Longtime readers know Spotify was the first stock I covered on Asymmetric Investing and shares are up a whopping 118.4% since that report was written.

But the Spotify in April 2024 looks very different from the Spotify I covered in March 2023. This is a much bigger, more profitable, and more confident company and I think the upside for the stock is at least 10x from here over the next decade.

Where Spotify is Going

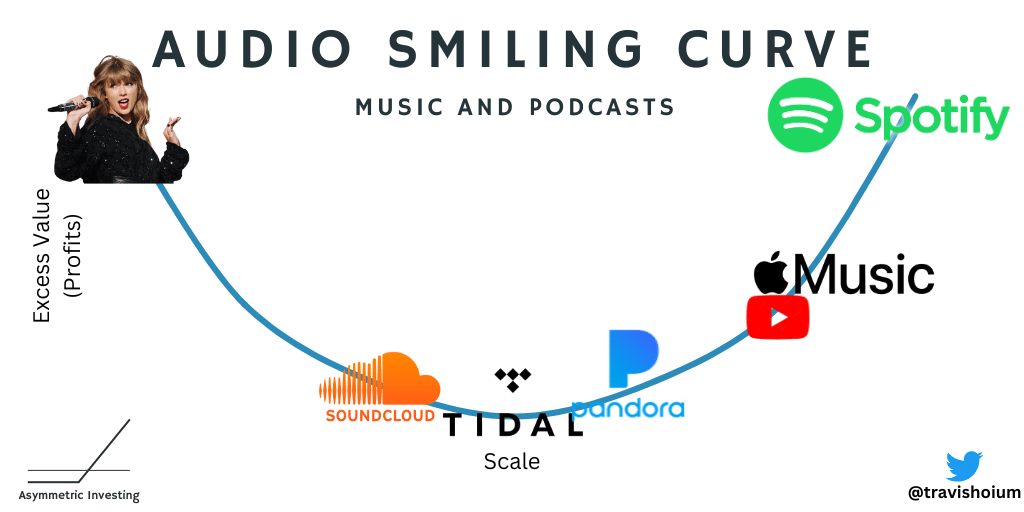

I know, the smiling curve is getting old for some of you, but it’s a great framework for thinking about companies in two-sided (or 3-sided if you include advertising) markets.

In the case of Spotify, the visual below shows why you want to be the company with scale in music. You don’t want to be a has-been like Pandora or an afterthought in a bigger business like Apple Music. You want to be the audio winner in the top right of the smiling curve.

Once a company solidifies its place in the top right corner of the smiling curve, the fun begins. They can:

Raise prices

Bundle adjacent products

Build an advertising business

And Spotify is doing all three!

Thank you for being on Asymmetric Investing’s ad-supported tier. If you want double the content and zero ads you can join the premium tier.

Have you heard of Prompts Daily newsletter? I recently came across it and absolutely love it.

AI news, insights, tools and workflows. If you want to keep up with the business of AI, you need to be subscribed to the newsletter (it’s free).

Read by executives from industry-leading companies like Google, Hubspot, Meta, and more.

Want to receive daily intel on the latest in business/AI?

Pricing and Bundles

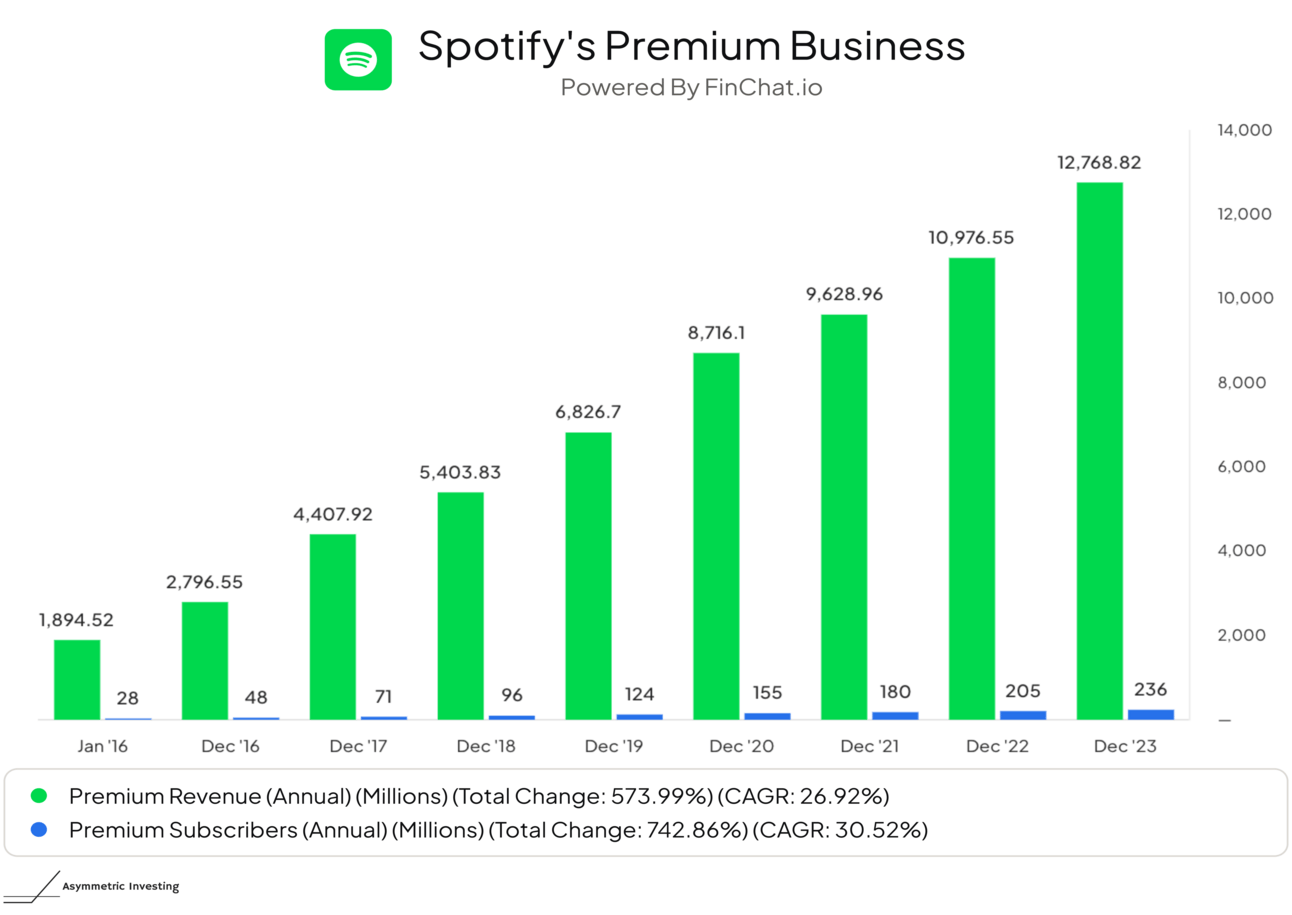

In July 2023, Spotify announced its first price increase in years. The modest $1 increase for individual plans and $2 increase for some family plans started in the U.S. and slowly made its way around the world.

Yesterday, it was reported that Spotify is planning another $1 price increase in the U.S., Europe, and Asia. This time, the increase is directly related to a new “free” feature that was added in 2023 — audiobooks.

In October, Spotify announced that 15 hours of audiobooks would be included in premium subscriptions, bundling the value of music and audiobooks into one subscription. But this was a temporary giveaway because the $1 increase announced yesterday can be avoided if users “downgrade” to a music-only subscription.

This is a first step toward truly bundling audio content on Spotify and I think it’s the right move long-term. But it’s not going to be as straightforward as cable companies bundling TV with internet connections and phone lines.

Podcasts don’t currently have the same economics as music and audiobooks, primarily relying on advertising to make money.

Is that an opportunity for Spotify?

6 months from now, I could see Spotify offering a bundle that’s $5 more than music-only and includes ad-free audiobooks and podcasts. For podcast creators, this could monetize better than advertising and would be less of a headache.

Think YouTube Premium but for your ears.

From Music to Movies?

If we assume Spotify is moving to bundle music, podcasts, and audiobooks all under one premium subscription that’s a strategy that makes sense to me.

And we may already be seeing the groundwork of this strategy as Spotify blurs the lines between different kinds of content.

Have you noticed that music, podcasts, and audiobooks sit next to each other in the Spotify feed? Below is a screenshot of Spotify on my desktop and music blends seamlessly with podcasts.

This is great for Spotify because it allows the company to move into more verticals. One we shouldn’t overlook is video. Spotify is now bundling music with audiobooks and is a leader in podcasts. But have you noticed videos showing up more and more on the platform?

I have to wonder if that’s the next step. If Spotify wins the audio market it’s a natural extension to move into video, so watch out for that over the next few years.

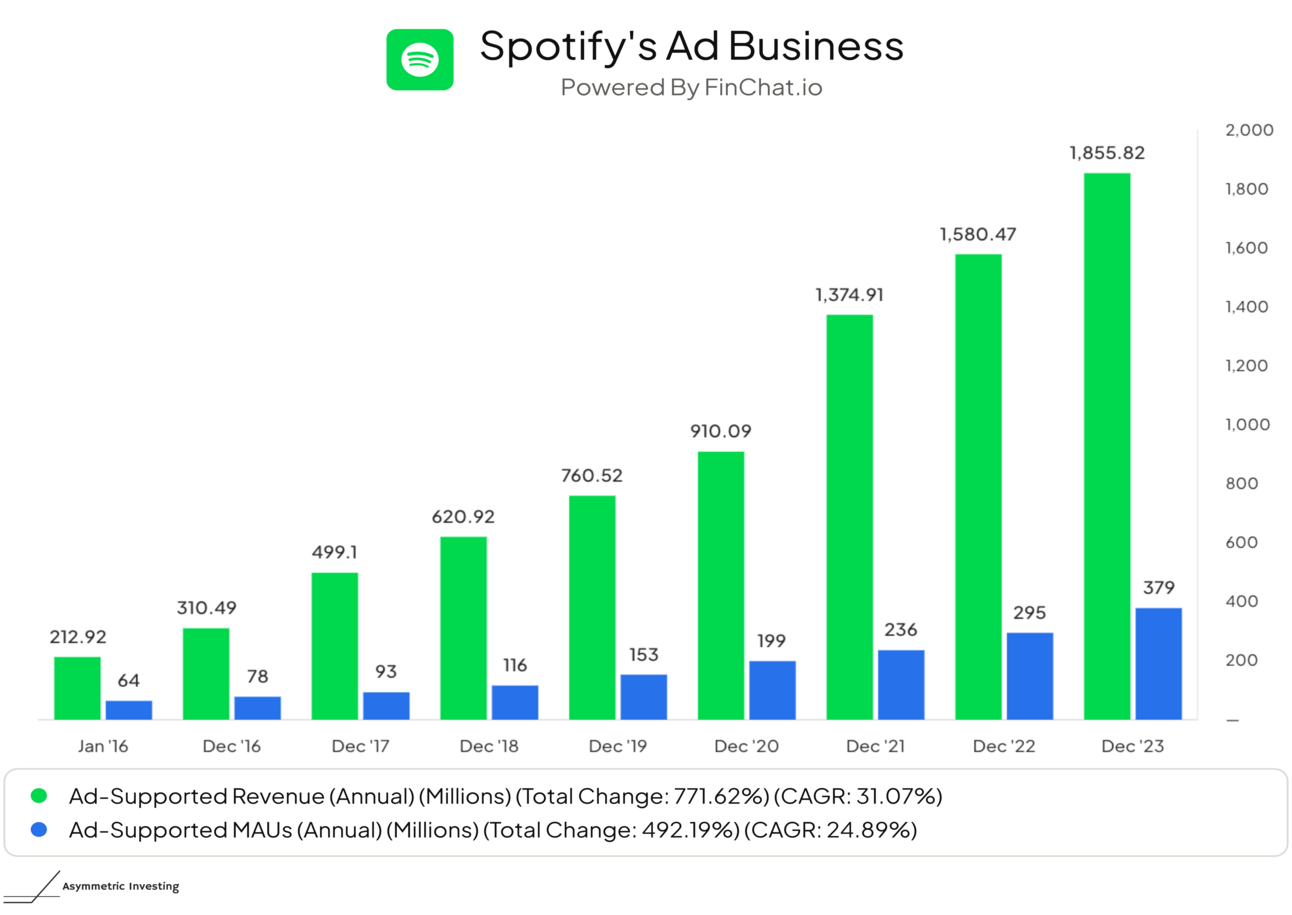

Advertising Is Spotify’s Weakness and Opportunity

Monthly revenue per subscriber was $4.85 on the premium side of the business.

Ad-supported subscribers generated just $0.41 per user.

This is the opportunity for Spotify. Netflix and Disney are raising prices on ad-free tiers because advertising tiers are generating more revenue than premium-only tiers. Spotify has at least a 10x revenue growth potential in advertising if it can get the advertising flywheel working.

Bundles are a huge tailwind in 2024, but over the next decade, advertising is Spotify’s biggest opportunity.

Spotify’s Financial Focus and Potential

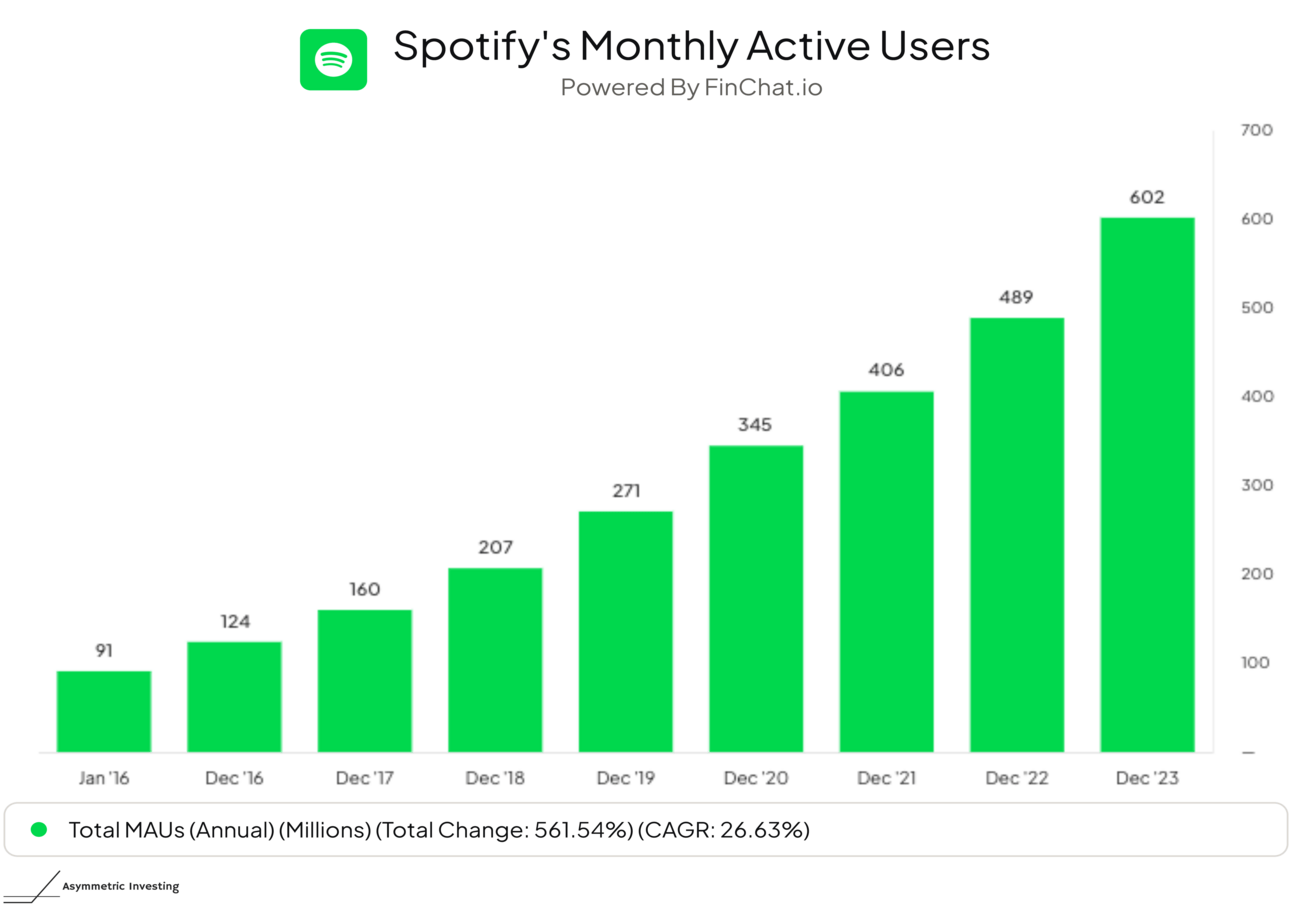

I think price increases are an indication that Spotify is confident in its position as the winner in the audio market. And it’s hard to argue against that if active user growth continues at the current rate.

The next challenge is turning a strong strategic position into a profitable business. Spotify is doing that by raising prices and lowering operating costs. You can see some of the cost reductions from 2023 in the blue column below and additional cost cuts made over the last 6 months will flow through the income statement throughout this year.

Put all of this together and you get Spotify suddenly becoming a cash flow machine. Cash flows will be volatile depending on the timing of some payments (which inflated Q4 2023 FCF slightly) but the trend higher is clear.

With the price increases and cost controls, I think Spotify can get to $1 billion in quarterly free cash flow by the end of 2024. Given the $60 billion market cap, that would put Spotify at 15x free cash flow.

To 10x from here, Spotify needs to keep slowly raising prices and needs some of these growth opportunities in bundling and advertising to play out. But that’s what I like about its position in the market and the smiling curve framework. As a leader, it can play offense rather than defense.

There’s so much potential at Spotify and it starts with winning audio. Now the fun begins watching the company compound on that success.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.