It’s a big week coming up for Asymmetric Investing:

Monday (late): For premium, I am doing a 1st half of 2025 review. I’m going over every single stock and where they’ve gone so far this year.

Tuesday (early): Premium. My monthly buys will go out before the market opens.

Thursday: Normal free article.

Friday: Holiday. No article.

Saturday: Premium article.

Sunday: Normal free weekly recap article.

So, I have a shorter Sunday update than usual this week. If you want the first half review and the stocks I’m buying this week, be sure to sign up for premium.

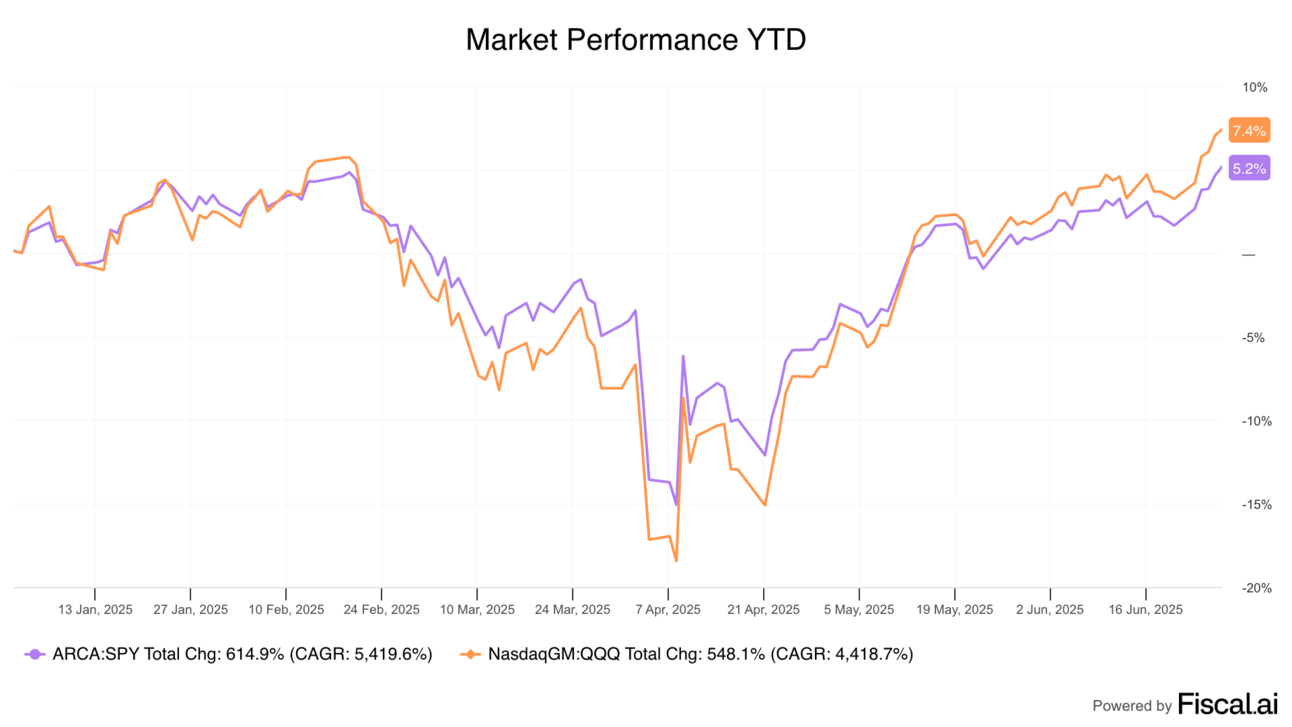

First off, the market overall had a great week. The reduced tensions in trade talks and the Middle East seem to be bringing buyers back to the market. We’ll see what they do to earnings and guidance starting in a couple of weeks, and that’s where the news may not be as good.

The Asymmetric Portfolio had a solid week, despite one of the biggest holdings being down 23% for the week. Diversification wins!

All of the charts you see here are easy to make with Fiscal.ai, the first place to go for all of my research. I can’t say enough how much easier it’s made my research, and you can start with 2 weeks free. 👇

In Case You Missed It

Here’s some of the content I put out this week.

Hims & Hers vs Big Pharma: I gave early takes on why Hims & Hers fell 30% on Monday and why I thought the reaction was a little crazy from the market.

The Talent Magnet: Speaking of Hims & Hers, I used them as an example of a company attracting quality talent today. And as investors, talent matters more than anything else.

Google and Artificial Intelligence: Google may be better positioned in AI than you think.

My 4 Worries About the Market: There are reasons to be worried about the market, and these are the big things I think about.

The Impact of Buybacks

We are at a point in the market where investors need to start thinking about valuation more deeply. Growth isn’t enough to outperform the market because valuations are getting so high.

The price-to-earnings multiple of the S&P 500 has only been higher than it is today on three occasions — the dot-com bubble, during the Great Recession, and early in COVID.

With prices this high, I’m looking for deals.

What is the market overlooking?

And what stocks are so cheap that management says, “Our stock is so cheap we HAVE to buy it back.”

I’ll talk more about buybacks with Tuesday’s picks, but I wanted to give a couple of examples of great buybacks. And I write this with the 4 reasons stocks go up in mind.

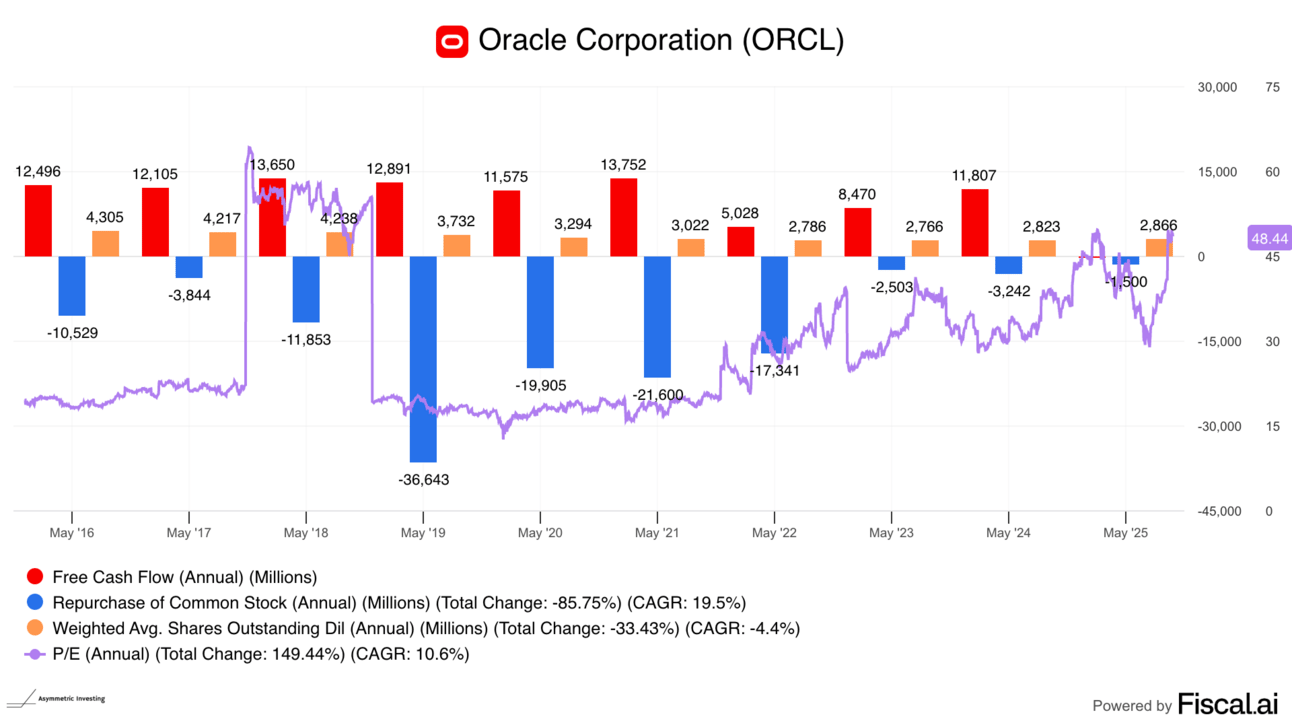

Oracle

We don’t think about Oracle as a high-return company, but the stock is up 484% in the past decade before dividends despite just 5.0% compound revenue growth and falling cash flow. But the cash they did generate went to buybacks (and then some), and the P/E multiple rose at a 10.6% compound annual rate.

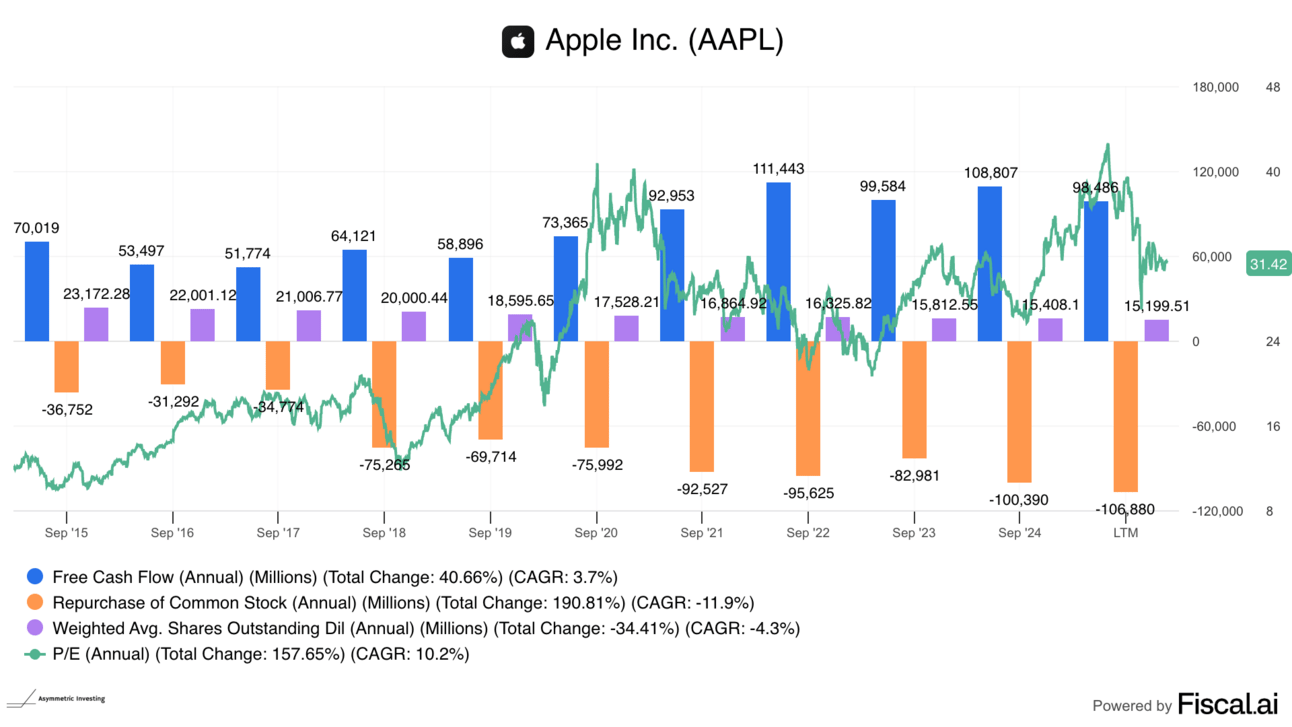

Apple

You may be surprised to learn that Apple’s free cash flow is up just 3.7% on a compound annual basis over the past decade. But the number of shares outstanding fell 4.3% and the P/E multiple expanded 10.2% on a compound basis. Add it up and you get a stock up 541% even before considering dividends.

Overlooked and Unloved

I’m seeing some companies with great balance sheets and low earnings multiples, much like Oracle and Apple a decade ago. And where their management teams are using that value to buy back stock aggressively is where I see opportunities.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your research before acquiring stocks.