Note: The Saturday article took longer than expected and is delayed until Monday for premium subscribers. Sorry for the delay.

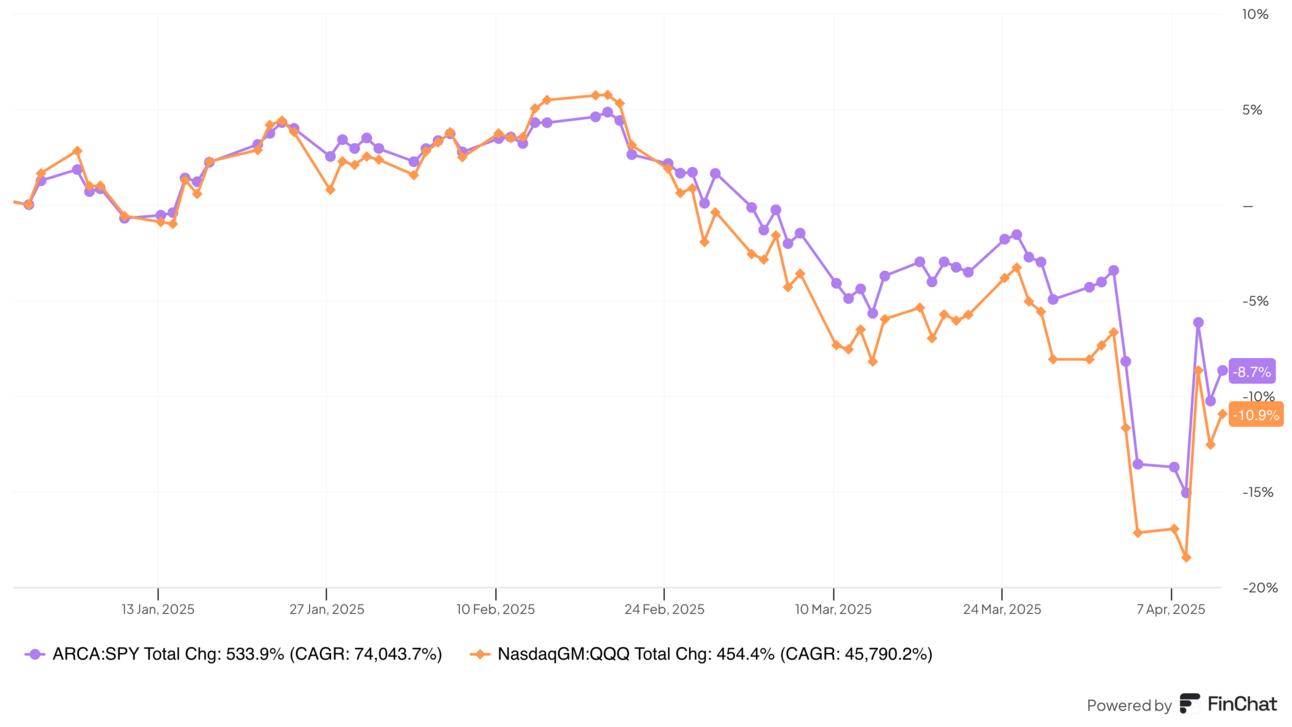

The last 11 days on the stock market have been nothing short of crazy. Tariffs on, tariffs off, yields down, yields up, risk off, risk on. It’s times like this that show why I’m not a day trader. And we’ve barely started earnings season.

The Asymmetric Portfolio is back to beating the market in 2025, albeit by a very small margin, and the portfolio is still down for the year. Earnings seasons will play a big role in the next move, particularly for some of the more volatile stocks, so the next few weeks will be key. But I like adding some of the higher growth companies in the portfolio recently and will get more aggressive if the market slide continues.

With all of the noise, I want to spend some time today giving perspective to what’s going on in the market.

What stocks am I adding to my market-beating portfolio each month? You can sign up for premium here to find out, get 2x the Asymmetric Investing content, and gain access to the market-beating Asymmetric Portfolio. What are you waiting for?

How do I make all of the charts in Asymmetric Investing? Simple. With Finchat. You can get started with FinChat Pro for free for 2 weeks below. After that, you’ll get 15% off for being an Asymmetric Investing subscriber. I can’t say enough how much easier it’s made my research. Check it out. 👇

In Case You Missed It

Here’s some of the content I put out this week.

Trade Wars, Breaking Things, and American Resilience: America will get through this.

Why Zillow Has Already Won the Housing Market: Zillow has become the only aggregation play in housing, and that’s why it has a 10x-100x potential over the next 20 years.

April Buys After-Show: I recently joined Slice as a mentor, and this week, I shared this conversation with Lou Whiteman about the monthly buys in the Asymmetric Portfolio in April. Let me know what you think about this conversation!

Always Zoom Out

The common refrain last week was that President Trump’s capitulation on tariffs — which seems to be wavering depending on the hour — was driven by rising yields in the bond market.

Markets are the fastest way to get feedback on policy changes and economic data, so it’s not surprising that investors were worried about 30-year yields rising from 4.6% to 4.9% in 3 days.

But was this move a big deal? Kind of.

It’s a sharp move higher, but we’re still below yields early in 2025. So, this may just be an unwinding of some of the bond market’s hope for rate cuts in 2025, which isn’t the end of the world.

Zoom out even further, and you can see we’re at a 30-year yield below the 1980s and 1990s. The 2010s were an outlier historically, and we may never get back to 2020 yields under 2.5%.

The U.S. dollar was the other big worry of the week. The dollar crashed as the trade war escalated, which is the opposite of what the market would expect to happen.

It’s not uncommon for stocks to drop 4-5% in a few days, but it is a big deal if the dollar moves that quickly.

This could be a big deal, but again, let’s zoom out to a year. The dollar is simply back to where it was in October.

Pull back further, and the dollar is still stronger than it was a decade ago.

Don’t mistake the freakout of the CNBC class for the impact of tariffs, the dollar, or anything else on the real economy.

Take a step back and put some of the short-term worries into perspective. It’ll make it easier to determine if this is a big deal or a short-term blip.

For now, these are blips, not broken parts of the market. And if we can invest with a clear head in a chaotic market, we’re a few steps ahead of the market.

Earnings season will be much more important for the market and evidence about the direction of the economy. If companies are changing their investment and hiring plans because of tariffs or general uncertainty, it would be a big deal.

Stay tuned for more on that, but let’s not lose our heads. That’s how you miss opportunities and big recovery days.

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your research before acquiring stocks.