The internet was abuzz with “Founder Mode” this week following Airbnb CEO Brian Chesky’s talk with the current class at Y Combinator and Paul Graham’s subsequent essay.

The most snarky comments I saw were about a Chesky interview a few years ago (he had pneumonia) or the Silicon Valley ecosystem as being egotistical. Protos wrote an entire piece blasting Founder Mode as wanting to be a dictator who lives forever. Criticisms are fine, but most miss the point.

I wrote about my ups and downs in entrepreneurship in “I Have Failed (And So Can You)” and even I could identify with “Founder Mode”. There’s something to having a vision, building it, and understanding why it works/doesn’t work better than anyone else. If you’ve started a company, you may be nodding along. If you haven’t been there, it’s hard to explain.

It’s like trying to explain parenting to someone who doesn’t have kids.

“Founder Mode” is a different framing of one of the frameworks of Asymmetric Investing to over-indexing to founders. They have the vision, experience, and entrepreneurial capital to make decisions that can pay off 100x and that’s what I want. From the frameworks article:

+ Over-Index on Founders

Founders simply look at their businesses differently. They’ve built the company from nothing to where it is, demonstrating the vision needed to build a business that can 10x in value. And they have the entrepreneurial capital to pivot when it’s necessary.

This is why historically founder-run companies outperformed the market.

Never buy a stock just because the founder is involved, but I want to over-index on founders because they’re more likely to unlock long-term value than their non-founder counterparts.

Asymmetric Investing has a freemium business model. Sign up for premium here to skip ads and get double the content, including all portfolio additions.

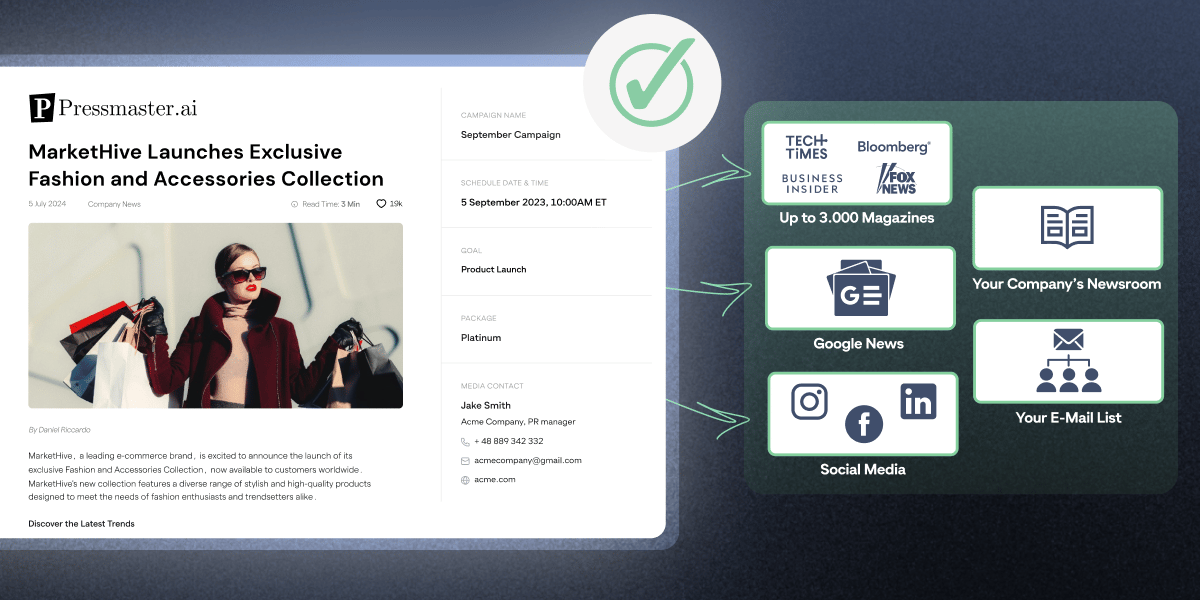

Building trust and increasing sales has never been easier

As a business owner, you know how important PR is to your company's success.

But the challenge of maintaining a consistent media presence can be overwhelming.

Now imagine being able to publish unique content to your website newsroom, social media and top magazines with just A FEW CLICKS.

Without a bunch of expensive tools...

Without a PR agency...

Or even a lot of time (because AI automates 98% of your work 🤌)...

Pressmaster.ai makes it a reality:

What Is Founder Mode?

Here are a few of the key excerpts from Paul Graham’s essay about Founder Mode following Chesky’s talk. You can read the full copy here.

The theme of Brian's talk was that the conventional wisdom about how to run larger companies is mistaken. As Airbnb grew, well-meaning people advised him that he had to run the company in a certain way for it to scale. Their advice could be optimistically summarized as "hire good people and give them room to do their jobs." He followed this advice and the results were disastrous. So he had to figure out a better way on his own, which he did partly by studying how Steve Jobs ran Apple. So far it seems to be working. Airbnb's free cash flow margin is now among the best in Silicon Valley.

Why was everyone telling these founders the wrong thing? That was the big mystery to me. And after mulling it over for a bit I figured out the answer: what they were being told was how to run a company you hadn't founded — how to run a company if you're merely a professional manager. But this m.o. is so much less effective that to founders it feels broken. There are things founders can do that managers can't, and not doing them feels wrong to founders, because it is.

In effect there are two different ways to run a company: founder mode and manager mode. Till now most people even in Silicon Valley have implicitly assumed that scaling a startup meant switching to manager mode. But we can infer the existence of another mode from the dismay of founders who've tried it, and the success of their attempts to escape from it.

There are as far as I know no books specifically about founder mode. Business schools don't know it exists. All we have so far are the experiments of individual founders who've been figuring it out for themselves. But now that we know what we're looking for, we can search for it. I hope in a few years founder mode will be as well understood as manager mode. We can already guess at some of the ways it will differ.

Seems like something worth studying to me.

Parental Frameworks?

As a 3-time biological parent, I felt uneasy about the interview Chesky gave below where he compares founding a company to having kids.

#1: Businesses aren’t kids.

#2: Get over the verbiage in #1, businesses are exactly like kids and this is the best analogy possible.

There’s a reason Howard Schultz needs to come back to save Starbucks a few years after “retiring”.

There’s a reason Steve Jobs was the one who brought Apple back to prominence.

There’s a reason Jensen Huang can steer NVIDIA to AI dominance while Intel’s highly credentialed managers destroy the company.

“Founder Mode” is real. And while it’s not fully understood and it’s not without risks, it’s the best way to achieve 10x+ outcomes. And that — after all — is the point of Asymmetric Investing.

Asymmetric Risks and Rewards

If you’ve ever worked in a corporate environment, you know what manager mode looks like. You want to spend $1,000 on something, so you need to ask for approval and justify the expense using made-up numbers. The connection between you and the company’s goals is filtered through the organization, distorted by each layer of the bureaucracy.

That’s how you manage a business.

Founder mode is breaking down those barriers and making the vision of the founder the vision of the company. It becomes the culture.

I like to put strategy frameworks around these decisions, but a founder may be flying by the seat of their pants.

THAT’S THE POINT!

Differentiation doesn’t come from making an incremental decision.

Differentiation comes from taking big bets that can pay off 100x. Does a manager or a non-founder CEO have the ability to take that 100x bet?

Given a 10 percent chance of a 100 times payoff, you should take that bet every time.

It was easy to dunk on “Founder Mode” this week because everyone’s doing it.

However, founders keep having more success than the professional managers who replace them.

There seems to be something to the concept.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.