Part of the journey of the Asymmetric Investing newsletter is explaining how I think about asymmetric opportunities (10x in 10 years) and how I find stocks that I think fit that mold. Longtime readers will recognize the framework articles I refer to time and again like internet economics, winner-take-all markets, the smiling curve, and embracing uncertainty.

Today, I’m highlighting why I did not invest in some popular stocks that seemed to have asymmetric potential in emerging markets. I hope this provides a valuable juxtaposition to the stocks I see in a more positive light. With that background, on to the article:

One of the central tenets of Asymmetric Investing is leaning into investment opportunities farther out on the risk curve than market indexes to generate market-beating returns.

To give an analogy, I’m building a venture capital-style portfolio with public stocks. This graphic from Mercer Capital puts the expected returns and their relation to risk into perspective.

While I lean into higher-risk stocks, there’s a balance between taking risks and investing recklessly. In the past two weeks, we saw two popular stocks collapse and they are likely headed for bankruptcy, despite high-profile partnerships and billions of dollars of funding.

EV charging company ChargePoint announced its CEO and CFO were leaving immediately as revenue plunged and the EV charging market got more crowded. Plug Power gave a going concern warning (see page 8 of the SEC filing) and appears headed for bankruptcy without some kind of bailout.

They were farther out on the risk curve, which I like, in big addressable markets. But they were also built on little more than hype and didn’t have a solid foundation on which to build a market-beating investment.

The Downfall of ChargePoint and Plug Power

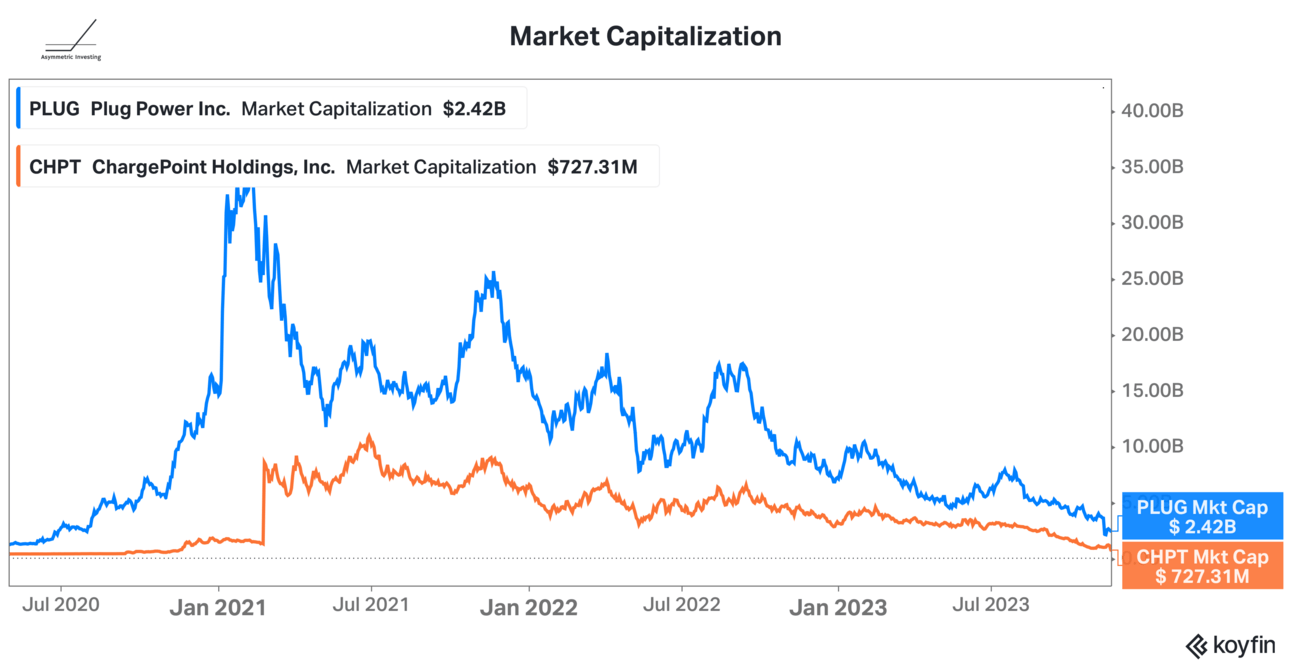

The chart of ChargePoint and Plug Power’s market cap is striking. Plug Power peaked with a market cap of over $34 billion in early 2021 and ChargePoint was worth nearly $11 billion three years ago.

Hydrogen. EV charging. Growing revenue like crazy. What’s not to like?

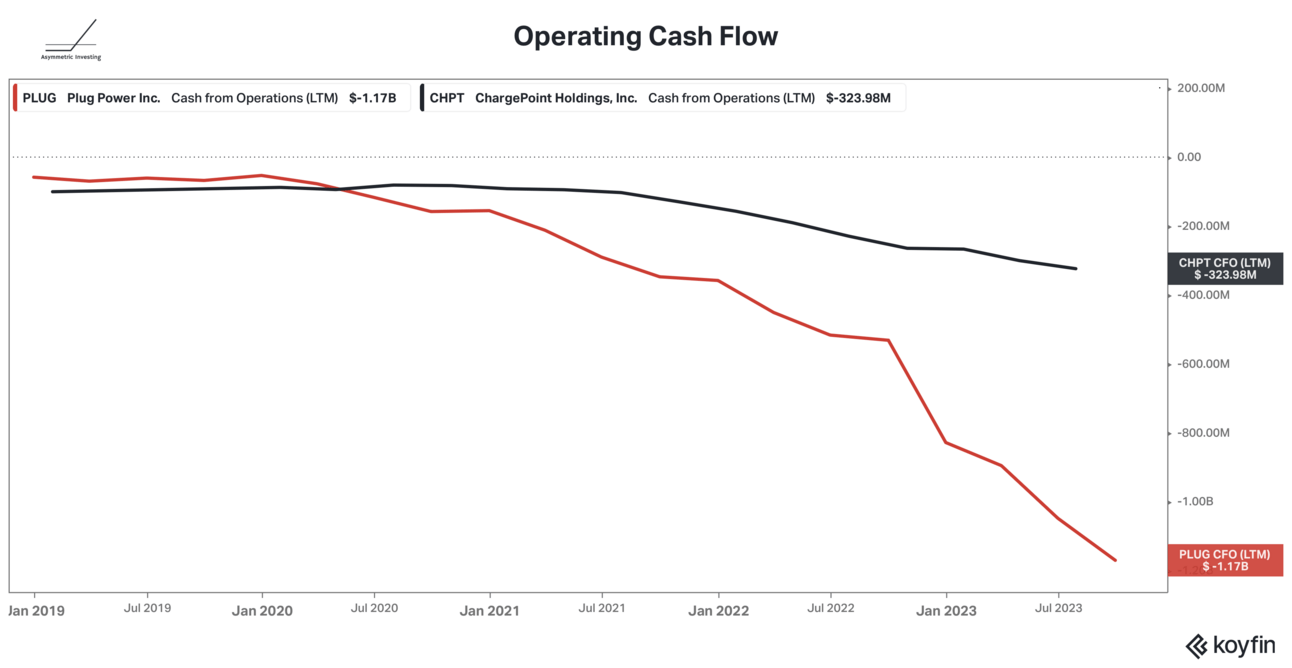

Despite their high valuations and incredible hype, a simple search of their financials would show that neither company was ever able to generate positive cash flow from operations.

I’m not scared off by negative cash flow today if there’s some kind of high growth potential or differentiation in a business that will manifest in the future. But I saw nothing changing 5-10 years down the road.

Differentiation Didn’t Exist

I love a company with some kind of differentiation. But is that what either ChargePoint or Plug Power brought to the table?

A company with differentiation is…doing something different than competitors.

In ChargePoint’s case, the company was building chargers that would move a commodity (electricity) through an industry-standard plug (also a commodity).

There was no way to differentiate. There was no lock-in. There was no network effect. Charging isn’t a winner-take-all market. It’s a money-losing commodity business.

I honestly don’t understand what the hype was about.

At Plug Power, the company was making hydrogen fuel cells that went into forklifts.

Yes, that was their primary business, forklifts.

Fuel cells in cars have failed.

Hydrogen-powered commercial trucks failed.

Even hydrogen semi trucks are a failure given over a decade of development.

From a technology side, the proton-exchange membrane (PEM) fuel cell Plug Power made wasn’t differentiated from rivals and wasn’t as efficient as solid oxide fuel cells that work better in energy storage and (theoretically) in electrolysis.

Heck, I worked in a lab working on PEC fuel cells almost 25 years ago!!!

There was no differentiation and if you want confirmation, just look at the cash flow numbers above.

There are no cut-and-dry rules when it comes to defining differentiation. But nothing about ChargePoint and Plug Power screamed differentiation to me.

Promises Made vs Promises Kept

In March 2017, I wrote this article highlighting all of the promises Plug Power’s management had made to investors. And every time those promises weren’t kept.

The most glaring was the projected EBITDA breakeven by mid-2014. More than nine years later, Plug Power still isn’t EBITDA breakeven.

Management teams that constantly over-promise and under-deliver should be looked at with a questionable eye. Like it or not, managing investor expectations is part of the job.

Frameworks > Hype

I lean into taking more risk than buying an index fund in order to beat the market. But it doesn’t mean being reckless.

I build frameworks that have historical precedents of success and logical reasons they can be repeated for a reason. This guides how I think about and analyze companies and gives me guardrails as an analyst.

I won’t find every 10x stock and not every investment I make will succeed. But the goal is to stack the odds in our favor whenever possible.

ChargePoint and Plug Power never fit the frameworks of an asymmetric stock, they never showed the ability to allocate capital effectively, and they had questionable technology and strategies.

I’m not surprised they’re likely on their way to zero. And I hope we all learned something along the way.

What do you want more of?

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.