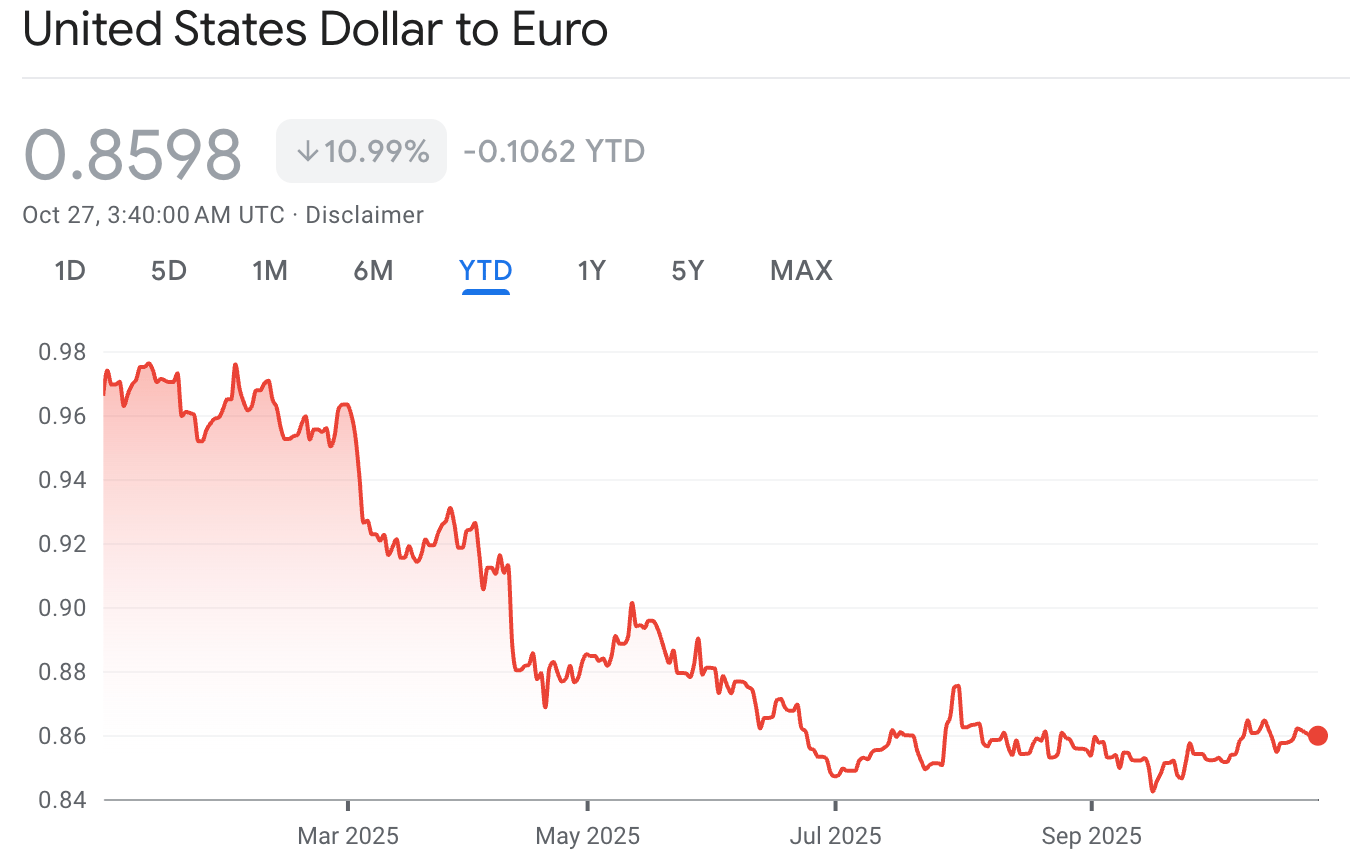

A hidden force in the market and economy in 2025 is a rapid decline in the U.S. dollar. After climbing against most currencies from 2008 to 2024, the dollar has fallen sharply (as far as currencies go) in 2025.

The drivers range from foreign countries reducing dollar reserves to the U.S. debt continuing to march higher. For us as investors, the reality is, the dollar is down. Now, what are we going to do about it?

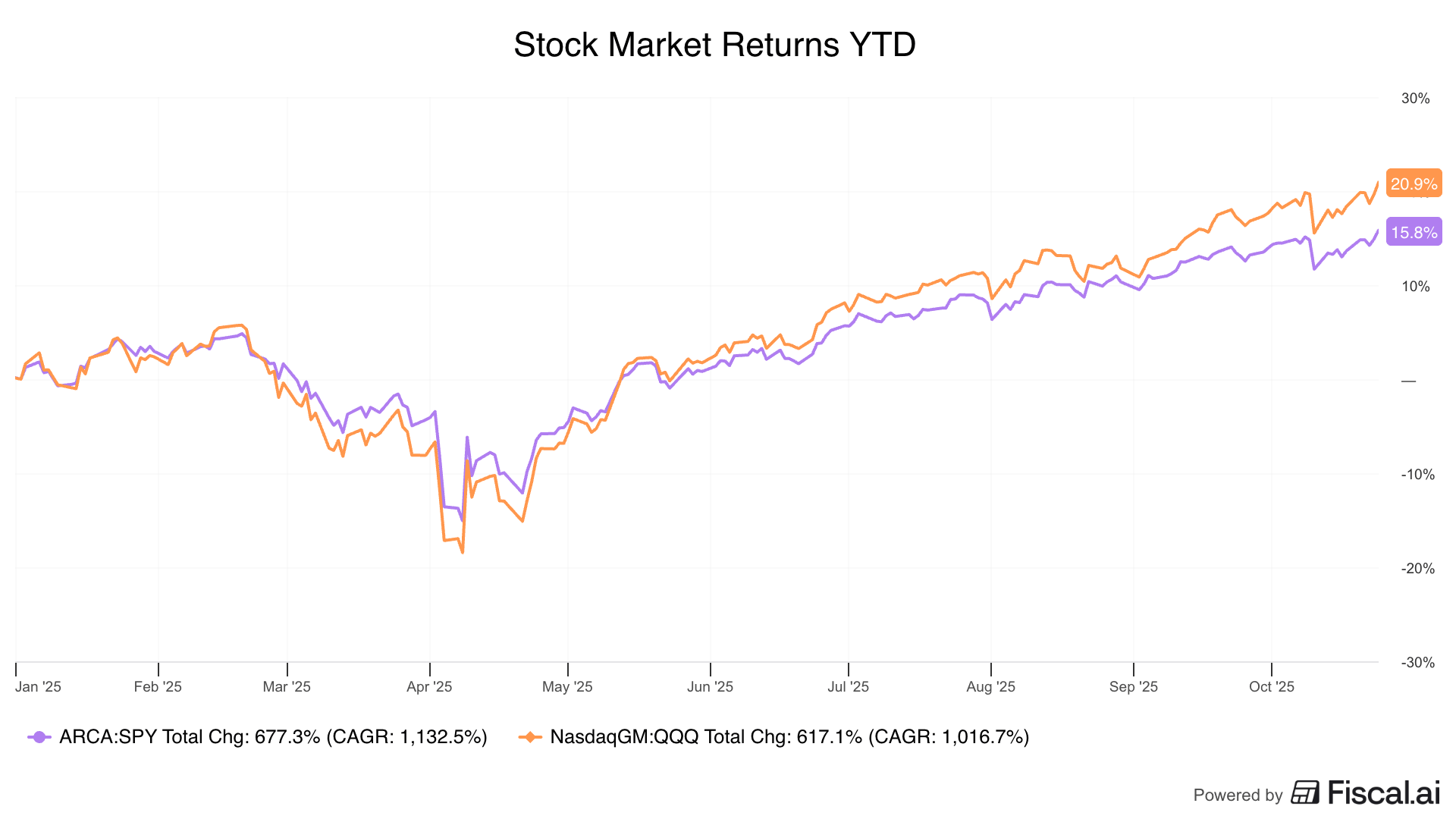

I’ll get to that in a moment. First, after some ups and downs, markets moved higher again last week. Talk of bubbles and some concerning news from banks was brushed off, and even trading late on Sunday looks like we’re headed higher early on Monday.

s

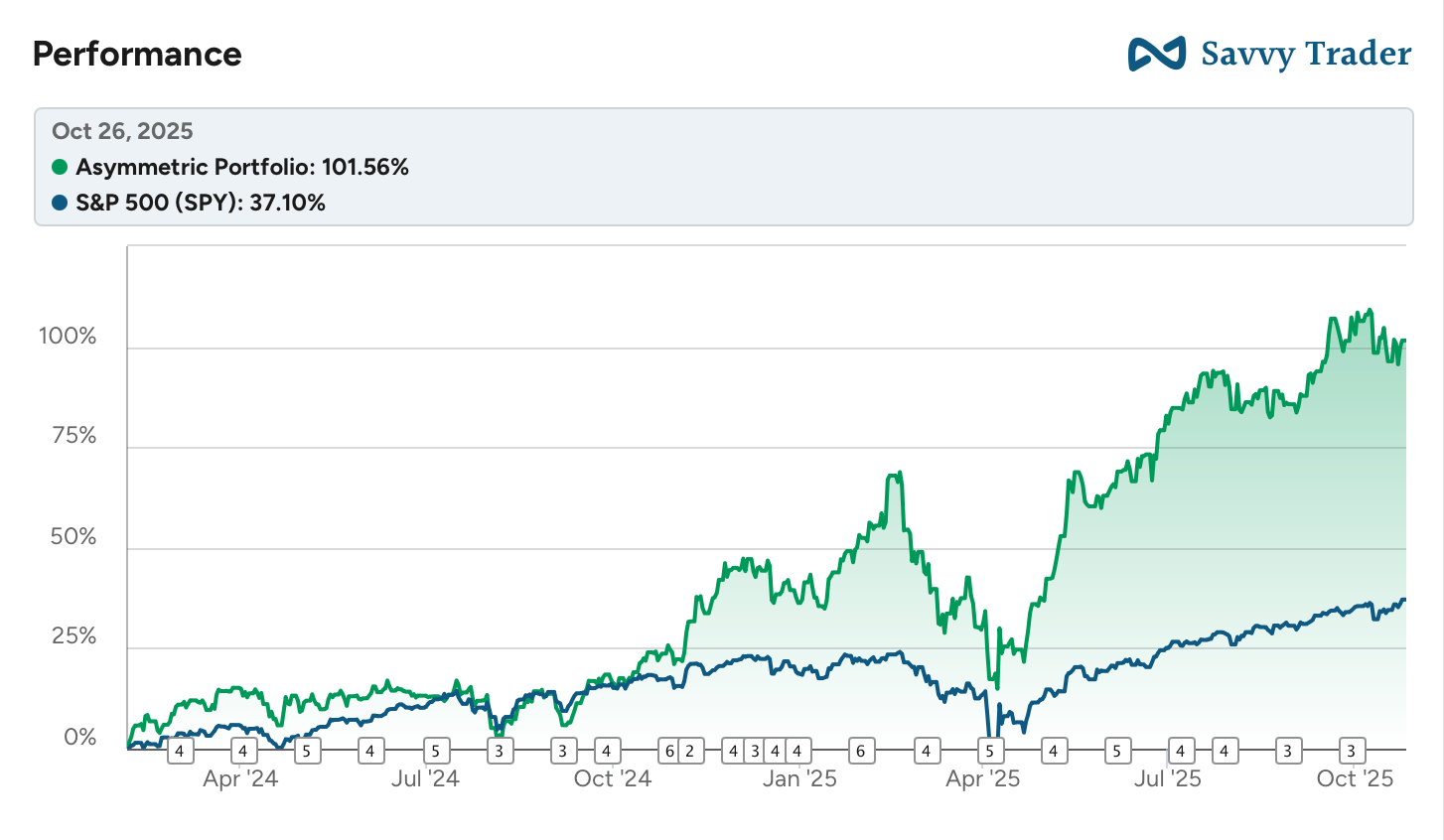

The Asymmetric Portfolio was down and has been trending lower for a few weeks as some of my high fliers pull back. We will see if that trend continues, but the portfolio is up 47.9% so far in 2025, so I’m not concerned about a week’s underperformance.

In Case You Missed It

Here’s some of the content I put out this week.

OpenAI’s Spaghetti Strategy: I covered OpenAI’s strange strategy to launch a TikTok competitor and a Chrome competitor within weeks of each other.

Earnings Preview - Part 1: I previewed what I’m looking for in the top five holdings in the Asymmetric Portfolio.

Earnings Preview - Part 2: Here, I went through the next five stocks.

What’s a Dollar Anyway?

Currencies don’t normally move all that much over time. There are fits and starts, but a 10% move in the U.S. dollar to the Euro, for example, only happens once or twice a decade.

But 2025 has seen some pretty big moves. The dollar has fallen sharply against the Euro.

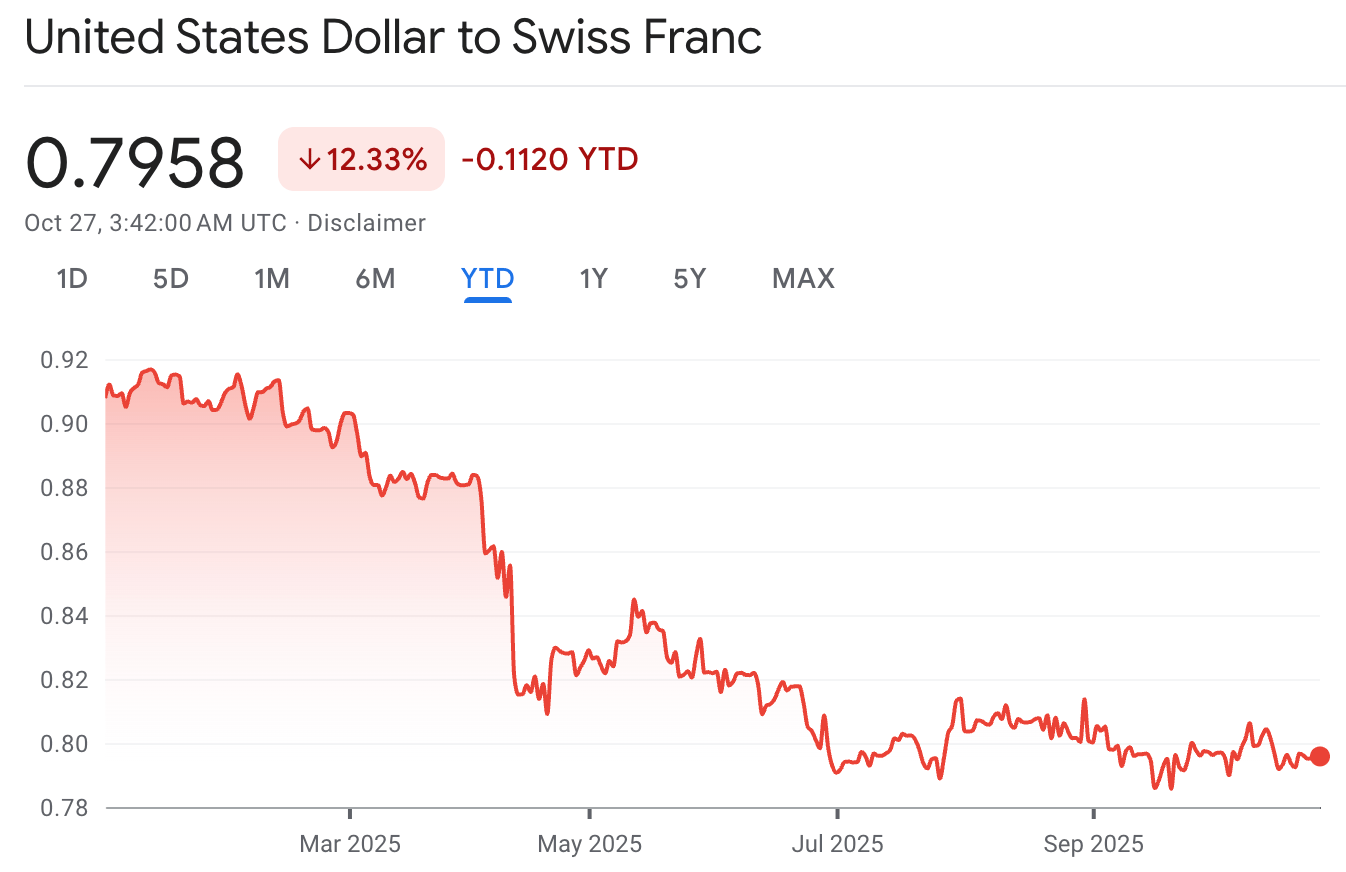

It’s also dropped against the Swiss Franc, which is what On Running reports earnings in.

So, how does this drop in the dollar impact business and earnings? Here’s a quick primer.

From the U.S. operations perspective:

A weak dollar makes it more expensive to import goods from overseas, all else equal.

This is seen by businesses and consumers through higher prices.

A weak dollar can also increase the buying power of other countries, making exporting out of the U.S. more attractive.

Countries that want to export goods (ahem, China and Taiwan) have often tried to keep their currencies lower than their natural rate in an open market to make exports more attractive to other countries.

From the U.S. financial reporting perspective:

If a company reports in U.S. dollars but generates a large portion of sales overseas, a weak dollar may make growth look higher than it would be otherwise.

3M, for example, generates about 70% of sales overseas. A good that’s exported from the U.S. and sold overseas may see higher revenue and/or margins because of a weak dollar.

Other currencies held on the balance sheet may need to be “marked to market”, resulting in gains as the dollar falls.

This may happen with many foreign assets, from land to inventory.

From a foreign reporting perspective:

More confusing is being a U.S. investor looking at a company that reports in a different currency, but makes most of its money in the U.S.

On Running falls into this category.

In Q2, revenue was up 32.0% on a reported basis but 38.2% on a constant currency basis.

There was also a 139.9 million Swiss Franc foreign currency loss, which was primarily simply marking dollars down from their value at the beginning of the quarter to their value at the end of the quarter.

Changes in currency aren’t inherently good or bad. But it’s important to understand how currencies impact earnings and market expectations. If the dollar continues to weaken, it may hurt some companies and help others.

How a company reacts to these market forces will tell us who has pricing power and a durable business for any currency or tariff environment.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your research before acquiring stocks.