When I wrote the Zillow Spotlight on October 31, 2023, the company was a popular app for finding homes, but it was far from “winning” the housing market.

Realtors still controlled the market, and the idea that Zillow could aggregate demand onto one app for the entire country (eventually the world?) was still far-fetched given agents’ power. And rentals were a bifurcated market, to say the least.

But the 10x — or 100x — opportunity was for Zillow to be an aggregator of demand and ultimately own the best strategic position in the housing market.

A lot has changed since then, and I think we are starting to see aggregation take hold.

Aggregation

For some background, this is from Ben Thompson’s Aggregation Theory:

The fundamental disruption of the Internet has been to turn [supply being the point of power in the market] on its head. First, the Internet has made distribution (of digital goods) free, neutralizing the advantage that pre-Internet distributors leveraged to integrate with suppliers. Secondly, the Internet has made transaction costs zero, making it viable for a distributor to integrate forward with end users/consumers at scale.

This has fundamentally changed the plane of competition: no longer do distributors compete based upon exclusive supplier relationships, with consumers/users an afterthought. Instead, suppliers can be commoditized leaving consumers/users as a first order priority. By extension, this means that the most important factor determining success is the user experience: the best distributors/aggregators/market-makers win by providing the best experience, which earns them the most consumers/users, which attracts the most suppliers, which enhances the user experience in a virtuous cycle.

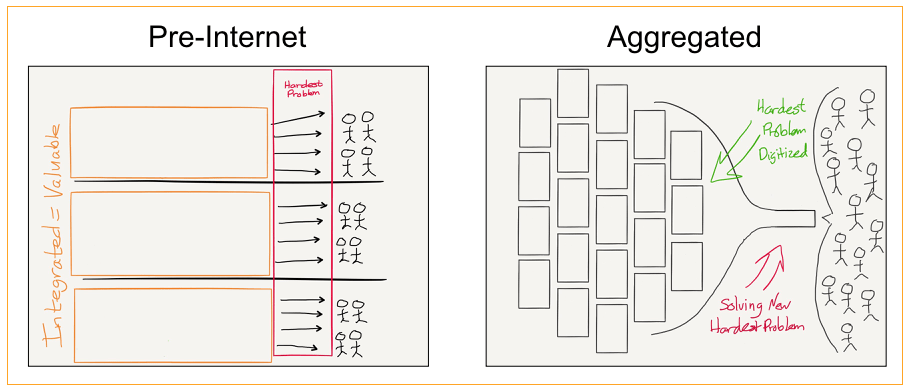

This is the visual he used to describe the concept.

I’m going to go through the three statements I highlighted, but here’s another simple way to think about aggregators. A great aggregator controls demand because people choose to interact with them every day. Netflix, Google, Facebook, and Uber are examples of aggregators.

We need to ask a simple question: Who do customers choose to interact with?

That’s usually the winner in the market.

Consumers As an Afterthought

Shortly after the spotlight was published, the National Association of Realtors was found to have colluded against customers by tying buyers’ agents’ fees with sellers’ agents’ fees. Nothing screams customers as an afterthought like exorbitant fees and collusion.

The finding makes sense when you think about it. Why isn’t there more price competition in the agent market in the internet age, and why are agents still charging 6% to sell a home?

And why do buyer’s agents get 3% for showing buyers around?

In the 1950s, when information was scarce, the structure made sense. But today, you can find the value of any home or any listing in the U.S. with a few clicks of a button.

The changes made to the realty business after the collusion finding won’t fundamentally cause changes, but it shows the crack Zillow can exploit. Now, buyers and sellers need to disclose their fees and negotiate them. If you’re cool with paying a buyer’s agent $15,000 to show you around and help find a $500,000 house, that’s great. But you’ll know how much they’re making, and if you do the legwork and only want an agent to help file paperwork, maybe that’s worth less.

I’ll note that we didn’t use an agent when buying the home we live in today, choosing to pay $1,000 for the same legal forms from an agent, and we negotiated out the buyers’ agent fee from the home price. We were the exception in 2018, but soon, we may become the rule.

Suppliers Can Be Commoditized

We know customers were an afterthought in the old system, but can suppliers (agents) who charged high fees be commoditized by an aggregator like Zillow?

Take the last week as evidence that they can:

Zillow announced HomeServices of America — Berkshire Hathaway’s real estate brokerage business — would “empower agents with Zillow Showcase.” This is Zillow’s proprietary showing platform, and this is a big supplier looking to win business by leveraging Zillow’s tools and distribution. (See what a Showcase listing looks like below.)

This is a short-term win for HomeServices of America because it may differentiate them from other agents, but it’s a long-term win for Zillow, getting more supply on Showcase.

The analogy here is Disney getting ~$200 million per year for licensing content to Netflix starting in 2012, which would ultimately drive Netflix subscriber growth that would ultimately help upend Disney’s core business.

eXp, the #1 brokerage by transaction count in the U.S., announced it would “commit to posting listings in the Multiple Listing Service (MLS) within one day of publicly marketing to consumers and ensuring that eXp listings are on Zillow and available to the largest possible audience of buyers.“

A practice to keep agents relevant is doing “pocket listings” or “off-market” showings, which makes agents seem powerful. But the reality is that it brings fewer buyers into a home than a full listing on a platform like Zillow’s. And if Zillow has all of the supply, it will attract more demand.

Example of a Zillow Showcase listing.

Read between the lines, and what you’re seeing is supply realizing they have to play ball with Zillow or they’ll lose business.

Once all supply is on Zillow, it’s all a commodity. One broker is no different from another in Zillow’s eyes. Self-listing a home may even become more desirable than using an agent…eventually.

Zillow’s Virtuous Cycle

The virtuous cycle has begun between supply (brokers and agents) and demand (buyers). And we see Zillow’s revenue growing faster than the market in both home sales and rentals. ✅

What we want to see now is competitors capitulating because they know Zillow has won the market.

Right on cue, Costar agreed to review its capital structure and “significant investments” in Apartments.com and Homes.com, two of Zillow’s biggest competitors.

It’s a rational response by Costar, which has a valuable commercial real estate business and a middling business in homes and rentals. But it shows them sliding down the Smiling Curve, if not falling off it altogether.

Redfin announced earlier this year it would bring supply from the Rent. network of rent.com and apartmentguide.com to Zillow.

Remember, Zillow isn’t just becoming an aggregator in home buying, it’s also an aggregator in rentals. This is a housing aggregator.

If competition fades and invests less in growth, Zillow will entrench itself further as the main aggregator in housing.

I think the market has already been won by Zillow. Now, the company needs to build the tools and consumer behavior to be a true disruptor in real estate.

True Disruption Will Take Decades

While all of these milestones are important for Zillow, it will take time for them to result in a truly disruptive business. Housing is slow to evolve, and most people only make a few housing transactions in their lives.

It could take decades before the vision of Zillow being “the first place” an individual (agent optional) lists their home and the go-to for buyers, abstracting away the high-cost value of real estate agents.

In this vision, discovery, due diligence, offers, moving logistics, and even closing could be done on the Zillow platform. Rentals are getting there, but housing will take more time.

But like Netflix in streaming, Google in news, Uber in transportation, or Airbnb in rental homes, eventually one player comes to aggregate a market, and Zillow looks like the one company with the business model and strategic position to do it.

Aggregating housing could be one of the most valuable businesses in the world. That’s the 100x potential for Zillow, eventually.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.