As background before we get going on this semi-emergency update: Hims & Hers $HIMS ( ▼ 1.39% ) entered the Asymmetric Universe of stocks on May 24, 2024, with this spotlight article. Since then, I have bought shares 7 times and have a cost basis of $24.65 per share in the Asymmetric Portfolio.

I’m not selling now, and this article explains why.

If you like what you read here, join Asymmetric Investing Premium to get deep dives, stock buys, and the full Asymmetric Portfolio. At $100/year, it’s the best value in investing, outperforming the market by 3x EVEN AFTER yesterday’s drop in Hims & Hers stock.

Being an Asymmetric Investor naturally puts me in uncomfortable positions from time to time. To make big returns, we need to live further out on the risk curve and be comfortable with uncertainty and being wrong. There are even times we have to lean into the gray areas of business.

Sometimes, those higher-risk/gray area stocks will give us massive gains.

Other times, they’ll fall on their face.

We’ve seen both at Hims & Hers $HIMS ( ▼ 1.39% ) this year alone.

For better or worse, this has been the most controversial stock I’ve covered on Asymmetric Investing, as everyone seems to have an opinion about the company and its stock.

Hims & Hers is the best stock ever!

Hims & Hers is going to ZERO!

Lawsuits are coming!

OMG, the Europe acquisition changes everything!

None of these takes is 100% right. None of them is 100% wrong. There are opportunities and risks.

When you’re trying to disrupt healthcare, it’s going to be…messy.

We saw that firsthand this week when Novo Nordisk accused the company of “deceptive promotion and selling of illegitimate, knockoff versions of Wegovy® that put patient safety at risk.“

Those are big claims. After letting the news set in for 24 hours, let’s go through what we know, perspective on the announcement, and what I’m doing now.

Novo’s Big Accusations

The full press release is here, but the key in Novo’s termination of the collaboration with Hims & Hers is the following quotes:

Hims & Hers deceptive promotion and selling of illegitimate, knockoff versions of Wegovy® that put patient safety at risk.

Based on Novo Nordisk's investigation, the "semaglutide" active pharmaceutical ingredients that are in the knock-off drugs sold by telehealth entities and compounding pharmacies are manufactured by foreign suppliers in China. According to a report from the Brookings Institute, FDA has never authorized or approved the manufacturing processes used by any of these foreign suppliers to make semaglutide, nor has FDA ever reviewed or authorized the quality of the "semaglutide" they produce. The report also found that a "large share of [these Chinese suppliers] were never inspected by FDA, and many of those that were [inspected] had drug quality assurance violations." US patients should not be exposed to knock-off drugs made with unsafe and illicit foreign ingredients.

Hims & Hers Health, Inc. has failed to adhere to the law which prohibits mass sales of compounded drugs under the false guise of "personalization" and are disseminating deceptive marketing that put patient safety at risk.

These are big accusations. Novo is saying the promotion and sale of compounded GLP-1 products is illegal, ingredients are illegal, and Hims & Hers’ products put patients at risk.

To be clear, if Hims & Hers is using illegal input ingredients, that’s a huge problem. And if it’s compounding illegally, that’s a huge problem. That said:

If these accusations are backed up with evidence, why wasn’t a lawsuit filed at the same time?

Why did Novo Nordisk dissolve this collaboration but kept other partnerships with telehealth compounders who are (based on the statement) using the same Chinese ingredients?

Indirectly, Novo is accusing the FDA of not properly regulating Hims & Hers’ 503B compounding facility because there are strict requirements about what can be compounded, where ingredients are sourced, and how the facility is run.

Novo came out with big words, but without big actions like a lawsuit backing up what was stated, I have to wonder what the real motivation is. A public tit for tat without having to produce evidence?

Novo Nordisk fired CEO Lars Fruergaard Jorgensen on May 16, less than three weeks after the Hims & Hers collaboration was announced, and whoever gets the job next will need to grow the GLP-1 business that’s been “disappointing” to investors.

Something doesn’t smell right, and I’ll get to how Hims & Hers responded in a moment.

Understanding the Incentives

I want to underscore one part of the release.

In late April, the FDA resolved the Wegovy® shortage based on its conclusion that Novo Nordisk is fully meeting current and projected nationwide demand for this medicine. In support of transitioning patients from knock-off compounded versions to authentic, FDA-approved Wegovy® through NovoCare® Pharmacy, Novo Nordisk began collaborating with telehealth companies.

In the first sentence, Novo says why they thought a partnership with telehealth companies was wise. It expands the market for them.

In the second sentence, it says what it thinks about compounded treatments. They’re KNOCK-OFFs!!!

Insulting the fastest-growing distributor of your products is an interesting strategy.

I’m not a doctor, and I won’t pretend to play one here. But my infant son got a compounded version of an antibiotic from the Children’s Hospital earlier this year. A reader told me a story about how standard dosages of GLP-1s made them sick, but lower-dose compounded versions were highly effective.

This is a sample size of 2 (out of 2), but it shows why the compounding exemption exists. Standard doses aren’t right for everyone.

Can Hims & Hers push people to compounded, or personalized, solutions because that’s where its incentives lie? YES!

Can Novo get upset because compounders haven’t ended the practice? YES!

Two things can be true. And with almost all things in medicine, there’s no “right” answer. It’s all grey. Incentives matter.

And that gets to the underlying incentives that Novo has in the market. It needs to maximize profits NOW, and if Hims & Hers isn’t going to do that, why be a partner?

Novo Nordisk’s patents that cover Ozempic and Wegovy end in 2032 in the U.S., 2026 in Canada and China, and 2031 in Europe.

That means the company has seven years to maximize what has been an incredibly high-growth business that is suddenly nearly 2/3 of the business overall.

Hims & Hers presented an opportunity to increase distribution, but at a cost.

Wegovy is sold for a relatively low price of $599 per month on Hims & Hers, well below the list price of $1,350. Note: A DTC version is available from Novo for $499 per month, and Novo mentioned this in their release yesterday.

Hims & Hers continued to offer personalized versions of semaglutide at a lower price than Wegovy, leaving competition within the Hims & Hers platform that Novo likely presumed would go away/be greatly reduced.

I wouldn’t be surprised if Novo Nordisk went into the partnership thinking they would scoop up all of the compounded prescriptions from Hims & Hers, elbowing out competitors like Eli Lilly. They likely found Hims & Hers sold some Wegovy, but were also happy to offer generic Liraglutide, oral weight loss offerings, and personalized semaglutide.

Is the answer as simple as, Novo expected sales through Hims & Hers to be X, and they were less than X, so they’re jumping ship?

Hims & Hers’ Response

Hims & Hers is a consumer company and had a consumer-like response to the accusations on social media. Here’s CEO Andrew Dudum:

I would be SHOCKED (sarcasm) if Novo wanted Hims & Hers to push Wegovy over other treatments. And Hims & Hers tries to have an arms-length relationship with providers (doctors) who prescribe treatments, which is where Dudum’s pushback seems to stem from.

This is a great opportunity for Hims & Hers to provide more transparency about its processes and why it’s within the law. And as a newly high-profile company, it has high expectations.

But we’re seeing that Hims & Hers is ready to fight back. If this does go to court, I’m not sure Hims & Hers would have a weak hand if they can prove Novo was pushing to “steer patients to Wegovy.”

Here’s an example of why being a founder is different. Dudum can put out a statement like this and put his cards on the table. Novo is being run by a CEO who’s already being shown the door.

The Perspective We ALL Need

I’ve written 1,500 words and not even mentioned that this partnership has had ZERO impact on this chart. Hims & Hers has grown at a 76% CAGR without a Novo Nordisk partnership.

And Hims & Hers isn’t a GLP-1 company.

It’s not even a weight loss company.

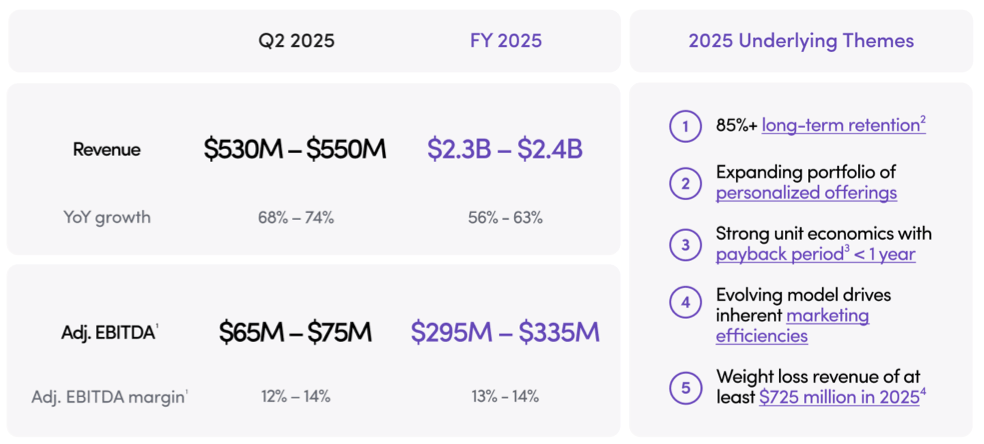

Weight loss is expected to be “at least” $725 million in revenue, including other GLP-1s, compounded solutions, and oral treatments. And that’s just 31% of the expected 2025 revenue. This deal may have been a few percentage points of revenue, but it’s not the end of the world.

What will be more impactful than this Novo Nordisk partnership is the upcoming launch of menopause and testosterone solutions expected later this year.

Hims & Hers is a medical platform/aggregator.

Hims & Hers is not a GLP-1 company! Novo Nordisk is!

Messy Disruption

One of the reasons I liked Hims & Hers when I first covered it was the clear strategy to disrupt healthcare as we know it.

And healthcare needs disrupting because it’s complicated, expensive, opaque, and doesn’t meet users’ needs. I think the disruptive nature of Hims & Hers has three key features:

No insurance

24/7 access

Direct to consumer

On the insurance side, this quote from the Q1 2025 conference call sums up the strategy well. In short, you can’t disrupt the status quo if you try to integrate with the status quo.

On the insurance side, no, I have very, very low interest in figuring out how to integrate insurance. And I think there's a few reasons. But mostly, it's because it is extremely complicated and extremely inefficient for consumers. So today, the vast majority of the country has insurance, as you know, and the vast majority of those people have high-deductible insurance plan. And so what that means is, on average, patients that are coming to the Hims & Hers platform are fully covered by insurance, but they have, let's say, a $2,000 to $3,000 annual deductible that they have to pay in cash before they get the benefit of $1 of insurance. And so while everybody is insured in this country, almost nobody is actually getting the benefit of insurance.

It's essentially a cash pay system today. People are just paying very, very high co-pays, and very few ever actually get the benefit of insurance unless it's a true catastrophic situation. So when I think about Hims & Hers and general health and wellness kind of everyday health care, I'm not talking about catastrophic care, but everyday health care, I think consumers having choice, selection using their cash where they want on services and providers that deliver really high NPS experiences, that's going to be the gold standard because it's a basic capitalistic environment where competition will drive great quality experiences, will drive the cost down and ultimately drive great valuable places for these people to put their money.

And I think what's happening right now, for example, in the obesity market, is a really great example of that. The pressure that Hims & Hers is putting by aggregating millions of patients who need choice, I think, is a huge component, and why some of the most important medicines of the last decade and probably the next decade are now being priced in the hundreds of dollars, not thousands of dollars range. So we want to be a party to everybody in the ecosystem, but we also want to put the consumer first ahead of all. And when I think about insurance and alignment, I believe we should be able to care for patients at a cash pay price for most of the things that affect us day to day, equal to or cheaper than the co-pays on their insurance plan.

And so far, we're pretty damn close to pulling that off for most categories, but I think that's kind of the ambition that we want to keep pushing on for the next 5 to 10 years.

That’s a founder clearly articulating why his disruptive vision is superior to the status quo.

This week, we saw the status quo fight back.

In these battles, I’ll bet on the disruptor over the disrupted any day of the week.

It’s going to be messy for a while, but unless there’s a major lawsuit with clear evidence of wrongdoing by Hims & Hers, I’ll hang on for the ride. And if the market gives us a good discount on the stock, I’m happy to buy more.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.