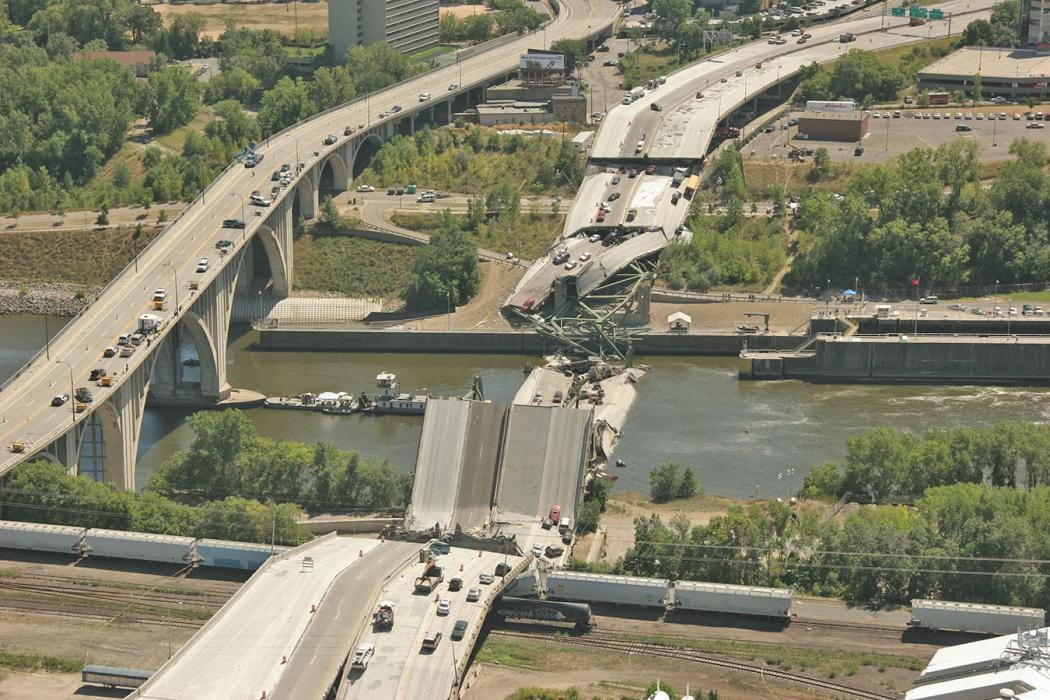

On August 1, 2007, the I-35W bridge crossing the Mississippi River into downtown Minneapolis collapsed. The disaster happened a few blocks from where I was living at the time (I had a line of sight to the collapse when news broke) and took the lives of 13 people.

The bridge collapse was a failure of government from Washington, D.C. on down, not unlike the hollowing out of the middle class and the Midwest — as we’ve seen over the past four decades — which led us to the current chaotic tariff response we’re seeing from President Trump. 145% tariffs on China will be destructive to them and us. But we have to deal with the unexpected.

What happened after August 1, 2007, in Minneapolis is what I want to focus on today.

Designing, tearing down, and rebuilding a bridge of this size in the U.S. would normally take years. A project on I-35W a few miles down took what seemed like a decade to complete.

But the I-35W bridge went from collapse through cleanup, design, and construction to reopening a new bridge in 13 months and 17 days.

Don’t tell me we can’t build things.

We can.

If we want to…

Tariffs and Breaking the U.S. Economy

I think the most consistent critique of the economy from President Trump is that the U.S. has lost its manufacturing core over the past four decades as production has moved to China and other countries in Southeast Asia.

That’s true.

You can see the impact in towns around where I live. Vibrance is gone. Homes are abandoned. The vibe is…bleak.

The question is, what do we do about it?

President Trump’s answer is tariffs. His answer has always been tariffs. The market seems surprised, but it shouldn’t be. This has been a consistent policy goal of his for decades, and as President of the United States, that’s what he’s doing.

I’m not here to prescribe better solutions or debate the impact of this tariff or that. I don’t want to get into politics, I’m an investor.

And investors have to play the cards they are dealt.

The hand today is tariffs. They may be 10%. They may be 145% (today’s tariff on Chinese imports). The may be somewhere in between.

Tariffs could break the economy.

Tariffs could break the consumer.

Tariffs could break something unforeseen in the market.

As far as I’m concerned, it’s August 2, 2007, and the bridge has collapsed. The question is: What are we going to do next?

Investing in Uncertainty and Resilience

The history of the United States and the reason it’s the best place to invest capital is the ingenuity and entrepreneurial spirit of the American people.

We move fast and break things. Sometimes that’s good. Sometimes, it’s not. But I have no doubt we as a society will thrive no matter what is thrown our way.

When the Great Financial Crisis hit, I was an engineer at 3M, and now I have a YouTube channel and a newsletter. You may have a similar story of adaptation or evolving with the world.

I see this as a time to adapt to the new rules of the game, and I want to invest in companies that can thrive in the new environment.

There’s uncertainty, which the market hates, but that generally gives us better prices for assets.

This uncertainty also puts more focus on the investments we make and who will thrive and who will die. I want companies with:

Positive net cash

16/20 stocks in the Asymmetric Portfolio have positive net cash

Positive free cash flow/earnings

16/20 stocks in the Asymmetric Portfolio have positive free cash flow

Resonable valuations

5/20 stocks have a P/E under 20x

18/20 stocks have a P/S multiple under 7x

If I get all three, it limits my downside, and it gives the companies I own a chance to not only survive but thrive with whatever comes next.

I’m betting on the resistance of the American economy and entrepreneurs to overcome tariffs or whatever comes next. I don’t know what they’ll create or what the companies I own will look like a decade from now, but I think I’m positioned for success no matter the hurdles.

In the last 100 years, the market has survived a world war, oil crisis, pandemic, and financial crisis, and that’s just a short list of uncertainties investors had to deal with.

This is different because it’s self-inflicted.

But the U.S. economy will survive and eventually thrive. I’m happy to buy stocks at a discount as the market waits through the uncertainty.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.