We’re probably headed for a recession.

New jobs are drying up.

Consumers are keeping the economy afloat but they’re buying goods on credit cards.

The yield curve has un-inverted a key recession indicator.

The Sahm Rule has been triggered.

That’s why the market is crashing.

The key for investors is to not overreact to short-term market moves.

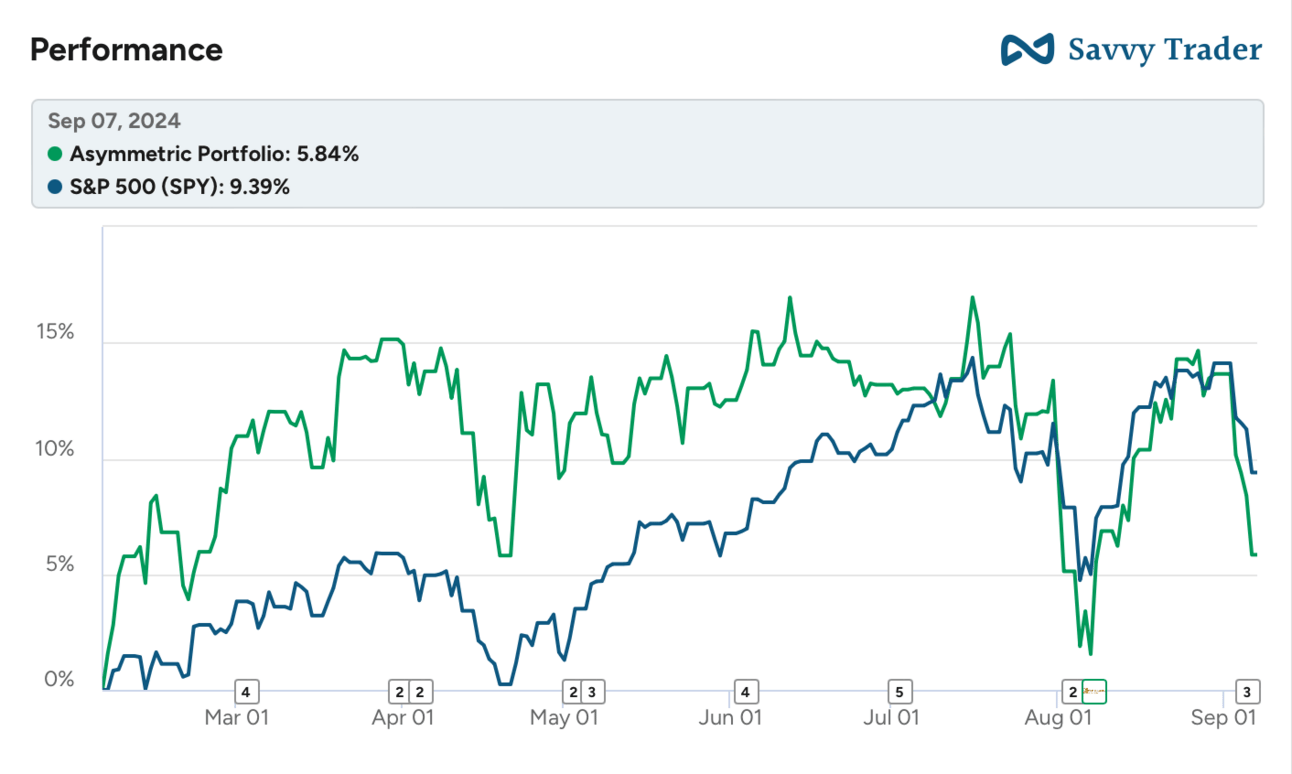

The Asymmetric Portfolio had a bad week driven by a couple of stocks falling. I covered their moves for premium members on Friday. But I’ll be buying whether the market goes up or down in the coming months.

Asymmetric Investing is a freemium business model, which means the free version is made possible by ads like this one. Sign up for premium here to get 2x the content, access the Asymmetric Portfolio, and avoid ads.

In Case You Missed It

Here’s the content I put out this week. Back to a regular publishing schedule next week.

What I’m Buying in September 2024: I bought three stocks this month.

The Trillion Dollar Opportunity: A breakdown of the autonomous driving industry and where I see opportunities.

A Defense of Founder Mode: Founder Mode was on trial this week and a lot of silly things were said and written. When you break it down, Founder Mode makes a lot of sense.

The Netflix of Sports: Netflix is the king of streaming. This company will be the king of sports streaming.

Timing Recessions vs Owning Great Companies

The market may be headed for a significant pullback over the next year.

The yield curve un-inverting has a 100% track record of predicting a recession (in the next few years).

The yield curve is the 10-year yield minus the 2-year yield. A positive reading is “normal” and a negative reading is “inverted”.

Jobs data shows a weakening job market and a rising unemployment rate.

Stocks are at all-time high valuations.

If you want more on the yield curve setup, this is an excellent video.

All of these economic and market indicators point to a recession…eventually. What we don’t know is the timing or how the market will respond.

As an investor, I’m not worried. Why?

Historically, buying great companies at points of market weakness is a smart move. So, I’ll keep buying and sometimes I’ll buy high, and sometimes I’ll buy low. What matters is the long-term trajectory of a business, which makes market gyrations look insignificant in time.

Let me give a couple of examples.

This stock went through a period of incredible volatility between 2007 and 2009. The business looked fine, but the stock seemed broken.

What stock chart is that?

It’s Apple! The iPhone had been introduced and the company was growing both revenue and profits, despite a recession. Over the next 15 years, the volatility you see above looks like a blip.

Apple is emblematic of focusing on the business and not the stock’s movement day to day.

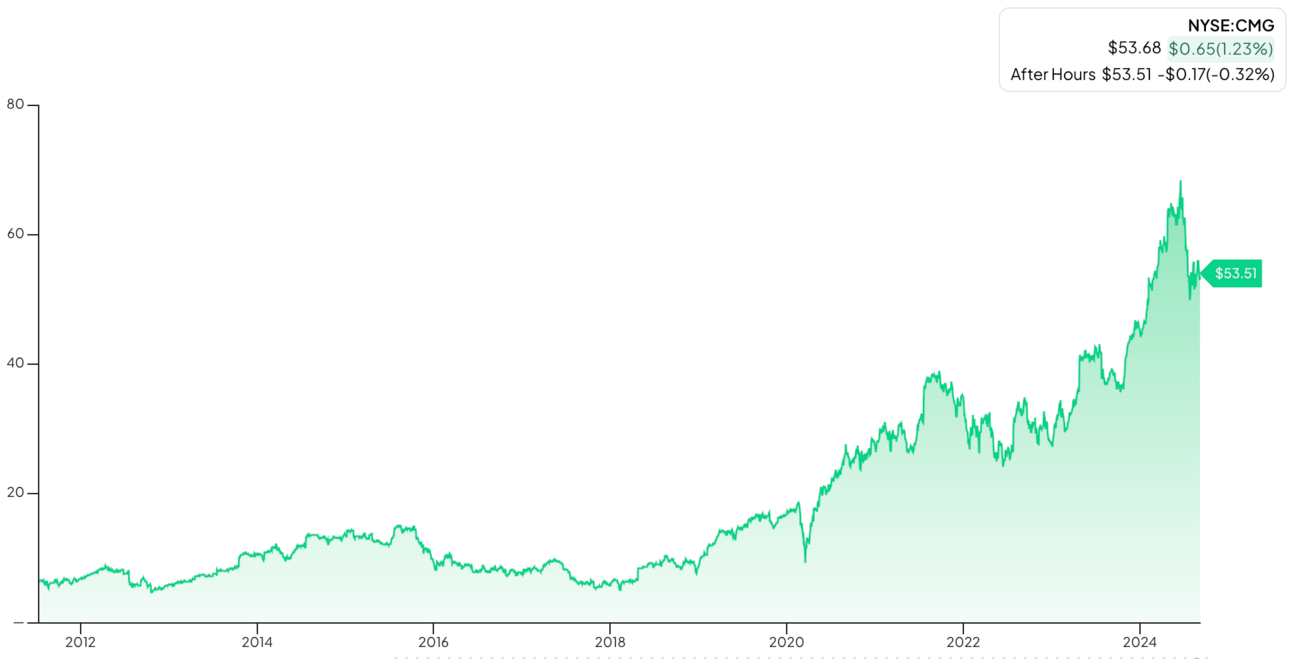

The stock below was hit by a famous short seller attacking the stock in 2012 and a salmonella outbreak in 2015. What a dud!

The stock is Chipotle and it would 10x in value over the next six years.

What’s an appropriate reaction by the market?

And what’s an overreaction?

Short-term, the day-to-day movements of the market look rational. We’re heading into a recession, so of course you want to sell stocks, right?

But what if you’re selling great businesses because of short-term volatility, it’s the wrong move.

I’ll keep buying growth stocks if the market gets weaker. And I’m buying at more attractive prices today than we’ve seen in a year.

The Asymmetric Portfolio’s forward P/E ratio is just 27.9x — lower than the broader market — and the 3-year revenue compound annual growth rate is 24.9% — well above the market.

I think that sets the Asymmetric Portfolio up for market-beating returns. I’m happy to buy the market’s overreactions and simply hold great companies long-term.

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.