I hope you had a wonderful week!

The market’s summer slowdown is over but we are still a few weeks from earnings season kicking into gear. That means the Federal Reserve’s FOMC meeting, rate decision, and comments were the market’s focus this week. I’ll get there in a moment.

Before we get to the week that was, here’s something you may be interested in!👇

How does NVIDIA make money? How much revenue does YouTube generate? How much cash does Airbnb have on the balance sheet?

These questions and more are answered in Compounders Daily, which uses simple charts to tell a company’s story. This project is a sister newsletter to Asymmetric Investing, it’s free, and launches next week.

In case you missed it

Here’s some of the content I put out this week. Enjoy!

Visa and the Blockchain: Visa is starting to use the blockchain to move money around the world and this could bode well for another Asymmetric Investing stock.

Asymmetric Spotlight: Alphabet: You know Alphabet’s biggest business, Google. But the company’s future growth may be driven by AI, video, and autonomous driving.

5 Stocks to Buy and Hold Forever: These companies have business models that are built to last for a long time. Maybe even forever.

4 Tech Stocks to Double Down On: Tech can be a disruptive industry but these companies have a durable advantage that should last for a long time.

Interest Rates & The Economy

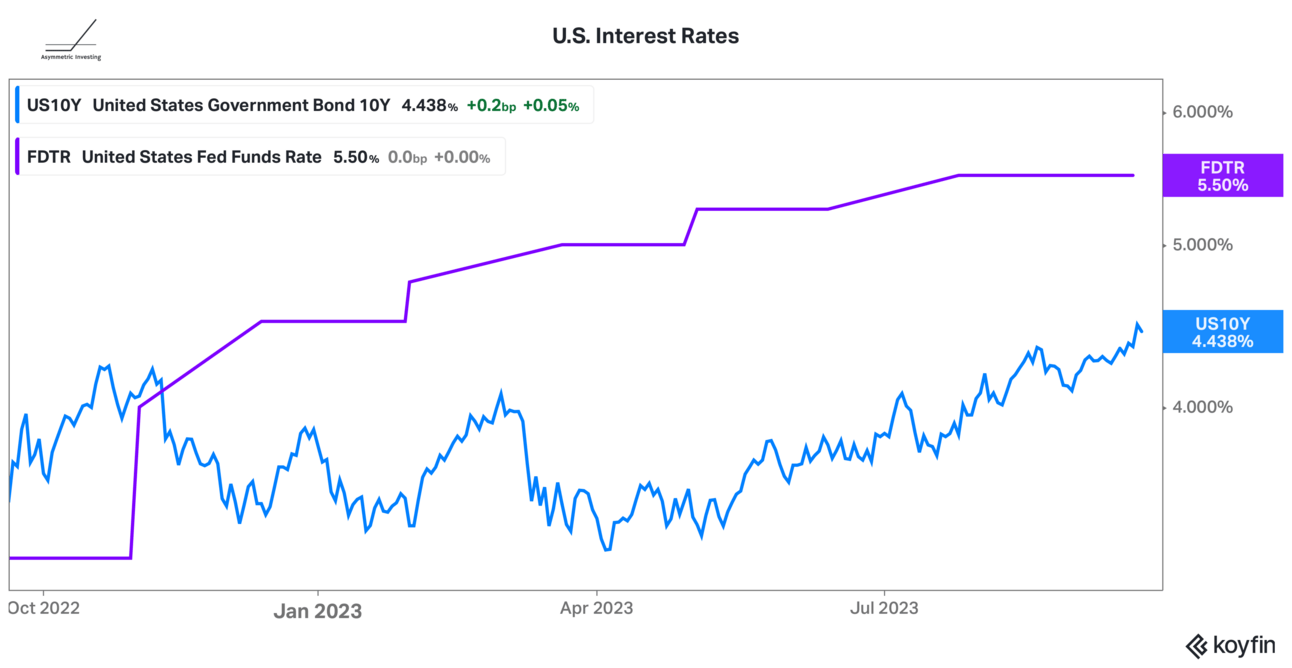

The biggest news of the week was the Federal Reserve keeping the short-term interest rate — known as the Fed Funds Rate — flat at a range of 5.25% to 5.5%. This was widely expected, but what wasn’t expected was very clear statements that rates would remain higher for longer than hoped. The stock market responded by selling off.

Fed officials see inflation being more persistent than hoped and until that changes rates will remain elevated, even if it hurts the economy in the process.

I think it’s instructive to look at what the market thinks about interest rates. The Federal Reserve controls the Fed Funds rate, which is very short-term bonds, but it doesn’t control the longer-term rates per se, the market does. And the market has been expecting a rate cut in the near future given the 10-year yield trading for a large discount to the Fed Funds rate.

However, long-term interest rates will rise when investors expect short-term rates to stay high for longer. After all, why own a 10-year bond with a 4% interest rate when you can get a 3-month interest rate of 5.5% for the foreseeable future?

On that note, the 10-year interest rate is up 1.1%, or 110 basis points, since April. That’s a big jump and the market now seems to be taking the Fed’s rhetoric seriously.

In the economy, higher rates will make it more expensive for companies to invest in capital expenditures, new hires, and acquisitions.

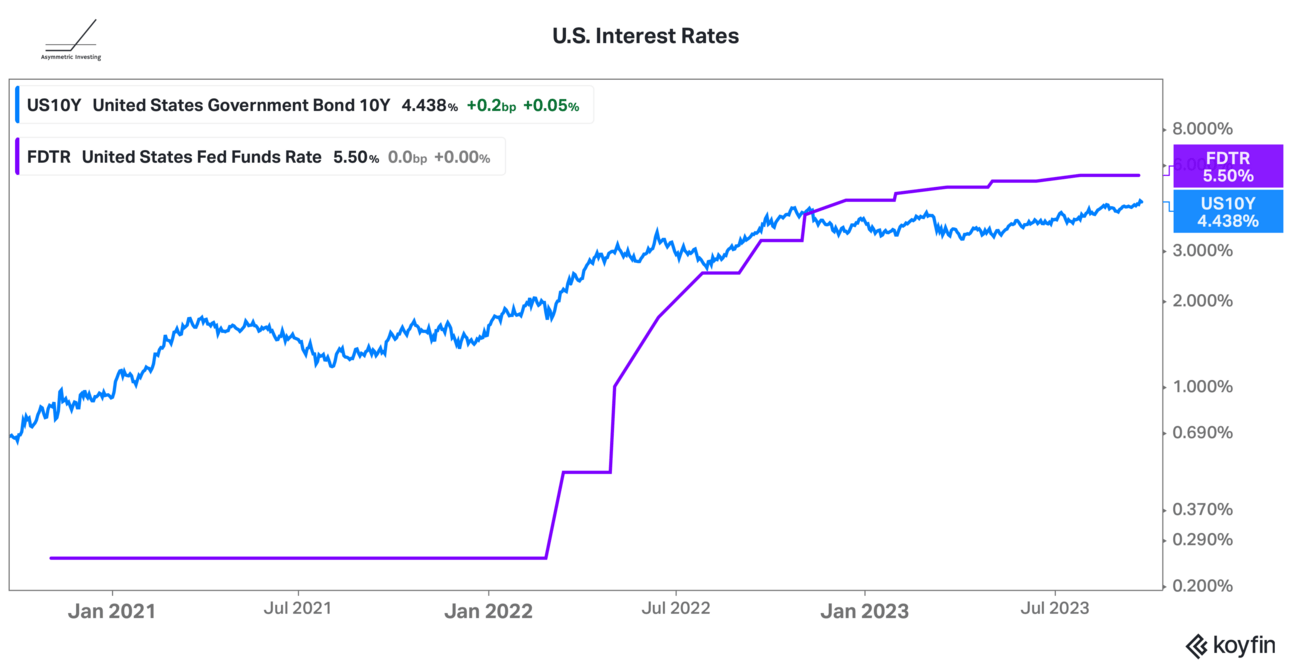

If we step back to the 3-year chart, the 10-year has risen from under 1% to 4.4%.

And rates don’t look like they’re coming down soon. Here’s part of the Fed’s statement this week.

If the economy evolves as projected, the median participant projects that the appropriate level of the federal funds rate will be 5.6 percent at the end of this year, 5.1 percent at the end of 2024, and 3.9 percent at the end of 2025. Compared with our June Summary of Economic Projections, the median projection is unrevised for the end of this year but has moved up by 1/2 percentage point at the end of the next two years.

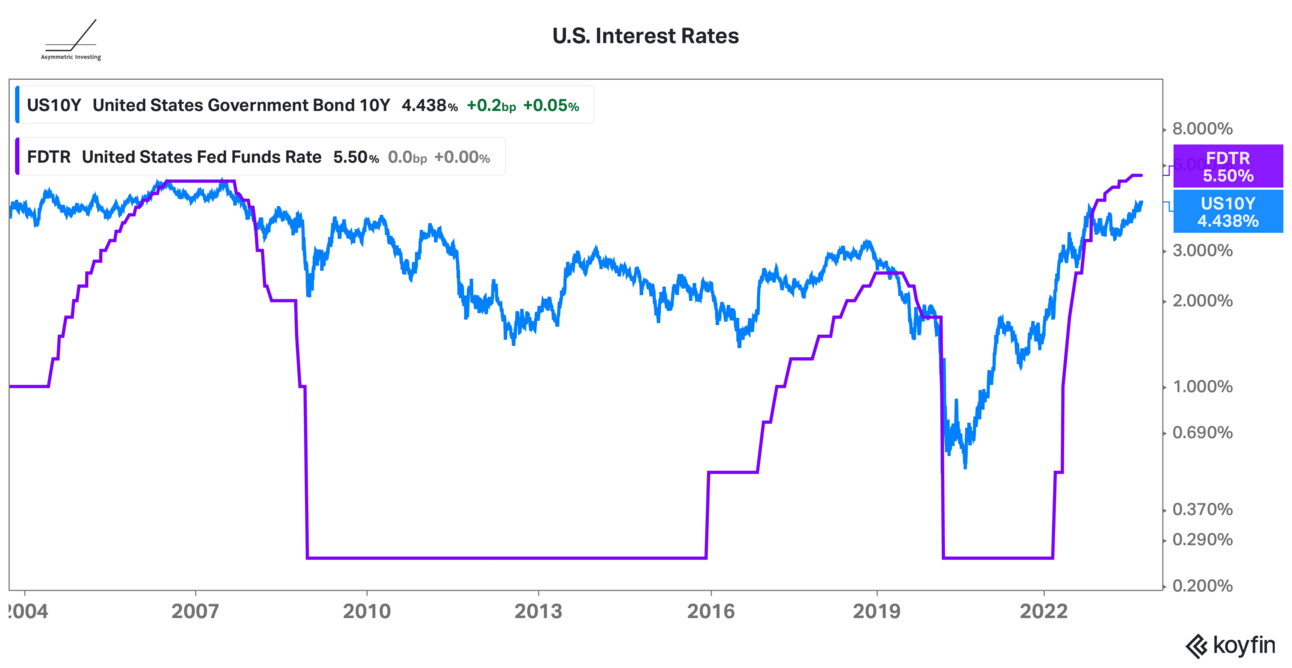

And here’s where the problems come in. You can see when the Fed raises rates it makes it more expensive to buy homes and cars and harder for companies to justify new investments. Eventually, something breaks. In 2000 that was the tech bubble. In 2007/2008 it was housing. In 2020, it was the pandemic (an outlier). This usually doesn’t end well.

The takeaway for investors is simple. Invest in companies that can make money in any interest rate environment because no one knows where rates are headed.

Thank you for being an Asymmetric Investing subscriber. If you want all of my stock deep dives, stock updates, and access to Asymmetric Portfolio trades before I make them you can subscribe below. The premium subscription is what makes this newsletter possible so I appreciate the support.

How are we doing?

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.