Is the economy in good shape today?

Are you sure of your answer?

Are you relying on anecdotal data to make your assessment?

Public data?

Private data?

Do you go off vibes?

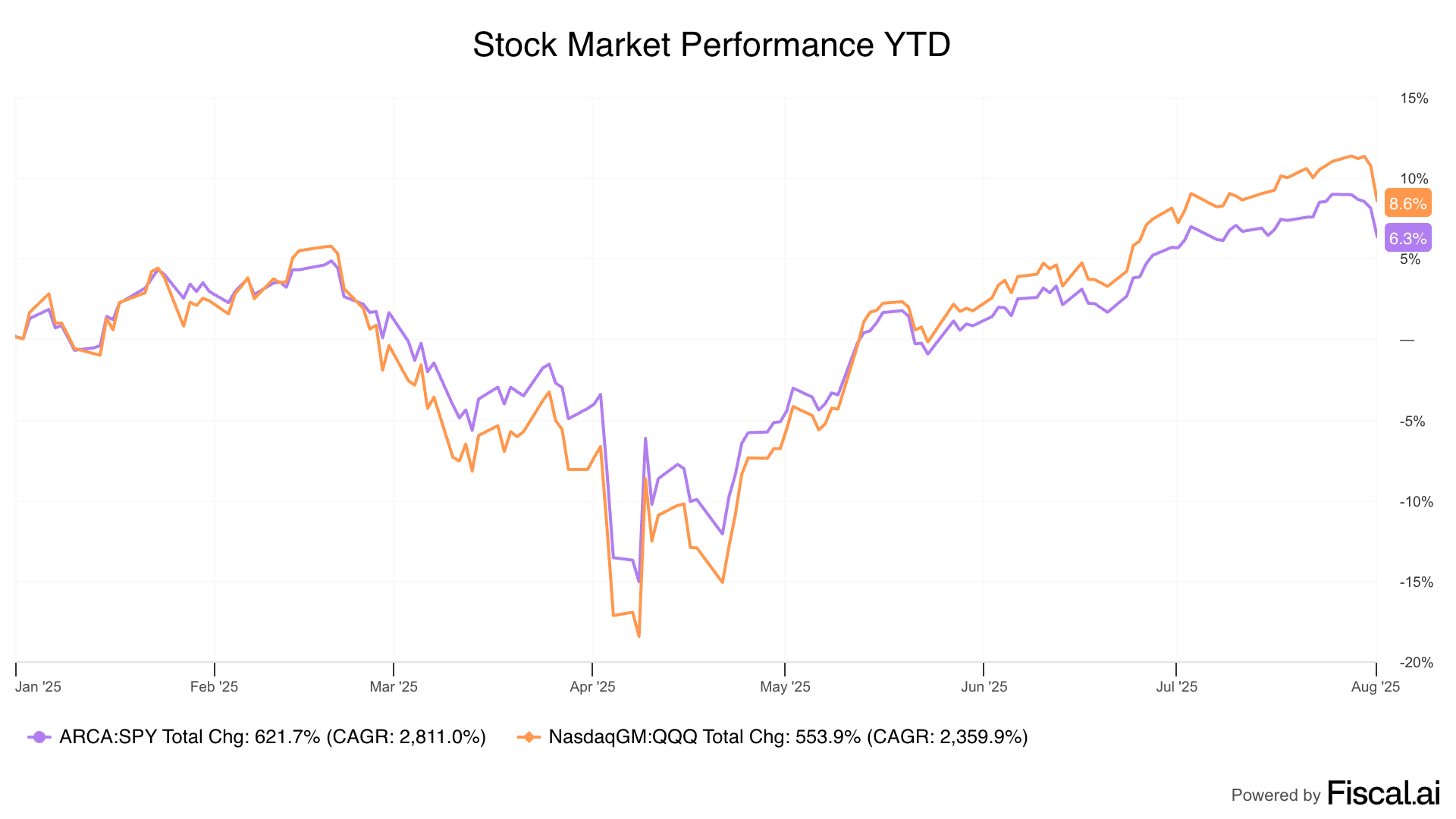

When the stock market is trading near all-time highs and valuations are at a non-recession peak, we can assume confidence is high. But should it be?

I’ll get to how data plays a role in the market’s confidence and why the BLS unemployment report on Friday was both shocking and entirely expected for those with a balanced view of the market.

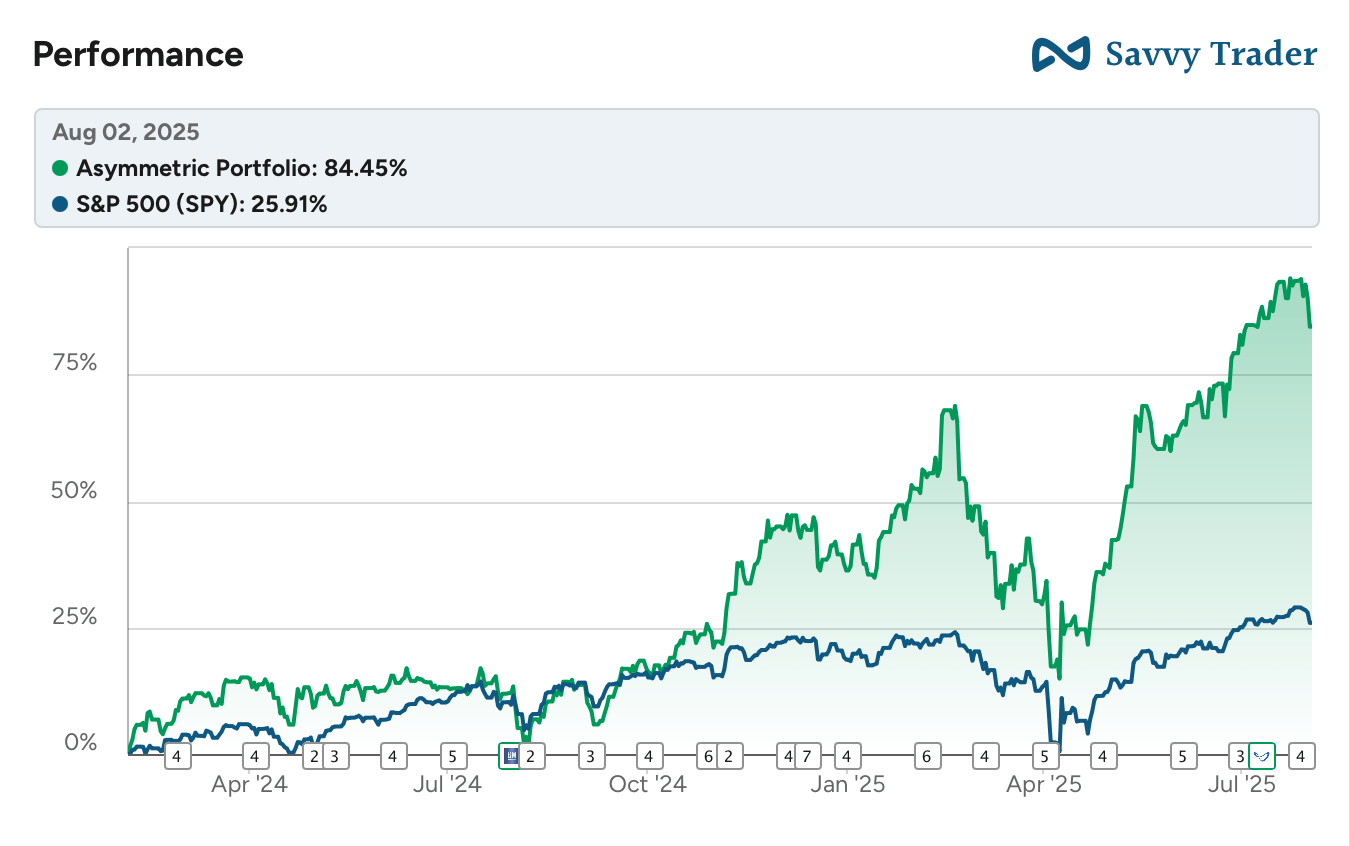

The Asymmetric Portfolio had a rough week, dropping 4.7%, but zoom out, and performance is still holding up. I went over the biggest contributor to the drop in the portfolio here, and I feel good about having a short position that should do well if the market pulls back further.

In Case You Missed It

Here’s some of the content I put out this week.

Spotify’s Record Quarter & Falling Stock: Spotify’s business is doing well, but the stock’s valuation is becoming a concern for the market.

SoFi and Robinhood Are the Future of Finance: SoFi and Robinhood are not only taking market share, they’re both talking about disrupting traditional finance.

What I’m Buying in August 2025: My buys for August 2025.

Coinbase’s Crash & What to Think Now: Coinbase stock plunged on Friday, but I’m not worried.

Data and Investing

12 years ago, my friend Morgan Housel wrote this about economic data and market studies.

It’s a short read, and if you have a moment, it’s worth your time. But this is the takeaway:

The takeaway here isn't a plea to ignore data, statistics, and studies. But they have to be taken for what they are: Fallible and often incomplete. People get tripped up when they take one set of data or one study and put all of their weight behind it. "I'm investing in X because this study shows Y." Or, "I'm selling everything because this economic report shows trouble ahead." At best, data guides us in a certain direction, but investors always have to have a healthy appreciation for the unknown. We talk a lot about how bad analysts are at predicting the future, but it's really worse than that. We barely know what's happening right now, or even what happened in the past.

Even the best data is flawed, especially when it’s data about the economy. And that ties into the jobs report we got last week that sent the market reeling.

Friday’s Jobs Report

You may have seen that Friday’s jobs report was disappointing, with only 73,000 jobs added in July and revisions of May and June data that reduced previous estimates by over a quarter million jobs. This is the report that sent the market lower, and it was indeed concerning, but for the reason most people in the political sphere think.

The concern is that revisions lower typically align with a weakening economy and potentially a recession.

Month | Reported Jobs Gained/Lost As of Thursday | Reported Jobs Gained/Lost As of Friday |

|---|---|---|

May 2025 | 144,000 | 19,000 |

June 2025 | 147,000 | 14,000 |

July 2025 | 73,000 | |

Total | 291,000 | 106,000 |

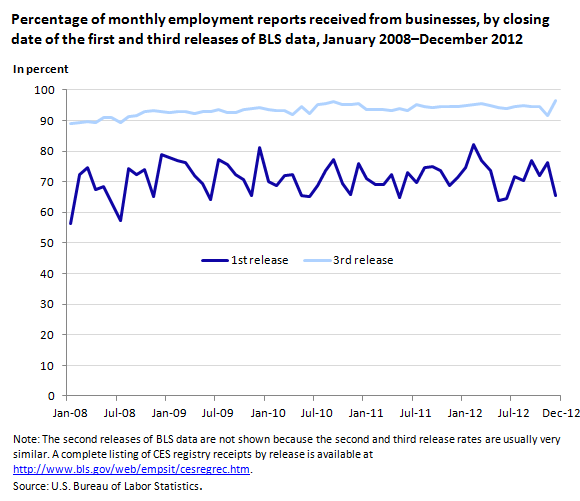

Here’s the strange thing. The unemployment rate didn’t change, and it usually doesn’t, which may seem odd. However, remember that this is survey data, and the BLS is trying to determine how many jobs were added or lost in a given month based on surveys. Complete data isn’t known for about three months, when BLS has ~95% of payroll data to work with, which is why there are two revisions after the initial report.

So, why are there often large revisions to the number of jobs, but not to the unemployment rate?

The simple answer is that it’s easier to determine what percentage of people are unemployed through a survey than it his to determine how many people are in the workforce and how many jobs there are.

Given the variables involved, what we’re likely seeing is a reduction in the number of people in the workforce.

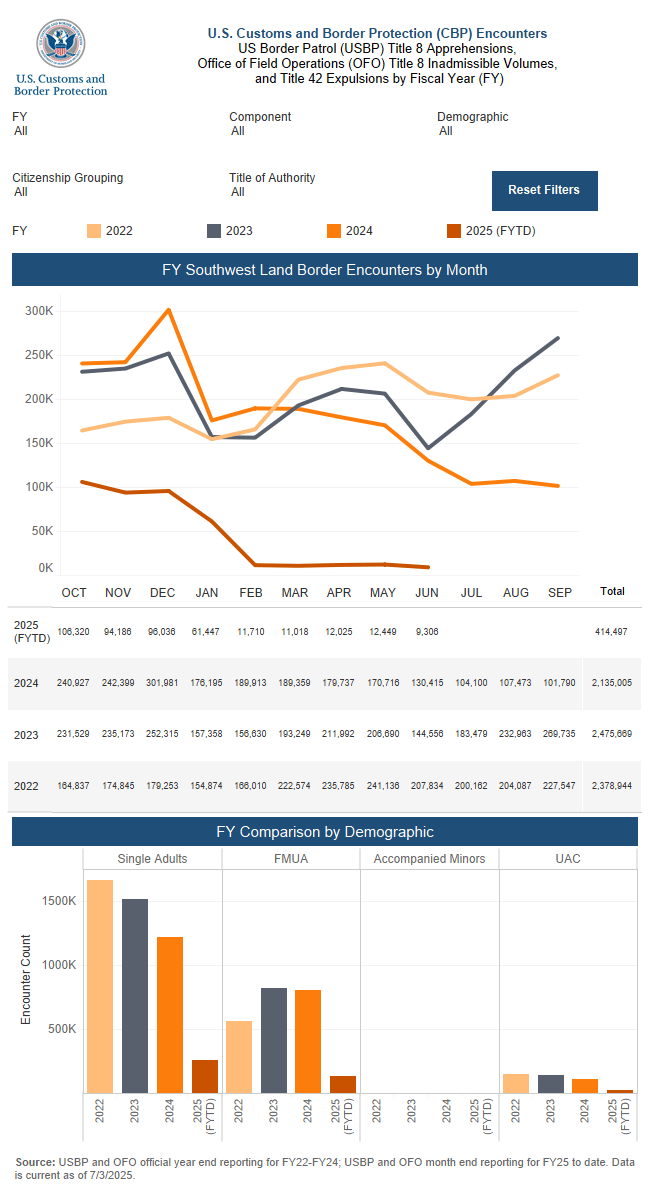

Why would we have fewer people in the workforce than previously expected in March, April, May, and June, leading to unusually large revisions?

What if there was a simple — and obvious — answer?

Is a change in immigration why there are revisions?

Maybe.

Or it could be people going back to school, or being disgruntled, or retiring at unexpected rates.

The initial estimates are based on surveys, so BLS needs to extrapolate to the full workforce before a more complete data set isn’t yet available. And if their extrapolation is based on assumptions made in 2024, but the conditions on the ground changed in late January 2025, it would take a few months to show up in the data.

The point here is that there’s often a reason when data is off or revisions are made. And it isn’t because of a nefarious plot. It’s because accurately counting the number of jobs created on a month-to-month basis is nearly impossible.

The Confidence Game

If we learned anything from the 2008/2009 Great Recession, it’s that the market is about confidence.

Without confidence, the entire financial system becomes a house of cards.

What was troubling on Friday was a very normal revision of jobs data being treated as a political act, and the head of BLS being fired over the report.

We’re also seeing very clear pressure put on Federal Reserve Chair Jerome Powell and potential replacements auditioning in public.

BLS and the Fed should be non-political institutions.

They should follow the data and report data, and make decisions that are best for the country.

That independence — or perception of independence — is what gives the markets confidence in the U.S. economy and results in a premium valuation for U.S. stocks over, say, China, where there’s little confidence that GDP or employment data is real.

Shaking the market’s confidence in the data it gets from economists or the independence of the Fed won’t be met with cheers by market participants.

As flawed as the BLS’s survey data is short term, the market had confidence that readings were accurate over time. Will that be the case if a new leader has clear political orders?

No matter your political persuasions, shaking the market’s confidence in economic data (as flawed as it is today) would result in higher yields for debt and lower valuations for stocks.

Give The Data Collectors a Break By Being Skeptical Of What They Say In the First Place

I don’t write any of this to say that BLS revisions aren’t annoying, and they shouldn’t work to fix them.

I wish there was an easy fix.

I’ve seen debates over the last few days about how modern data collections should make this easy. But the reality is that a simple solution for one cohort of employers (big business who use big payroll processors) would leave out another cohort (very small businesses) because they aren’t using a big data processor or (gasp) use paper to conduct payroll.

I keep coming back to the BLS having a pretty darn good process, from what I can tell.

The problem isn’t the data.

It’s how we interpret it.

As investors, we can’t use one number to rule them all, especially when it comes to something as complex as the economy.

As Morgan said a dozen years ago, data is “Fallible and often incomplete.“

I hope we aren’t heading down a path where data is fallible, incomplete, and skewed for political reasons.

That’s a world where confidence in the market would deteriorate and investing would become exponentially more difficult.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your research before acquiring stocks.