I recently listened to a conversation with Airbnb founder and CEO Brian Chesky that I can’t get out of my head. He was discussing Airbnb’s AI strategy, but he had an interesting perspective on ChatGPT.

We want to be the first true AI native application. We'll talk a little bit more about that, but ChatGPT is not an AI native application. It uses AI, but it's interface is the interface that would have existed before AI.

ChatGPT is supposed to be the most disruptive product since the iPhone, but when you think about it, the interface is the same as we had before AI.

If ChatGPT is just another app on a phone, that’s not the disruptive force the market thinks it is. Alphabet $GOOG ( ▲ 3.74% ) may not be disrupted, but like Oracle $ORCL ( ▼ 5.4% ) and Coreweave $CRWV ( ▼ 8.12% ) who are building out capacity for OpenAI, may not have the upside the market has priced.

Checky’s statement is simple, but profound.

OpenAI has convinced the investing world it’s the next great consumer tech company. But let’s be honest, the company doesn’t yet have a business model.

Subscriptions don’t pay the bills. An ad network doesn’t yet exist.

Yet the market thinks there are disruptive products on the horizon…right?

OpenAI’s Spaghetti Product Strategy

ChatGPT launched in late November 2022 and took the world by storm. But the interface hasn’t changed much, despite efforts to expand beyond being just a chatbot.

If OpenAI is going to be as big as Google, the company is going to need to expand beyond being a chatbot with weak monetization. And OpenAI has tried. Since 2022, it has launched:

Custom GPTs

The GPT Store

Plug-Ins

Assistants API

Apps

Sora 2

Atlas

Each of these launches was intended to push ChatGPT beyond being just an application with access to an AI model. The company wants to be a platform that extends beyond an app. Think Google, but with AI at the center. But none of these “hey, build on top of us” products has been successful.

The last two launches haven’t been about asking others to build on top of ChatGPT; they’re leaning into ChatGPT being the point of demand and integration on the internet. If ChatGPT is indeed a disruptive consumer product, that’s worth leaning into.

But do people want ChatGPT following them around?

Sora 2 as the “New TikTok”

A few weeks ago, OpenAI introduced the Sora 2 model, which was accompanied by a social media feed that (I think) was intended to be a combination of TikTok and the old-school Facebook feed of people in your network. The hope was to build something like an Instagram model, built on going viral and attracting a social network with that virality.

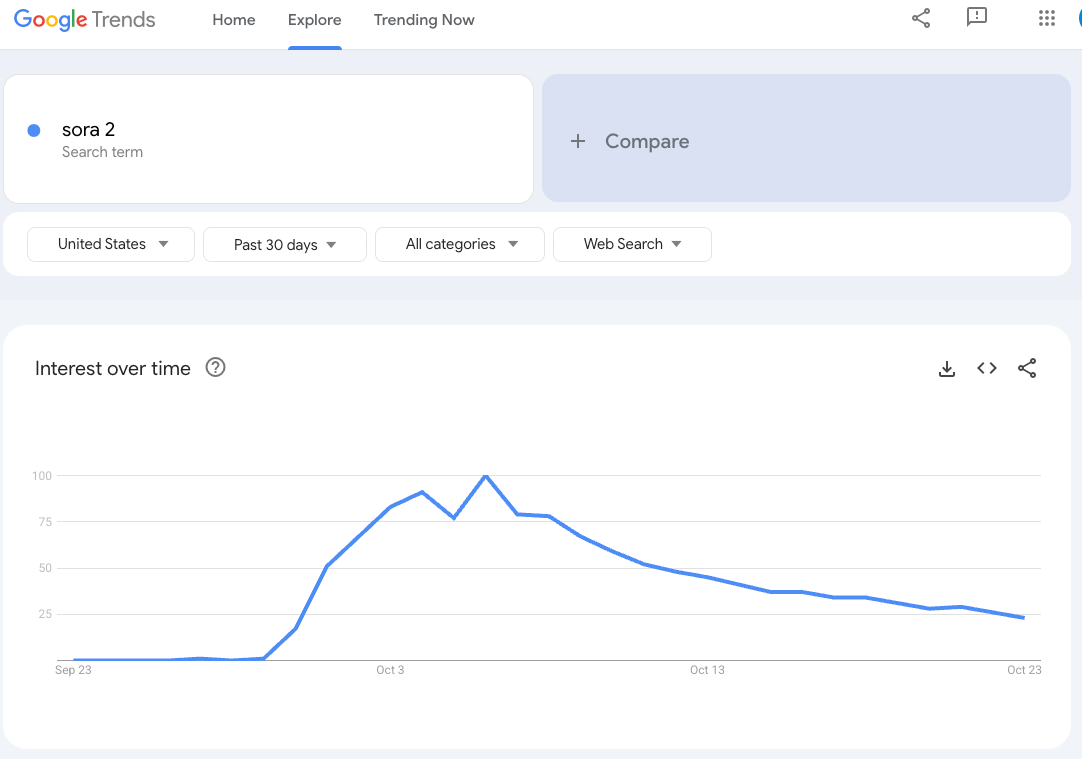

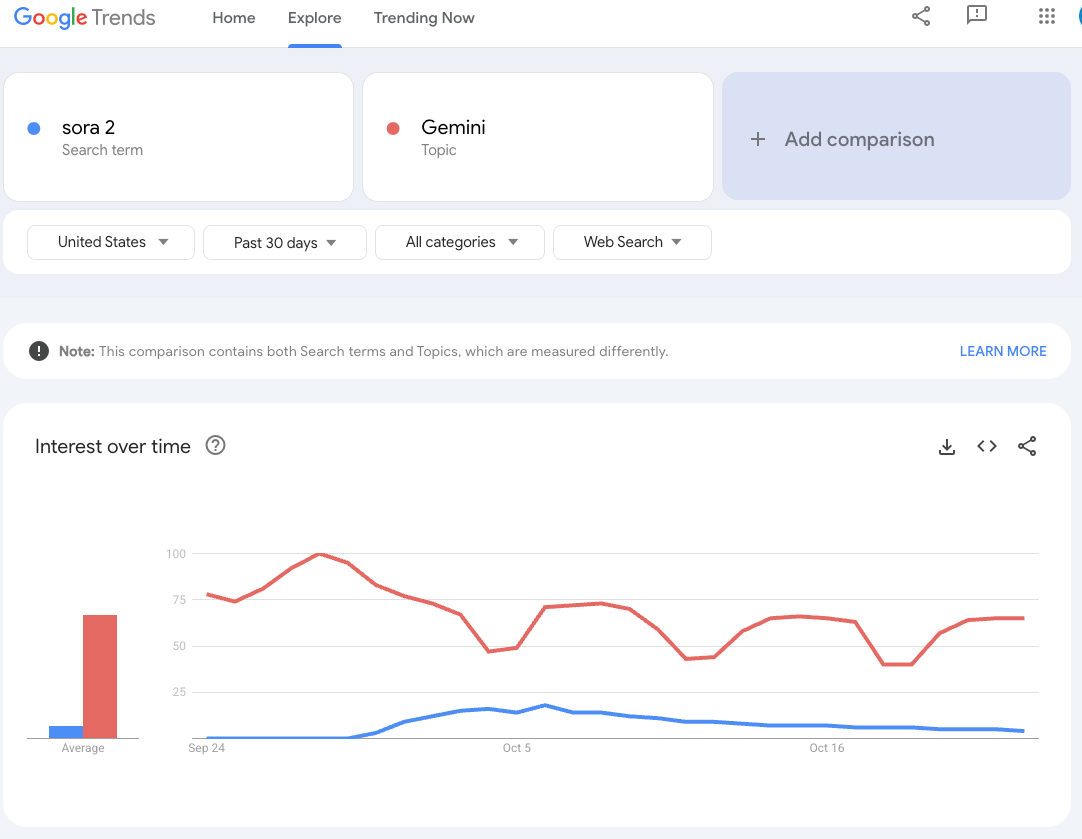

Sora 2 went viral within days, and early users loved the app. But since the first few days, interest has waned.

For perspective, interest in Sora 2 never reached the level Gemini is at.

Is Sora 2 and the social media app that came with it disruptive to anyone? I doubt it.

So, OpenAI moves on to the next thing.

ChatGPT Atlas Is Like Chrome…But More Annoying

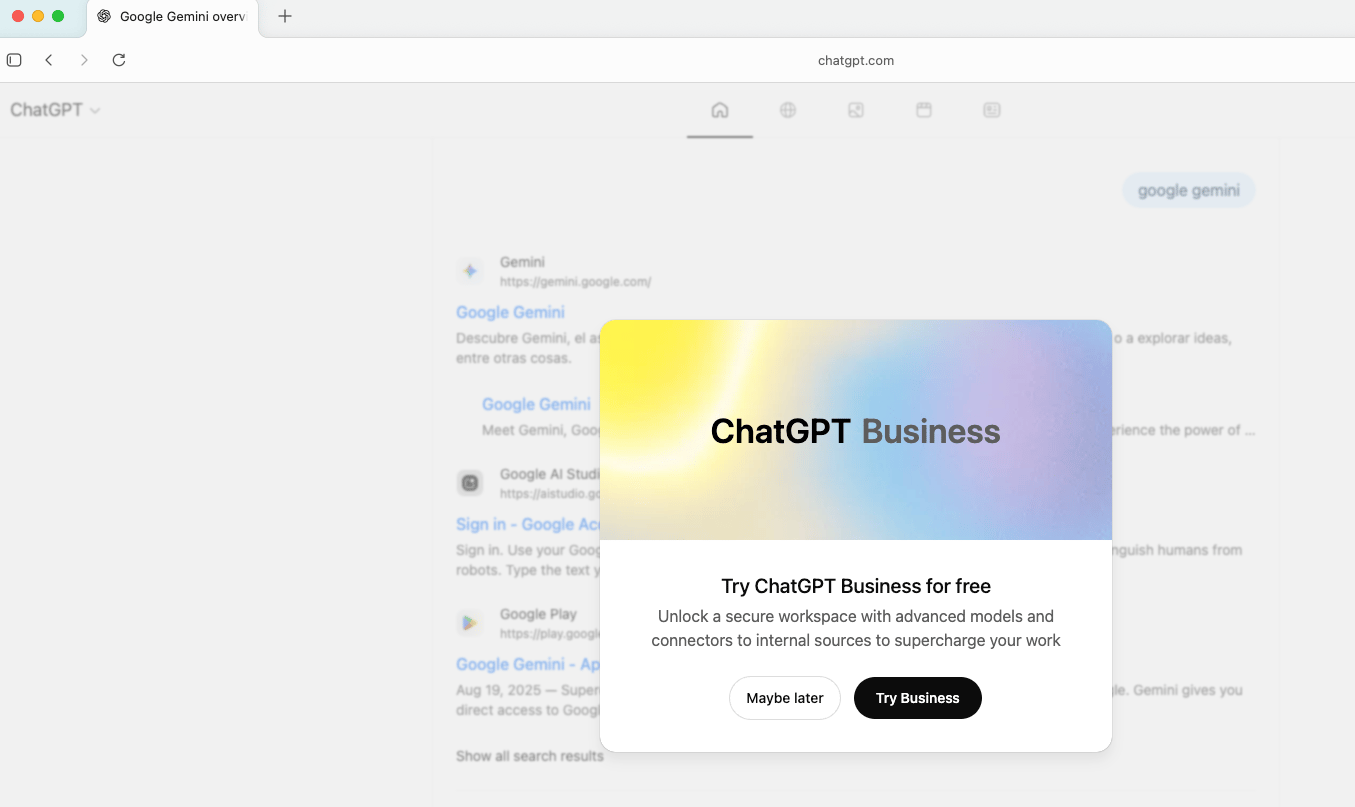

Next up was the ChatGPT Atlas browser that launched this week. The idea (I think) was to build a browser that’s easier to use ChatGPT with, and along the way, OpenAI will get valuable data about users.

If you’re a ChatGPT Plus or Pro user, Atlas may be the browser you’ve been waiting for. ChatGPT is in the browser with the click of a button.

After using it a bit this week, I don’t see how this makes doing…anything…easier. But maybe that’s a “me” problem.

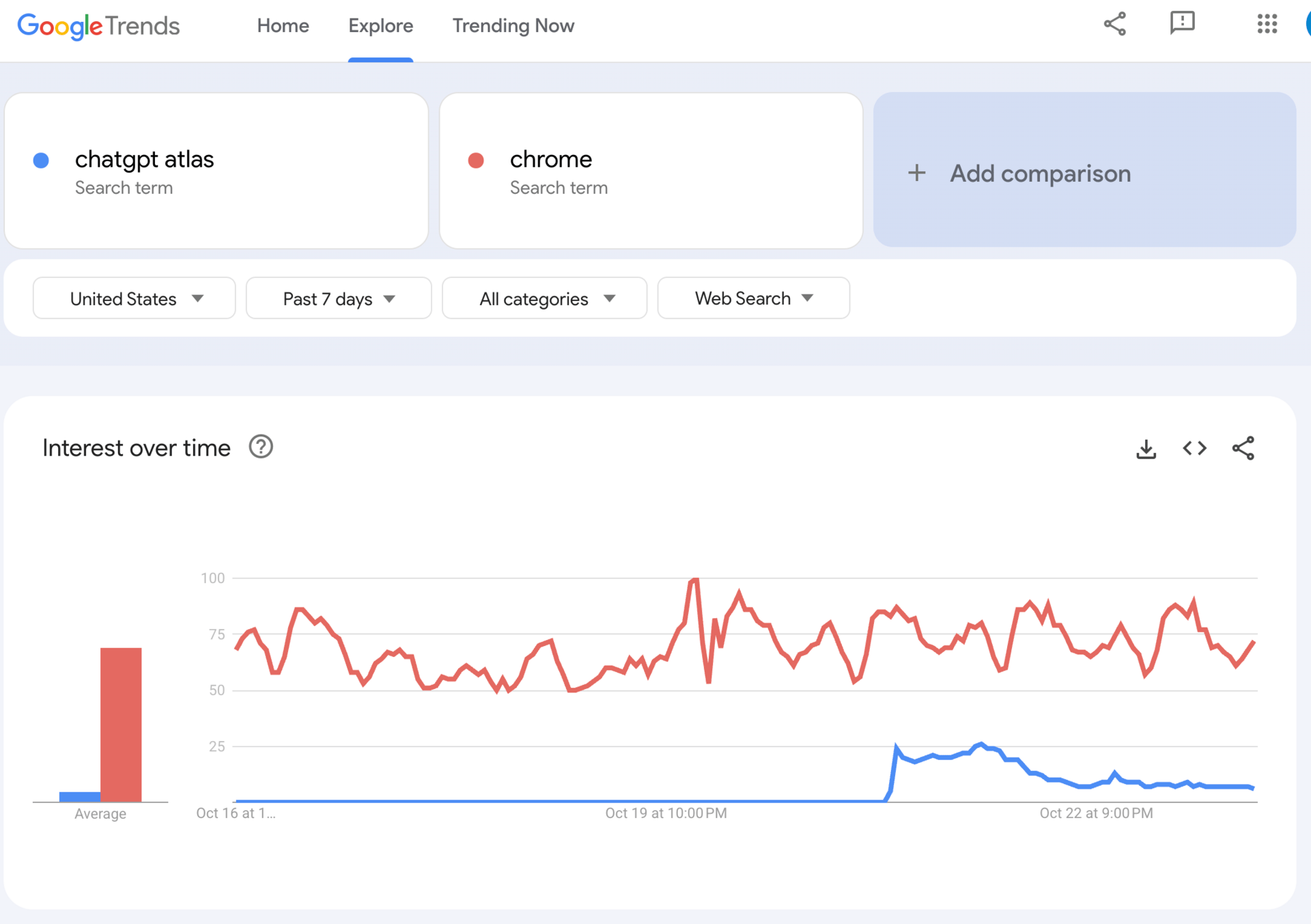

What’s interesting is that searches for Atlas spiked when it was launched, and again, interest has waned.

But this was the kicker. 👇

Atlas seems to be nothing more than a Chrome wrapper (it’s built on Chromium, which is open source) with annoying upgrade pop-ups.

Is this what disruption looks like?

The common theme with OpenAI’s product launch is that they’re throwing stuff at the wall. It’s a spaghetti strategy. There’s no through line, there’s no understanding what customers want than anyone else, there’s no real strategy, at least the way I see it.

OpenAI Needs New Products to Win

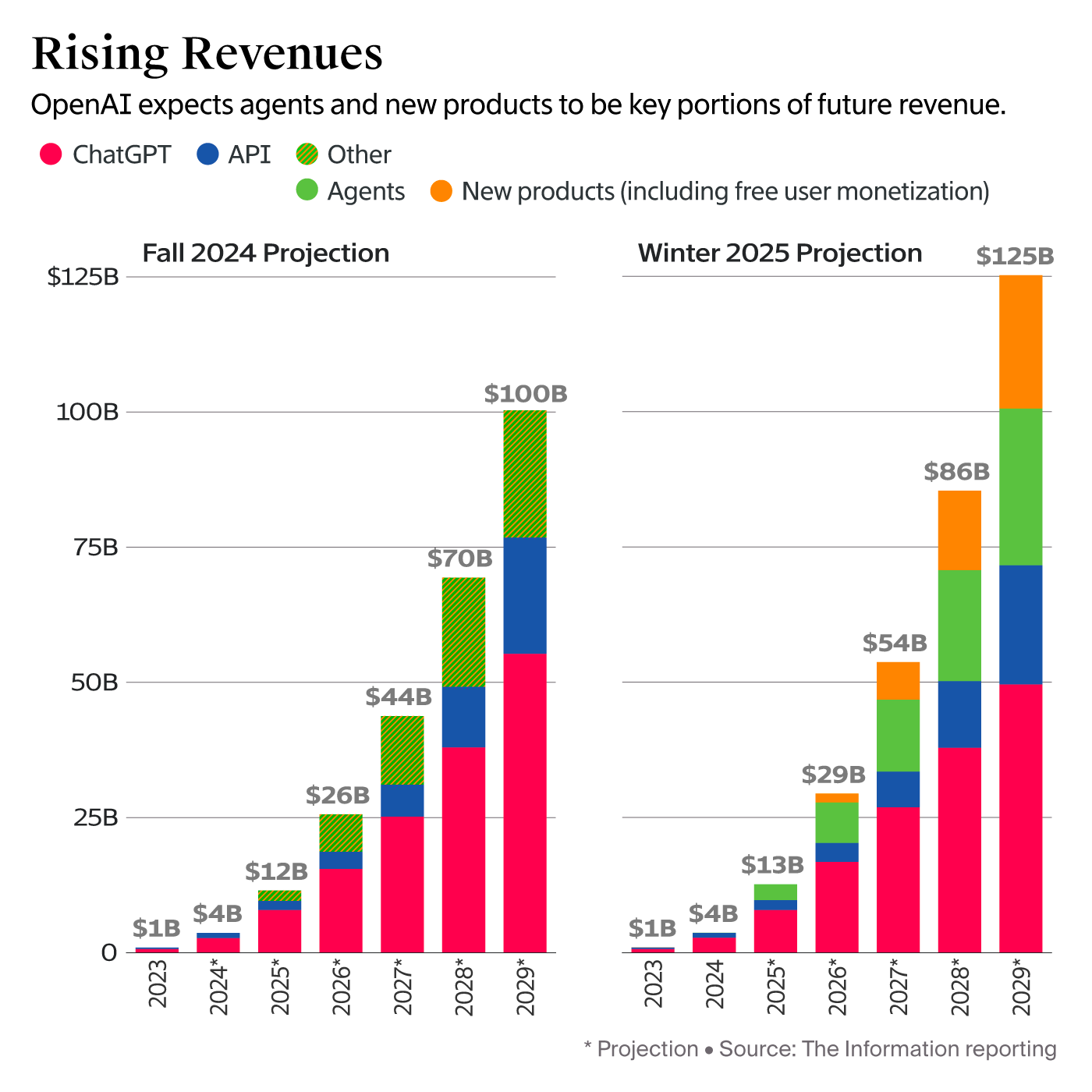

I can’t help but look at all of these products and wonder how OpenAI plans to get to $125 billion in revenue. After all, that growth curve is what NVIDIA $NVDA ( ▲ 1.02% ), Oracle, Coreweave, Iren, and more are counting on to fund their ~$1 trillion in investment.

If OpenAI’s strategy is to simply become Google before Google can become OpenAI, as we’ve seen with the Sora 2 launch and Atlas, that’s a tough proposition.

Google has the distribution with YouTube, Chrome, Android, and search. It has the cash flow from search and all of the businesses that make up Alphabet. And it likely has a cost advantage with a vertically integrated cloud, models, and chips.

Alphabet is one of the biggest positions in the Asymmetric Portfolio, and the biggest position in the Asymmetric Investing Autopilot portfolio, so I’m betting on Alphabet’s potential in AI and against OpenAI’s disruption.

As I see it right now, OpenAI is struggling to gain traction with new products, and for a company that’s holding up the market, that’s concerning.

Alphabet’s Underappreciated Investing Portfolio

Speaking of Alphabet, did you know Alphabet owns large stakes in SpaceX, Anthropic, and AST Spacemobile, to name a few?

The company’s public investments can be found here, and I added up some of the largest positions, along with the SpaceX and Anthropic stakes. In total, I got to $58.8 billion in value just in those companies.

Company | Shares | Alphabet’s Value |

|---|---|---|

SpaceX | 7.5% | $30 billion |

Anthropic | 14% | $26 billion |

ARM | 1,960,784 | $326.7 |

AST Spacemobile | 8,943,486 | $641.4 |

Dexcom | 1,036,937 | $73.7 |

Freshworks | 16,206,643 | $185.1 |

Gitlab | 2,724,712 | $131.1 |

Metsera | 4,961,744 | $261.1 |

Planet Labs | 31,942,641 | $413.7 |

Revolution Medicines | 4,133,277 | $220.9 |

Tempus AI | 1,551,102 | $135.0 |

UiPath | 7,034,337 | $108.6 |

Vera Therapeutics | 12,409,753 | $350.0 |

There’s probably around $100 billion in value in other companies on the balance sheet.

Plus, there’s Waymo, which I think is worth over $100 billion today.

We focus on search, but Alphabet has a lot of value outside of its traditional business. When it comes to the future of technology, that could give the company a leg up, whether it’s purely financial or performing tuck-in acquisitions.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.