I hope you had a wonderful week!

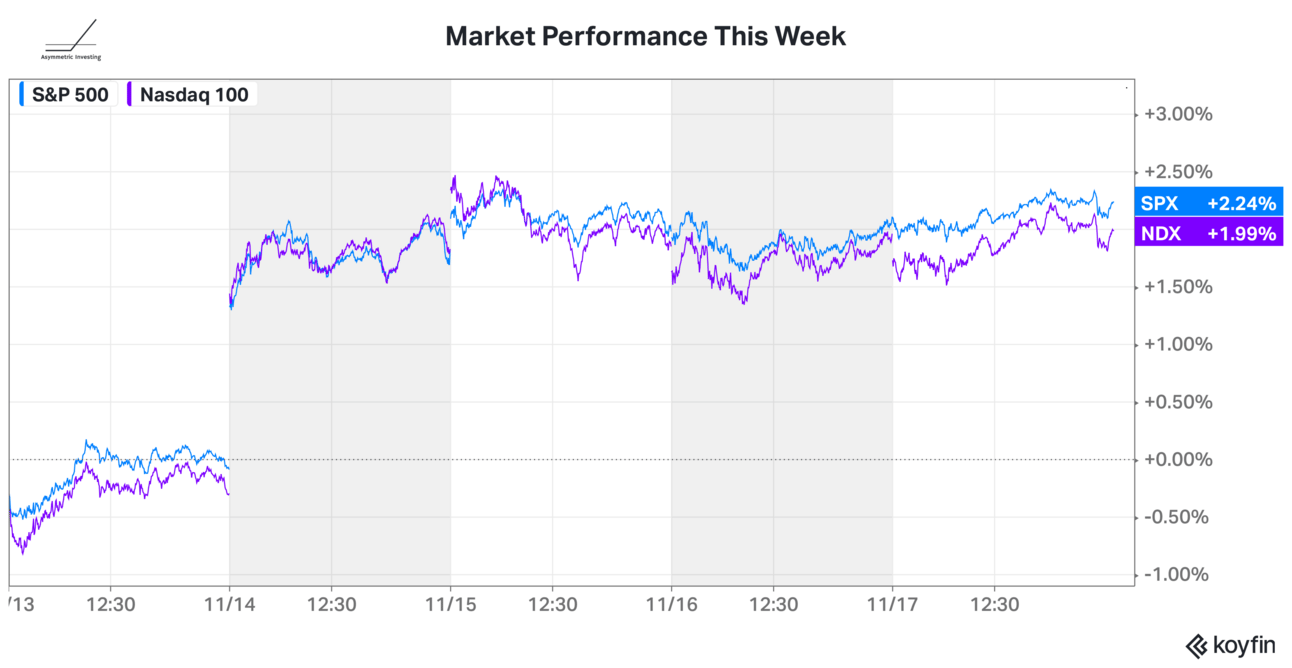

It was another positive week for the stock market, helped by a CPI report that showed inflation screeching to a halt in October. That caused investors to speculate that interest rates will stop rising and may even fall in 2024. I’m more worried about weaker consumer spending and the broad impact on earnings (which I’ll get to below), but the market didn’t seem to care about that much this week.

Before we get to the week that was in investing, we have an advertising partner this week!👇

I’ve been living in the Quartr app all earnings season because it’s the easiest access to conference calls and company presentations. If you follow the market closely, this is a must-have.

In case you missed it

Here’s some of the content I put out this week. Enjoy!

The Fall of ChargePoint and Plug Power: These two popular stocks have some bad news that may ultimately lead to bankruptcy.

Cruise’s Moment of Crisis: Cruise has pulled its vehicles from roads across the U.S. This can either be a moment to fall apart or a moment to set a clear path for the future.

A Tale of 2 Stocks: On Holding and Virgin Galactic: A review of earnings and the market’s reaction for On Holding and Virgin Galactic.

3 Reasons to Buy Apple Stock and 1 Reason to Sell: There’s one huge risk Apple needs to worry about.

Watch Out For Consumer Spending

Long-term, the stock market is driven by consumers, not interest rates or the Federal Reserve. Consumer spending accounts for 68% of U.S. economic activity and when consumers are weak the entire economy feels it.

What stuck out to me this week was the commentary from Target and Home Depot about consumer trends. If anyone has a pulse of consumers it’s these companies and the trends aren’t great.

it's clear that consumers have been remarkably resilient. Yet at the same time, our research indicates that themes like uncertainty, caution, managing my time and budget and focusing on essentials while still finding ways to celebrate are all top of mind. Overall, consumers are still spending, but pressures like higher interest rates, the resumption of student loan repayments, increased credit card debt and reduced savings rates, have left them with less discretionary income, forcing them to make trade-offs in their family budgets. For example, this year, we've seen more and more consumers delaying their spending until the last moment. Guests who previously bought sweatshirts or denim in August or September are deciding to wait until the weather turns cold before making a purchase. This is a clear indication of the pressures they're facing as they work to stretch their budgets until the next paycheck. Consistent with these pressures, as we look at recent trends across the retail industry, dollar sales are being driven by higher prices with consumers buying fewer units per trip. In fact, overall unit demand across the industry has been down 2% to 4% in recent quarters. And the industry has experienced 7 consecutive quarters of declines in discretionary dollars and units.

Home Depot’s view is a little different but they’re seeing smaller home improvement projects and fewer big item purchases.

Similar to the second quarter, we saw continued customer engagement with smaller projects and experienced pressure in certain big-ticket discretionary categories.

…

Big-ticket comp transactions or those over $1,000 were down 5.2% compared to the third quarter of last year. We continue to see softer engagement in big-ticket discretionary categories like flooring, countertops and cabinets.

Expectations for consumer spending have been down, so these results weren’t a surprise. That’s why stocks didn’t react much this week.

But we’re only a few months into student loan repayments resuming and higher interest rates impacting borrowing, so there could be major headwinds for the market. Something to be aware of.

Thank you for being an Asymmetric Investing subscriber. If you want all of my stock deep dives, stock updates, and access to Asymmetric Portfolio trades before I make them you can subscribe below. The premium subscription is what makes this newsletter possible. I appreciate the support.

What do you want more of?

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.