Robinhood $HOOD ( ▲ 2.48% ) is being added to the S&P 500 on September 22, 2025, and in overnight trading, shares are up 8% in anticipation of the buying pressure this will cause.

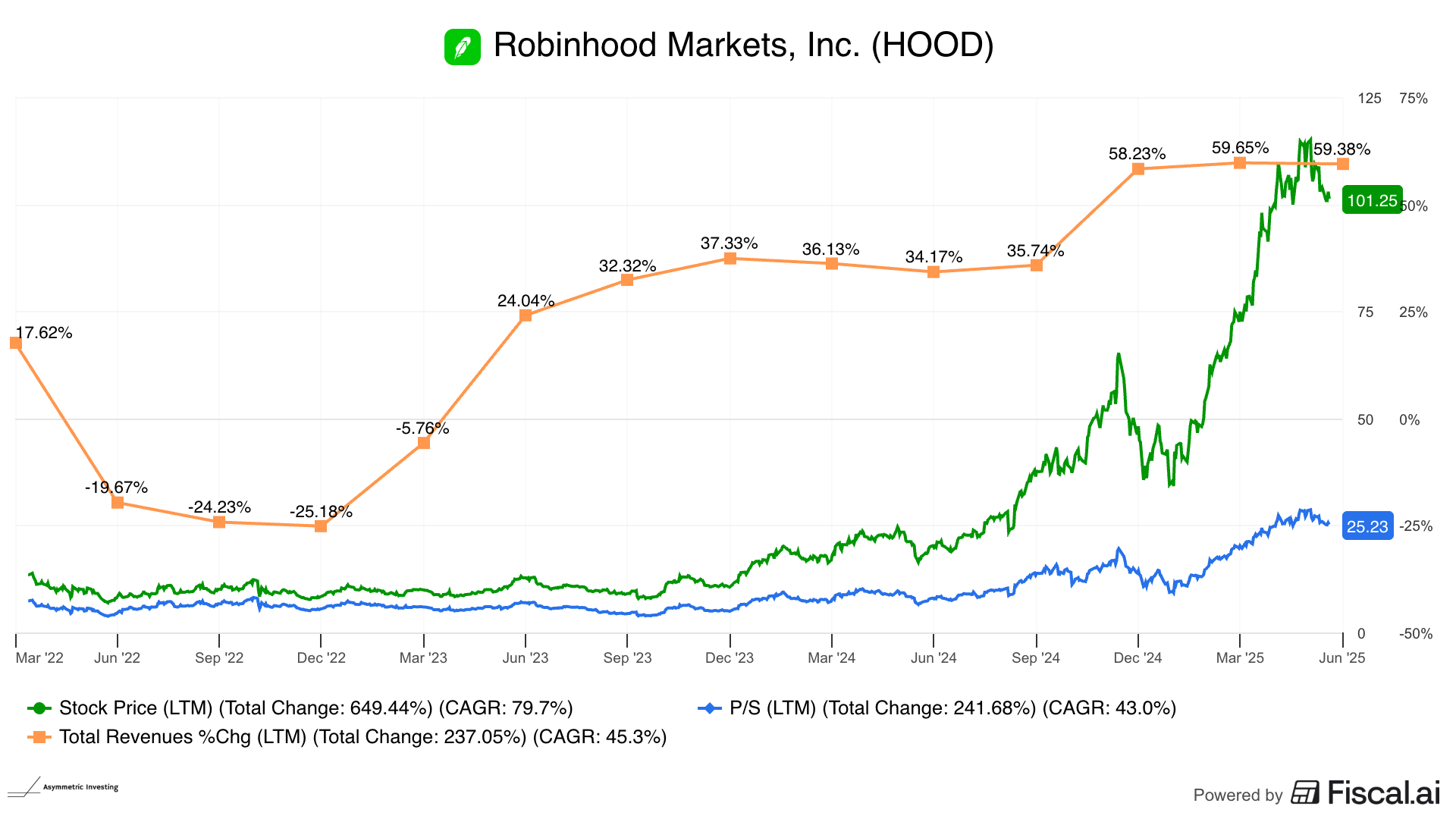

The move isn’t all that surprising. Robinhood’s business has been performing well and has been an incredible performer for the Asymmetric Portfolio, rising 422% since the Robinhood Spotlight article was written.

But there’s another growth market that I think could be underestimated, which I’ll get to in a moment.

The market overall shrugged off a weak jobs report on Friday and continues its sideways trading. The next few months will say a lot about both job and inflation trends, so expect some volatility.

The Asymmetric Portfolio has benefited from Robinhood’s performance as the largest holding. And I’m not selling any shares today because momentum should be strong for the foreseeable future.

In Case You Missed It

Here’s some of the content I put out this week.

Google’s Massive Win & the Patience Payoff: Google won in court and will get to keep Chrome and Android in-house, giving the company leverage in both search and the future of AI.

Why DoorDash Should Buy Lyft: DoorDash could use a mobility business, and Lyft’s stock is cheap.

Hims & Hers’ Next Growth Phase: Testosterone fits Hims & Hers’ growth profile, and it could impact the company’s sales soon.

The Potential of Prediction Markets

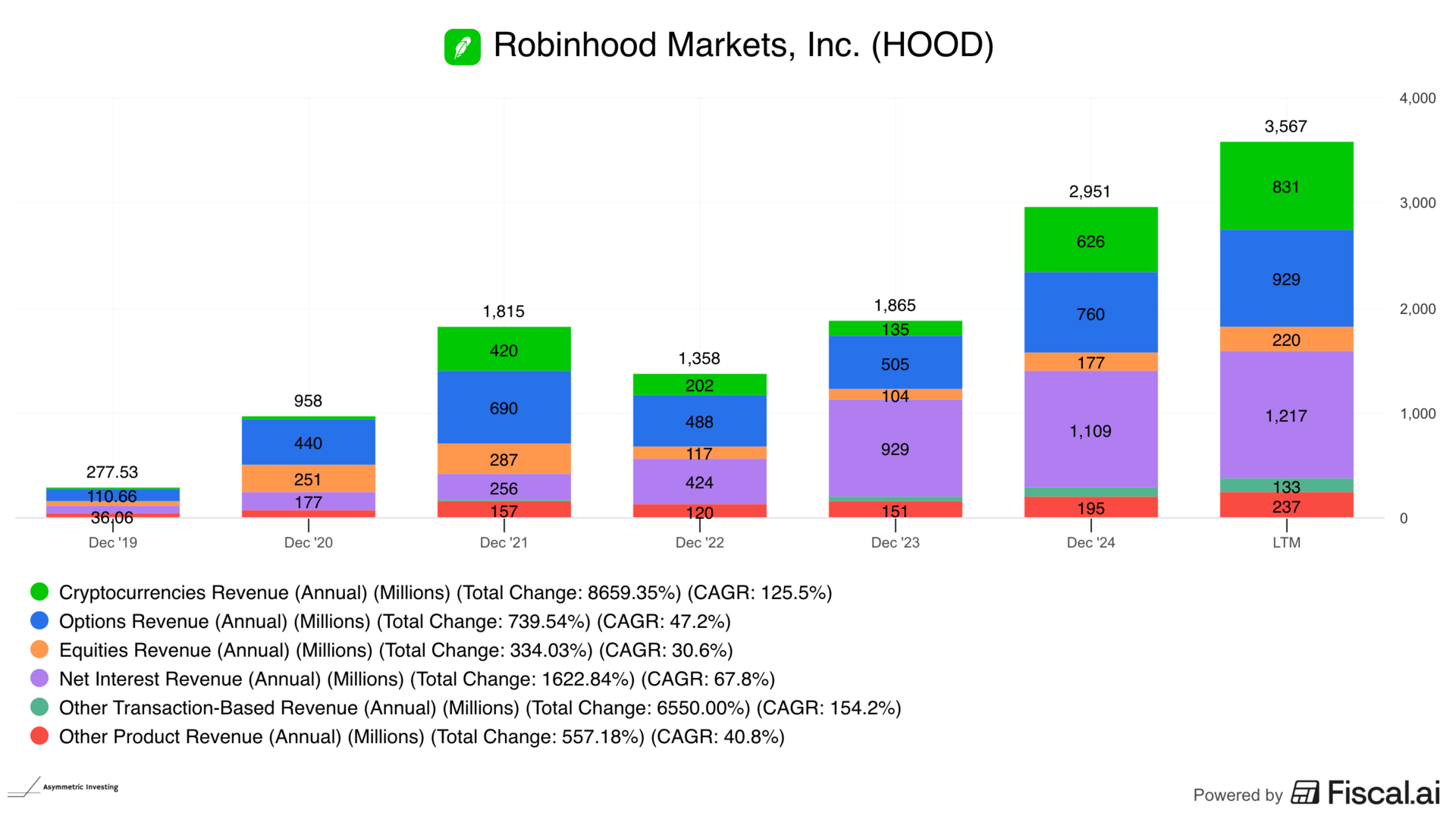

Robinhood’s growth has been driven by its expansion into a growing number of booming markets. In 2020, the company’s revenue was driven by options, but today, cryptocurrencies, net interest revenue, and transaction-based revenues (credit cards) are growing.

What this doesn’t include is significant revenue from prediction markets.

And this is where I think Robinhood has another point of disruption on its hands.

Prediction markets are technically futures contracts, according to CFTC rules. It’s not gambling, it’s a futures contract. This is an important distinction.

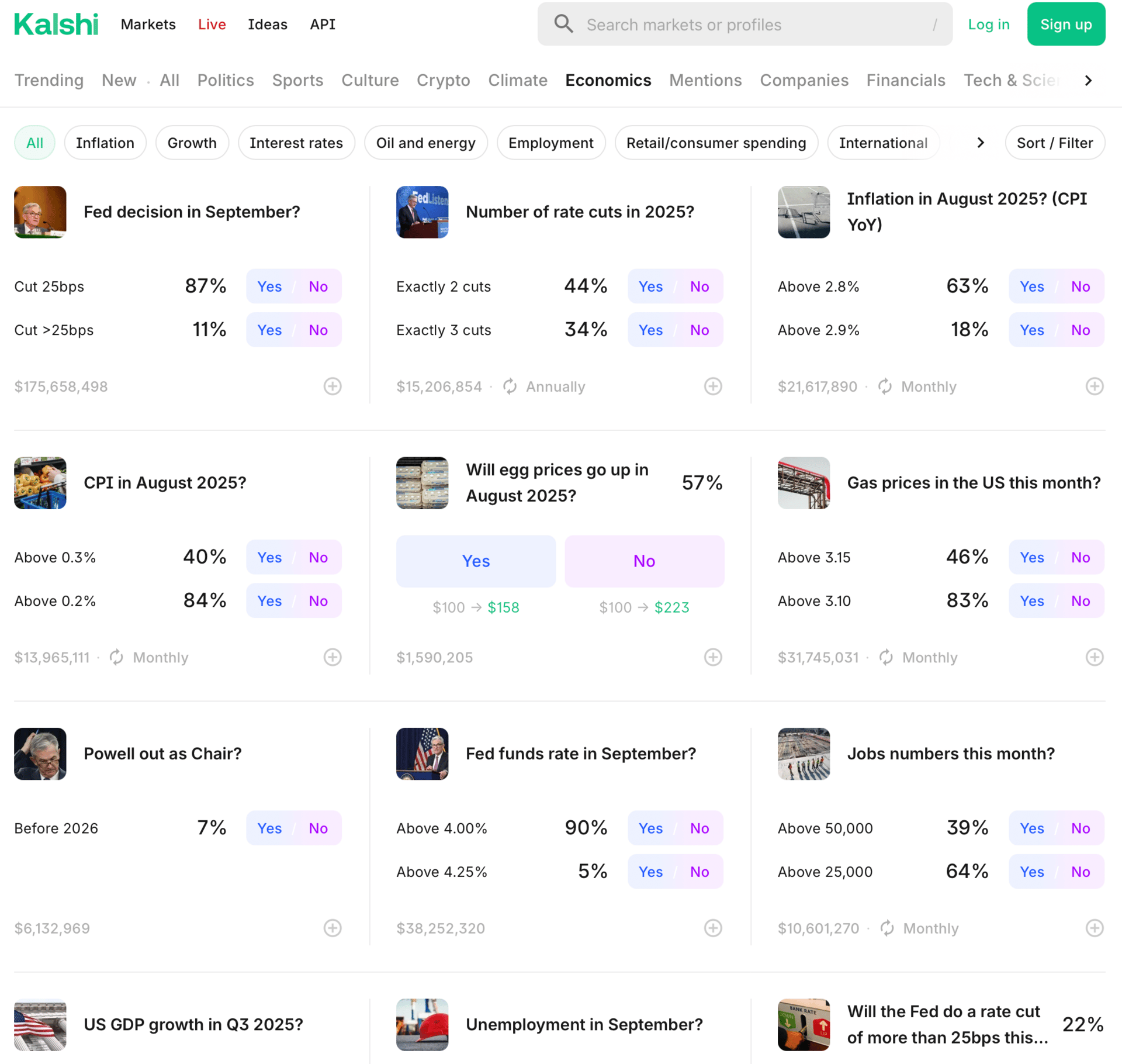

And the U.S. is now becoming increasingly friendly to prediction markets, with Polymarket’s CEO saying they will be approved in the U.S. soon. Robinhood is powered by Kalshi, the other big name in the space.

Here’s what’s interesting. Prediction markets do two things that could drive Robinhood’s growth:

Opens up real economic futures to the average investor.

Hedge funds and other institutional investors have long been able to “make a market” in almost anything they want to have a position in.

Moves sports gambling from online gaming sites to a more efficient prediction market.

On the first point, there’s real value in being able to put on a position related to the Fed’s rates or inflation, for example. And the number of potential contracts is mind-blowing and only limited by your imagination.

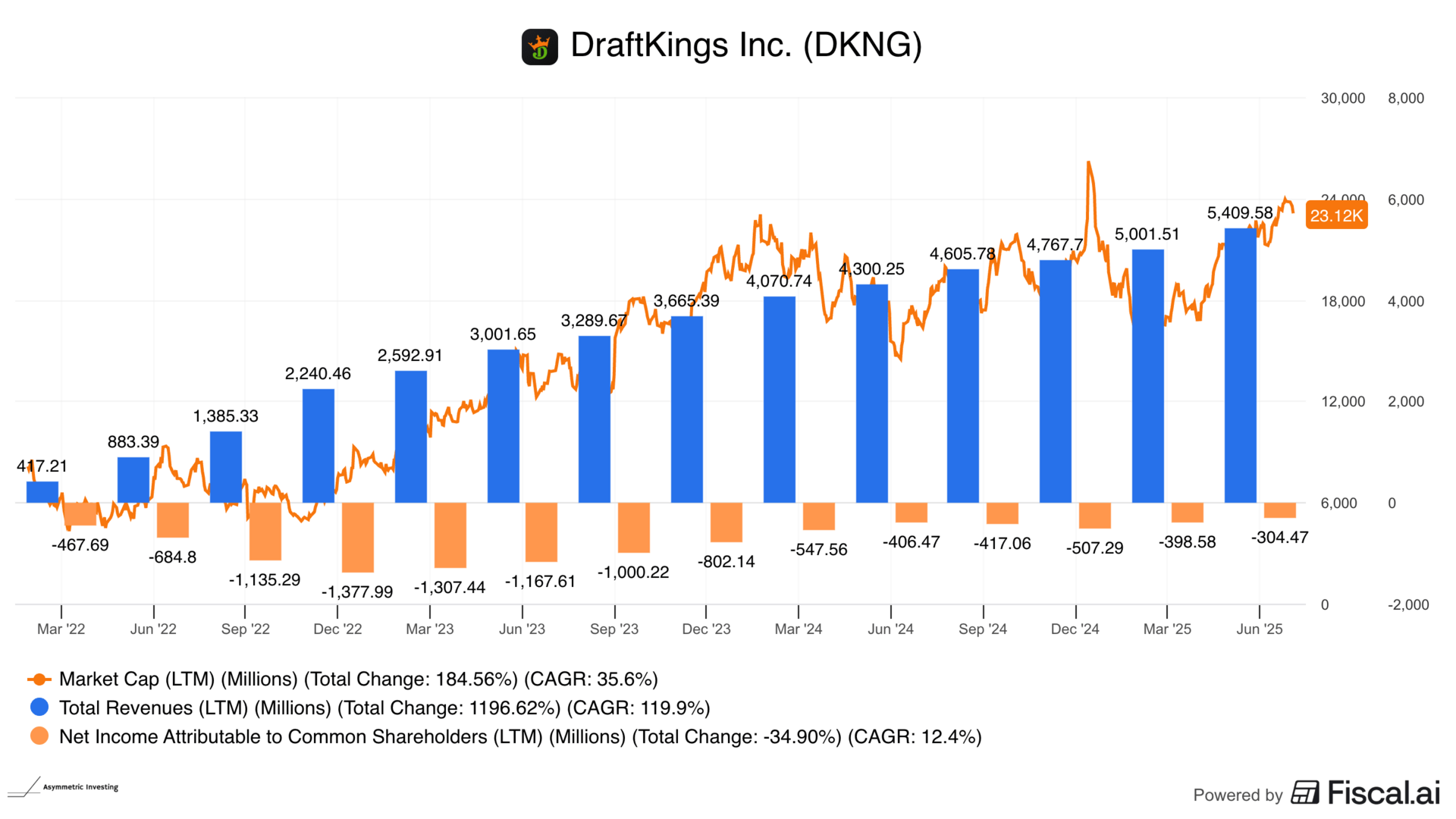

Where this gets more interesting and disruptive is sports betting. Only about half of the states allow sports betting, and yet DraftKings is a $23 billion business with strong growth.

But it’s also not profitable. And Robinhood (and other prediction markets) may be a disruptive force.

Earlier this week, I pulled the win odds for the Dallas Cowboys for this season and what the percentage win would be on each bet (ie, Win $/Bet $). The results may be surprising, but shouldn’t be. Prediction markets have far better odds across the board.

Here are the over odds for the Cowboys to win over a certain number of games.

DraftKings | Robinhood | |

|---|---|---|

Over 3.5 Wins | 11.1% | 11.1% |

Over 4.5 | 20.0% | 22.0% |

Over 5.5 | 40.0% | 37.0% |

Over 6.5 | 66.7% | 61.3% |

Over 7.5 | 100.0% | 117.4% |

Over 8.5 | 180.0% | 185.7% |

Over 9.5 | 280.0% | 300.0% |

Over 10.5 | 450.0% | 614.3% |

Sum | 1,147.8% | 1,348.7% |

And the under odds.

Under 3.5 Wins | 600.0% | 669.2% |

Under 4.5 | 350.0% | 426.3% |

Under 5.5 | 200.0% | 233.3% |

Under 6.5 | 125.0% | 143.9% |

Under 7.5 | 83.3% | 75.4% |

Under 8.5 | 45.5% | 47.1% |

Under 9.5 | 27.8% | 26.6% |

Under 10.5 | 15.4% | 16.3% |

Sum | 3,044.7% | 3,601.2% |

Look at the sum of the odds. That’s not a perfect metric, but it shows just how much better the odds are on prediction markets than sports betting apps.

This could be an enormous point of disruption and a growing market for Robinhood. DraftKings alone generates $5.4 billion in revenue from only about half of the U.S. population, and only those who choose to interact with sports betting.

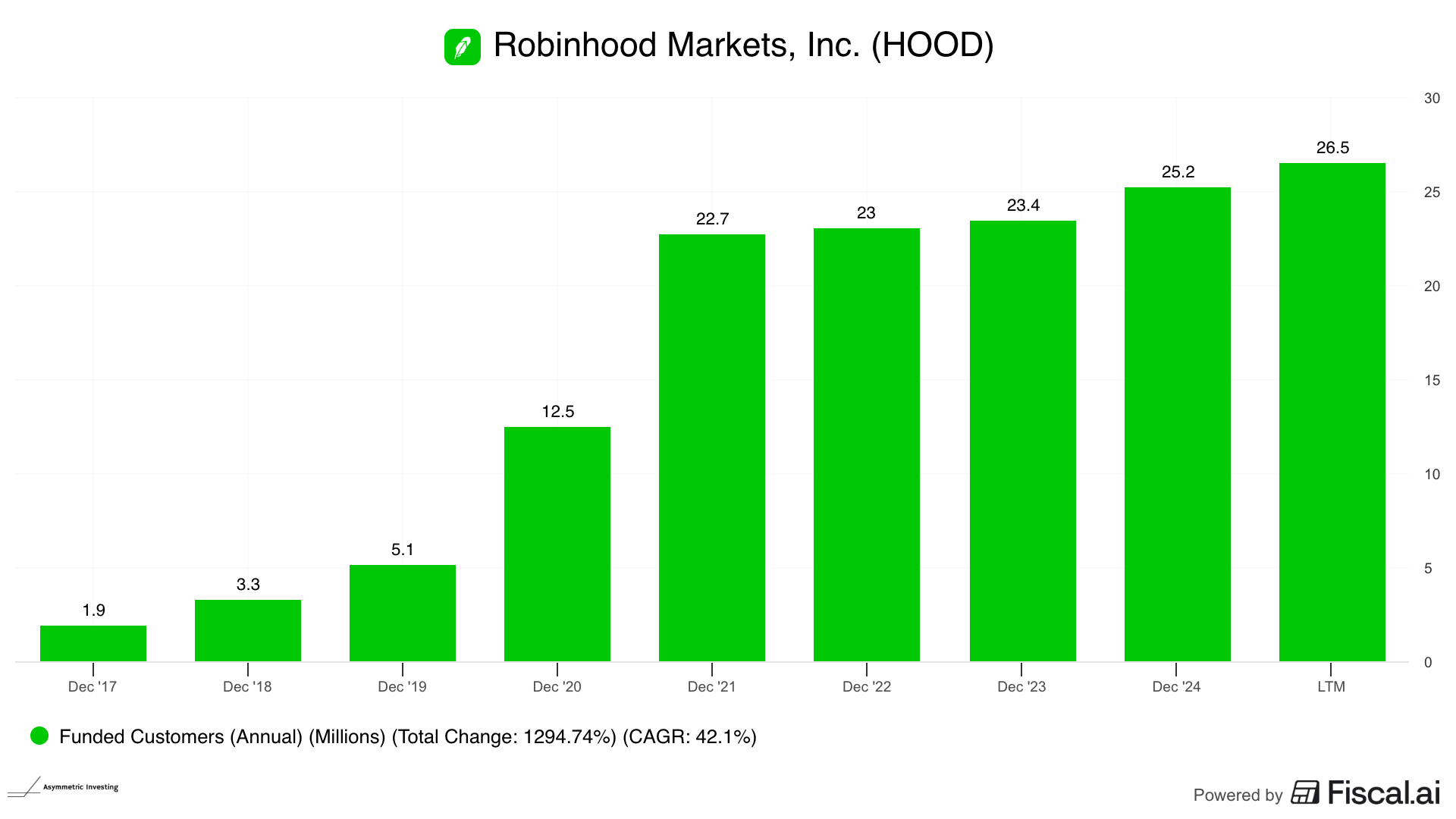

In the second quarter of 2025, DraftKings had just 3.3 million unique monthly active users. Robinhood has 26.5 million funded customers.

If these users take up sports betting and other futures contracts, it could be another growth business for Robinhood. And given how much more efficient prediction markets are and how many more users can legally participate, I think this could be a booming business.

Growth doesn’t always come where we expect it, and with a hot stock like Robinhood, it may be the emerging market of predictions where we see exponential growth in the future.

The stock isn’t cheap at 25.2x sales, but a growth rate over 50% deserves a high price. And with prediction markets, that growth may continue.

If Robinhood continues to innovate and disrupt competitors at this pace, I’ll be a shareholder for a very long time.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your research before acquiring stocks.