The stock market is still trading near all-time highs, and for stock investors, there appears to be little concern about potential risks from the economy, AI, or other factors at present. Earnings are strong and interest rates are coming down, so 🚀!

But the stock market doesn’t run the world.

The bond market does.

The bond market is ten times the size of the equity market, and bond investors are more concerned about risk than opportunity. They aren’t worried about the asymmetric upside we have with stocks because…there isn’t that much upside in bonds. The upside is you get paid back with interest.

That’s it!

So, when bond investors start demanding more for taking even the smallest risks, we need to pay attention. And yields are up in places you wouldn’t think they could be. I’ll get to more in a moment.

Stock markets were flat this week, despite some volatility.

s

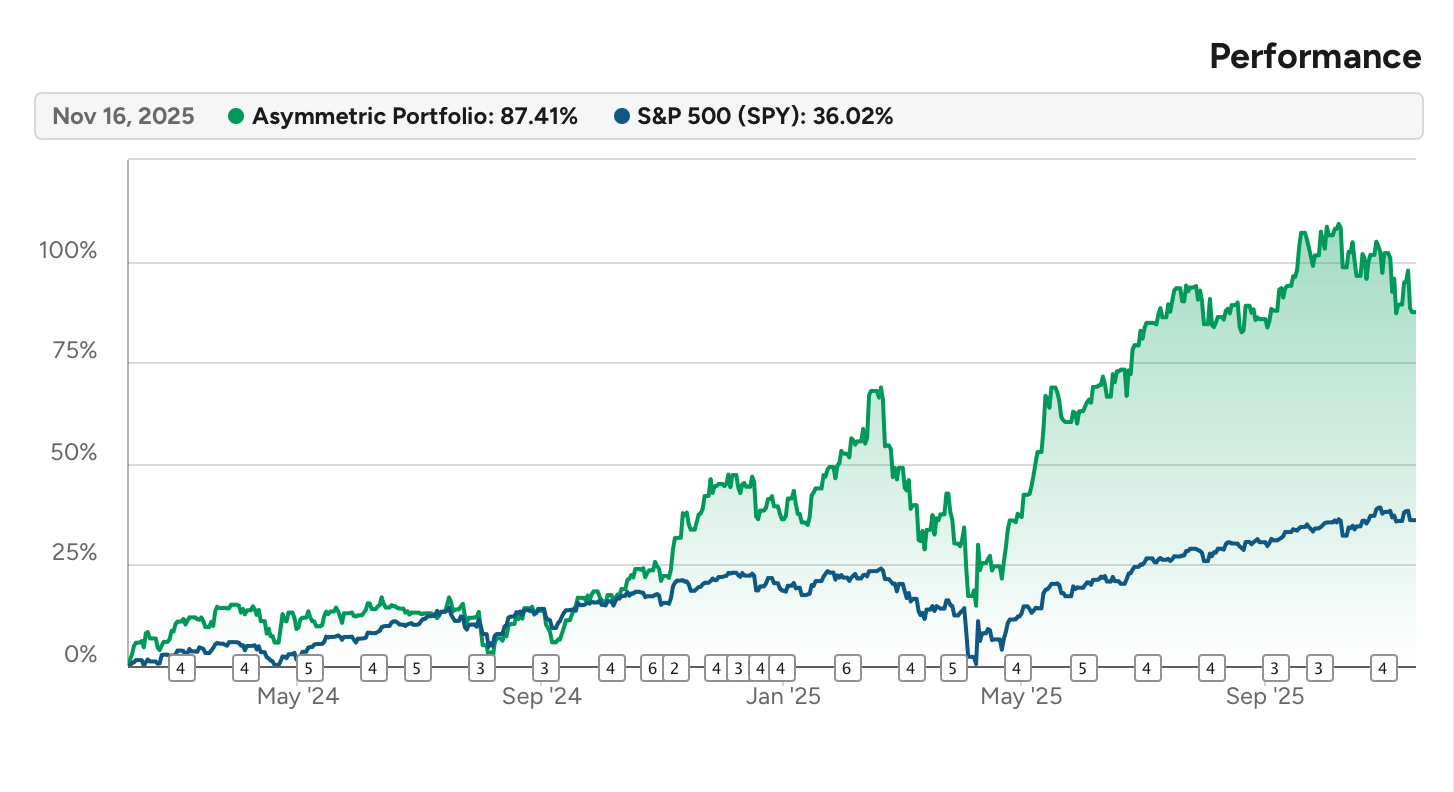

The Asymmetric Portfolio lost ground to the market again this week. Some of the bigger positions in the portfolio (Robinhood $HOOD ( ▲ 5.64% ) and SoFi $SOFI ( ▲ 3.38% )) dropped this week on valuation concerns. They’re both growing like crazy, so volatility comes with the territory, but this was one of those down weeks.

In Case You Missed It

Here’s some of the content I put out this week.

On’s Earnings & Autopilot Portfolio Changes: On had another great quarter, and the market finally paid attention. Plus, I made some changes to the portfolio on Autopilot.

Disney’s Inflection Point: Disney’s streaming business is now 3x the size of the linear TV business, and it’s nearly passed the legacy business in profitability.

Owlet’s Comeback: Owlet has finally turned a profit, and with the product going into hospitals more regularly, the business may finally be sticky enough to reach its full potential.

What Bonds Are Telling Us

The story of 2025 was supposed to be about interest rates and AI.

The market’s anticipation of rate cuts by the Federal Reserve helped push banks, tech, energy, and various other stocks higher throughout the middle part of the year, as the market rallied.

On September 17, 2025, the Fed did the first of two cuts of the fed funds rate, a short-term rate in the bond market. The market’s hope for rate cuts had finally become a reality.

But businesses and consumers don’t usually borrow money overnight, which is what the fed funds rate measures. People and businesses borrow for 5-10 years for purchases like cars and homes.

That’s why looking at the 10-year treasury yield is more important than the fed funds rate. And what’s the 10-year doing?

It’s UP since the Fed started cutting short-term rates and has jumped sharply in the past month.

Put simply, investors who control trillions of dollars are more worried about risks in U.S. debt than they were two months ago.

The rate cut narrative isn’t holding up to scrutiny.

Then there’s the AI trade.

Tech companies have announced $1+ trillion in spending on AI data centers, and companies like Oracle $ORCL ( ▲ 1.2% ), Coreweave $CRWV ( ▼ 1.3% ), Nebius $NBIS ( ▲ 3.45% ), and Iren $IREN ( ▲ 1.23% ) saw their stocks explode on little more than an announcement of a new data center deal.

However, those deals must be funded somehow, and these companies are turning to debt to finance the necessary investments. And the market started rejecting that debt a few weeks ago.

Oracle raised $1 billion at a 4.375% interest rate in September, and the debt is already at a 6.54% interest rate. Higher costs will make it harder to fund new projects, which trickles down to NVIDIA and other chip companies. Bubbles burst because debt investors say “no more”. Are we getting to that point?

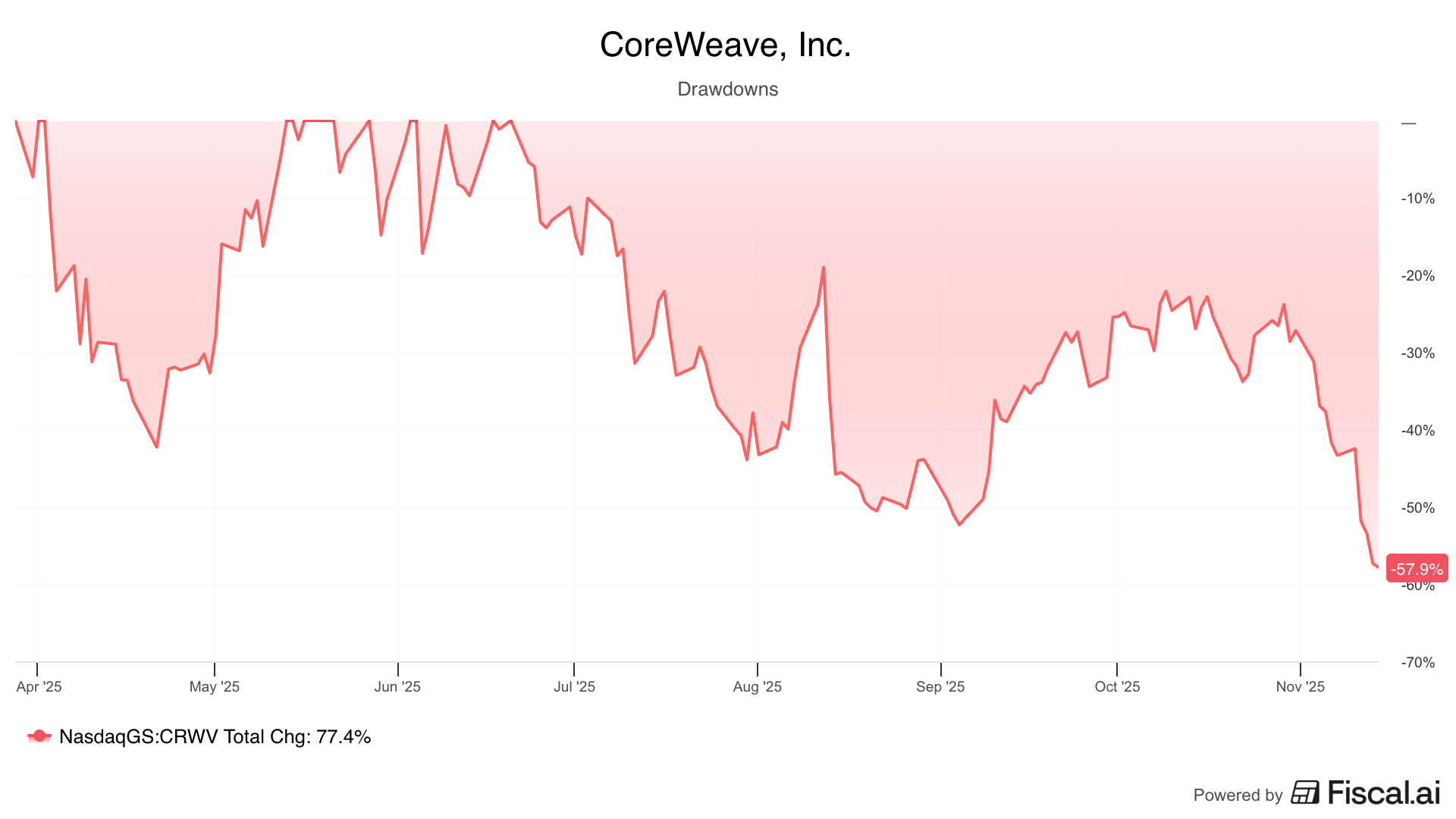

Coreweave’s debt currently yields over 10%.

When yields reach over 10%, it’s a warning sign for investors.

On the equity side, Oracle’s stock has cratered 32% in just a few weeks.

CoreWeave is down 57.9% from its high.

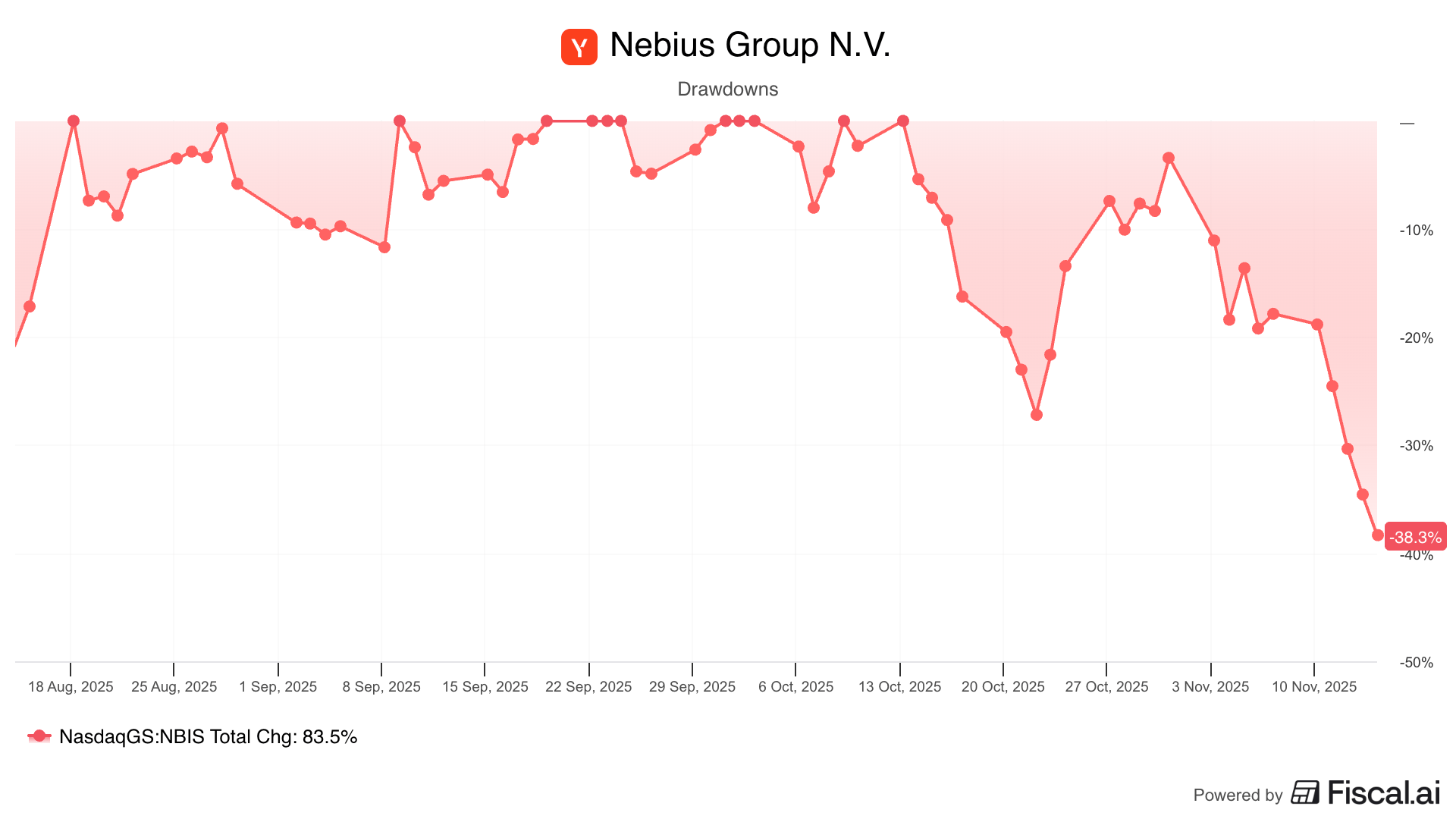

Nebius is 38.2% off its high.

You get the point.

Debt costs rise, while stocks decline.

This is why I spend so much time talking about cash flows and balance sheets on Asymmetric Investing. That’s where risk comes from.

Oracle lacks the cash flow to fund its AI ambitions without incurring a substantial amount of debt. So, when the market sees risks going up, it’s Oracle that falls first.

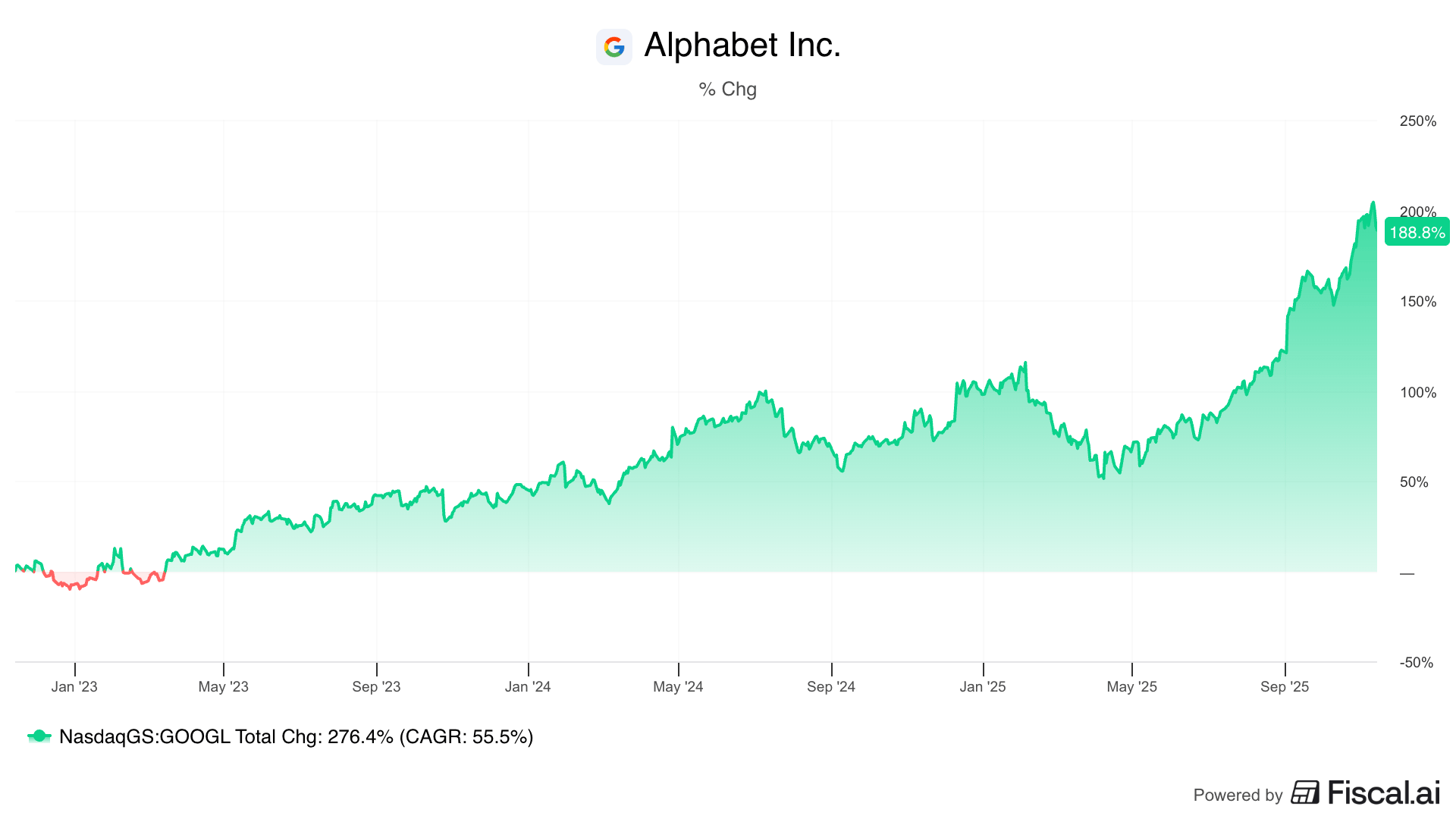

The only “AI stock” I own is Alphabet $GOOG ( ▲ 0.68% ), and it can fund AI ambitions with operating cash flow and a rock-solid balance sheet. The risks are lower, and the business model fits the moment. The market is taking notice.

The bond market may be boring, but it’s essential, and when bond investors start selling debt in companies, industries, and countries we are invested in, there’s usually a good reason.

Bonds are the canary in the coal mine for the risk we will eventually see in stocks.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your research before acquiring stocks.