billions of the $13 billion in debt he took out. If banks — who are at the front of the line in the case of bankruptcy — are writing down Twitter’s debt, the equity may already be worthless.

Twitter is a warning. Perfect product market fit doesn’t equal a great business.

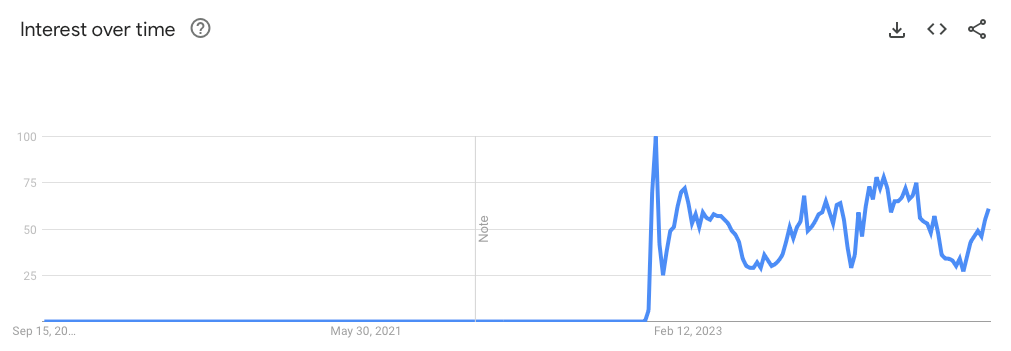

ChatGPT hit the scene in late 2022 and hit 100 million users in two months, faster than any other product in history. It had a perfect product-market fit…and no business model.

Since then, interest has waned.

OpenAI, the company behind ChatGPT expects to reach $3.4 billion in revenue this year, so there’s a business there, but reports are the company will burn through $5 billion on operations and is looking to raise another $6.5 billion at a $150 billion valuation.

✅ Product Market Fit

❓ Business Model

Something seems amiss.

Asymmetric Investing has a freemium business model. Sign up for premium here to skip ads and get double the content, including all portfolio additions.

The Rising Demand for Whiskey: A Smart Investor’s Choice

Why are 250,000 Vinovest customers investing in whiskey?

In a word - consumption.

Global alcohol consumption is on the rise, with projections hitting new peaks by 2028. Whiskey, in particular, is experiencing significant growth, with the number of US craft distilleries quadrupling in the past decade. Younger generations are moving from beer to cocktails, boosting whiskey's popularity.

That’s not all.

Whiskey's tangible nature, market resilience, and Vinovest’s strategic approach make whiskey a smart addition to any diversified portfolio.

Product Market Fit, Fundraising, and Business Models

The “success” of AI today seems to be indexed to the product market fit Silicon Valley sees and the fundraising being thrown around.

OpenAI had an early product market fit, at least for users wanting to test the product, and raised $10 billion last year at an $80 billion valuation. Now, it’s looking to raise more funds at a $150 billion valuation. That funding indicates success, but the business model that’s burning capital as fast as it can raise it tells a different story.

Twitter had an early product market fit and raised $205 million in 2010 and $1.28 billion in 2011 before a 2013 IPO. However, the company was never consistently profitable and was a laggard in the market for a decade.

Will OpenAI follow Twitter’s disappointing fate?

Are we over-indexing to LLM success in certain areas just like we over-indexed to Twitter’s early user growth and fundraising success? All before AI figures out a real business model.

One worry I have is the early investors and users are also perfectly suited to artificial intelligence’s current capabilities, but may not be suited to assess its long-term potential.

Current LLMs are incredibly good at creating code because they can be trained specifically to code and can then generate code at a rapid rate. Since there’s a “right” and “wrong” answer, the AI can learn and iterate to solve problems at a pace humans simply can’t with a wider range of knowledge than any single programmer.

When asked to explain something to an inquiring mind, the same great coding LLM will write a paragraph that sounds like it was written at 2 a.m. by a 9th grader. Product market fit isn’t there for writing, graphic design, presentations, and even responding to emails.

Product market fit in one area doesn’t extend to product market fit in another.

I couldn’t get this quote out of my head last week:

I think everyone is talking about trying to figure out GenAI use cases within companies, but the reality is that very few are using it en masse today other than there's a lot of technology-focused companies. But I'm talking brick-and-mortar large enterprises across the world.

If big, brick-and-mortar enterprises aren’t finding use cases for AI, the market may not be what investors currently expect.

Estimates today are that less than 2% of Microsoft’s users have upgraded to Copilot, the OpenAI-powered AI assistant. That’s…unimpressive.

Over-Indexing On Personal Experience

I listen to a lot of podcasts and videos from smart people about artificial intelligence because I want to understand what I don’t know. They often end up with a discussion about how great it will be to have a super smart personal assistant powered by artificial intelligence.

But I as a human, I can have a smarter model locally and then I could opt it into maybe Apple will just make it easy. They'll say, okay, you can have cloud super intelligence or you could have cloud intelligence. And I pay $60 a month for cloud super intelligence now or whatever it is. $1,000 a month, $10,000 a month, what did you pay for that? And so I have 20 points of IQ on my phone relative to a lot of people, and then I paid $10,000 a month for cloud and super intelligence, hyper intelligence, superintelligence, just $1,000 a month, then regular intelligence is $20 a month.

First, how many people have $10,000 monthly to spend to be a little smarter? A VC in Silicon Valley? A high-skill computer programmer?

Sure.

What about the factory worker in Ohio?

The server in Dallas?

The housekeeper in Minneapolis?

Nurses? Truck drivers? Dock workers? Retail workers?

The world in which people will pay large amounts of money to be a little bit smarter is small. But the people who would see that kind of product market fit and financial benefit would be concentrated in Silicon Valley. No wonder the Silicon Valley CEOs and VCs are so excited about AI.

What if we take a step back?

Why is the iPhone such a successful product?

Did it make people smarter? Maybe. It brought the world of information to our fingertips.

What do real people use their iPhones for every day? They scroll Instagram endlessly or play pointless games to kill time.

Let’s not overthink this.

Most people aren’t dying to be 20% more productive at work.

Here’s another quote from the BG2 podcast (which is fabulous) and it’s Altimeter Capital founder Brad Gerstner talking about how he thinks about AI assistants. The transcript is from YouTube and if you want the full context the podcast link is below.

I talked about this I mean and listen, I think open AI open the kimono a little bit I think they're further out in front than they've revealed. But you know again I come back to this idea that I'm really lucky out here my my assistant Brit she's been with me for 15 years she knows me longitudinally my likes my dislikes my family everything about my kids everything about hotels I've stayed at rooms I want to stay at, etc so my expectation of her is that she can take offload a lot of that because she has all that prior history right and um but if every human had that exactly you think about the productivity unlock for humans if you give that for free to every human in their pocket

This use case is incredible because it’s so unrelatable for 99.99% of the population. I’ve never had an assistant. I’m not picky about the rooms I stay at when I travel. And my wife and I shop for my kids ourselves. We can’t “offload” our lives to someone else.

But if you’re a high-powered executive or a VC with an assistant or two…why wouldn’t your life be easier without having to deal with a human assistant? A digital assistant that’s even smarter sounds AMAZING!

I’m going to open the kimono a little bit:

The vast majority of people don’t have assistants.

The vast majority of people don’t think about booking a vacation or buying a kids’ birthday present as “unproductive time” better suited for an assistant. They think it’s a fun part of life.

Most people don’t want to “unlock” more productivity in their daily lives. If they did, they wouldn’t spend so much time on Instagram.

In a hyper-competitive world like startup investing, it makes sense Gerstner would put immense value on saving minutes so he can make another phone call or research another company.

But most people don’t live that way.

Most people don’t want to live that way.

And I’m not convinced the productivity Silicon Valley thinks they’re unlocking is an unlock at all.

Am I Over-Indexing On Personal Experience?

It’s always struck me that artificial intelligence and generative AI are supposed to be this paradigm shift for society, but it never comes up in casual conversation with parents at a soccer game or shooting the shit with my friends.

The iPhone, on the other hand, was a constant talking point in the same moments. So was Google. I remember someone saying “You gotta try this” about the search engine.

AI is something different. Maybe that’s good. Maybe that’s bad.

What I’m trying to articulate is, that we need to be aware if the voices giving you a bullish view on artificial intelligence are telling you a compelling story about how 99% of people will use AI or are they they’re telling you a very specific story that applies to the 0.00000001% of the world they see.

If the product market fit for AI is too strong among a small subset of people who aren’t representative of humanity as a whole, we may be disappointed with AI’s impact on our everyday lives.

And the financial returns for the hundreds of billions of dollars of investment may be extremely low.

And maybe I’m wrong. This is a strong opinion and I’m holding it loosely.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.