I hope you had a wonderful week!

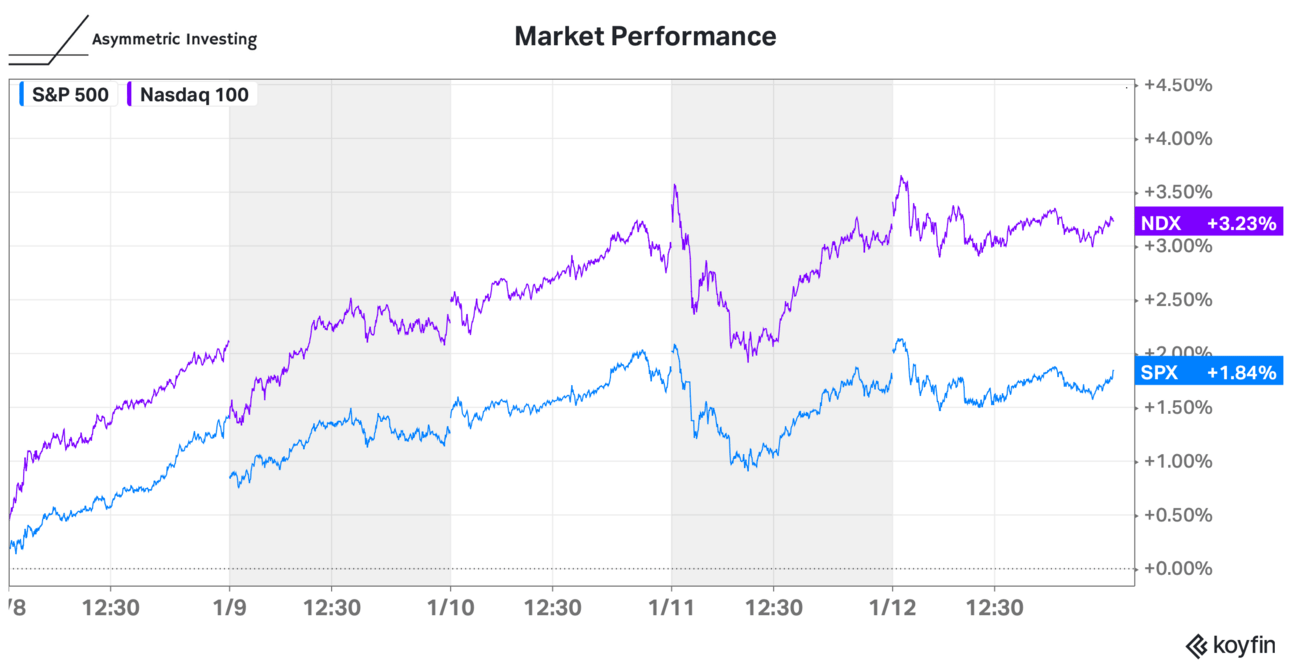

The stock market had another good week ahead of the start of earnings season. Big banks will kick off results this week with tech following and then the season gets crazy early in February.

In Case You Missed It

Here’s some of the content I put out this week. Enjoy!

The End of the Mega-Endorsement Era: Tiger Woods is no longer endorsing Nike, ending a nearly three-decade deal. I covered the changing landscape of celebrities in business and why this may be the last mega-deal for a global brand.

Coinbase, Crocs, and Zillow Update: This premium update covered some news affecting Asymmetric Universe stocks.

Asymmetric Portfolio Look Back at 2023: What went right and what went wrong in the Asymmetric Portfolio? I covered that and some valuation metrics for all 17 stocks.

Is Canoo a 10x Stock: Canoo is an interesting EV company with an innovative design and billions in orders. The question is, can it survive to get to positive cash flow?

Bob Iger Makes a Move on the NFL

News broke this week that the NFL is in “advanced talks” with ESPN to acquire a stake in the cable network. The outline of the deal is like this:

ESPN gets NLF Media

This includes the NFL Network, NFL.com, Red Zone, NFL Films, and NFL+.

The NFL gets a minority stake in ESPN

The player’s union and owners have reportedly been informed of the talks, indicating how serious they’ve become.

While we don’t know the details or if/when a deal will close, I think it’s worth outlining why this makes sense for both sides.

Disney’s Pitch to the NFL

Disney is trying to build a sports streaming service by taking ESPN over the top and it needs partners to catapult ESPN into a leading position. ESPN can always bundle with Disney+ and Hulu, but an ESPN over-the-top service needs more sports content and to that end, Iger has reportedly had talks with the NBA, MLB, and now the NFL.

NFL owners can see streaming as a big part of the future, but streaming isn’t like broadcast TV or cable. With linear TV, ABC, NBC, CBS, and Fox all reach the same houses in effectively the same way. No one has a distinct distribution advantage for the NFL outside of who writes the biggest check.

In streaming, there’s a massive distribution challenge because not everyone subscribes to every streaming service.

If you’re the NFL, it’s a Catch-22. You want to reach the most people and you want to make the most money. Big tech is an option, but the end game for them is just growing a tech monopoly, not servicing the NFL’s goals of growing the audience.

One option is to help Disney and ESPN build a sports streaming giant, taking an othership stake in the upside.

Disney’s pitch is likely that ESPN has the best chance to be the sports streaming winner and Disney’s media assets are the best bridge to streaming over the next 5-10 years.

A Bridge to Streaming

NFL owners aren’t stupid. They know streaming is the future.

They also know going all-in on streaming right now would be catastrophic. So, they’ve tip-toed into the streaming waters with a Thursday night deal with Amazon and a single playoff game on Peacock.

Unfortunately, the Peacock game yesterday may have been a bridge too far.

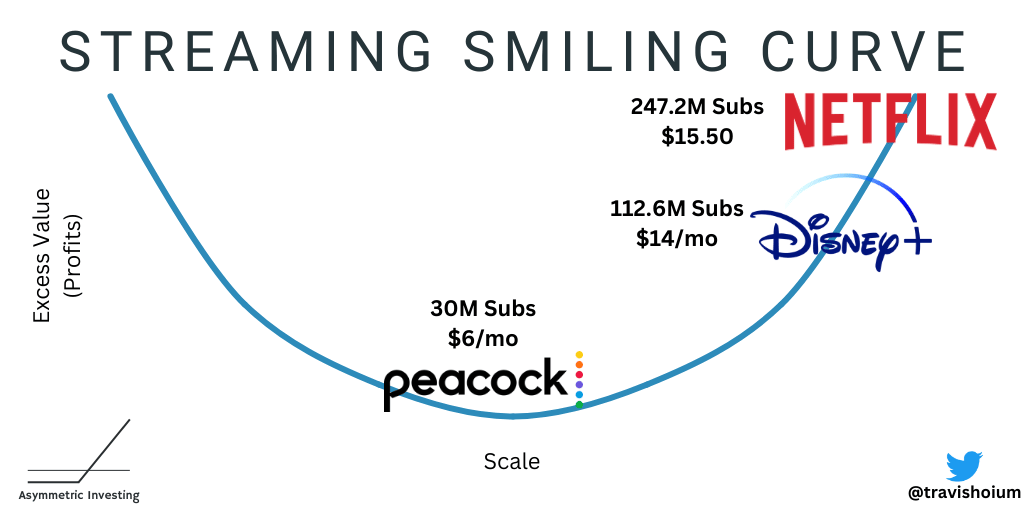

A good idea on the surface, Peacock only has 30 million subscribers, so the game looked more like “pay per view” for most fans.

Even Amazon, which has an estimated 220 million subscribers globally, has trouble breaking into every home with viewership about 40% lower than broadcast network games this season.

How does the NFL go from today’s broadcast world to a world of streaming?

Streaming-only companies like Apple, Amazon, Alphabet, and Netflix could write the biggest check to the NFL, but they’re a walled garden without any tie to the old world of broadcast TV and cable, which is relevant to millions of fans.

NBC has Peacock and CBS has Paramount+, but neither reaches a critical mass of households.

Disney is the natural partner to bridge linear TV to a streaming future. Iger pitch the NFL on a broadcast, cable, streaming combo of ABC/ESPN/ESPN+, and Disney has already built a scale in streaming that only Netflix can beat. And Netflix isn’t interested in live sports.

How Disney Wins Big

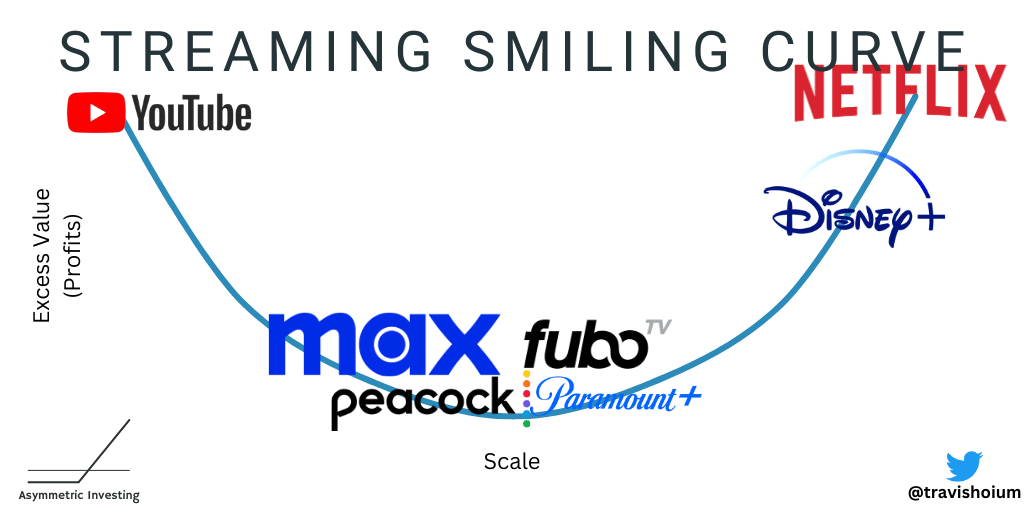

The game for Disney is clear as day. Streaming is a “winner-take-all” market and there will likely be only one or two streaming companies that can thrive long-term.

If Disney is going to build a profitable streaming business, it needs to bundle proprietary content (Disney+), general entertainment (Hulu), and sports (ESPN) to generate the most value. I’ll explain the thought process using my favorite strategic concept — the smiling curve.

Internet businesses — like streaming — depend on scale to be profitable. Scale allows companies to acquire better content, attract more users, and charge customers more for their service. There’s a feedback loop of better content attracting more subscribers, which gives more money to acquire content, which attracts more subscribers, and so on.

Once a company establishes a place in the top right corner of the smiling curve, it’s difficult for anyone else to catch up because they’re left with content scraps.

In many industries, there’s a single company in the top right of the smiling curve. For example, Meta Platforms in social media, Google in search, and Microsoft in PCs.

In the case of streaming, there may be more than one because of fragmentation in supply, monopolies being frowned upon in media, and Netflix leaving an opening in sports and premium IP. I think Disney can be that second company and is playing its hand aggressively.

Let’s take just Netflix, Disney+, and Peacock as examples of potential partners for the NFL (I’ve used Disney+ as a baseline for Disney and ESPN). You can see that Disney reaches nearly 4x more households than Peacock and has more subscription revenue.

If you’re the NFL, who do you want as a partner? And who can offer the most money?

Netflix is the obvious answer, but they’re not interested in live sports.

Peacock is out, especially after Saturday’s game.

Disney with ESPN, ABC, and the #2 spot in streaming is the obvious choice.

If ESPN can make a deal with the NFL it would be the foundation of a sports streaming giant. It would be a magnet for the NBA, MLB, NHL, and other sports. And ESPN will have more value to sports viewers than other streaming services. It moves Disney higher up and to the right in the smiling curve.

From there, Disney will slowly squeeze out Peacock, Max, Paramount+, and anyone else left. Eventually, a bundle of Disney+/Hulu/ESPN maybe $50 per month, but it’ll have a massive content library and premier sports content.

If Bob Iger can pull off a deal with the NFL, the future of sports streaming belongs to ESPN and Disney.

Unlike linear TV, Iger is playing to win it all.

This is why I own shares of Disney and why I think this is an asymmetric stock long-term. Now, let’s see if a deal gets done.

You can get all Asymmetric Investing content, including deep dives, stock trades before they’re made, and ongoing coverage of Asymmetric Universe stocks like Disney with a premium membership.

All for only $100 per year.

What do you want more of?

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.